Cheapest grain in the world

The Snapshot

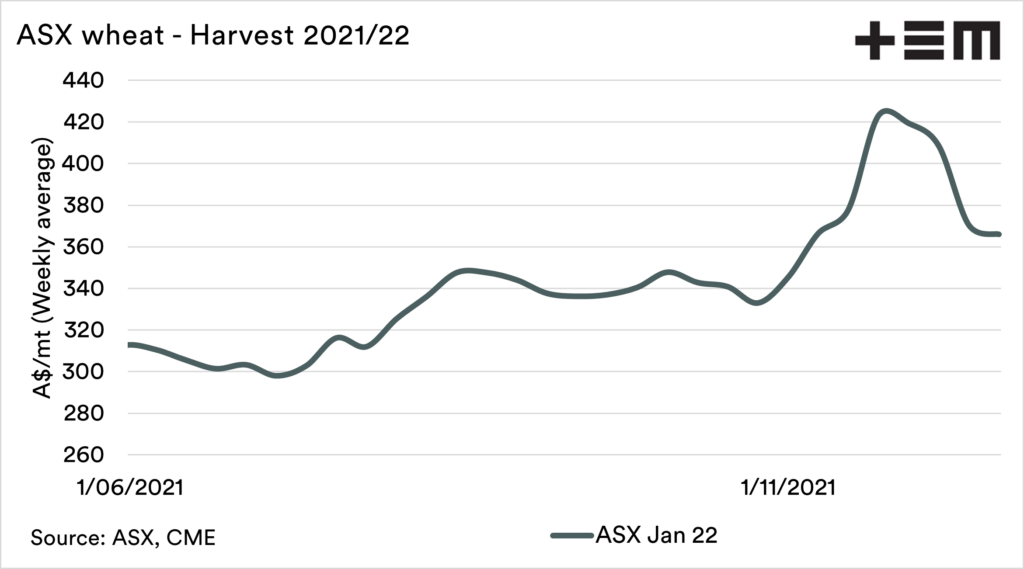

- Grain prices in Australia has fallen further as harvest has progressed

- It is important to view our pricing relative to the rest of the world, and especially our competitors.

- The cost and freight gives a basis overview of our competitiveness.

- Our barley, wheat and canola is the most competitive in the world.

- Our pricing is cheap and getting cheaper as farmers sell in large volumes.

- Buyers don’t feel the need to pay up as supplies are available.

The Detail

Christmas is almost upon us, but there isn’t all that much joy when it comes to grain pricing in Australia. We have seen prices fall as harvest has progressed. In Australia, growers are all selling at the same time, which is having a negative impact on pricing levels. Buyers don’t feel the need to pay up if growers are willing to sell.

With our prices declining, it’s important to see how we compare to the rest of the world.

