Market Morsel: The name is Bond, Chinese Bond.

Market Morsel

Discretionary spending is just that – discretionary. If people have money, they will spend it on items, which are not necessary. Wool is expensive and fits within that category. I wrote last week about the relationship between copper as an economic indicator and wool pricing.

This week, what about Chinese bonds and wool?

China is clearly a powerhouse of the global economy, especially since the turn of this century. Chinese bonds have been a strong indicator of wool performance over much of that time.

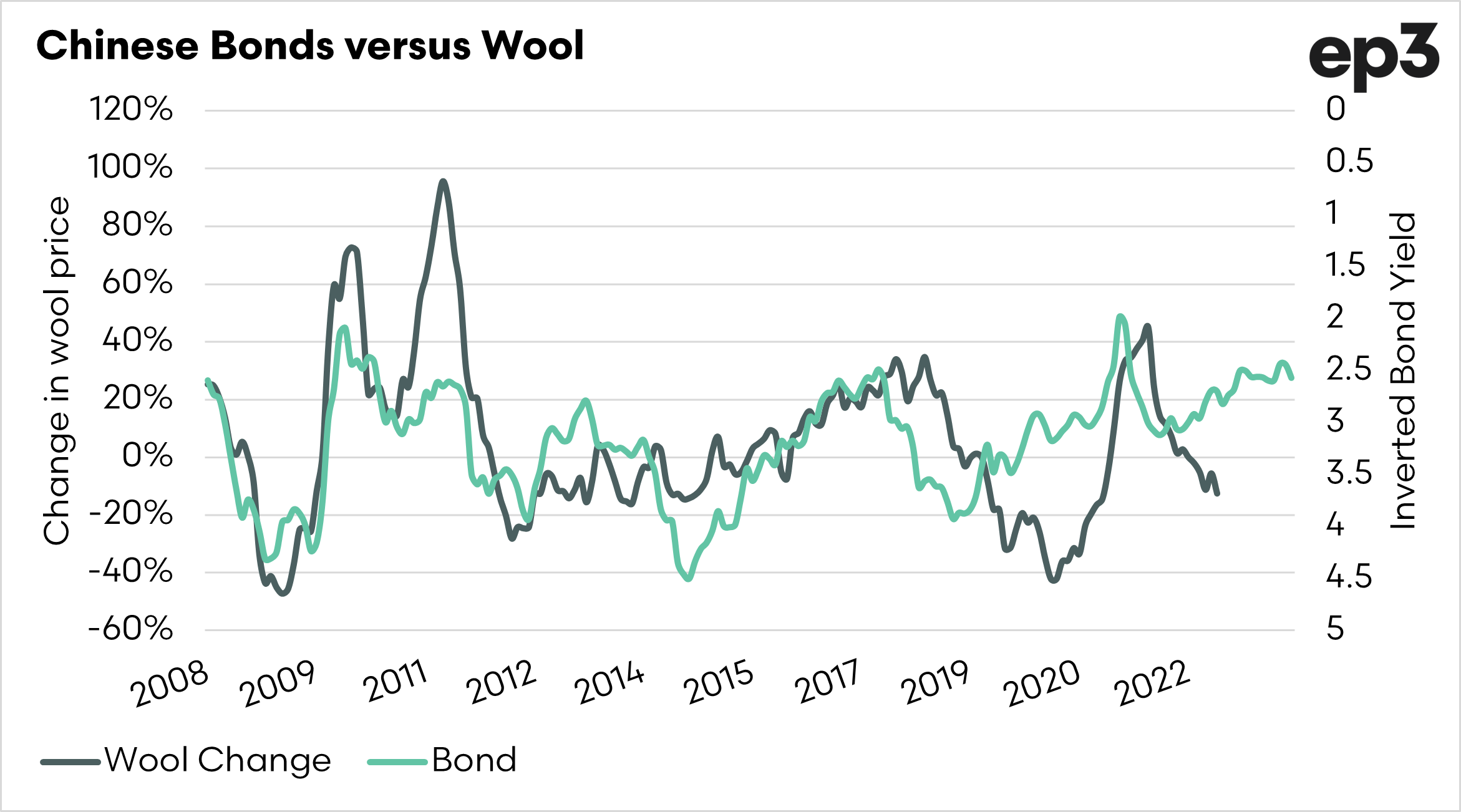

The chart below shows the change in wool price, along with a lagged bond yield (inverted).

The Chinese bond yield, when lagged, seems to provide an insight into the trend of fibres. When bond yields decline, fibre prices tend to perform well, and when they increase, that tends to correspond to a time of declining fibre prices.

Lagged Chinese bonds are showing a cheapening of credit over the next 12 months. This is a potentially good factor, but it’s not the only one. As mentioned last week, copper is a symbol of the global economy and its declining in value.

It is important to note that leading indicators are not an exact science. There are other factors to take into consideration. However, they are a valuable indicator to maintain a close eye on.

Leading indicators should never be used in isolation to make sales/purchasing decisions, but one of a bundle of tools to help develop a view on the market.