Word on the street

Independent Contributor

Word on the Street – July 2024

Fortunately much of West Victoria that was suffering from a green drought has had July rain and a few warmer days, a few more and the green pick will turn into a realistic diet for recently lambed ewes and farmers spring calving.

July sales in a quiet early Spring selling market.

Heywood $6,400/acre

Branxholme $6,700/acre

In June I was optimistic on milk price and pessimistic on lamb prices improving – happy to be proven wrong on the lamb There are rumours this is driven by supermarkets concerned about the Spring lambs supply, although let’s just see if it’s the usual late winter Supply/Demand volatility.

Sustainable pricing across the commodities has been in the news lately, Australian farmers quoting $7.50/kg for lamb as breakeven, NZ generally agreeing on $6.50/kg, both scenarios only allowing for minimal debt servicing and capital improvements.

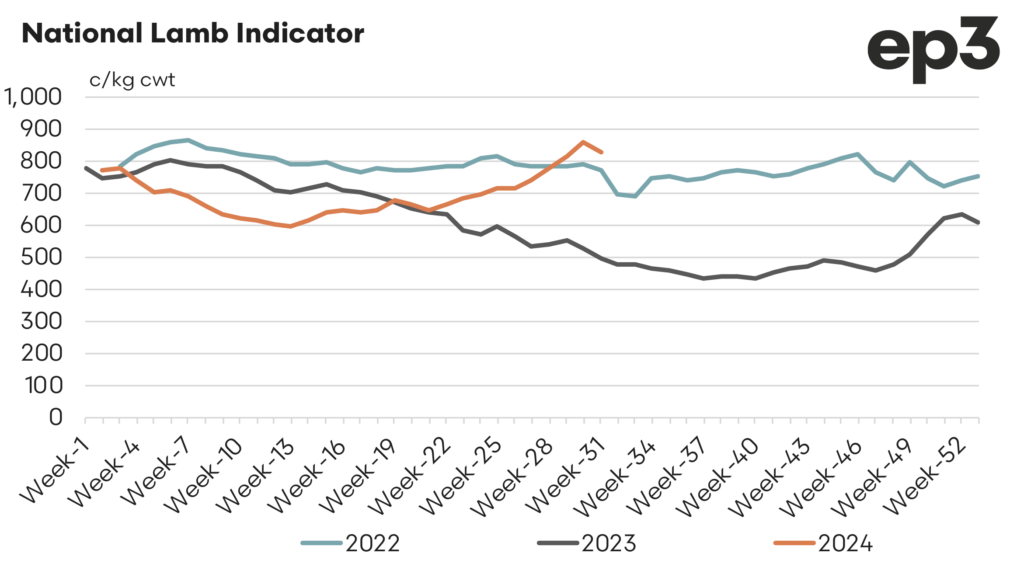

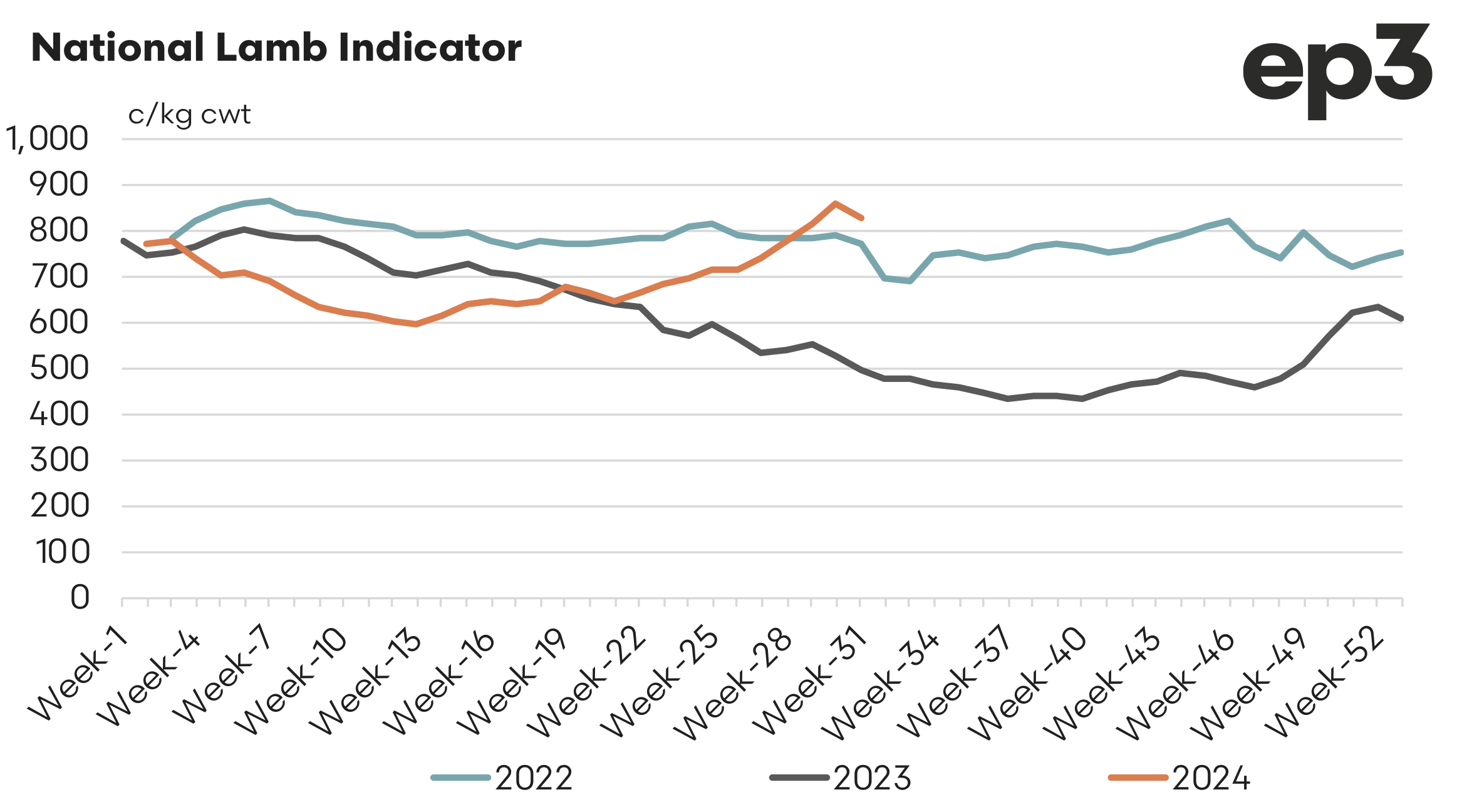

The graph below shows current spring pricing well above 2022 and 2023.

I was pretty concerned after the July 3 GDT dipped 7% and eagerly awaited the July 17 result which flattened – thankfully, although milk powders continued a slow decline with cheese and fat holding the index at a 0.4% rise. These levels still give a $8.50 Milk Price in NZ so with both starting at circa $8/kgMS, step ups still a possibility both sides of the ditch. This week’s GDT will be interesting.

General consensus in grass-based systems is $8 being an average breakeven payout, allowing for $1.50 debt servicing and capital maintenance. Many in Victoria and further North need $9 to breakeven with climate and purchased feed larger variables.

