Canola is in short supply.

The Snapshot

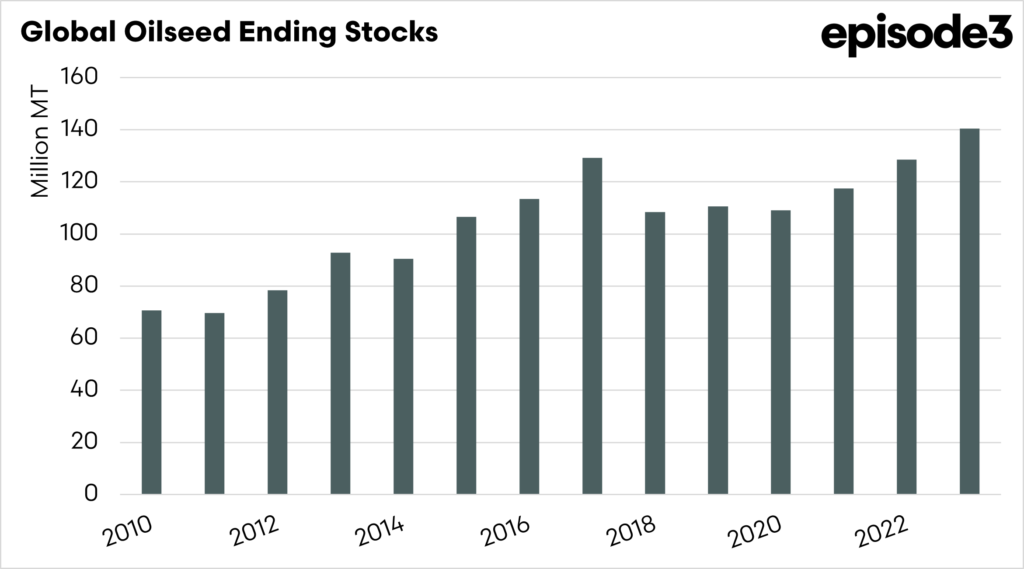

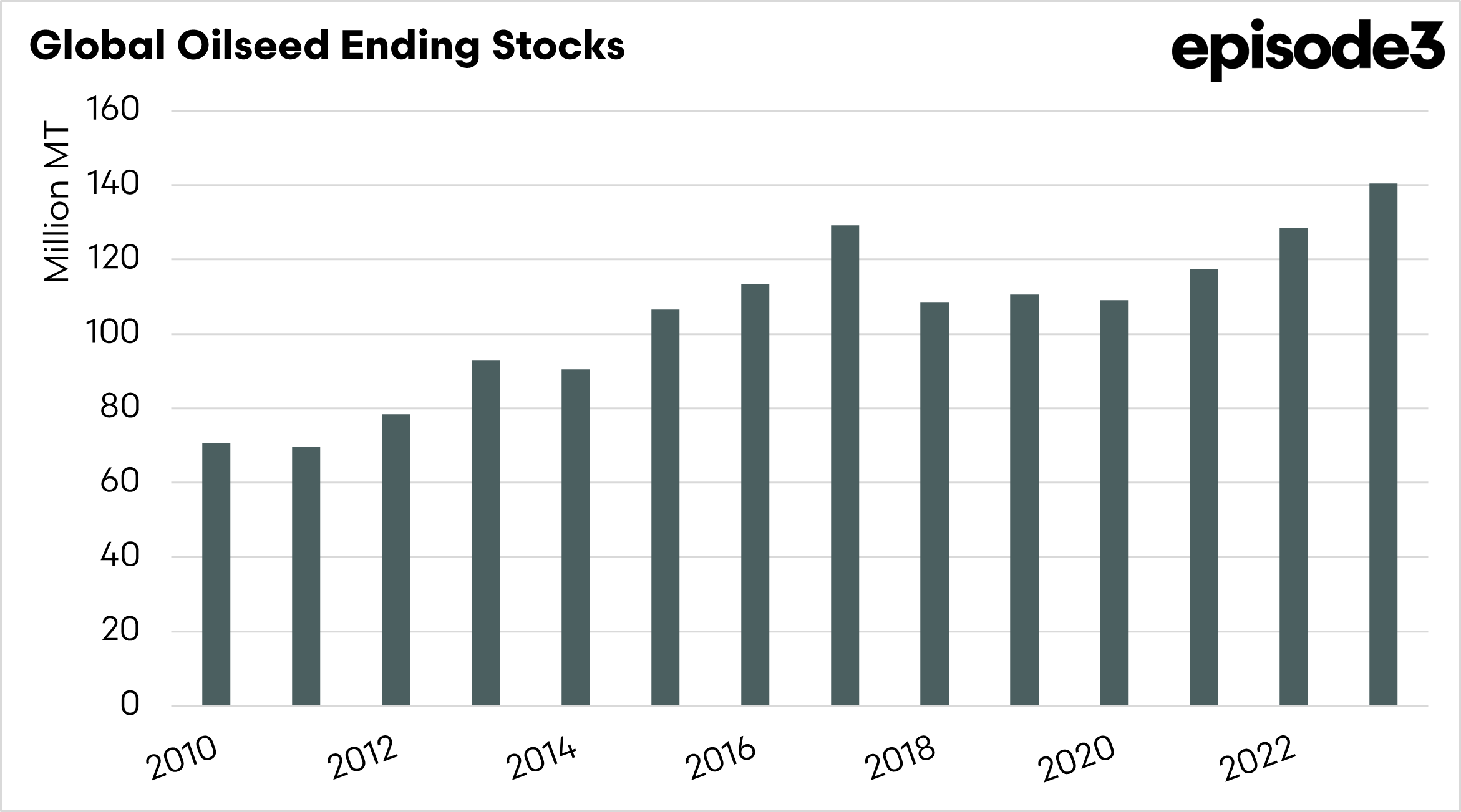

- The oilseed market overall has strong stocks

- Oilseeds can be substituted in many cases.

- Canola ending stocks are at the lowest level since 2020

- The stock-to-use ratio of canola is 9%, which is the lowest end of the scale.

- A low stocks-to-use ratio usually points towards higher pricing

- The high prices may encourage more planting this year.

- There are some geopolitical aspects to take into account this year as Canada faces potential tariffs from both China and the USA.

