Final food CPI for 2025

Monthly Food Inflation Update - December 2025

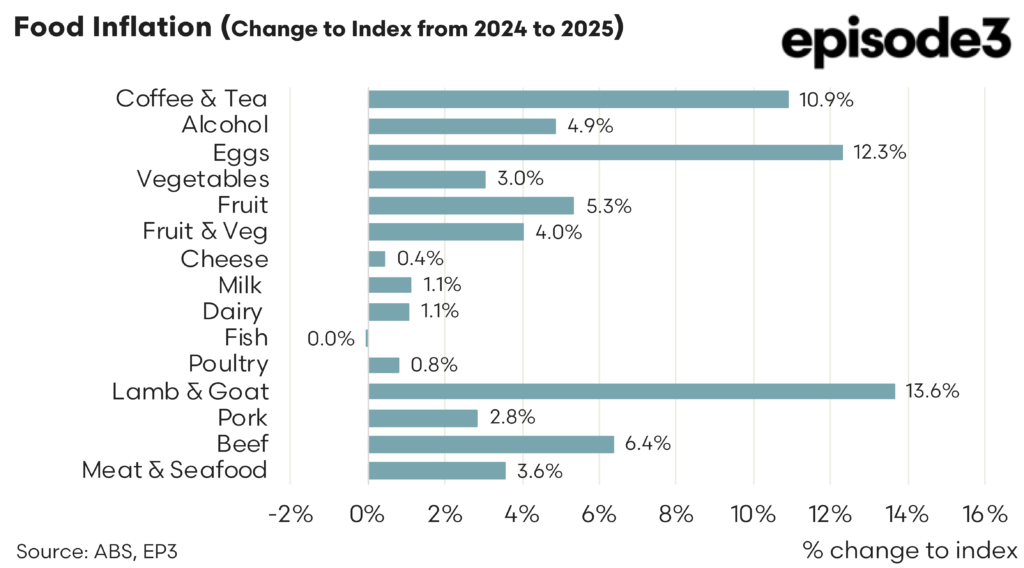

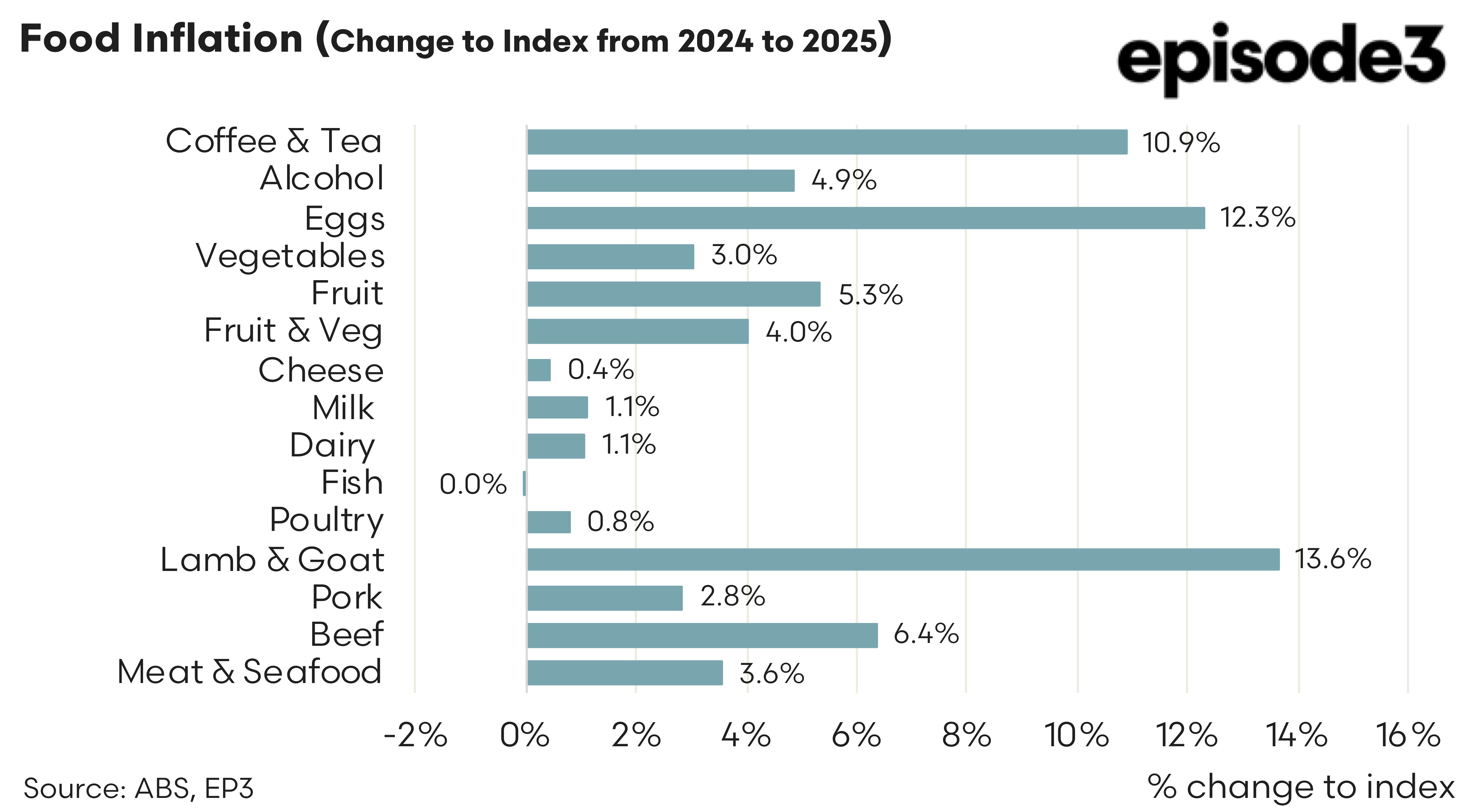

On an annual basis, the standout pressures remained concentrated in a handful of categories. Lamb and goat recorded the largest increase over the year, rising 13.6 percent, underscoring how earlier supply tightness continued to flow through to retail prices despite easing conditions late in the year. Eggs followed closely, up 12.3 percent year on year, reflecting the lingering effects of earlier production disruptions, due to bird flu outbreaks, and higher input costs that were not fully unwound by December. Coffee and tea prices rose 10.9 percent over the year, highlighting the influence of global commodity markets and elevated processing and transport costs rather than domestic agricultural conditions.

Beef prices increased 6.4 percent over the year, a moderate but still meaningful rise that points to tightening cattle availability and firm export demand feeding into domestic retail pricing. Alcohol prices rose 4.9 percent, while fruit increased 5.3 percent and vegetables rose 3.0 percent, contributing to a combined fruit and vegetable increase of 4.0 percent. These outcomes suggest that fresh produce inflation remained present but relatively contained when compared with proteins and imported or globally traded goods. Dairy prices were notably subdued across the year, with milk and the broader dairy category rising just 1.1 percent and cheese increasing only 0.4 percent. Fish prices were flat over the year, while poultry rose a modest 0.8 percent. Pork prices increased 2.8 percent, and the broader meat and seafood category lifted 3.6 percent, masking significant variation within that group.

