Market Morsel: I really want to CU again.

Market Morsel

At EP3, we spend a lot of time looking at a lot of different markets and commodities. Why? Well, firstly, it’s our passion. Secondly, it provides interesting insights.

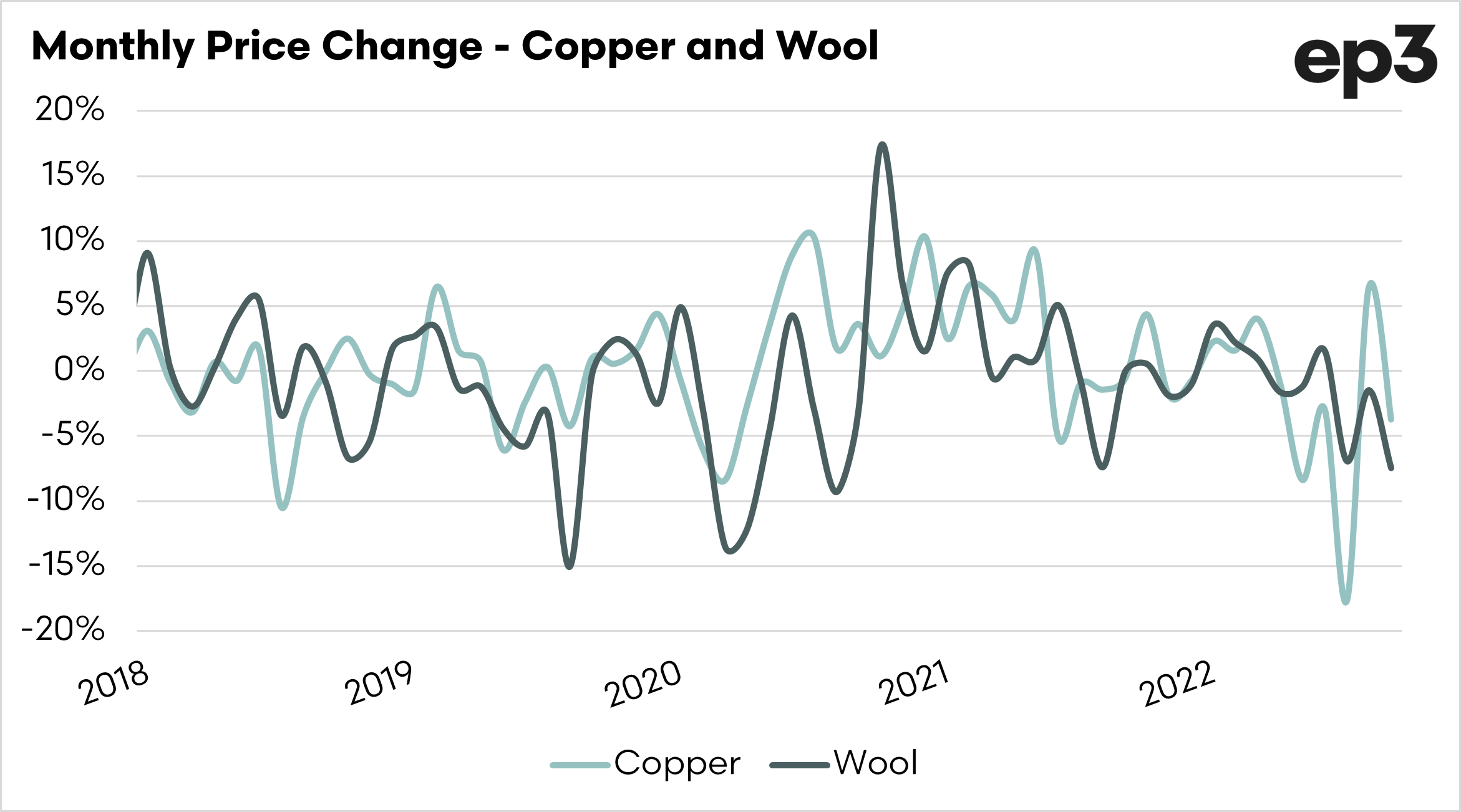

One basket of indicators we examine regularly is the lead economic indicators. These are indicators which provide a theoretical insight into the condition of the wider economic environment. These include factors such as bonds, energy, freight and importantly copper.

