Who is competing for Australian grain in 2023?

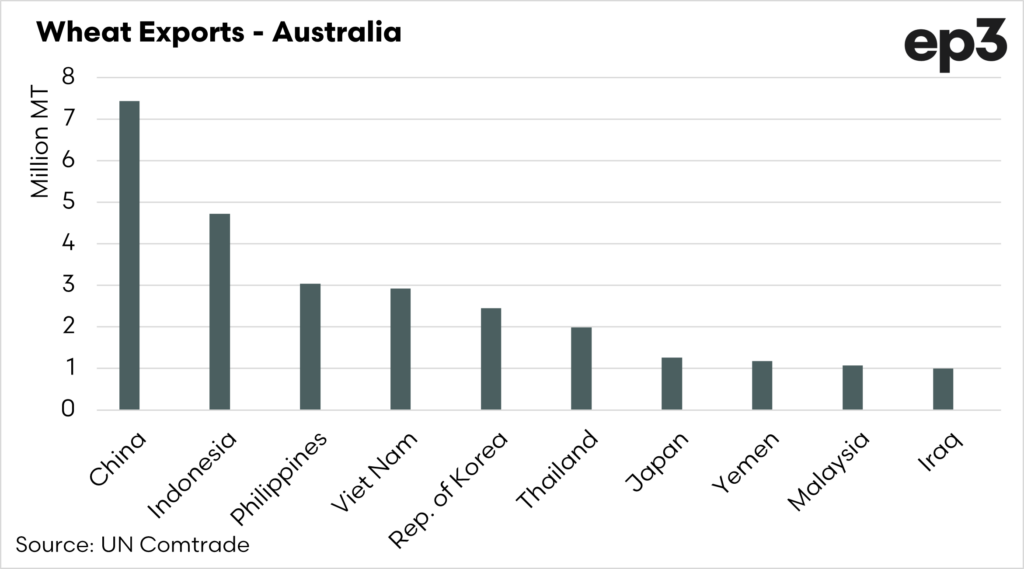

Wheat

The data is out for the 2023 season grain exports, November 2022 to October 2023. So who were the big boys this year?

The last harvest was huge, and therefore, the export volume was equally large. During the season 31.2mmt of wheat was exported.

The biggest buyer was China, at 24% of the total volume of our exports. This was followed closely by Indonesia.

We have spoken about the increased volumes that China is buying (see here) and the importance of Indonesia (see here). The top five countries equate to 66% of the total volume exported.

Suppose we were worried about being too reliant on China for barley. Should we be worried about the volumes of wheat they are buying? I don’t really think we need to worry; they will buy based on price – trade flows will change, we just need to accept that.

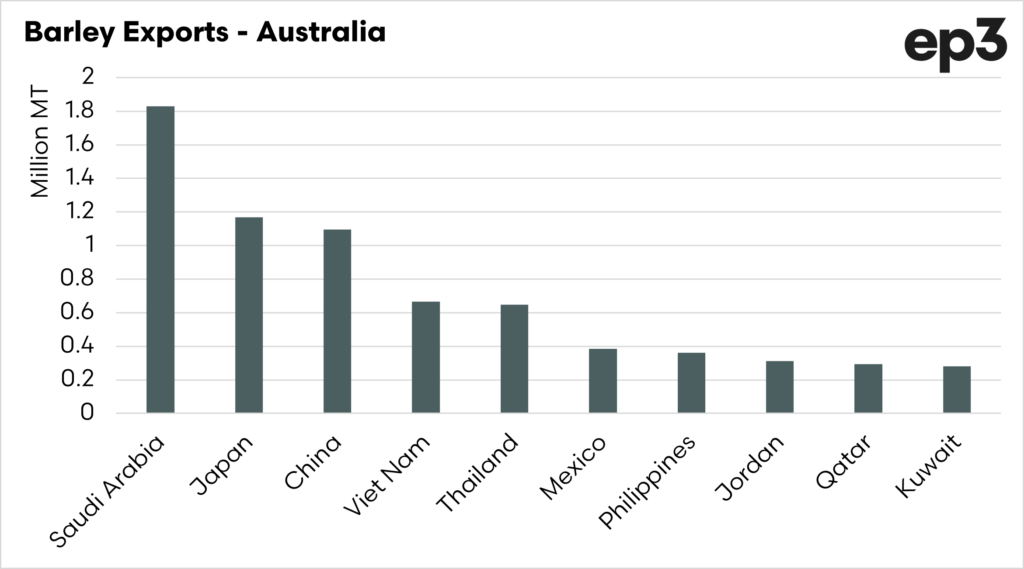

Barley

Barley has been an issue for the past couple of years. We lost a huge buyer in the form of China, and had to export to a lot of countries at smaller volumes.

