Market Morsel: Red, red sea – Fert, parts and canola risk.

Market Morsel

We are only two weeks into 2024, and conflict is grains’ main point of interest. Usually, there is little to talk about at this time of year, but not this year.

In the past couple of weeks and months, there has been an increase in the number of attacks on shipping on the Red Sea by Houthi rebels in Yemen.

The Red Sea connects with the Suez Canal, an artificial canal designed to make freight quicker between the Mediterranean Sea and Asia. The Suez Canal sees roughly 50 ships per day or more than 18,000 per year. This equates to 10-12% of global trade.

Many ship owners are now electing to redivert to go south of Africa, adding between 10 to 15 days to voyage times.

How does this impact agriculture in Australia?

- A huge proportion of our canola trade goes to Europe (see here), and these vessels may be delayed in getting to their destination.

- Eqypt and Morroco are major supplies of phosphates, and with China restricting exports, they are more important. A vessel carrying phosphate rock to Indonesia was attacked.

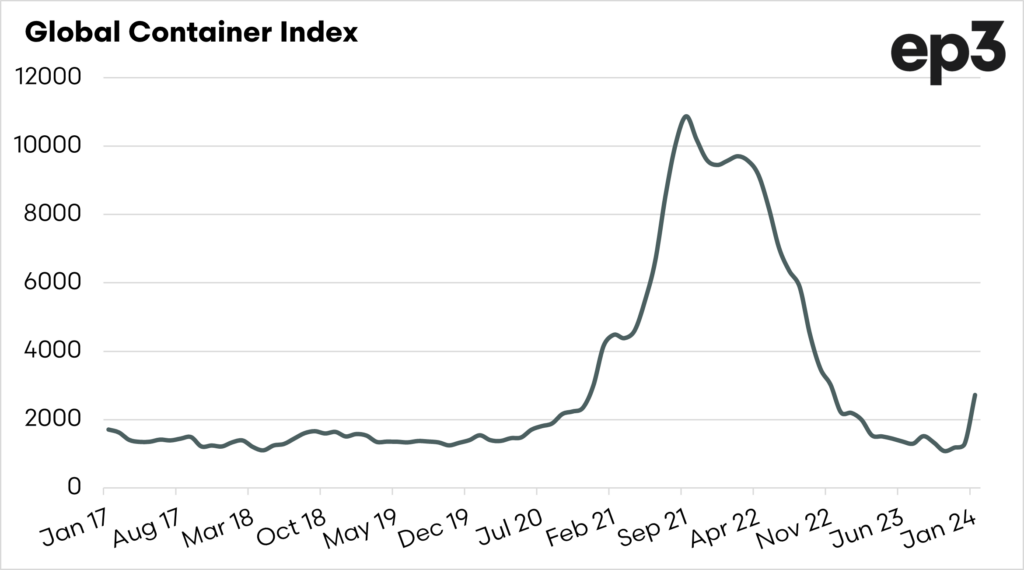

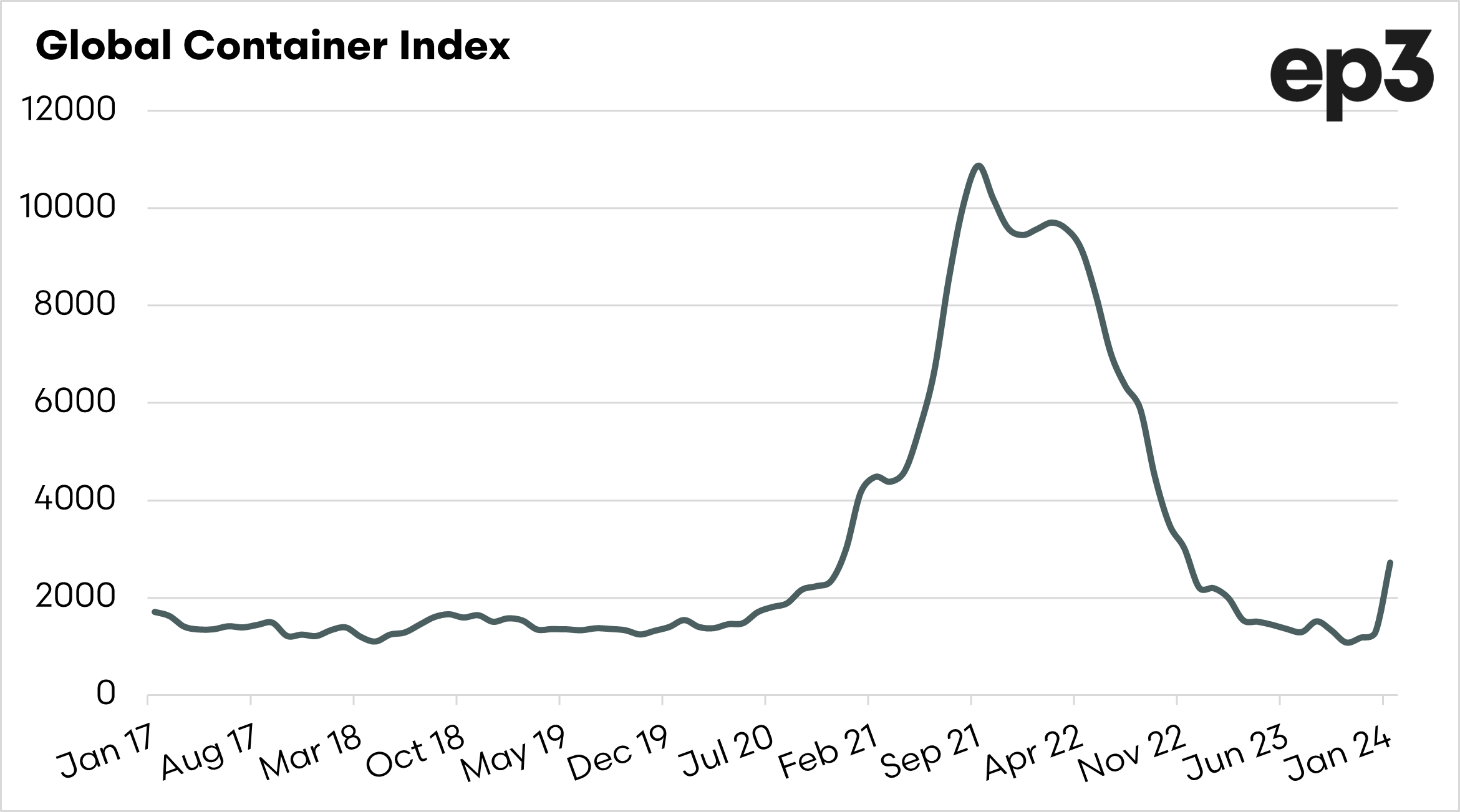

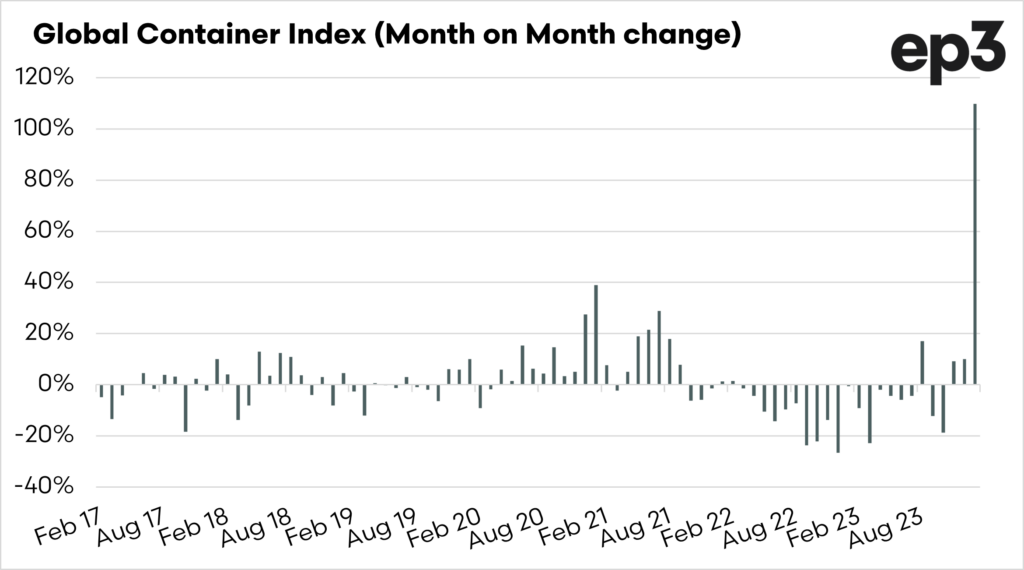

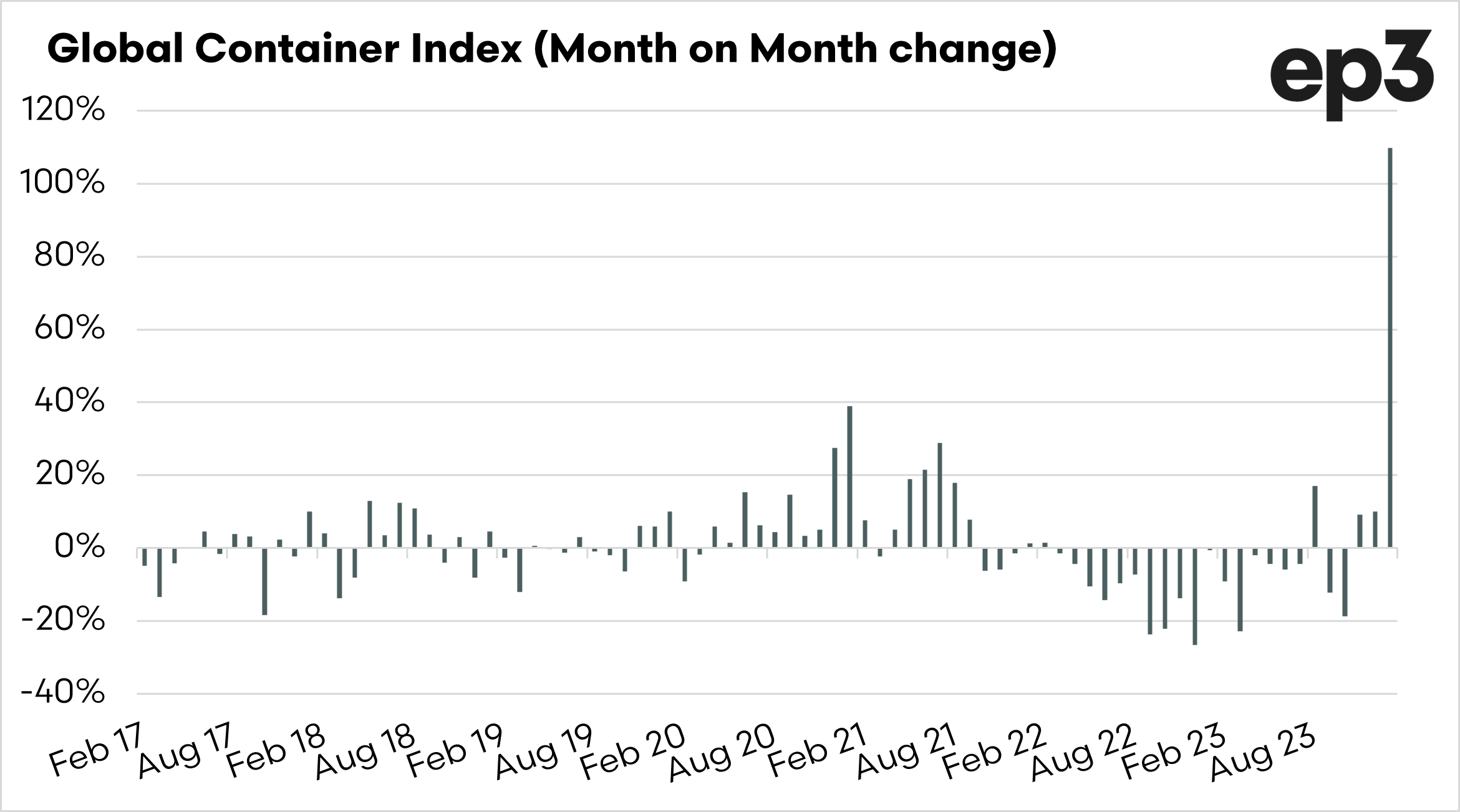

- Freight rates for containers have massively increased, and this has a flow-on effect on many of the products that we import and export via box (think parts)).

The last few years have been full of supply chain disruptions from COVID to the Evergreen Suez blockage, and it seems that trade flows will be disrupted for at least January and February.

The cost of containers has had its largest month-on-month change, massively exceeding the price reaction felt during COVID. Whilst container rates are nowhere near the highs of 2020 to 2022, the reaction has been strong at a monthly increase of 110%.

(AI generated image)