The Detail

Last week I wrote about soybeans. In this article, I wrote about how the market had swung and prices had increased off the back of USDA amendments. Stocks had shrunk between December and January. Yet, global inventory and stocks to use ratio were very high.

In that article, I said I would look more in-depth at the canola side of things. So let’s get into into it.

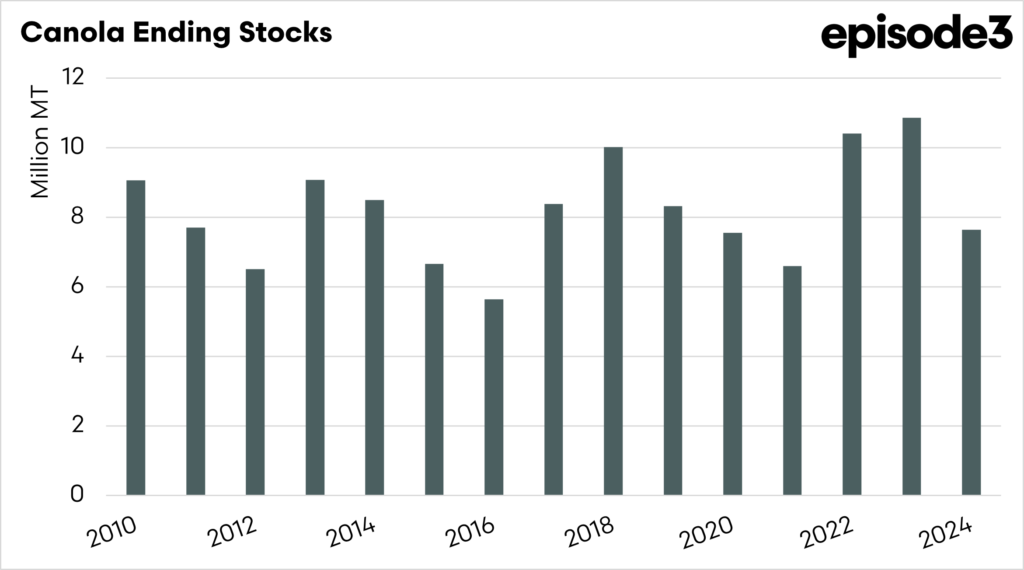

The ending stocks of canola globally are set to fall to 7.6mmt, from 10.8mmt last year. That is a considerable drop, and end stocks are set to be the lowest level since 2020.