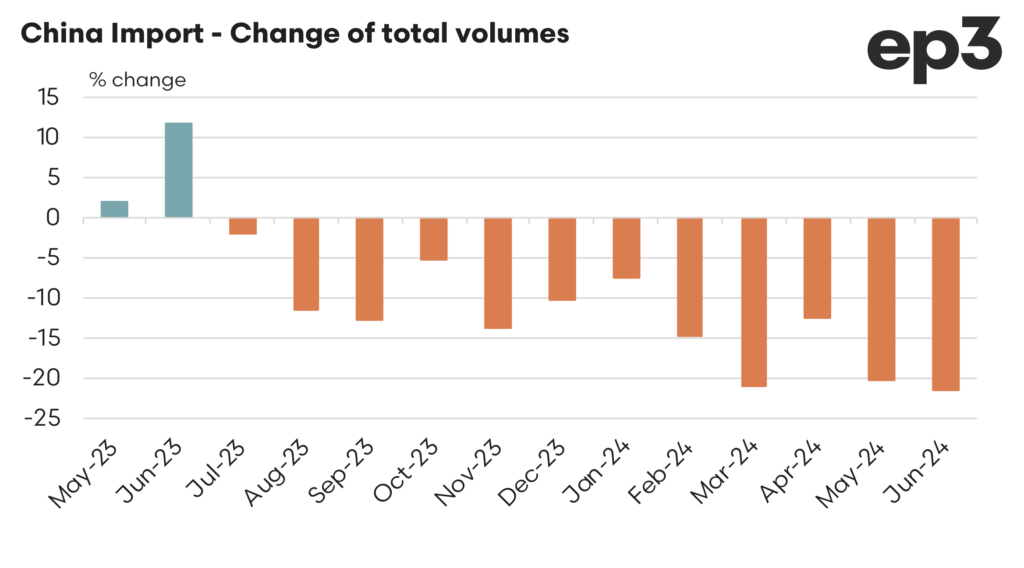

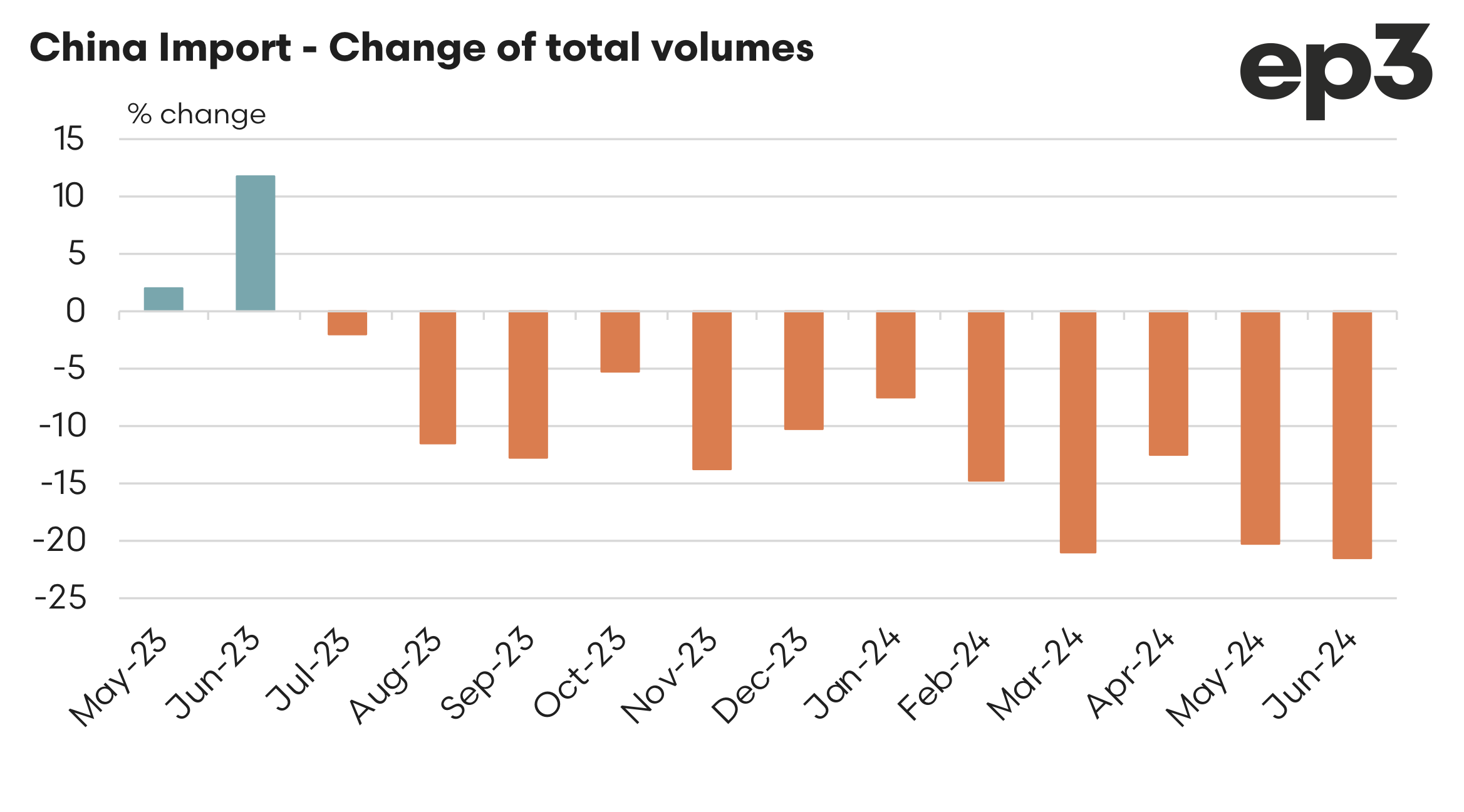

The graph below shows Chinese dairy import demand for each month compared to a year ago, from all source countries supplying China and a negative trend is clearly evident. A flat GDT with $8 plus milk price is actually quite positive considering the historical reliance on China. Interestingly as Episode 3 alluded to earlier, sheepmeat exports to China have experienced a similar drop in demand in recent months.

Whilst there has been much publicity on sustainable pricing, I suggest that since before Christ we have been purely price takers based 100% on supply versus demand, and we are dreaming if we think this is going to change. Some of us pool our milk to obtain a scale based premium. Processors will loosely collude to protect their margins when product demand is lower, and the supermarkets will always play their seasonal games. It’s really just “Business 101”, and the only solution if your unhappy is to market your own produce…..and not many get that recipe right.

I enjoy farming because I know 80% of my business is real estate and have a 50-year lens, although after a lot of land values doubling since 2019, it hurts to see prices easing circa 10% with the current interest rates and commodity price volatility.

Next couple of weeks I’m discussing Israel/Gaza and Russia/Ukraine with insights from those closer to the coal face…..we don’t appreciate how lucky we are!