That was until August when China got back into the market. In the three months leading up to the end of the season, China imported 1.09mmt, or 14% of the overall export program. An impressive feat in a short period of time. Saudi Arabia was the major buyer for it’s sheep programs at 1.8mmt or 23%.

As we move into 2024, I expect we will see China emerge again as the country’s destination for barley.

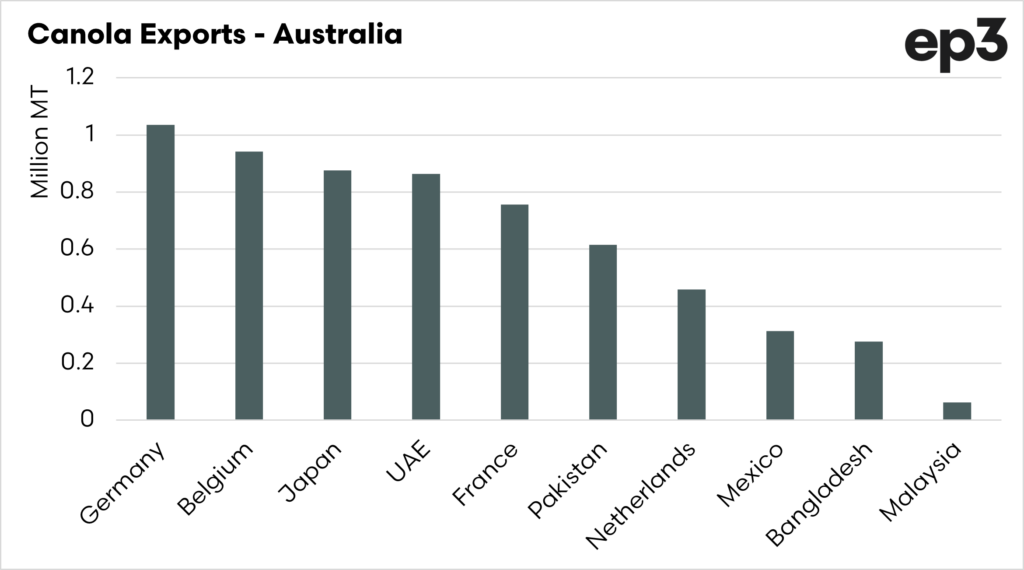

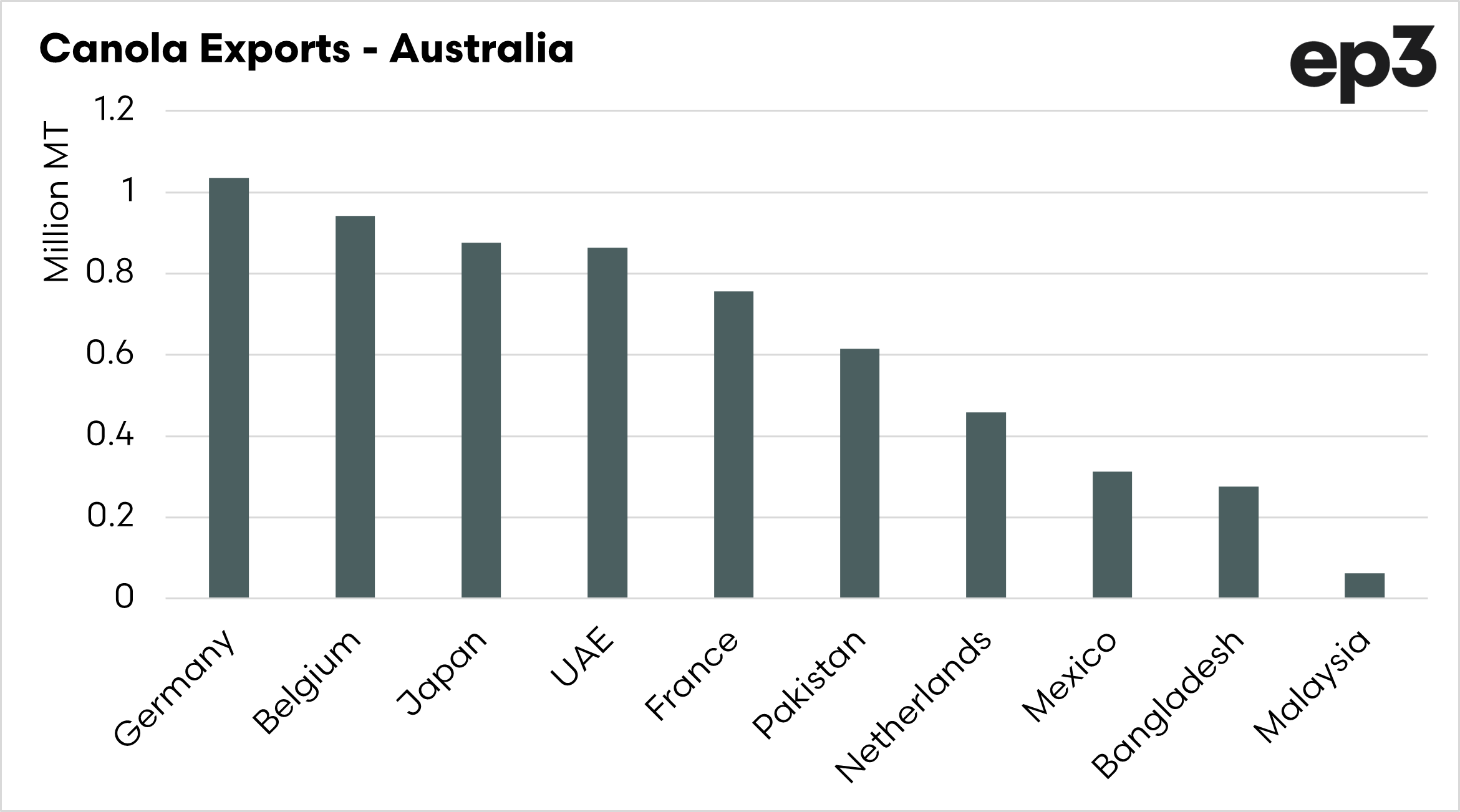

Canola

One thing I always find interesting is that people are concerned about diversity. We always seem to want to push for as many export destinations as possible when the market is too heavily skewed towards certain countries (see here).

The canola market is heavily skewed towards Europe; in the chart below, the top ten export destinations for canola are displayed. If we add up the European countries, which are the same for all intents and purposes, over 57% of the total volume went to Europe.

