Market Morsel: We’ve been expecting you, Mr (Chinese) Bond

Market Morsel

This week, I covered the relationship between copper and wool (see here). The crux of this analysis is that copper price growth indicates a strong economy. Strong economic growth leads to stronger demand for discretionary products such as wool.

Credit is an important factor in all commodity trades. Lower bond yields point towards easier to access credit and vice versa.

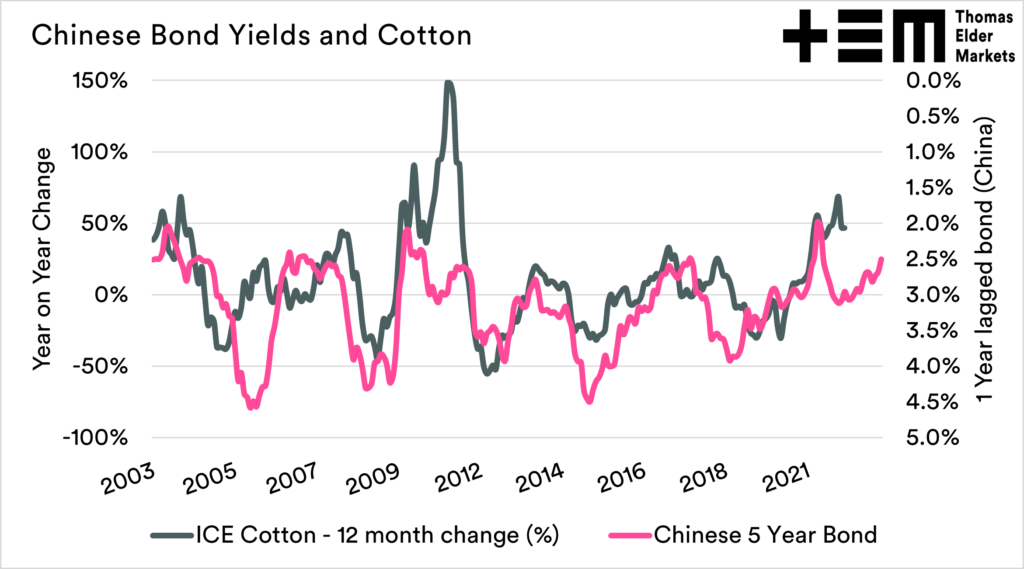

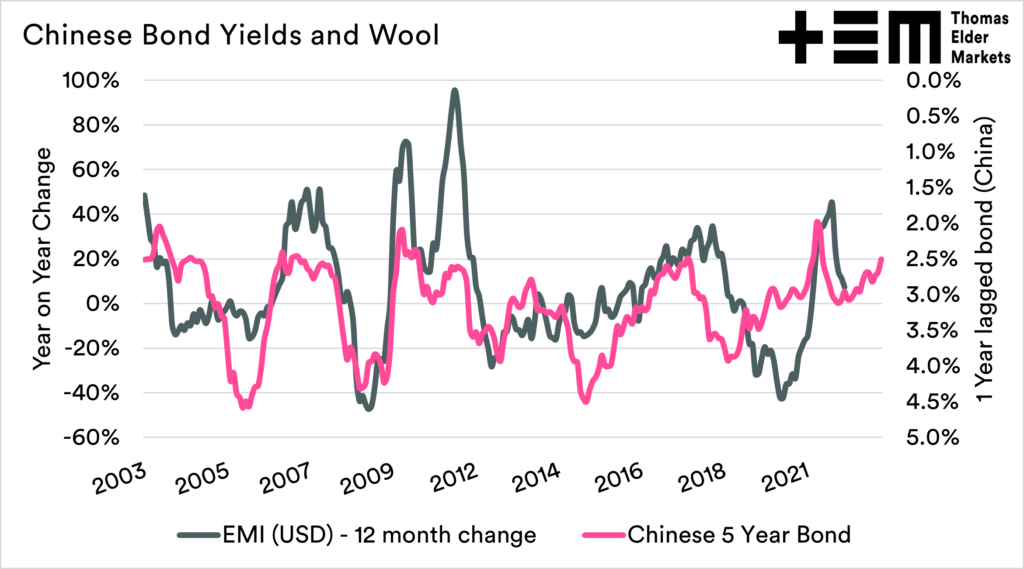

The charts below show the Chinese bond yield with a one year lag against the yearly change in Cotton/Wool price from 2003 to the present.

The Chinese bond yield, when lagged, seems to provide an insight into the trend of fibres. When bond yields decline, fibre prices tend to perform well, and when they increase, that tends to correspond to a time of declining fibre prices.

The 12 months lagged bond is lower at the moment and could point towards improved conditions on the horizon.

It is important to note that with leading indicators, it is not an exact science. There are other factors to take into consideration. However, they are a valuable indicator to maintain a close eye on. In the same way, increasing copper prices could increase economic growth and higher pricing, but this information should also not be used in isolation.

These indicators should never be used in isolation to make sales/purchasing decisions, but one of a bundle of tools to help develop a view on the market.

That being said, bond yields are supportive.