The Lazy Buck

Independent Contributor

Post our November AgWatchers interview and last article discussing best ‘Bang for your buck’ with a slightly dairy bias, I will look at the question of where I’d invest a spare $10 million.

It’s even more relevant now after a meeting I had last week where a family was discussing how to use their ‘lazy equity’. In this case they all run their own farming businesses but due to a relative passing with no family they inherited a $10 million property leased out for $200,000 per annum.

Now at a 2% return selling would seem logical…..or use the equity. The property has no debt so can be used as security on another investment…..but what? And passive or hands on…..

In the previous article I ruled out sheep and beef in the race for best ROI in the current environment but discovered that, according to MLA they average over 90% equity! So they too could put some lazy equity to work if a good returning investment presented itself.

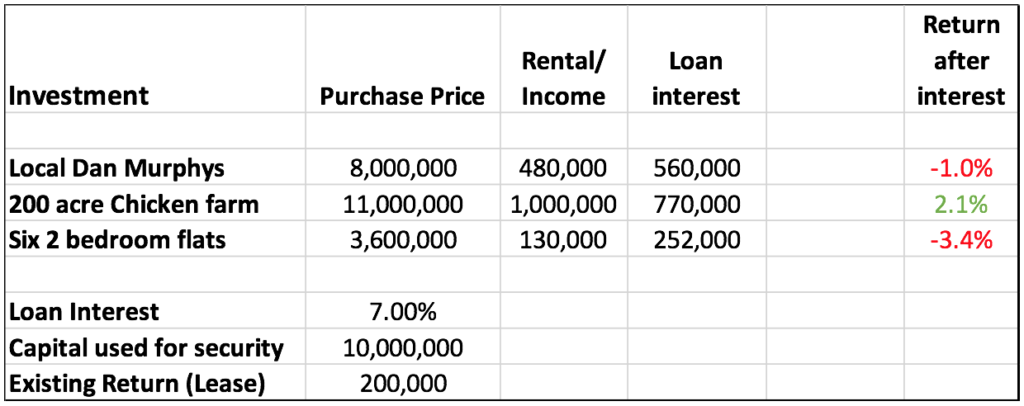

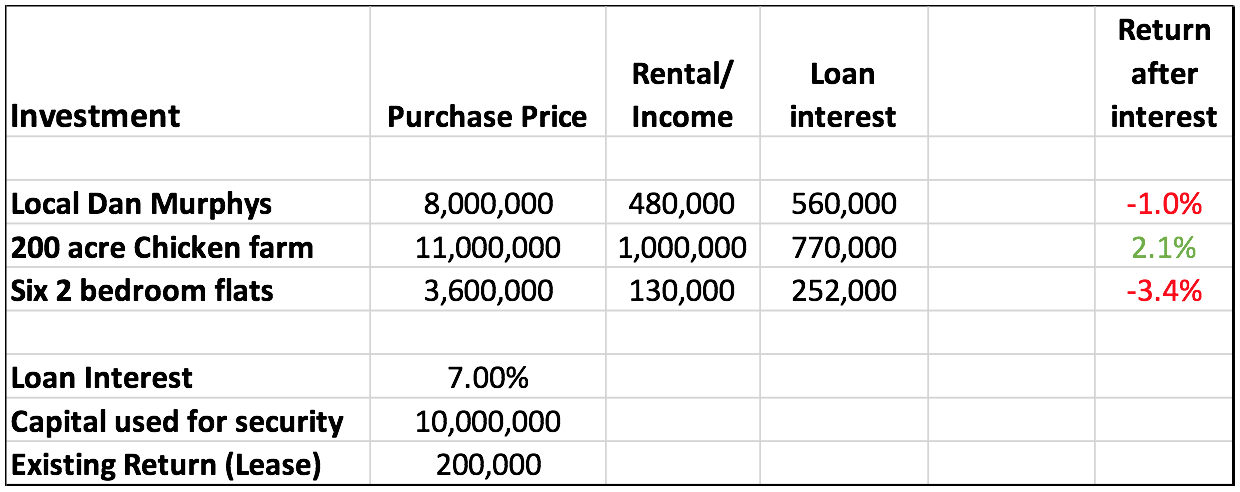

Ruling out buying the neighbours or expanding with the son or daughter coming home (a logical option) let’s look at 3 passive…ish investments and their possible returns (Back of the envelope sorta numbers).