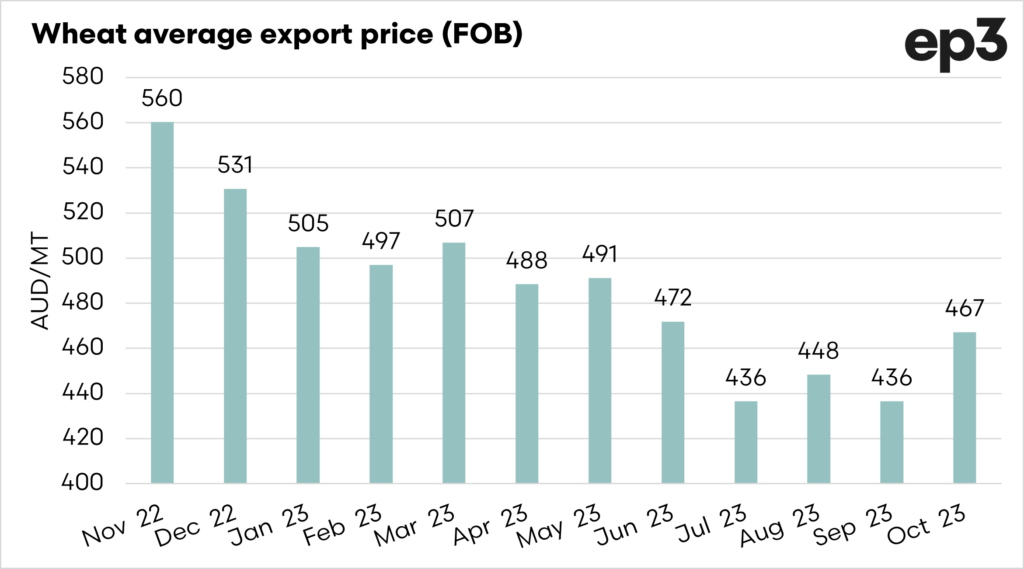

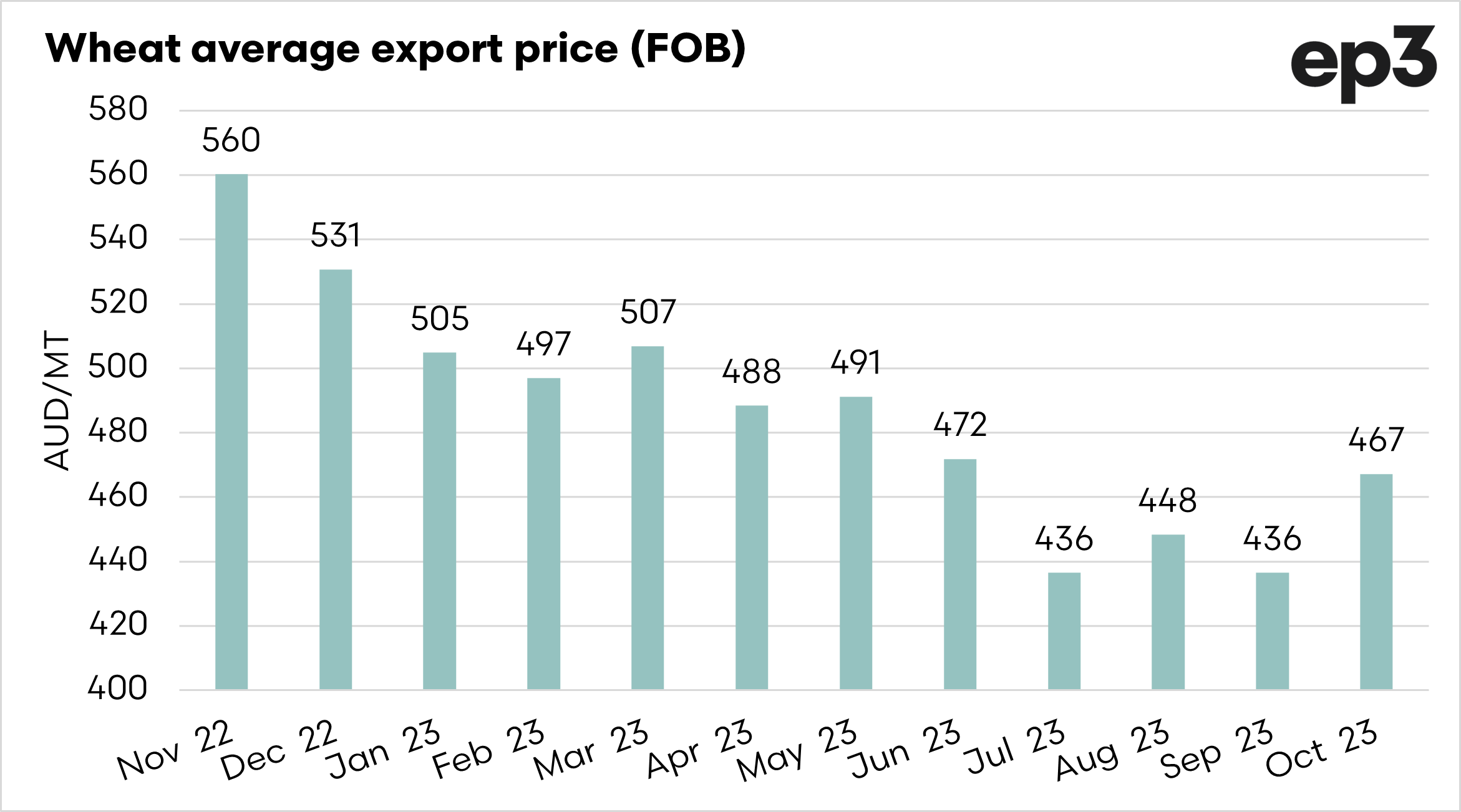

What about Price?