Cost and Freight

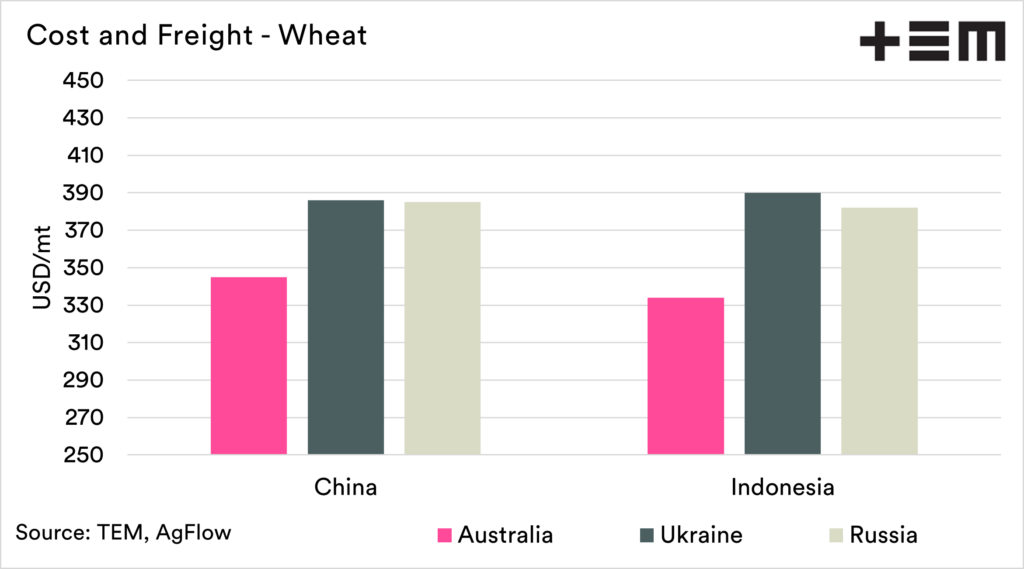

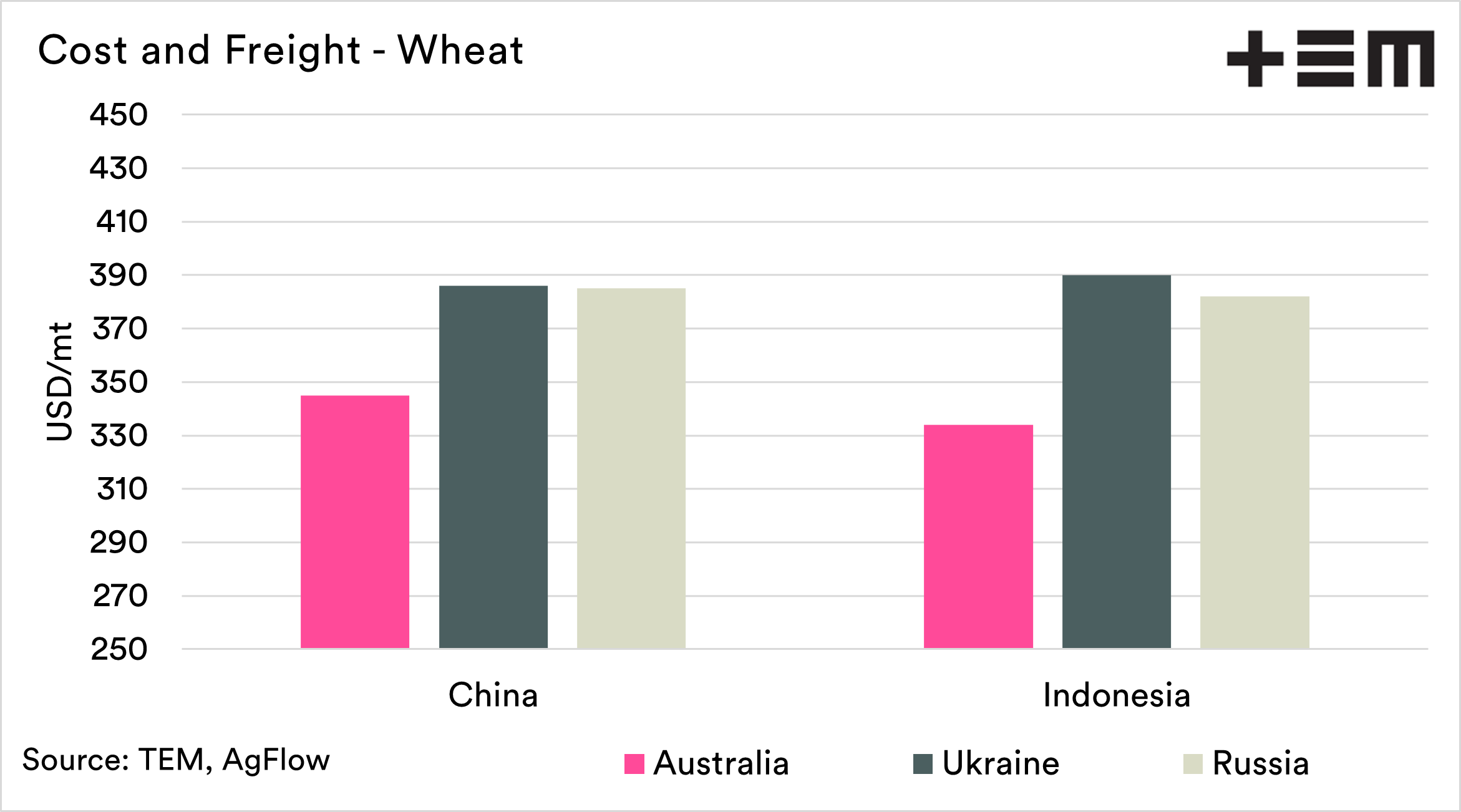

We examine our relative value (or competitiveness) in a number of ways, but an important way of doing this is by looking at the cost and freight.

This is pretty simple. We examine the cost of purchasing the grain/oilseed at origin and the cost of freight to the destination. We combine our data, with that of our partners at AgFlow. The Australian prices are the grower bid converted.

It is important to note that these models are theoretical and do not include factors such as trader margin, unexpected logistical costs etc. They are intended to give an overview of the environment.

We need to be competitive, but we don’t need to be too competitive.

Wheat

On wheat, we have chosen to display our relative value to Indonesia and China, as these are two nations taking large volumes of our wheat.

After some feedback from an avid reader, I have changed the legend so that that is easier to see the difference in value between different origins.

As we can see, the cost of our wheat into China and Indonesia is incredibly low compared to our competing origins of Ukraine and Russia.