A lot of large commercial buildings like the local Dan Murphys are owned by private investors and leased by the associated brand, who are happy to pay 5-8% annual leases and all the costs. They do this because their own businesses FMCG (Fast Moving Capital Goods) can make 20-40% net returns, albeit with the associated risk. A lot of Australia Industrial real estate has doubled in value in 5 years. At -1% its near enough to break even, but the capital gain potential as cities expand is compelling.

The 200-acre chicken farm requires a specific skillset and does run better with an owner operator due to the care required. But many have picked it up quickly and returns have been constant at this level for 10 years. A healthy 2.1% and potential to be your own boss.

The property market has doubled in the last 10 years and pockets of some cites are still affordable with $400-600,000 2-bedroom apartments still common in some central city areas. Whilst this doesn’t look appealing with a -3% loss, tax incentives can offset a lot, if not all of this……in Australia, sorry kiwis…..

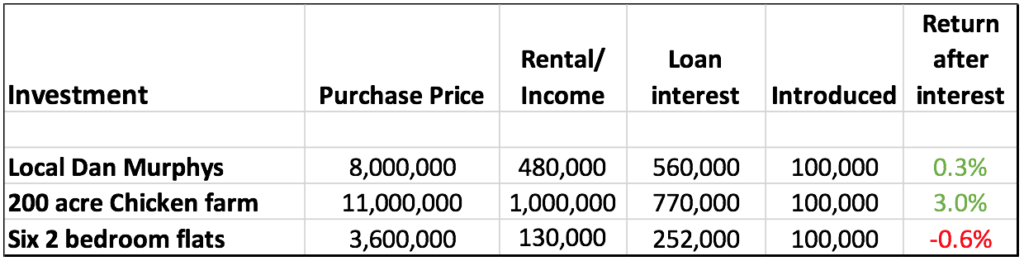

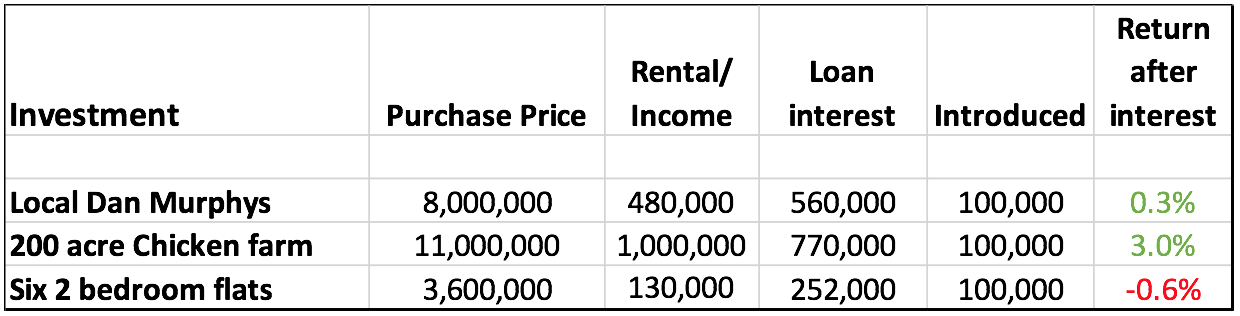

Now because our initial form of security was a $10 million farm returning 2% or $200,000 let’s flog half this to assist in the new investment as it’s 100% leveraged…..this happens.

Things become a bit more comfortable, however upside revolves around where your crystal ball sees the next 10-20 years CAGR (Compound Annual Growth Rate)…..

Will history keep repeating itself with CAGR’s well above 5% as happened the last 20 years?

Can we assume the government targeting inflation at 2-3% is directly correlated to land/property inflation?

Would you be happy with a 3% CAGR…..if you are, compounding interest on a $5 million investment means in 10 years its value will grow by $1,719,581.90

Righto I’m off to Dan’s for a 6-pack and dream about owning it…..then I’ll search for old mate ‘Lazy Equity’.