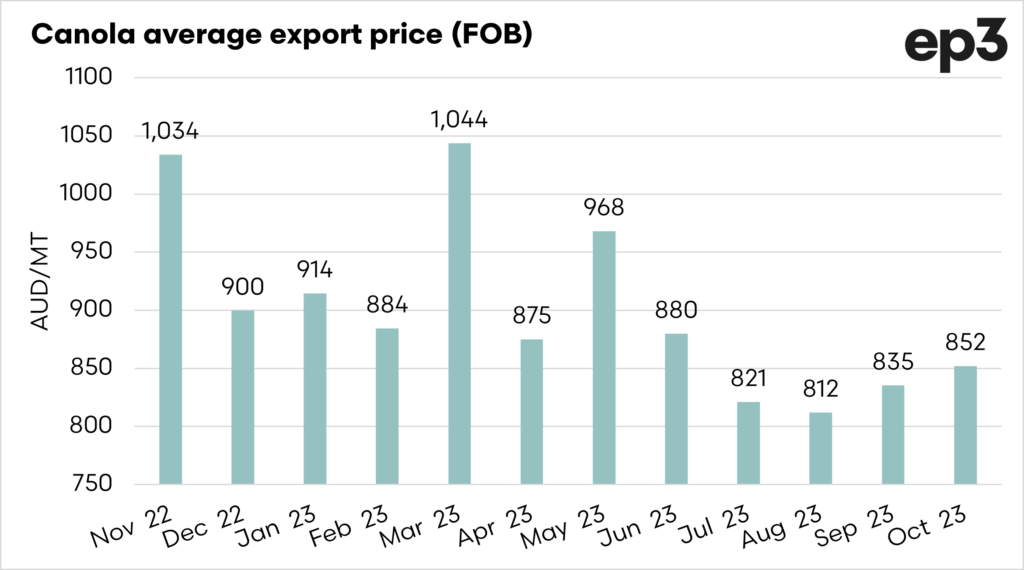

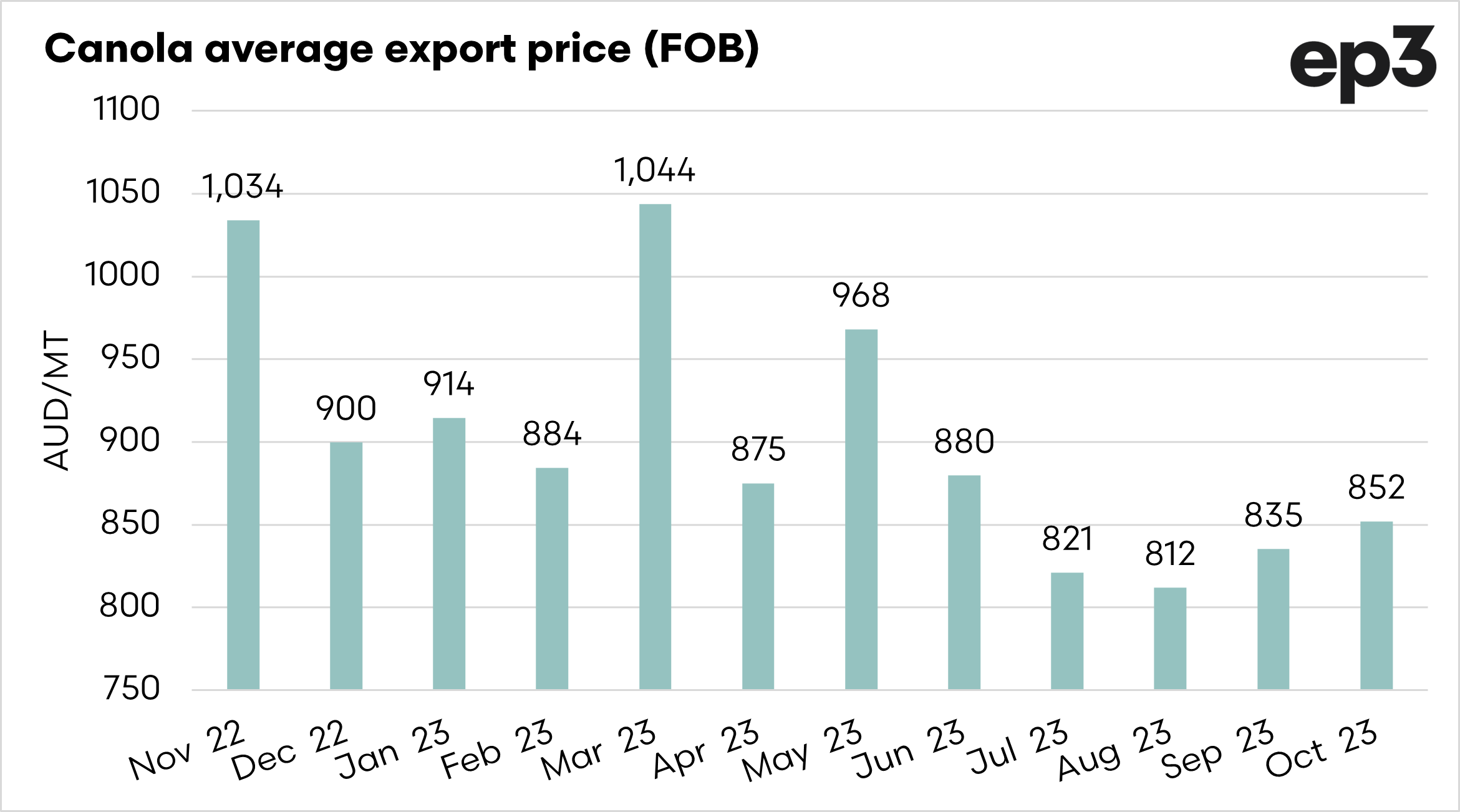

Last year was a huge year for pricing. We had the black sea conflict, which caused prices to rocket, then months and months of stop-start negotiations for the black sea grain corridor.

As we moved through 2024, the market lost ground across most of our grains.