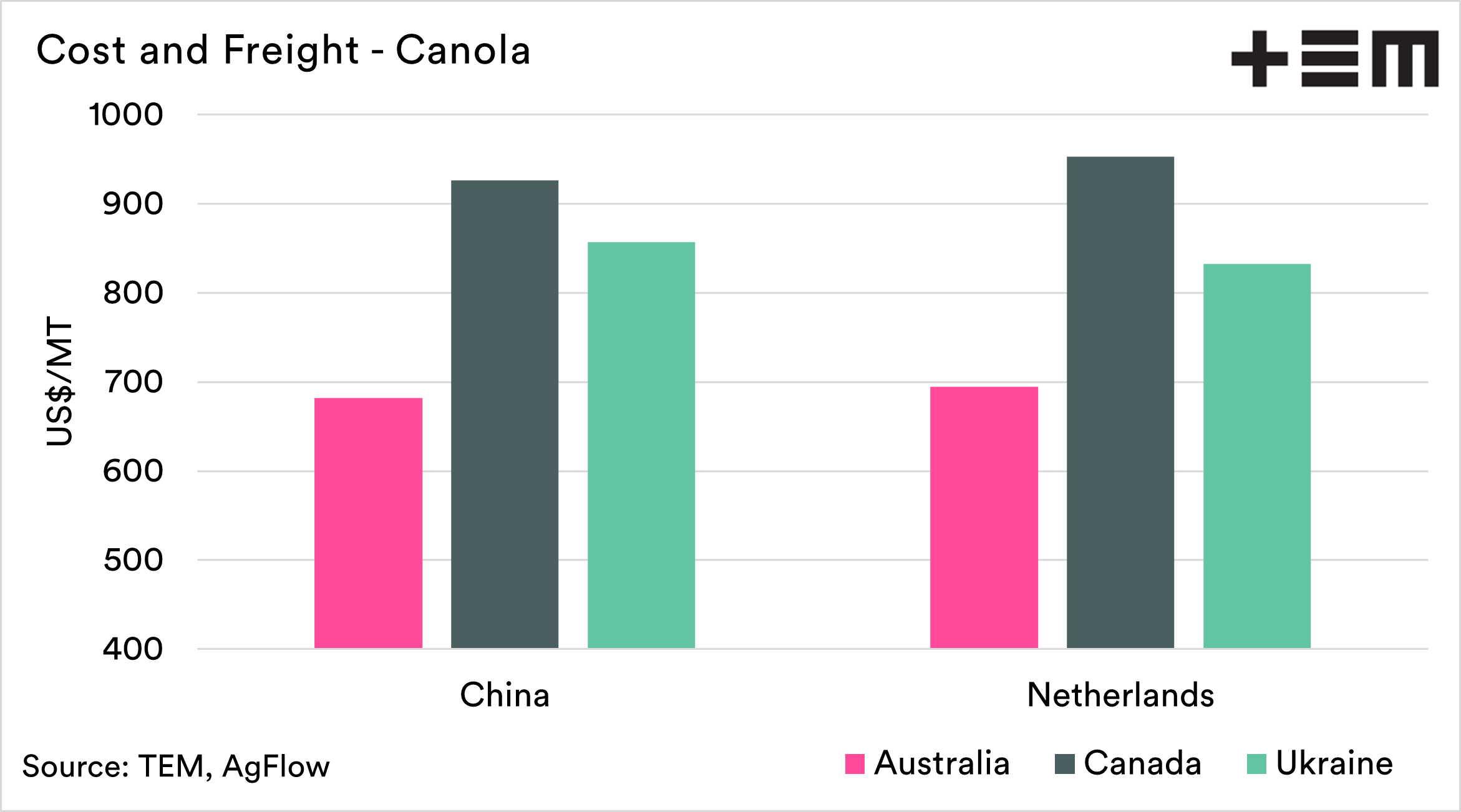

Canola

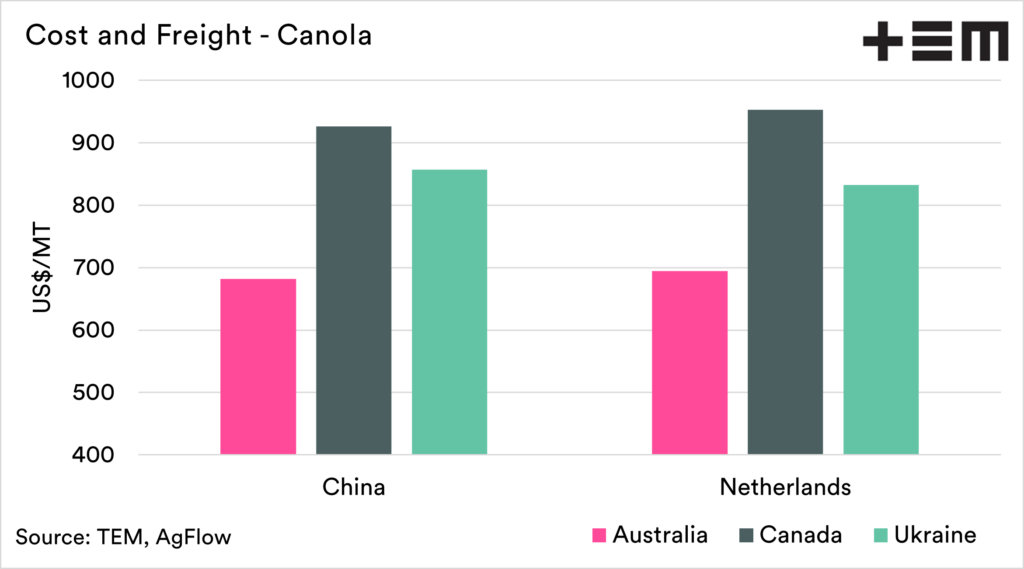

I have spoken at great length about how our canola is heavily discounted for months (see recent here). The main markets for canola for us tend to be into Europe and China. The chart below shows us against Canada and Ukraine, two major competitors.

As we can see, in a similar fashion to wheat, our canola is heavily discounted. The drought in Canada has reduced their ability to export in large volumes, and Australia is the 2nd largest exporter behind them.

Our record crop has placed pressure on pricing, but with a lack of available stocks around the world, and strong demand, it does seem that our canola is cheap.

