Food inflation

Food Inflation Update - November 2025

The latest ABS food price data for November 2025 reinforces just how uneven inflation pressures remain across the supermarket basket. While the broader narrative is one of moderation compared with earlier inflation peaks, the detail shows sharp divergences between categories, particularly within proteins and key household staples. The benefit of the expanded monthly dataset is that these shifts are now visible in near real time rather than being smoothed away in quarterly averages.

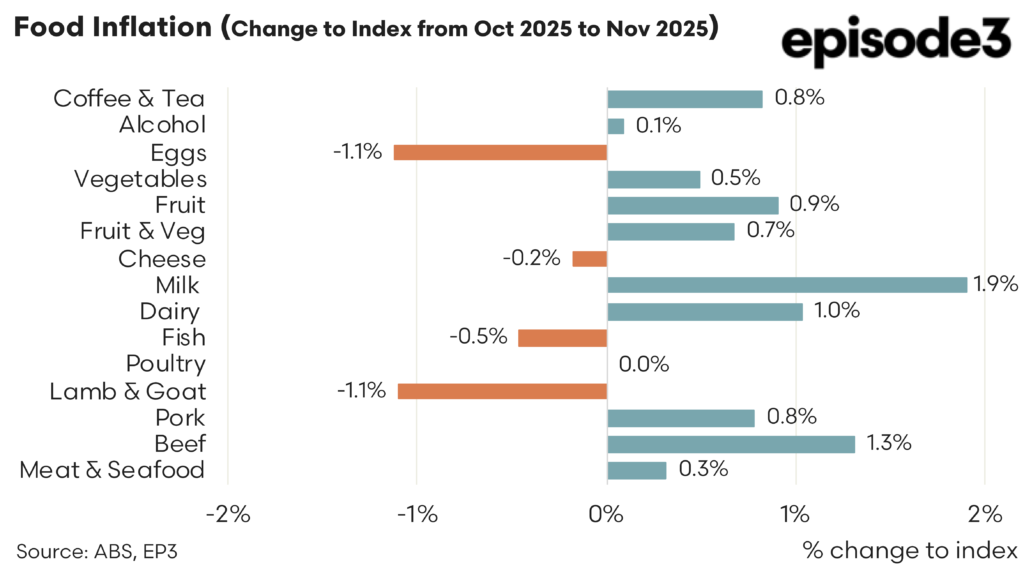

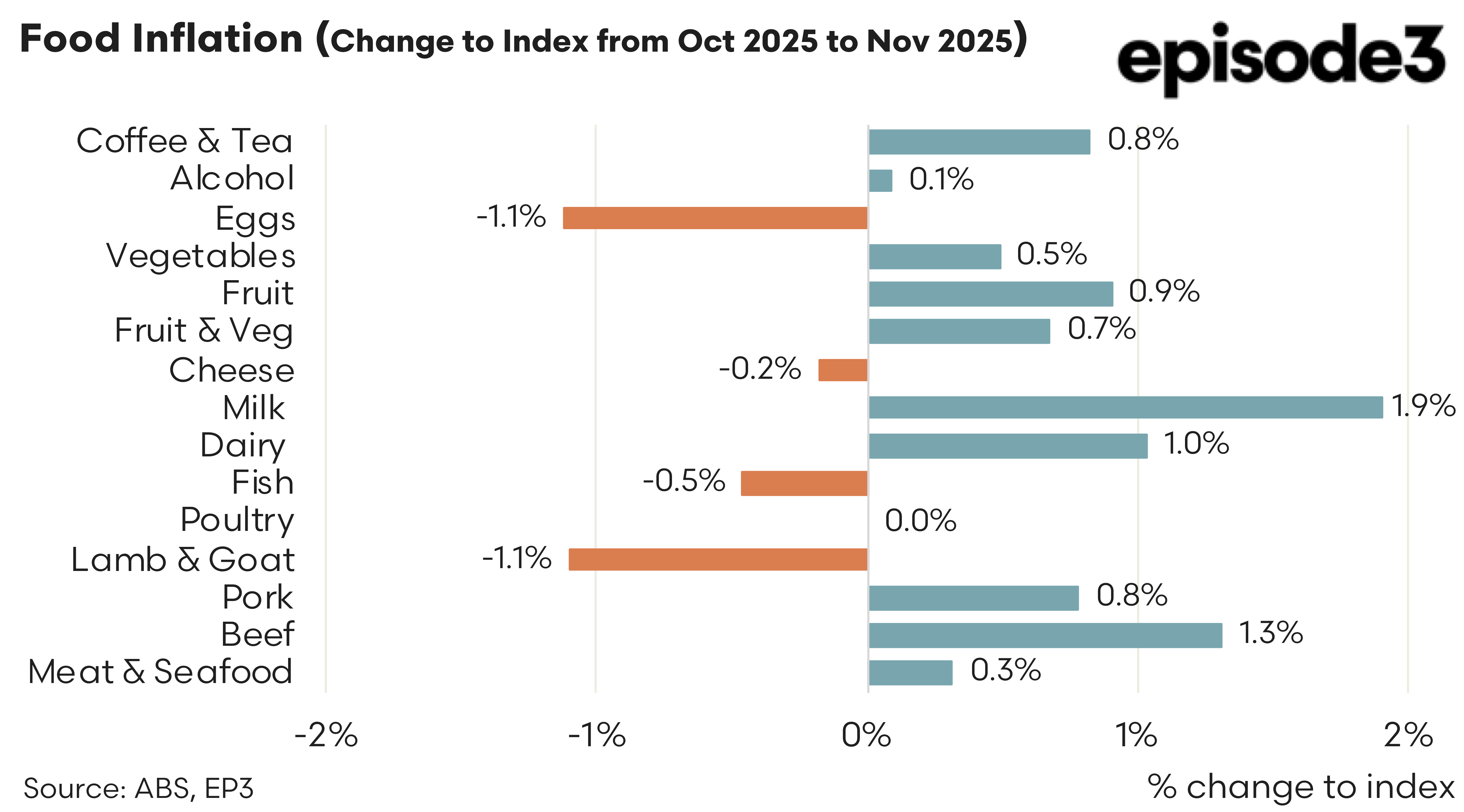

On a month-on-month basis, food prices were mixed in November. Fruit and vegetables continued to edge higher, with fruit prices rising close to one per cent and vegetables lifting by around half a per cent. This reflects typical seasonal dynamics as supply transitions through late spring, alongside higher logistics and retail costs that continue to flow through fresh produce categories.

Protein prices showed greater volatility. Beef prices rose strongly through November, increasing by more than one per cent in the month, continuing the upward momentum seen earlier in the quarter. Pork also moved higher, while poultry prices were effectively flat. In contrast, lamb and goat prices fell sharply on the month, declining by just over one per cent. This reversal follows a period of elevated pricing and likely reflects increased spring supply availability and easing wholesale conditions rather than a broad-based collapse in demand.

Egg prices also moved lower in November, falling by just over one per cent. This decline stands out given the sustained strength seen over the past year and suggests some short-term relief as supply conditions normalise. Fish prices declined modestly, while dairy categories were mixed. Milk prices recorded a solid monthly increase, lifting close to two per cent, while cheese prices edged lower, leaving the broader dairy category up around one per cent for the month. Beverages showed modest inflation, with coffee and tea prices rising close to one per cent, while alcohol prices were largely unchanged.