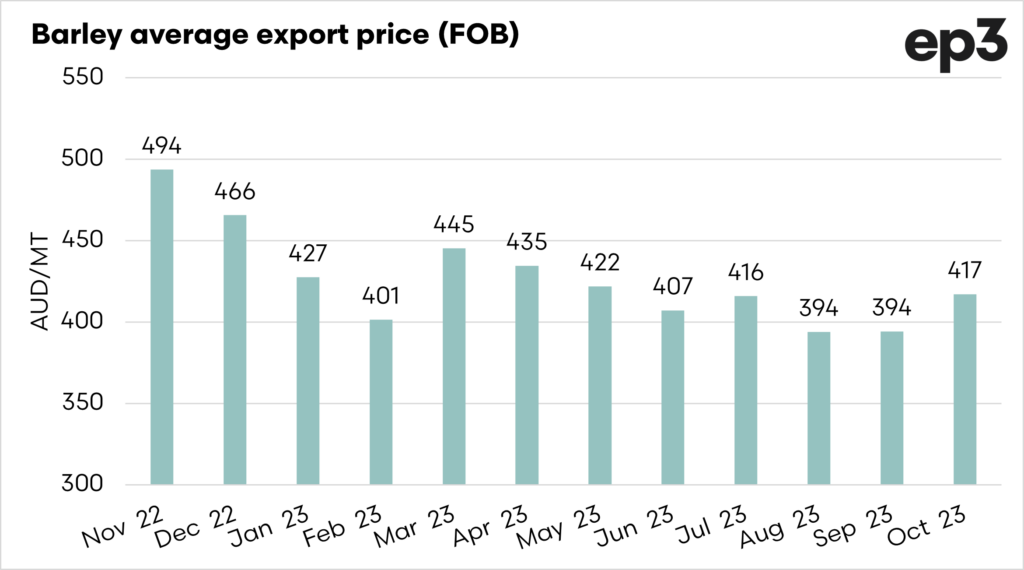

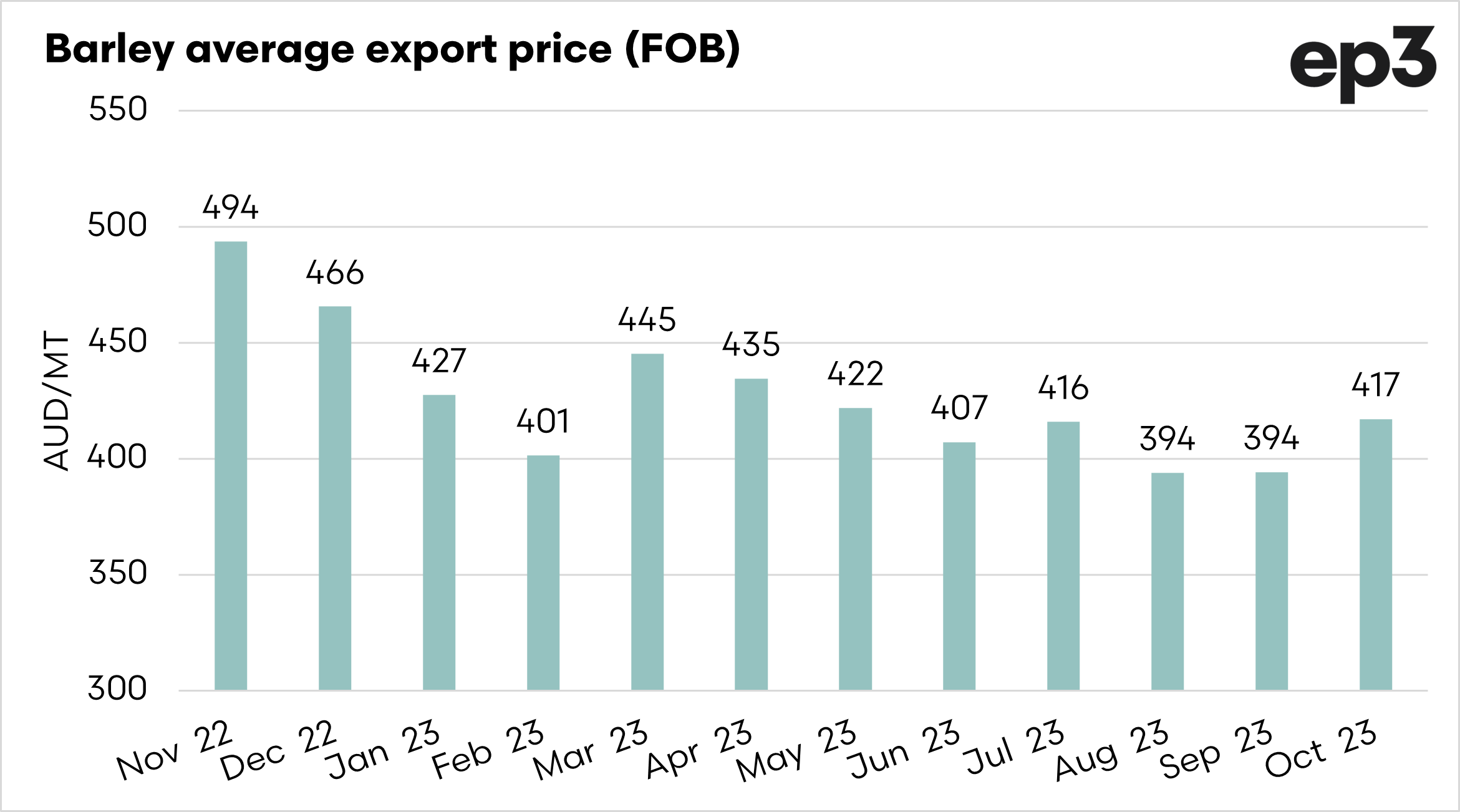

The charts below show the average price for each commodity converted into Australian dollars per tonne. This is the total value divided by the volume exported for each month to provide an indication of the trend.

