Where did you come from where did you go, cotton ratio?

The Snapshot

- Wool is a fibre and operates in a subset of natural and man-made fibres.

- Cotton and wool prices have tended to follow one another.

- The past ten years have experienced wool trading at a substantial premium to cotton when compared with historical levels.

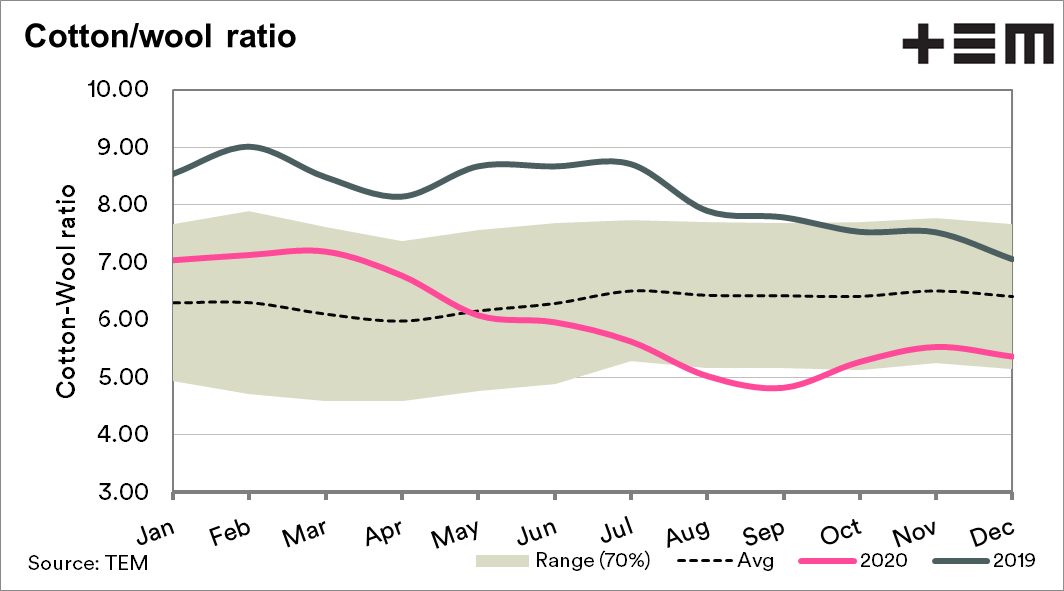

- The ratio has dropped during 2020 as wool prices collapsed and cotton prices remained stable.

- A cotton-wool ratio of 5.5 to 6.5 is a sustainable level.

The Detail

Last week, I spent some time expanding our fibre pricing database. I thought it was worthwhile examining some of the different fibre types.

In the article ‘Fibre optics’, I covered off on several competing fibres (Cotton, wool and polyester). This short article showed that the price of apparel fibres tends to have a close relationship with one another.

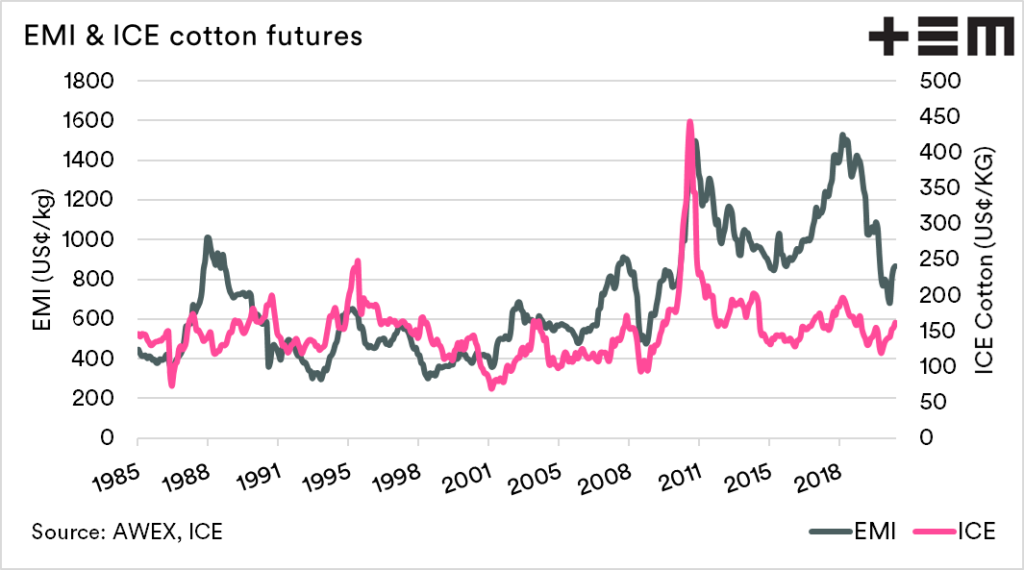

In this article, we will look at little closer at two natural fibres, wool and cotton. In this analysis, I have used the EMI as a representation of the wool price and ICE cotton futures. These are converted to US¢/kg.

As can be seen in the chart below, cotton and wool have tended to follow very similar patterns. The past ten years has experienced prolonged periods where wool has traded at solid premiums to cotton.

