Country Profile: Kazakhstan

“Very nice!”

Most people know of Kazakhstan from it’s connection with the fictional character Borat. Kazakhstan is more than Borat, and we are going to cover it in the second of our country profiles.

These country profiles aim to provide initial insights into countries that are competitors, customers, or both for Australian agriculture.

Kazakhstan is a vast, landlocked country located in Central Asia, stretching from the Caspian Sea in the west to the Altai Mountains on the eastern border with China. It is the world’s ninth-largest country by land area and the largest without a coastline. Kazakhstan has a continental climate marked by hot summers and bitterly cold winters.

The country is rich in natural resources, including oil, gas, uranium, and various minerals, which have played a central role in its economic development since gaining independence from the Soviet Union in 1991. However it is agriculture that we want to know about.

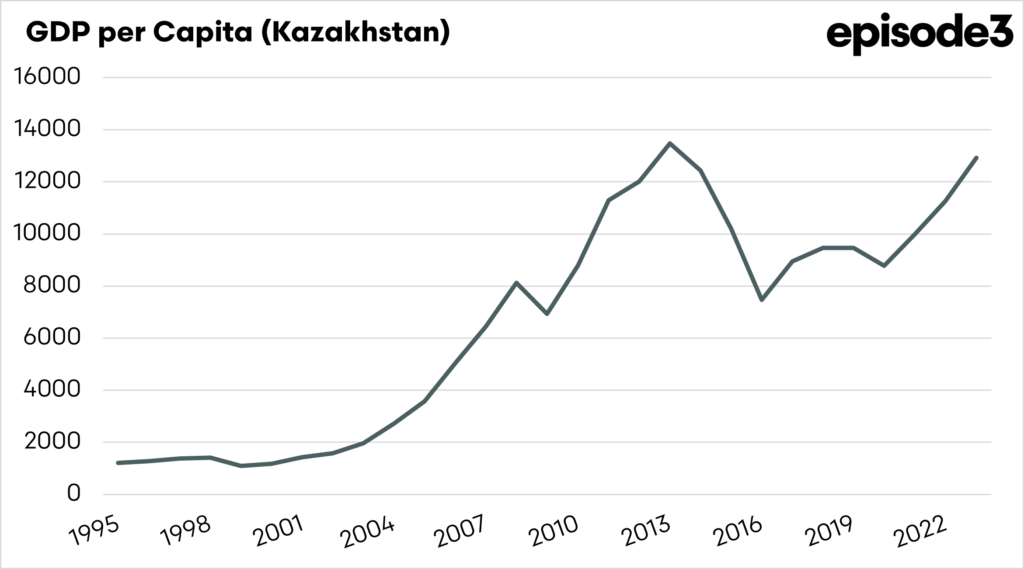

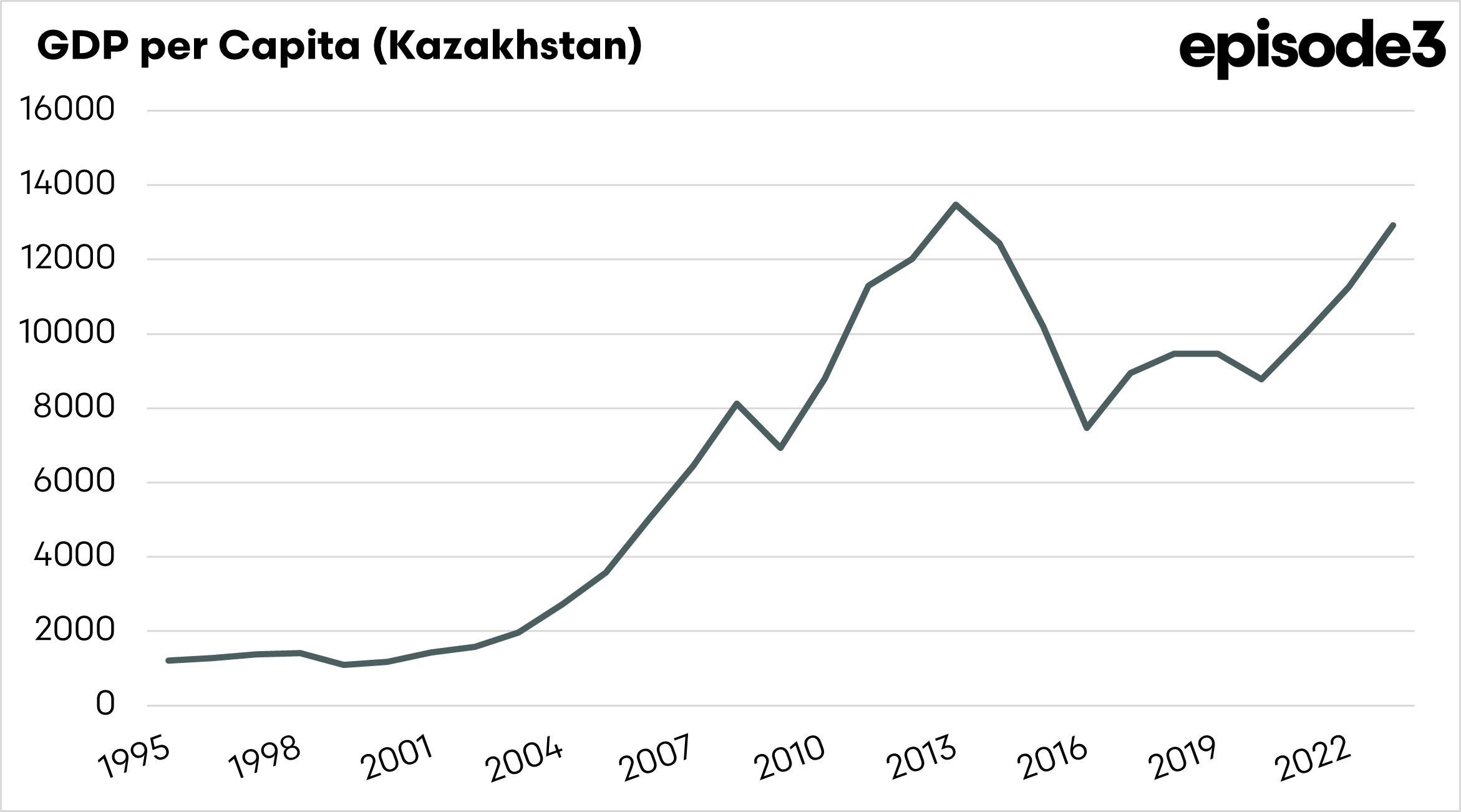

GDP per capita

Kazakhstan’s GDP per capita reached an estimated US$12918 in 2023, positioning it slightly above the global average of around US$13,842. Kazakhstan’s gradual economic development over the past decade has been supported by its resource rich economy and growing investment in agriculture and infrastructure. Although still considered an emerging economy, Kazakhstan has narrowed the gap with many middle-income nations, driven by efforts to diversify away from its traditional reliance on oil and gas exports.

In contrast, Australia’s GDP per capita was significantly higher, standing at approximately US$ 64,820 in 2023, more than four times that of Kazakhstan. This difference highlights the disparity between developed and developing economies, with Australia benefiting from a mature services sector, strong trade networks, and high productivity.