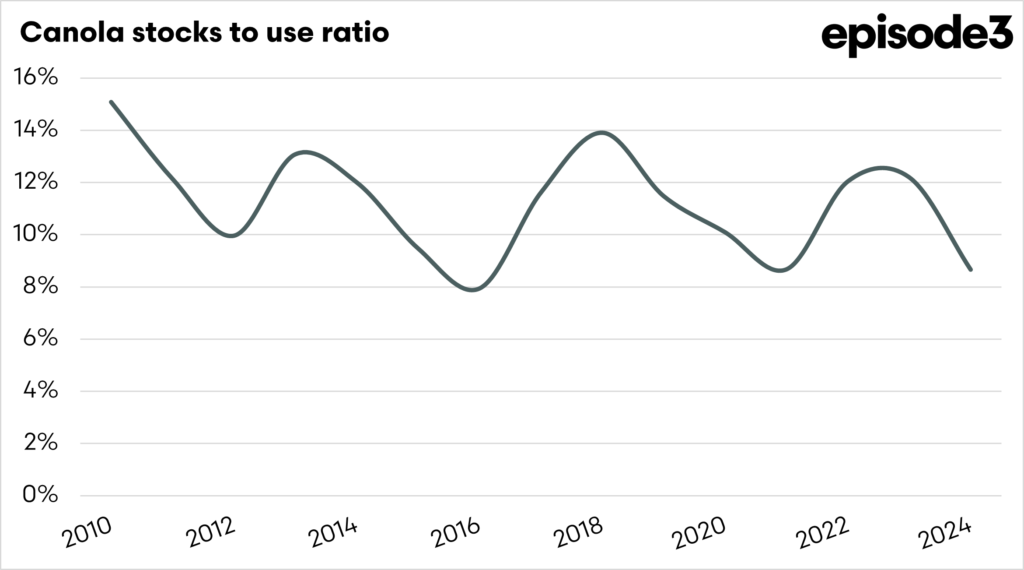

We need to look at the stocks to use ratio to get a better indication. The stocks-to-use ratio shows how much of a commodity, is left at the end of the year compared to how much is used in that year. It’s a percentage that helps measure supply and demand. A high ratio means there’s plenty available, so prices may stay low, while a low ratio means supplies are tight, which can push prices up. It’s a helpful tool for understanding market conditions.

If we look at the chart below, the stocks-to-use ratio is at 9%, which it sat at during 2021. It is on the very low end of the spectrum.

As we go into 2025, canola is tight. If supply drops, then prices will rise dramatically.

That being said, as mentioned in our previous article, supplies of overall oilseeds are very high (especially soybeans), which does place a limit on the upside potential. If canola becomes too expensive, alternative oilseeds will be used.

It will be a really interesting year for canola, not just for the supplies available, but also the side issues it faces. One of those is the potential for Chinese tariffs on Canadian canola (see here and here) and of US tariffs on Canada (see here).