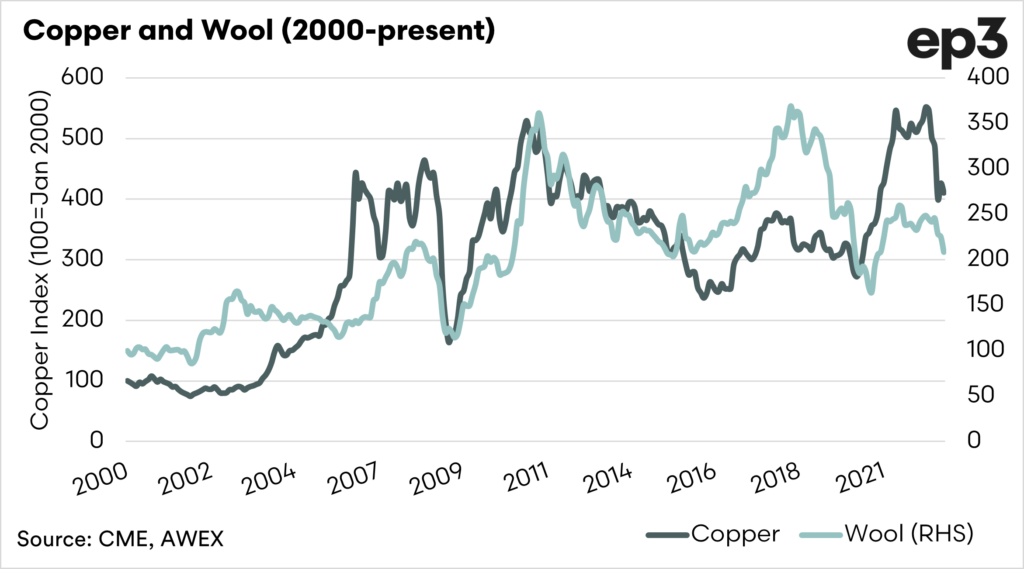

The term ‘Dr Copper’ has been in use for a long time as a predictor of economic prosperity. It has long been established that copper performance provides an insight into the performance of the general economy. This is due to its use in many industrial and electrical processes.

If the copper market is rallying (increasing), it points to an improving economy and, hopefully, more disposable income.

Why is this important? If we take a product like wool, it is discretionary. There is no argument that wool is a fantastic product, but let’s be realistic, it is expensive for the majority of consumers.

In many articles over the past year or two, we have pointed towards an economic downturn being a risk to wool pricing. It seems that other commentators are starting to cotton onto that.

Copper has started to come under pressure in recent months. It hit historical nominal highs in March and since then has started declining. This could be pointing towards a downturn in demand in consumer spending as the economy suffers from both the energy crisis caused by the Russian invasion of Ukraine and the lingering effects of Covid.

Wool demand could come under pressure as consumers switch to cheaper alternative fibres such as polyester and acrylic. It is important to keep a close eye on economic indicators when examining the wool market.

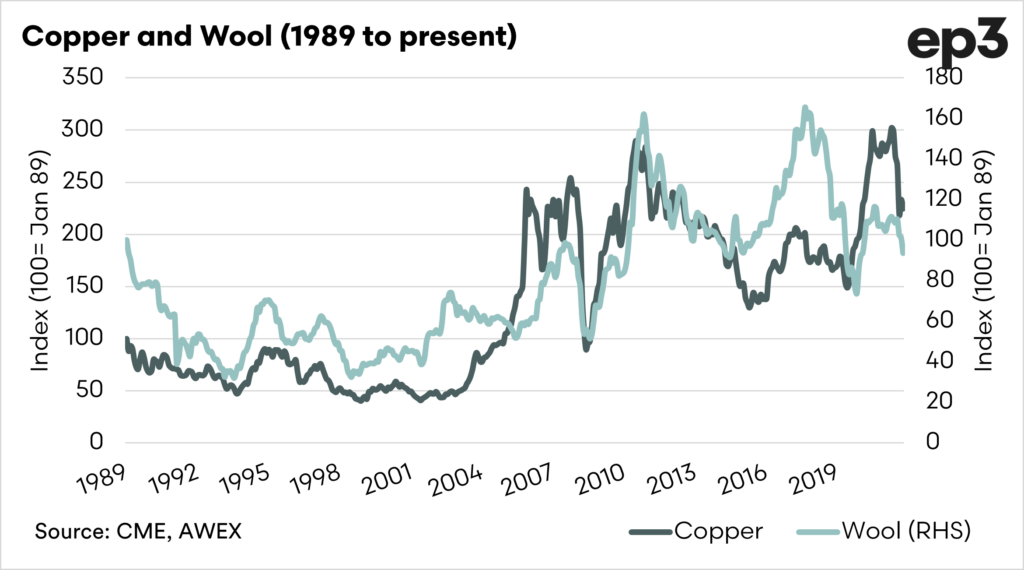

A series of charts follow below showing the similar trends of copper and wool.