A useful way of examining inter-commodity movements in price is through a ratio. This is something that EP3 regularly use (‘Getting corny’), to provide a quick snapshot of the relative value between two related commodities.

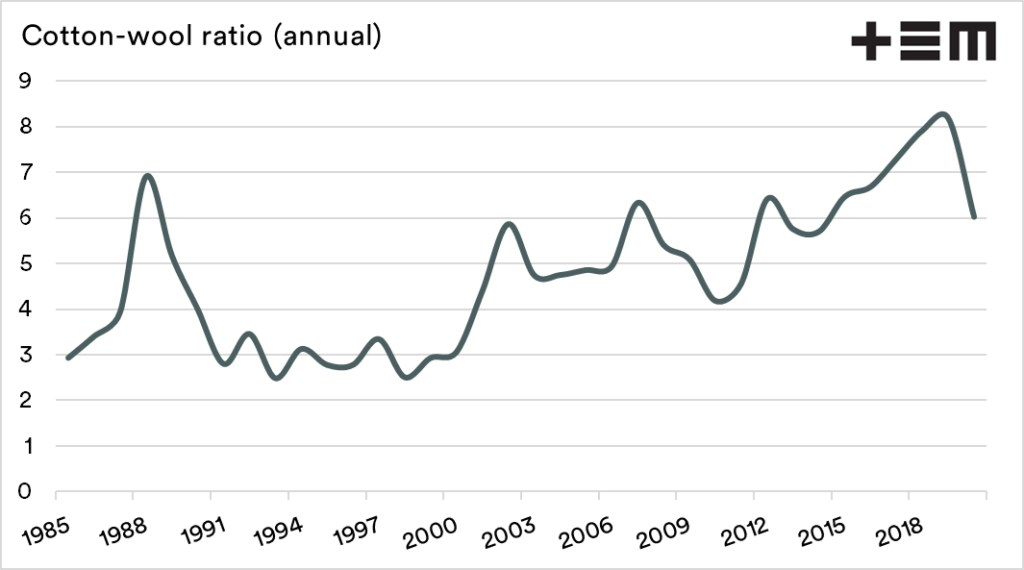

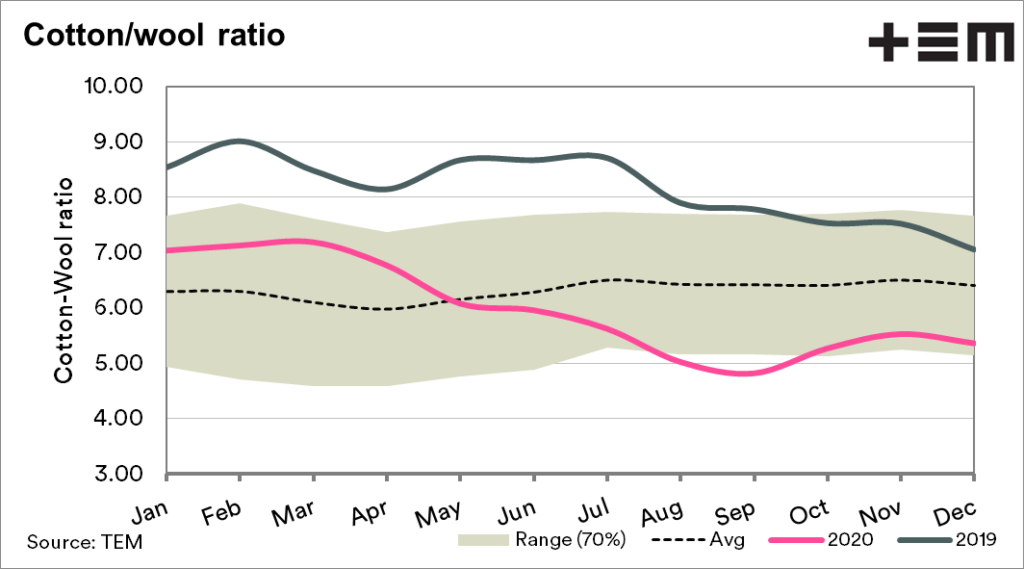

The chart below shows the annual ICE-EMI ratio for the past 35 years. To provide some guidance a ratio of 10 means that wool is 10x more expensive than cotton.

The chart shows an interesting timeline. There were two periods of stability, and two large peaks (1988 & 2018/19).

The period 1991-2000 saw the ratio average of 2.9. This was the period immediately after the end of the reserve price scheme, which led to a period of sustained low wool prices. The period 2001-2016 saw wool prices gradually rise, with the result that the ratio rose to 5.4.

The recent period of high wool prices since 2016 has seen the ratio rise to an average of 7.3. This year the market declining wool market has seen the ratio fall to 6.

We would expect that a ratio between 5.5 & 6.5 to be a sustainable level.

Wool pricing has borne the brunt of the COVID demand destruction this year. Cotton, on the other hand, has performed relatively well or at least hasn’t experienced the same level of fall, which has resulted in the ratio collapsing.

Some like to maintain a positive view of commodities which they have a passion for. It is, however, essential to remove bias and look at markets objectively. Wool is a great product and one worthy of a healthy premium.

It is important to remember that it does not operate in isolation; it still operates at a replacement value to other fibres. If it becomes too expensive, then demand is rationed.