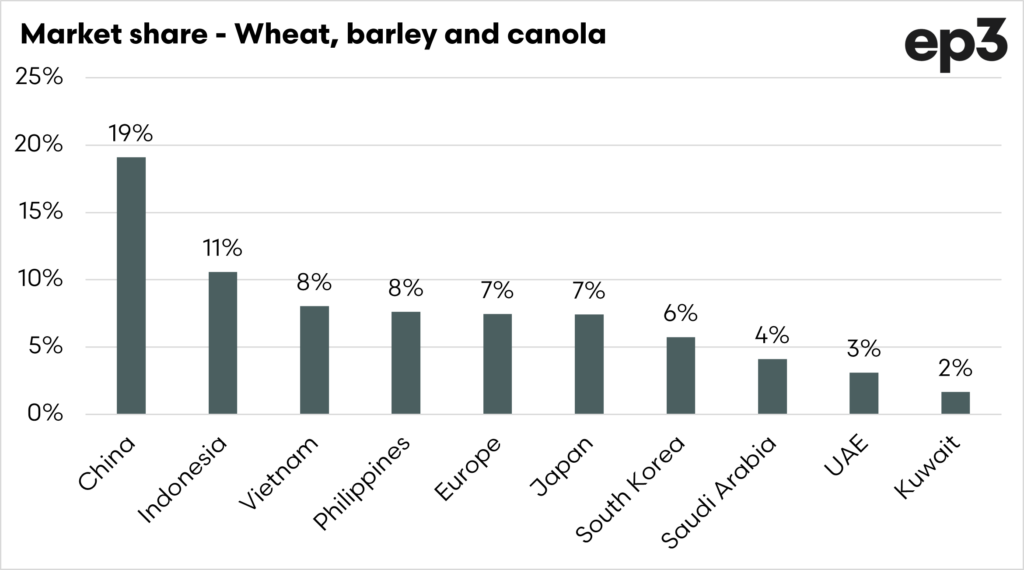

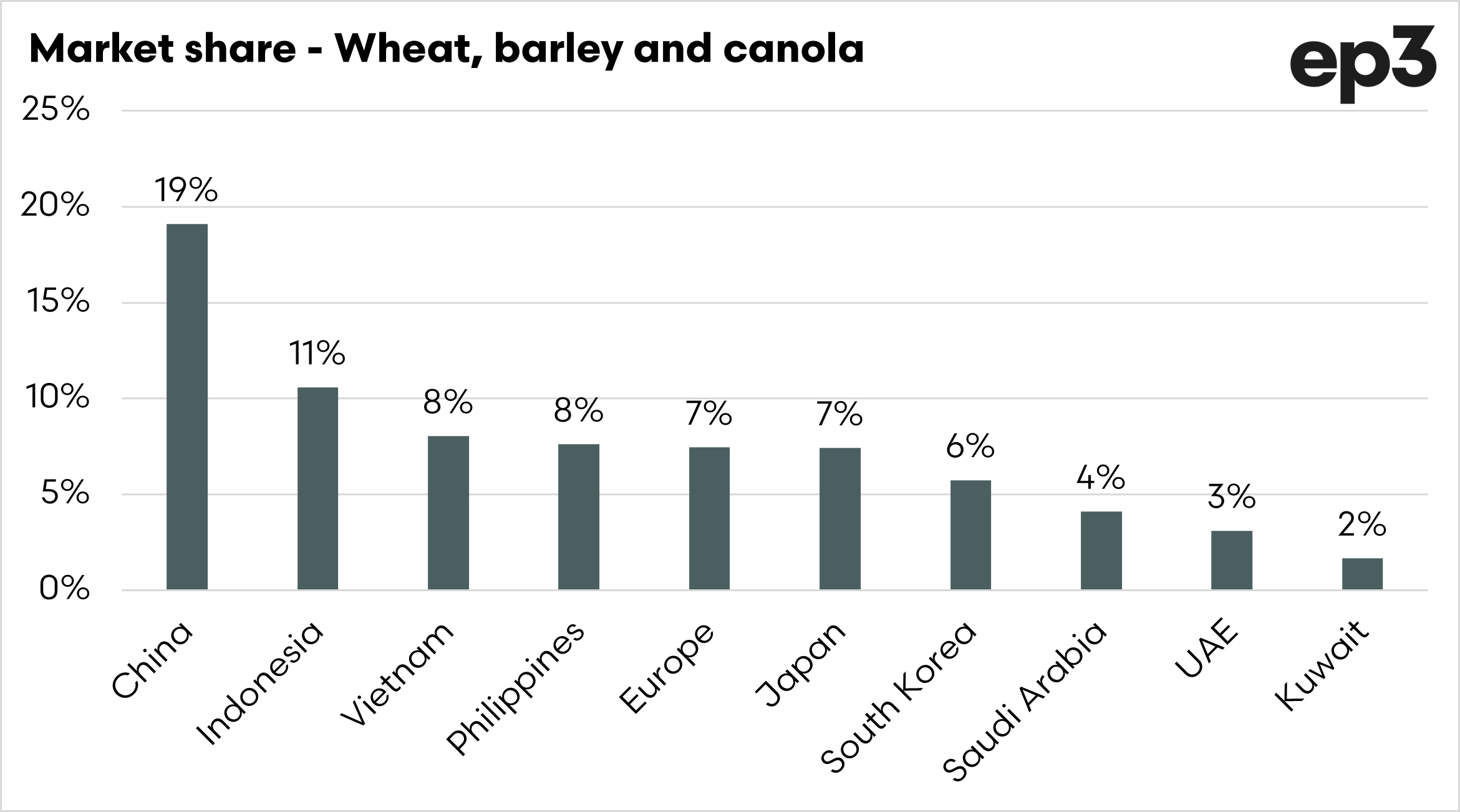

Market Share

I mentioned our reliance on certain trading partners in the barley and canola section. This will always be the case. Grain will flow to those willing to pay the most.

If we look at the overall trade in our three main grain commodities, we can see that China is the biggest customer by a healthy margin. The Chinese share of our grain trade would be substantially higher if they had purchased more than three months of barley.

These ten nations (or trading blocs) account for 75% of our total trade in barley, wheat and canola.