Market Morsel: Wool comes a copper

Market Morsel

Last year, we looked at the relationship between copper and wool in early April (see here). I updated the data the other day and thought it was time to review how the relationship had gone over the past year.

Why did we look at this? Wool is a discretionary spend and theoretically should move with global growth. It is expensive, therefore, requires an element of prosperity.

Copper is a lead economic indicator. It has long been established that copper performance provides an insight into the performance of the general economy. This is due to its use in many industrial and electrical processes.

If the copper market is rallying (increasing), it points to an improving economy and, hopefully, more disposable income.

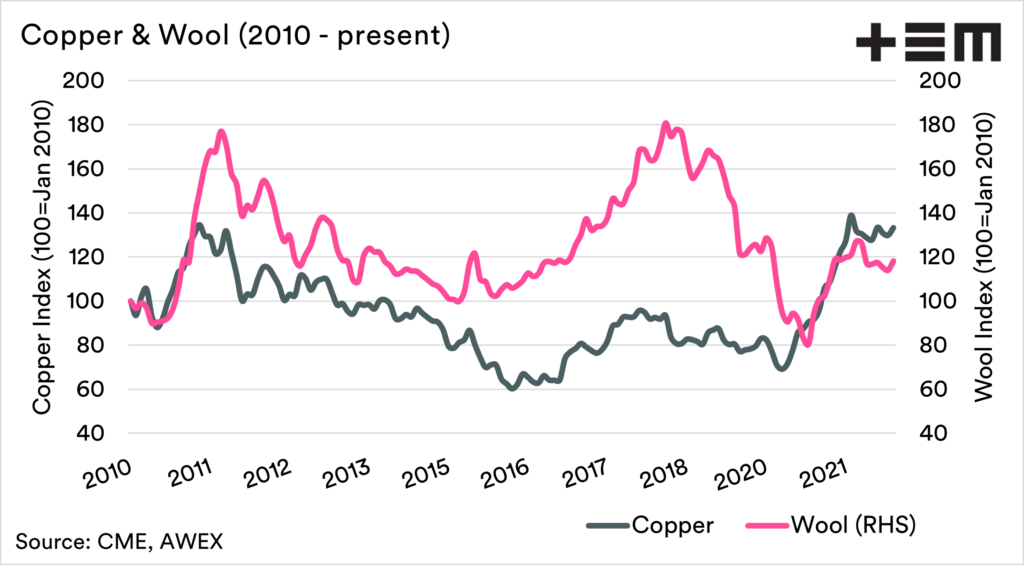

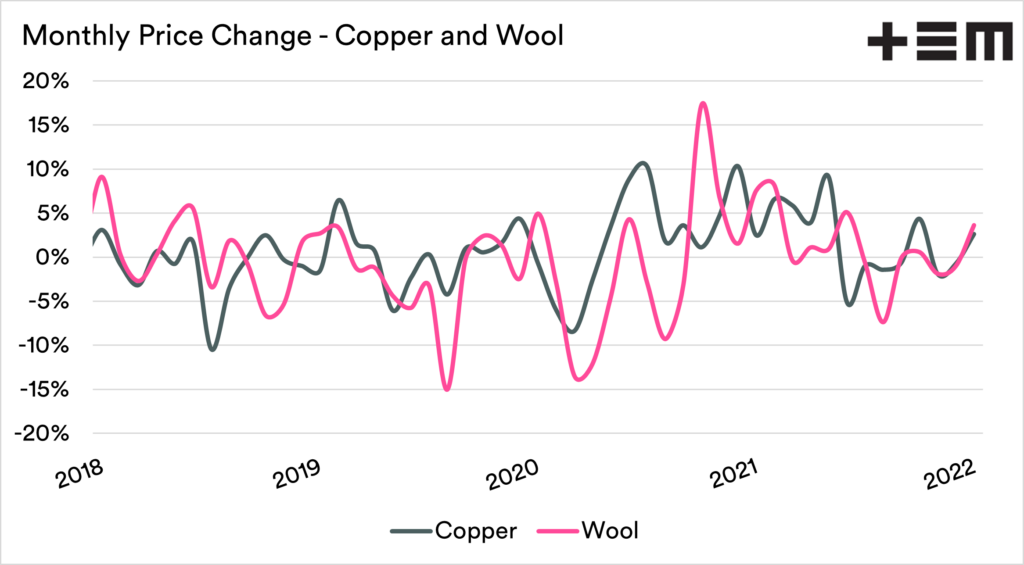

I have produced a copper and wool index starting in 2010. This is displayed in the first chart. One of the things you notice is that there is a trend of similar upward and downward periods. The second chart shows the monthly movement in price since 2016 for both commodities.

Whilst generally copper and wool have some similar patterns, it probably has more to do with economic prosperity. A period of strong economic growth could lead to higher wool prices, and copper is a good indicator of global growth.

So if you are looking at the long term trends for wool (and many ag products), commodities such as copper are good as part of a basket of indicators to use.