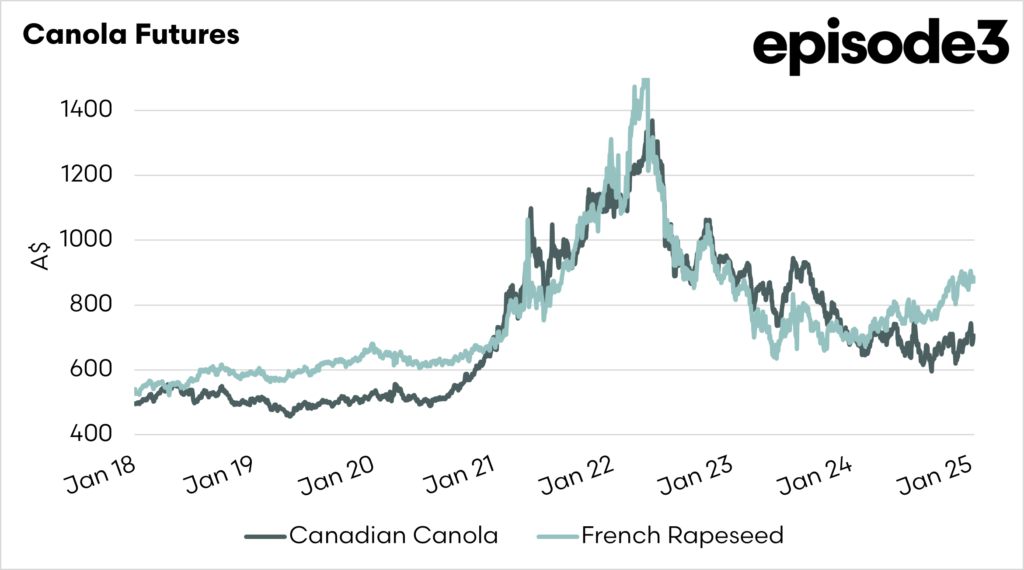

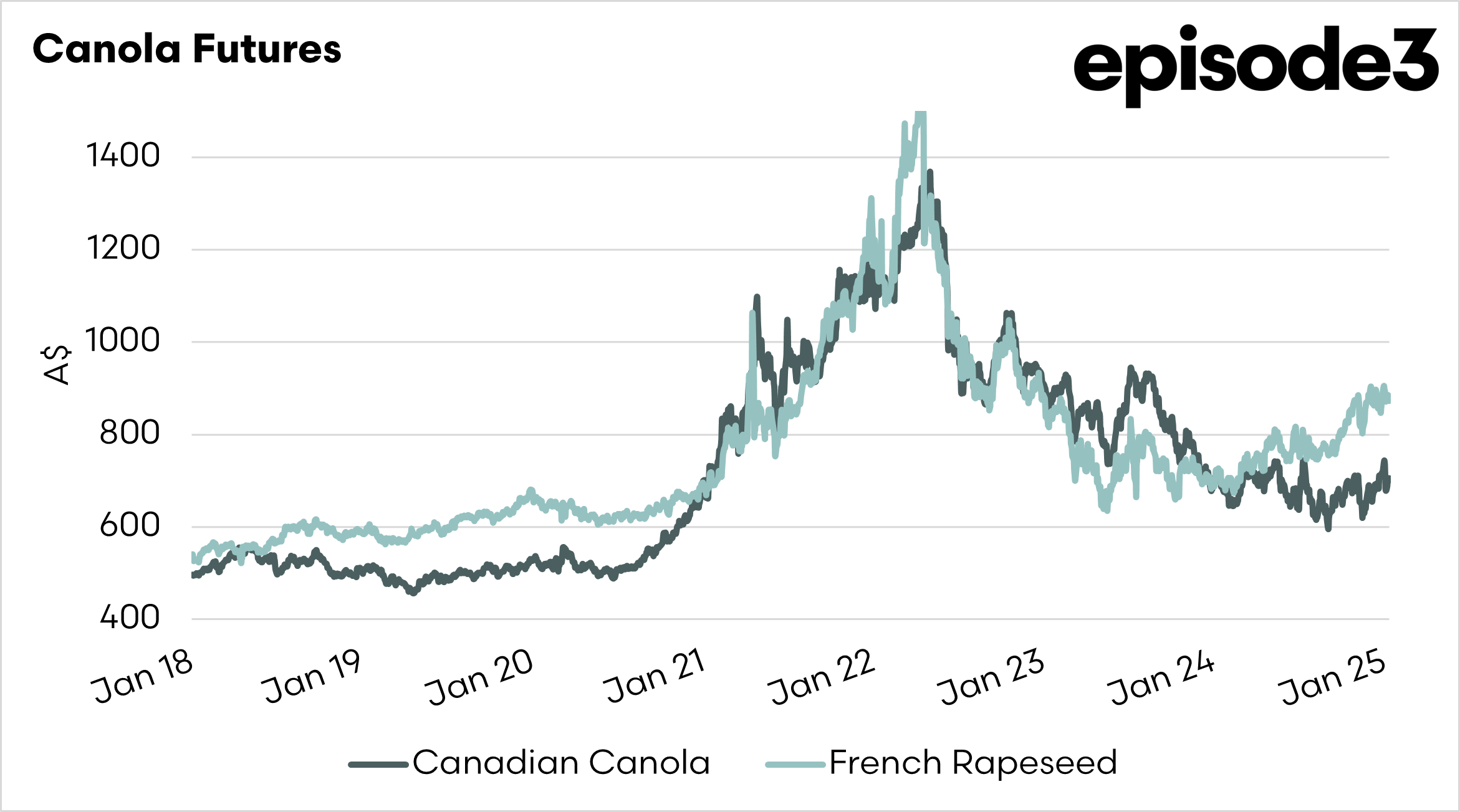

Canola/rapeseed futures have improved in recent months, which has flowed through to pricing levels in Australia.

This could encourage strong planting, which is weather-dependent, of course. However, The canola market looks well supported, provided there is not too much demand switching to alternative oilseeds.

The world is very short of canola.