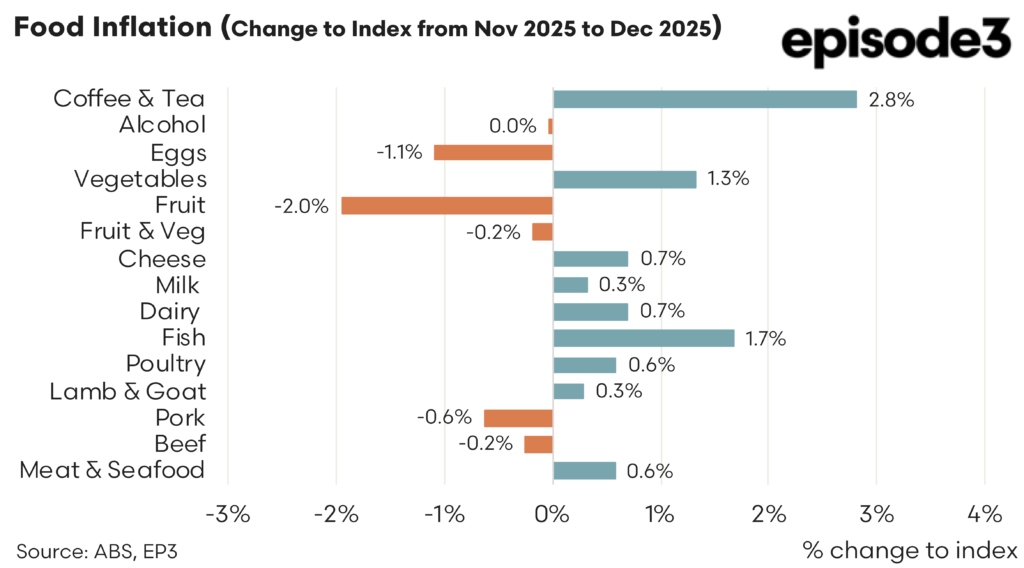

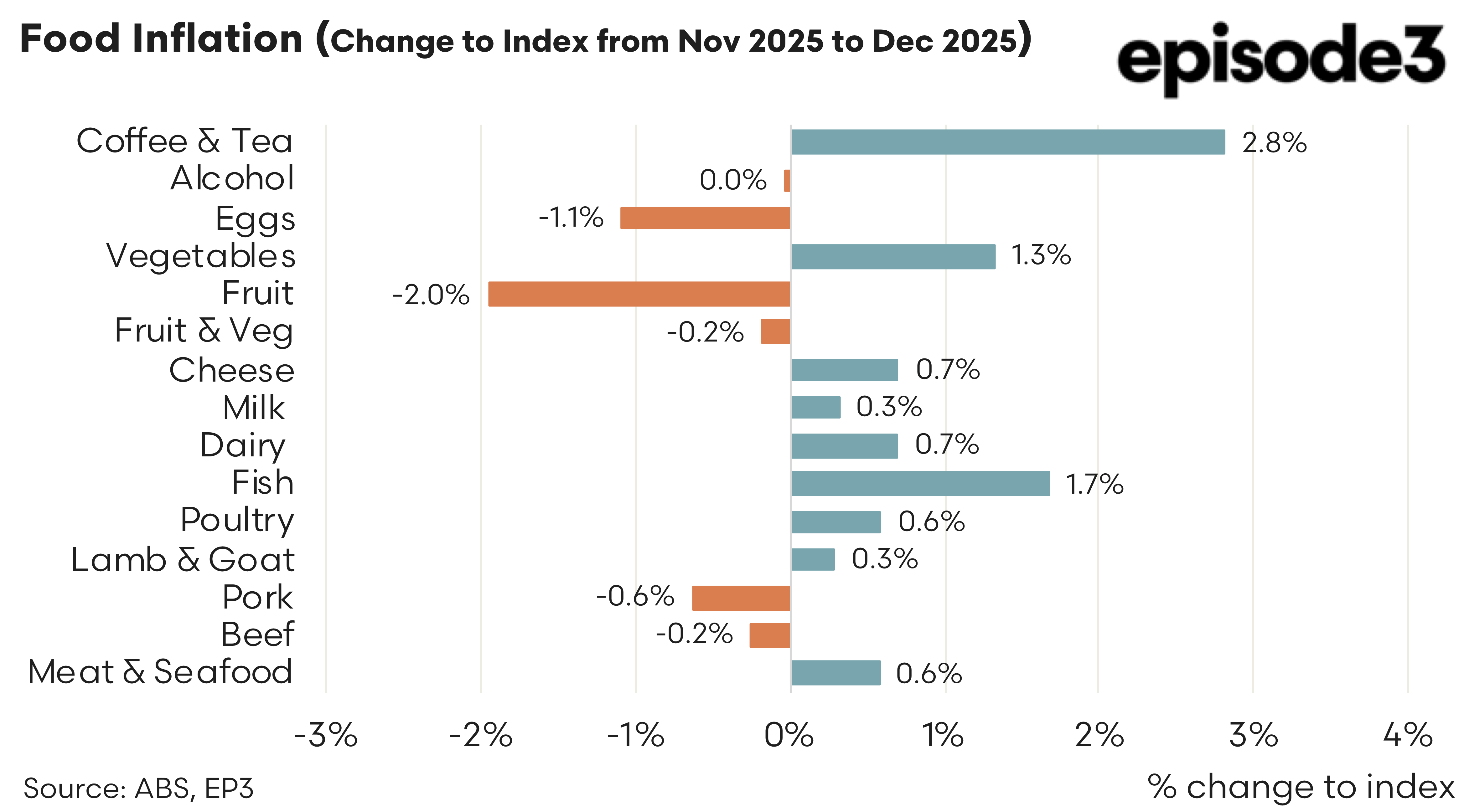

The monthly data for December tells a different but complementary story. Price movements into year end were mixed, with several categories easing after strong annual runs. Fruit prices fell 2.0 percent in December, pulling the combined fruit and vegetable category down by 0.2 percent for the month despite a 1.3 percent rise in vegetables. Eggs declined 1.1 percent month on month, providing some relief after sustained annual increases. Pork prices fell 0.6 percent and beef eased 0.2 percent, suggesting that short-term supply improvements and seasonal factors were beginning to temper meat prices as the year closed.

At the same time, other categories experienced renewed upward pressure in December. Coffee and tea prices rose a further 2.8 percent in the final month, reinforcing the strength of their annual trend. Fish prices increased 1.7 percent, while cheese rose 0.7 percent and milk increased 0.3 percent, lifting the dairy category by 0.7 percent for the month. Poultry prices rose 0.6 percent, lamb and goat edged up 0.3 percent, and the broader meat and seafood category increased 0.6 percent. Alcohol prices were unchanged in December, signalling stability rather than acceleration.

The December figures show that food inflation in 2025 finished in a far more fragmented state than it began. The sharp, economy-wide food price surge of earlier years has given way to a pattern where global exposure, biological production cycles and category-specific supply dynamics matter more than broad cost inflation alone. Some of the largest annual increases, particularly in lamb, eggs and coffee, are now showing signs of stabilisation or short-term pullbacks, while other areas such as dairy and poultry remain relatively contained.

As 2025 closed, food inflation was neither fully defeated nor accelerating out of control. Instead, it settled into a more nuanced phase, where headline figures mask significant divergence beneath the surface. For consumers, policymakers and industry alike, the key lesson from the final month of the year is that food inflation risks are now targeted rather than universal, and understanding where pressures persist is more important than focusing on the aggregate alone.