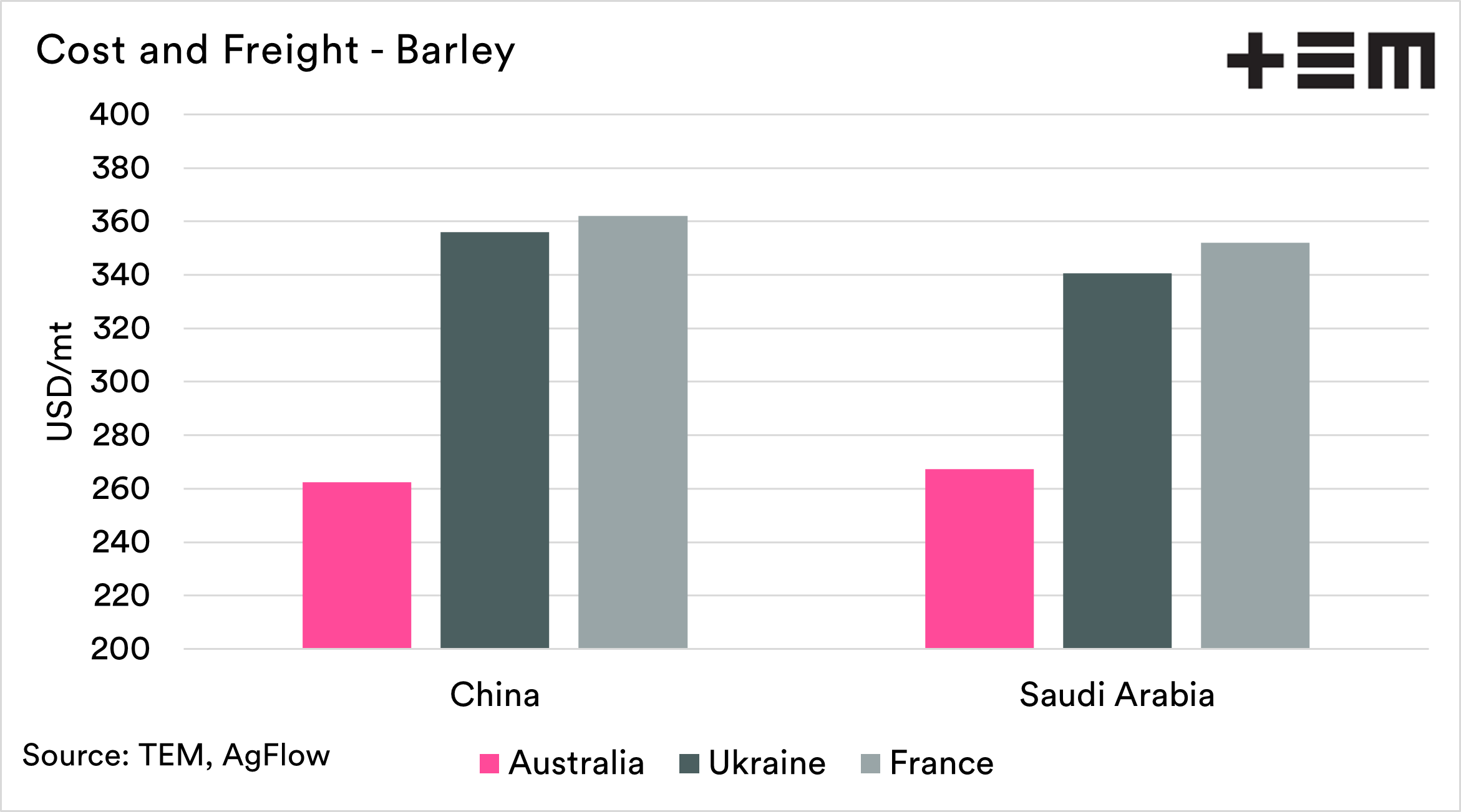

Barley

I still hear from many that the Chinese ban has not impacted upon pricing. That is nonsense on stilts. The lack of Chinese activity has heavily impacted the barley price; we just might not have noticed it because the overall price is relatively good compared to history.

If we look at the chart below, we can see the scale of our discount for feed barley. We have consistently been the cheapest origins since around May 2020. Coincidently the same time that the tariff on Australian barley was introduced.

Our barley is heavily discounted to other origins, at almost US$100/mt.