Agricultural Trade

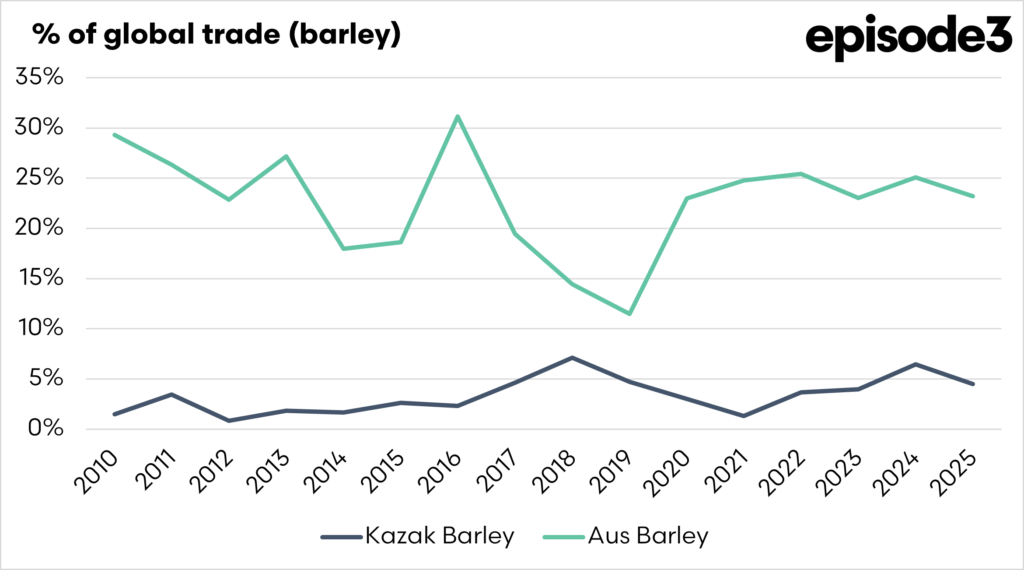

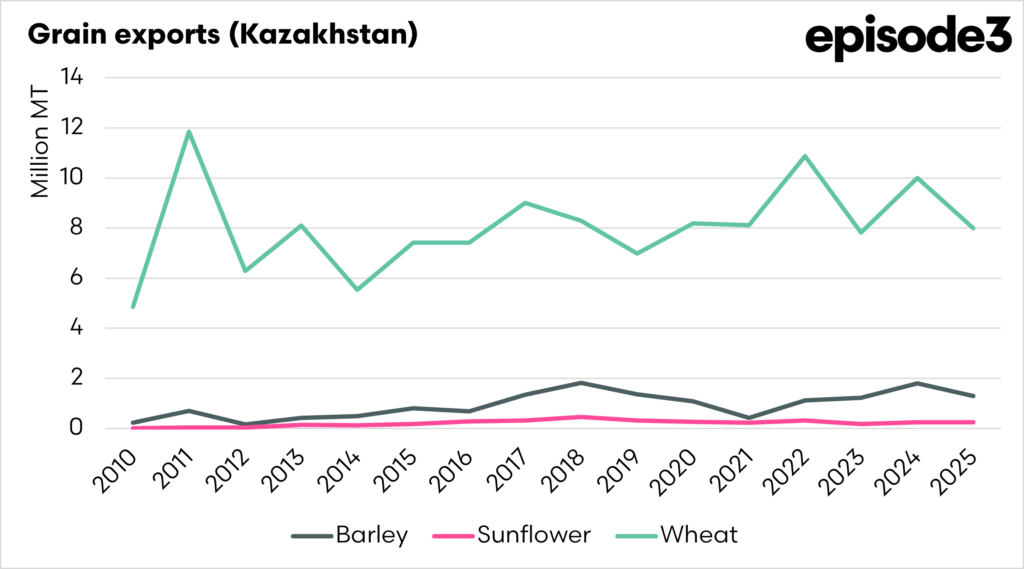

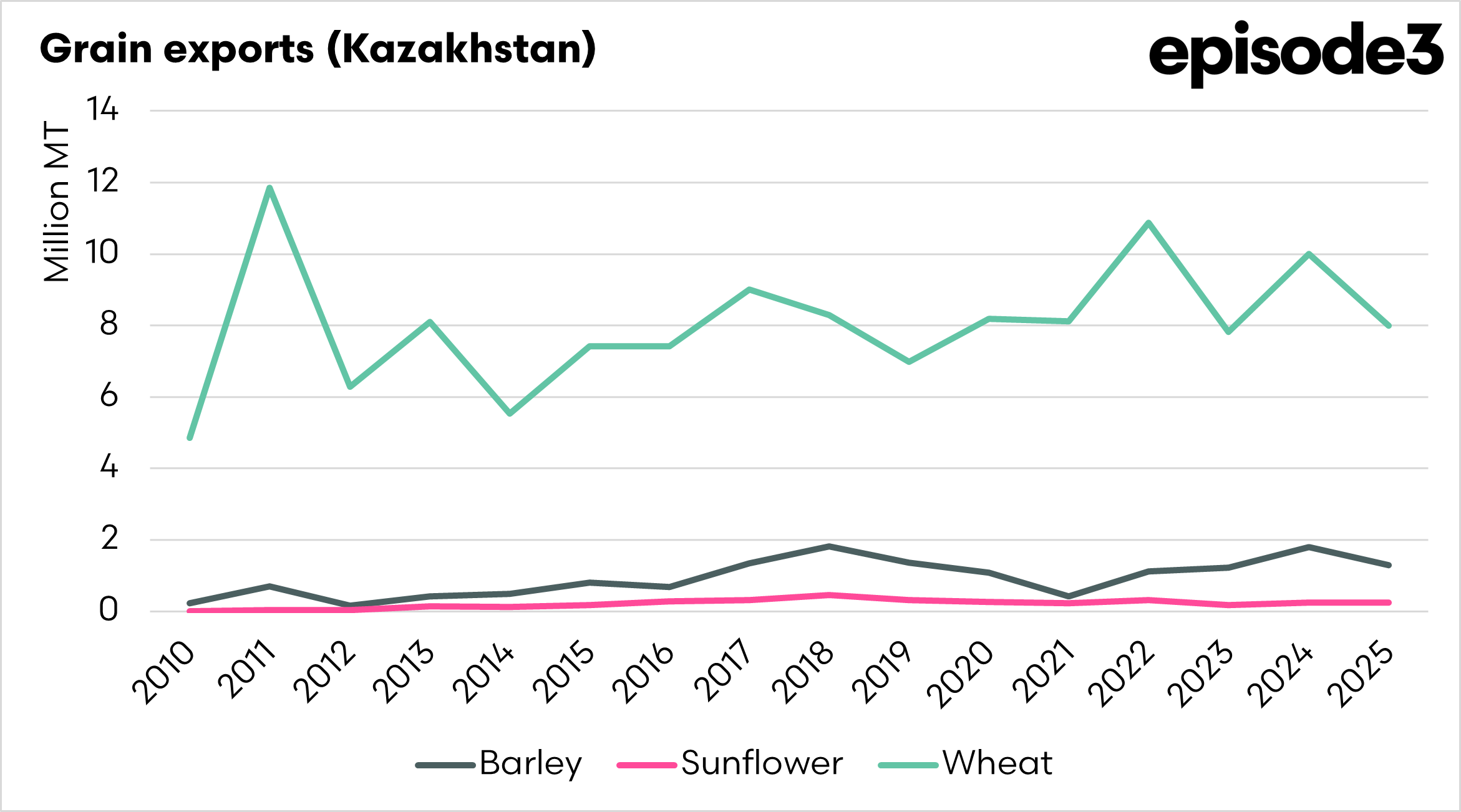

Kazakhstan is a significant player in the global grain market, particularly through its exports of wheat, barley, and sunflower products. Wheat is the country’s most important agricultural export, and Kazakhstan is often ranked among the world’s top ten wheat exporters. Much of its wheat is shipped to neighbouring Central Asian countries such as Uzbekistan and Afghanistan, as well as to China, where demand for feed-quality grain has been rising. Barley is another key crop, exported in large volumes primarily to China and other nearby nations. Meanwhile, sunflower seeds and sunflower oil have become increasingly important export products, with Kazakhstan supplying growing volumes to Europe and investing heavily in domestic processing to add value before shipment.

