A little ray of sunshine

Wool Market Update 30th June

“Hope is being able to see that there is light despite all of the darkness.” – Desmond Tutu

A little light was provided to the spot auction this week with the rate of decline tempered by the strong USD. The opening to the week was once again mediocre but the stimulus of the USD kicked in Wednesday with the strongest market seen as we moved into the close.

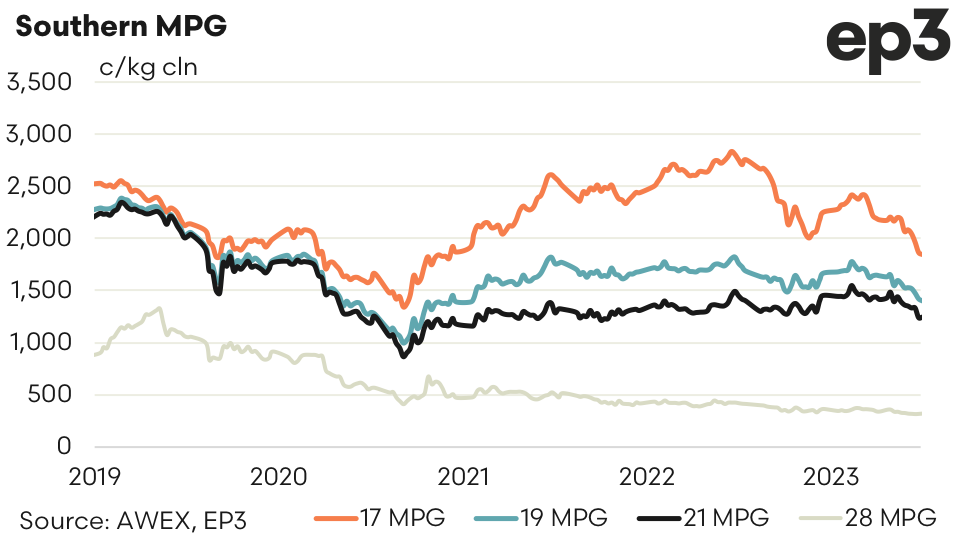

This ray of hope produced some reaction on the forward markets with bidding returning to the nearby window and trades being executed at a 2% premium to cash. Exporters and offshore processors took advantage of currency kick with key micron groups approaching long term support levels. 19.5 micron traded at 1400 (closing cash 1360) and 21.0-micron trading at 1275 (closing cash 1247). Spring traded flat to cash with 21.0 being executed at 1250.

These currency stimuli can be short lived and should be viewed as opportunities to gain some hedging cover. The main drivers will continue to be macro-economic outlook and consumer confidence.

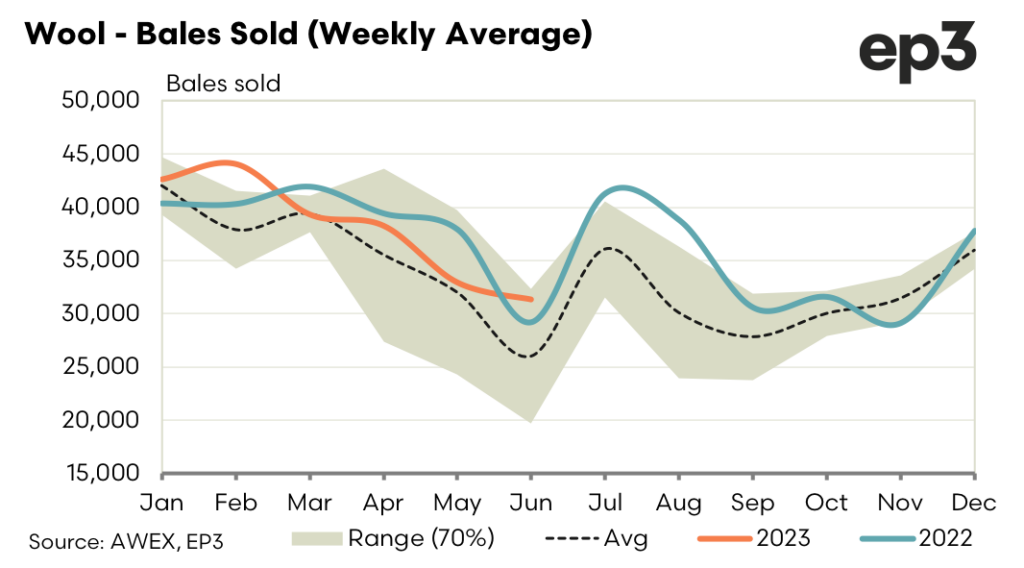

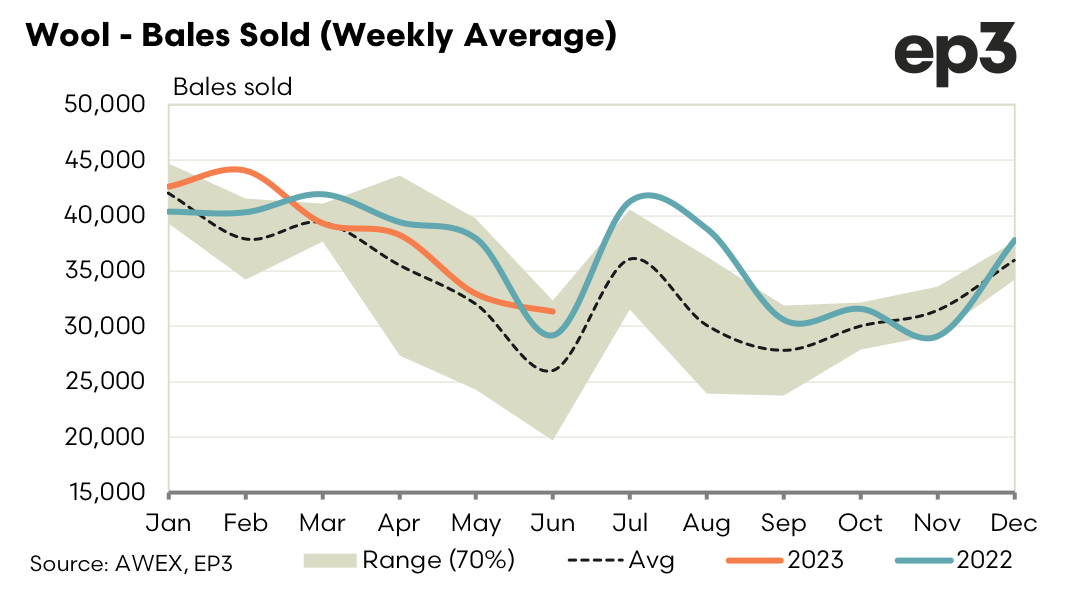

With just two more sale weeks before the three-week recess hopefully we will see enough demand inspired by gap in supply and an advantageous currency to encourage forward bidding into the spring.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.