Market Morsel: Wool forwards signal correction

Market Morsel

No correction so far, but forward bids have started to fall behind the auction market. Price ideas for the very fine merinos continue to point upwards, however price ideas for the big merino categories by volume are mixed, some up and some down.

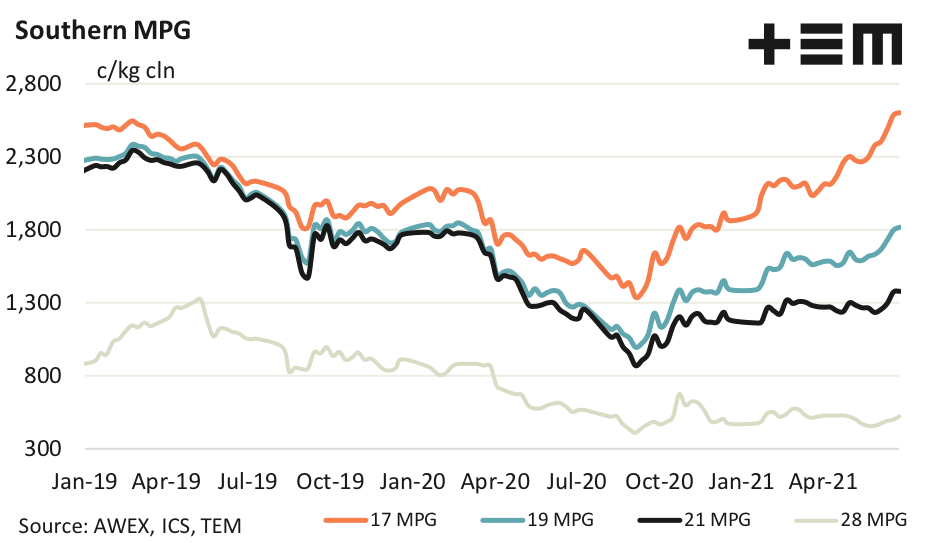

It looks like the finer AWEX MPGs are headed back to their 2018 highs, although this time with big micron premiums as opposed to 2018 when micron premiums were relatively small. Increased supply looks to be holding the broader merino category prices back, with this view seen more clearly in US dollar terms.

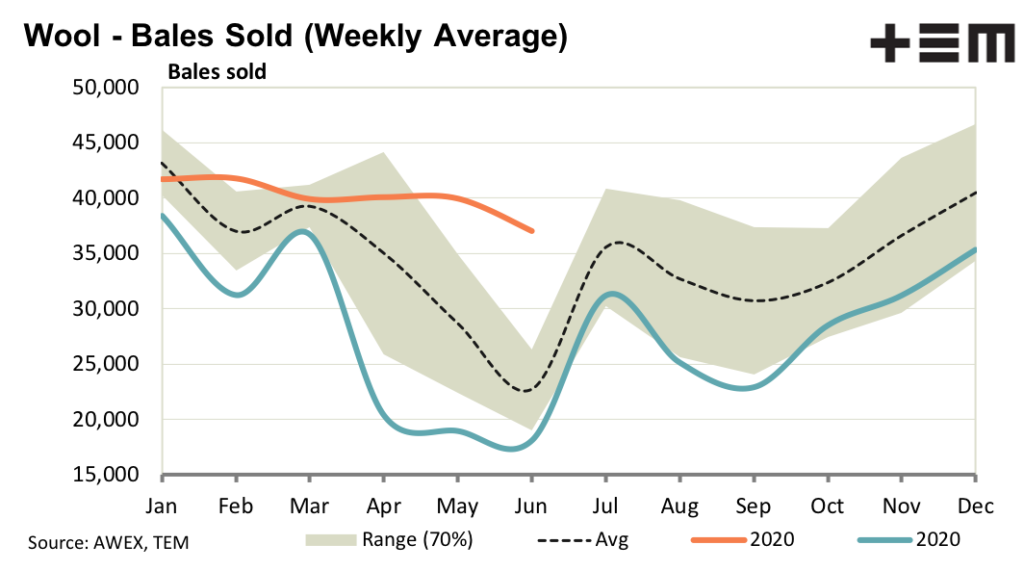

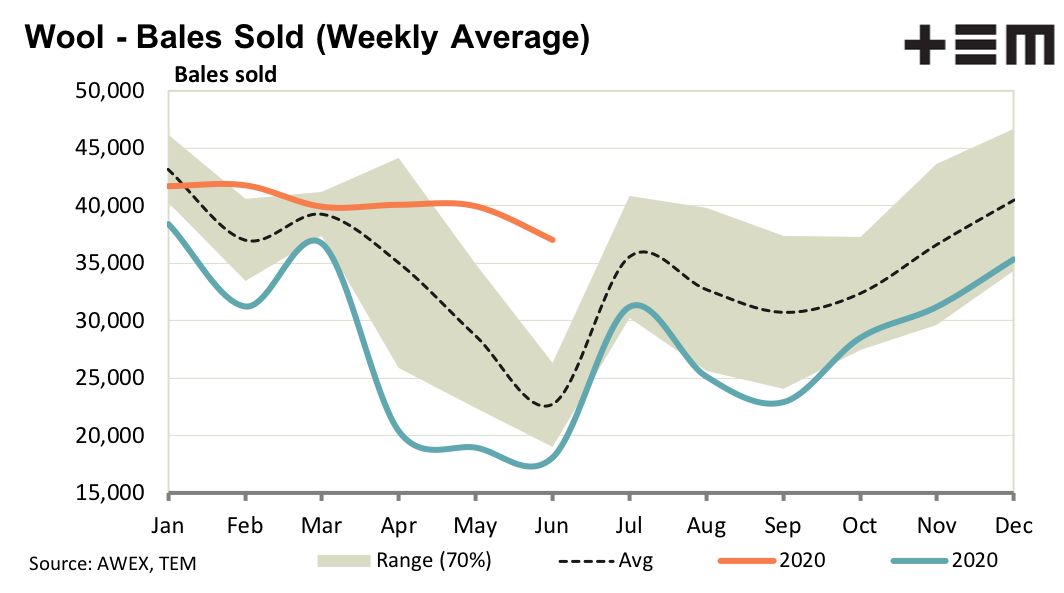

The Chinese economy is still on track to slow later in 2021, so price weakness for greasy wool in the spring – a normal seasonal pattern – is quite likely. The pandemic has diverted consumer spending from services to goods, with apparel demand picking up as a consequence. As economies work their way out of the pandemic in 2022 and beyond consumer spending is likely to move back to services, which will erode the pandemic boost to demand.

17 Micron

The finer merino micron categories continue to stretch the micron premiums. In relation to cashmere there is room for further price rises for 16 micron and finer wool, with some of the short staple types selling for extreme levels this week.

19 Micron

The supply of 19 micron wool looks to have been supplemented in recent months with grower stock as well as the natural increase in supply coming from improved seasonal conditions during the past 18 months (on average – not necessarily in every region). In US dollar terms the 19 MPG is holding at levels last seen in mid-2019 which is a solid recovery from the lows of 2020.

21 Micron

The 21 MPG was steady this week in US dollar terms, trading at the same level as the peak reached in February. If the price starts to rise further then the upside looks to be 100-200 cents but supply is ample and the supply chain is only spending median levels on broad merino wool.

28 Micron

New Zealand wool prices continue to firm, with the demand coming from outside of China which has been the main market for the past decade. Wool and preparation quality continue to play a big role in crossbred pricing with poorly prepared composite wools ignored.