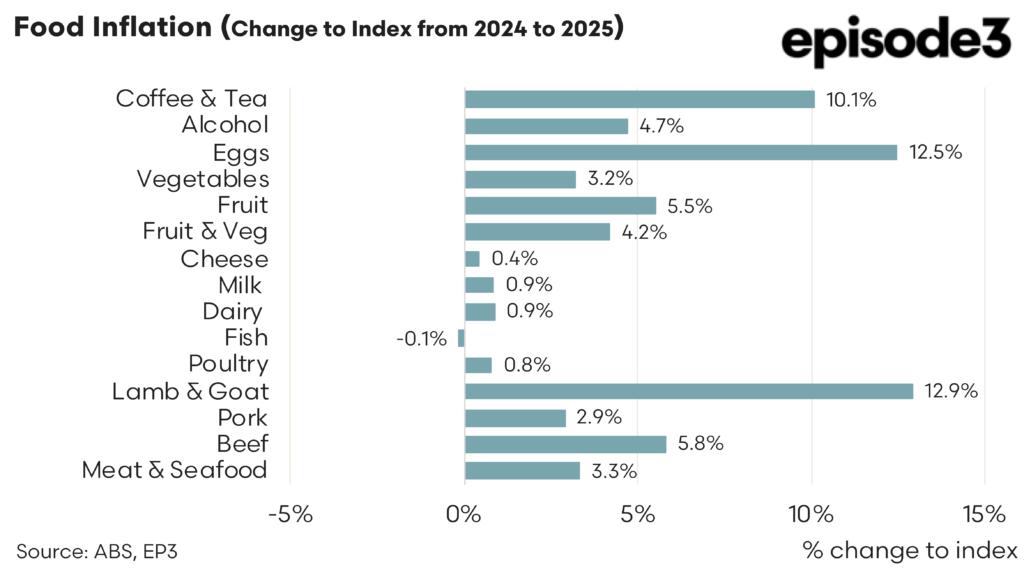

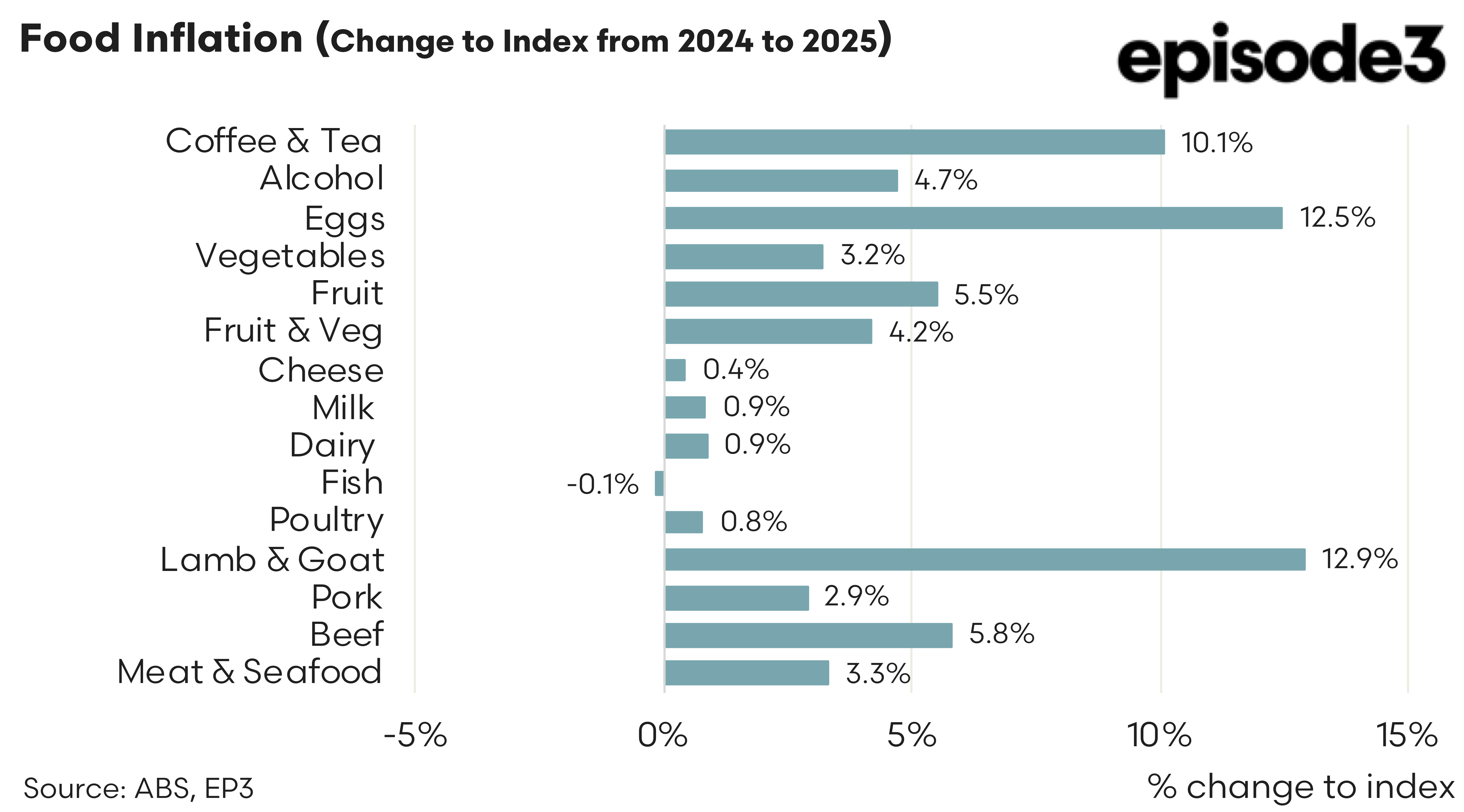

Looking at the annual picture from November 2024 to November 2025, the divergence across food categories becomes even more pronounced. Lamb and goat prices remain one of the strongest contributors to food inflation, up close to thirteen per cent over the year despite the recent monthly pullback. Egg prices also remain elevated on an annual basis, rising by more than twelve per cent, underscoring just how persistent the earlier supply disruptions have been.

Coffee and tea prices have increased by around ten per cent over the year, reflecting global commodity pressures, currency effects and higher processing and transport costs. Beef prices are up close to six per cent annually, a notable lift given the broader easing in some food categories and a signal that tight supply conditions are beginning to assert themselves further along the supply chain.

In contrast, dairy inflation remains subdued. Milk, cheese and the overall dairy category are all up by less than one per cent over the year, highlighting the lag between farm gate conditions and retail pricing outcomes. Fruit and vegetable prices have risen more moderately, with combined fruit and vegetable inflation sitting just above four per cent annually, masking significant variation within individual items across the year.

The November data highlights a food inflation environment that is no longer moving in a single direction. Some categories are clearly cooling, others remain stubbornly elevated, and a few are reaccelerating. The expanded monthly ABS dataset is increasingly valuable in revealing these shifts as they occur, providing a clearer read on where cost pressures are genuinely easing and where they continue to build within the food system.