Market Morsel: Canola gets Crushed

Market Morsel

Harvest is upon us, and the pressure is being felt across the grain and oilseed pricing. In this quicky, I thought I’d shine the light on canola.

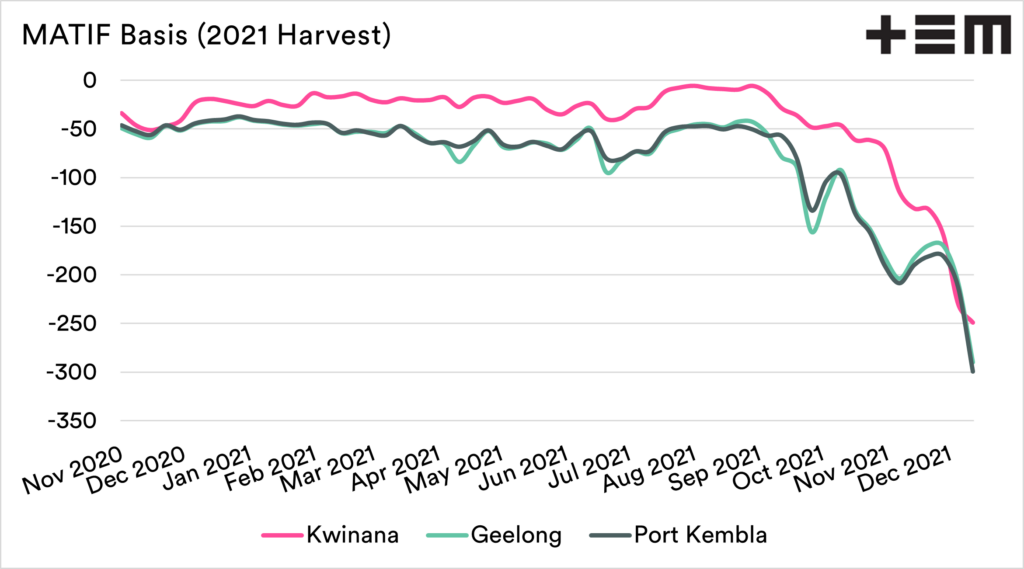

The first chart below shows port canola prices. WA has seen a gradual decline from the heady heights of the 1000+, falling A$125 since the start of November. The big shock has been the sharpness of the fall in Victoria and New South Wales. During the past week, the average price for this week is down A$70 on last week.

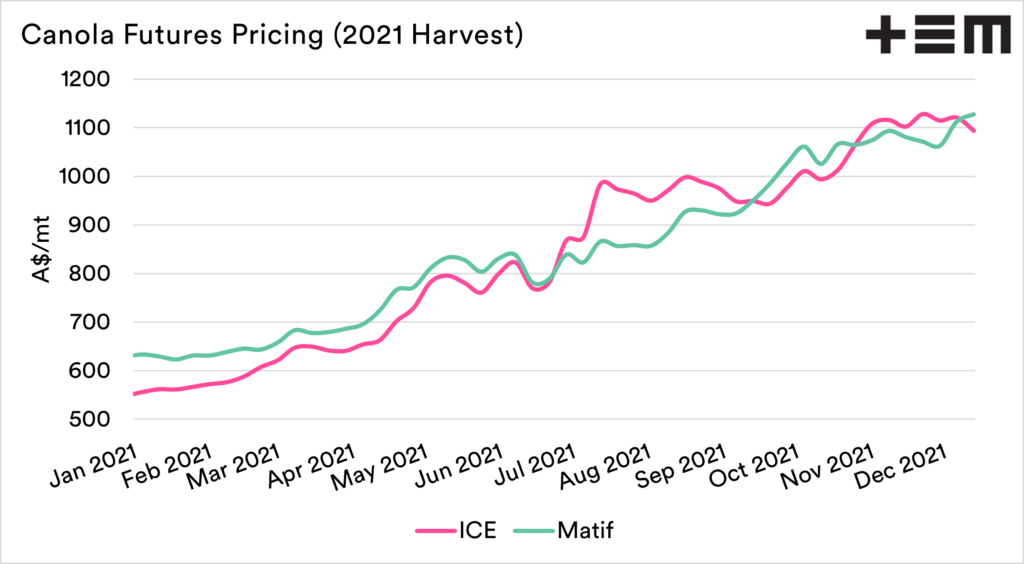

What about the overseas market? Have they fallen? Yes and no. The ICE futures market has fallen A$27. On the other hand, the MATIF market has risen A$15.

This has led to a further deterioration of the basis level, especially in the eastern states. Since seeding, Australian pricing has been at a very large discount to ICE futures, something that occurs very rarely, but not unexpected, with the level of drought in Canada. The current week’s actions have moved the eastern states to a record discount.

Typically we trade at a discount to Matif (French rapeseed). This year our discount to Matif has also grown to very high levels.

We have a record crop, and with lots of grower selling, that impacts price. It does however seem a very hefty discount to the rest of the world.