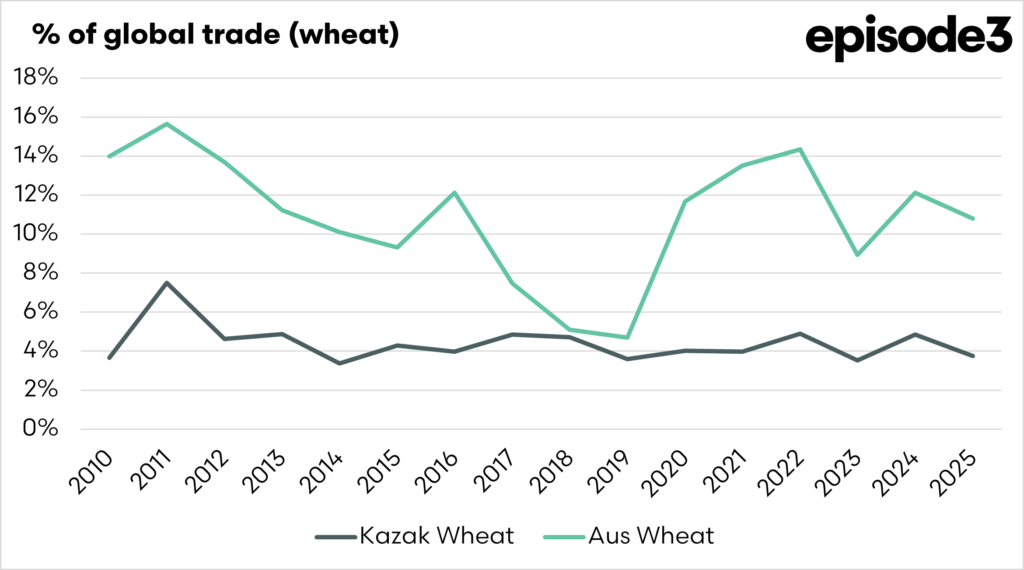

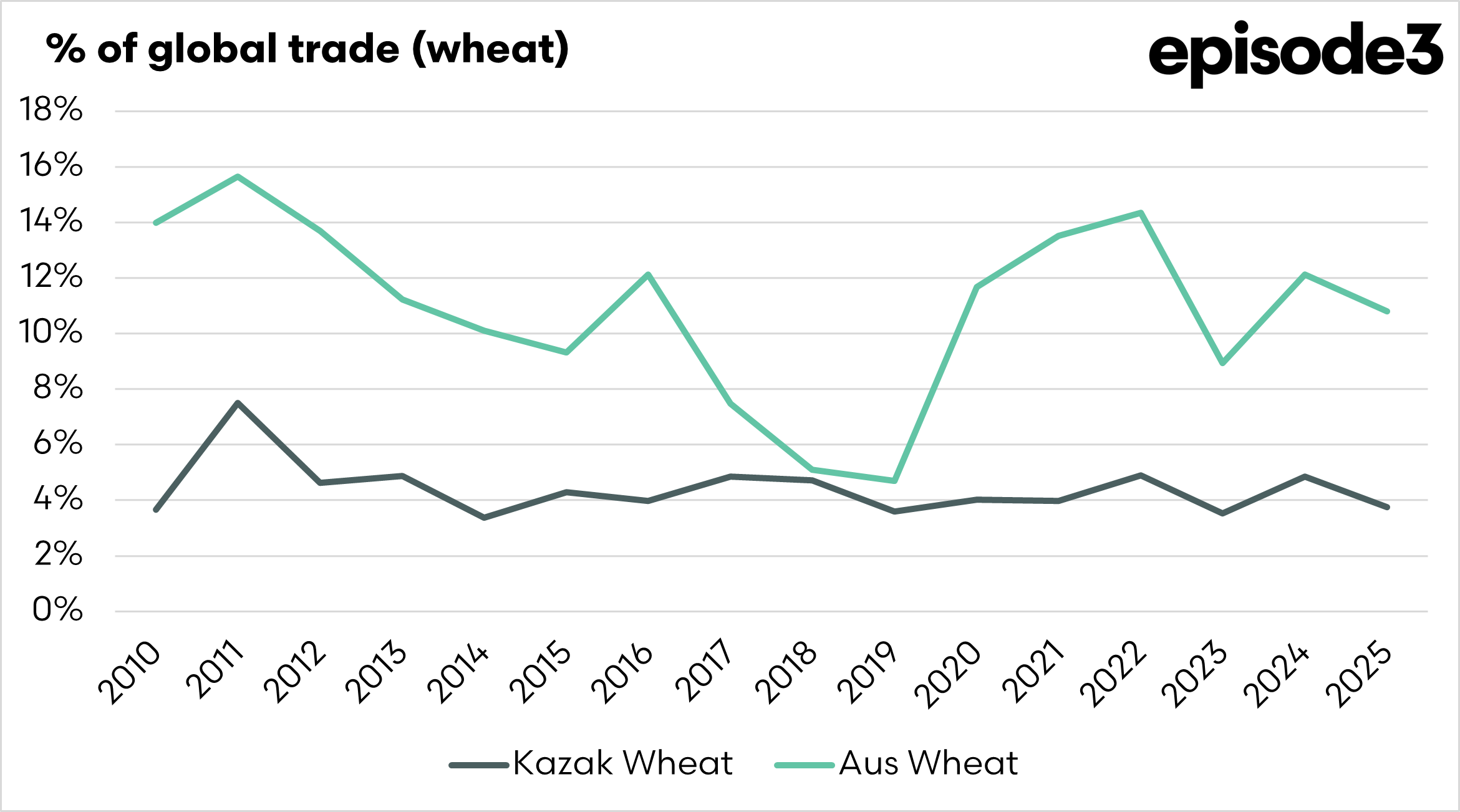

While Kazakhstan’s export volumes are smaller than those of Australia, its geographical advantage in supplying landlocked or nearby countries gives it a unique role in regional food security. Australia, by contrast, is a major global supplier of wheat and barley to distant Asian markets, including Indonesia, Japan, and China. As global trade dynamics continue to shift, Kazakhstan’s strategic location makes it an increasingly important grain supplier across Eurasia.

The future of Kazakhstan's agriculture.

Kazakhstan is working to expand its agricultural exports and become a more significant player in the global food trade. The country has set an ambitious goal to double the amount of farm products it exports by the end of the decade. This is part of a broader plan to reduce its reliance on oil and gas by building a stronger and more diverse economy. Agriculture is seen as a key area of growth, not just in terms of sending more raw products overseas, but also by adding value through processing.

One primary focus is on increasing exports of processed agricultural goods, such as flour, sunflower oil, and packaged foods. These products generate higher revenues than raw crops and can be sold to a broader range of countries. Kazakhstan has already made progress, with exports of processed foods doubling in recent years. The government is keen to maintain this momentum by supporting farmers and agribusinesses to invest in improved equipment, technology, and transportation.

To achieve this, Kazakhstan is upgrading its infrastructure, including the construction of new storage and transportation systems, as well as encouraging investment in food processing facilities. It’s also looking to expand into new markets beyond its traditional neighbours. Countries in the European Union, Southeast Asia, and the Middle East are all being targeted as potential new customers. By modernising its farming sector and reaching out to more global markets, Kazakhstan hopes to secure a strong future for its agricultural industry.

For Australian agriculture, this growing competition could present challenges. Kazakhstan’s lower production costs, proximity to emerging markets, and increasing trade ties with countries like China and the Gulf States mean Australian exporters may face more challenging conditions in some key regions. If Kazakhstan can offer similar products at lower prices or with quicker delivery times, Australia could lose market share, especially in commodities like wheat, barley, and oilseeds, where both countries compete directly. As Kazakhstan becomes a more reliable and capable supplier, Australia may need to focus more on quality, branding, and maintaining strong trade relationships to stay ahead.

So we need to keep an eye on Borat’s homeland. “King in the castle, king in the castle”.