It’s just a flu.

The Snapshot

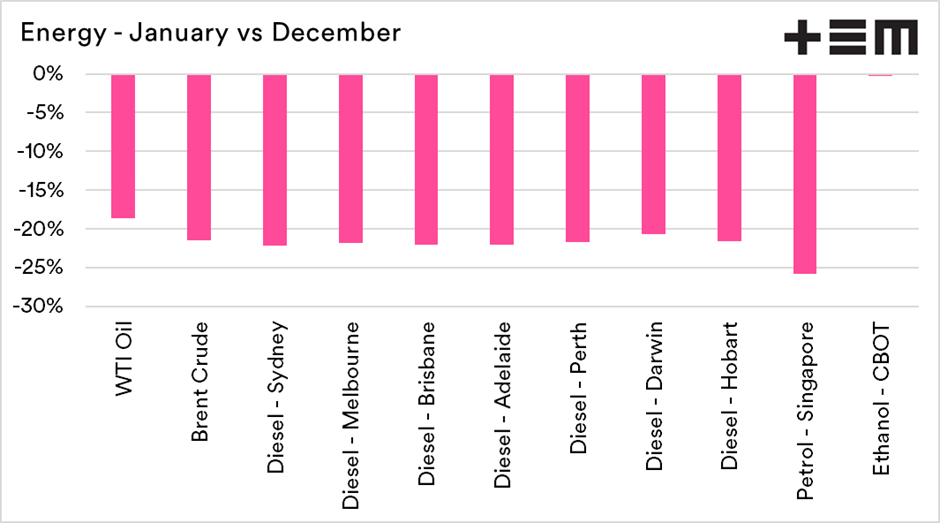

- Energy prices have declined due to low global growth.

- The price of diesel in Australia is between 20-25% lower, depending on the state.

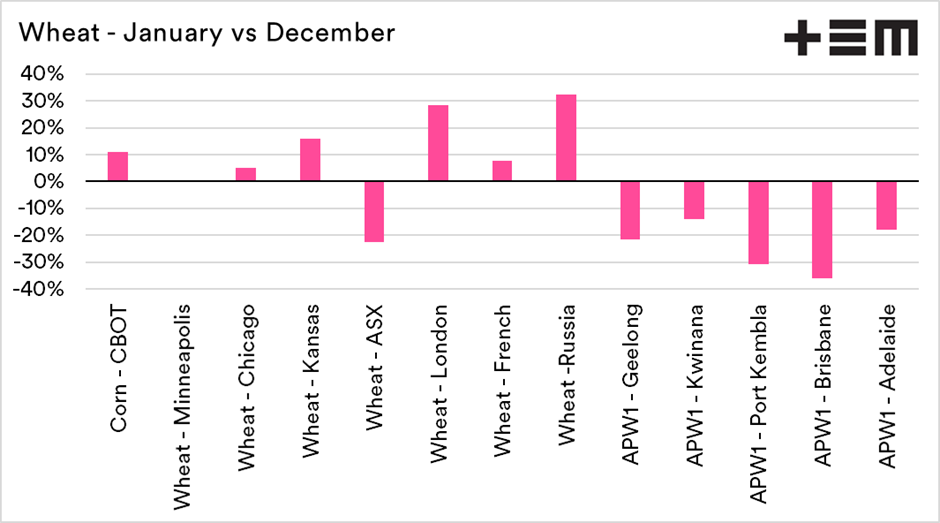

- Wheat prices have fallen in Australia as drought premiums erode.

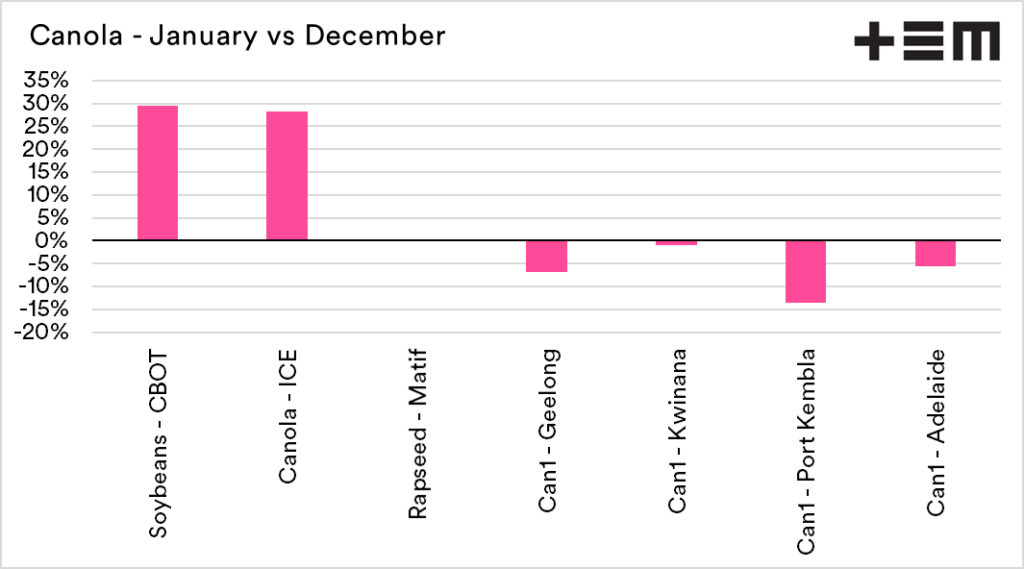

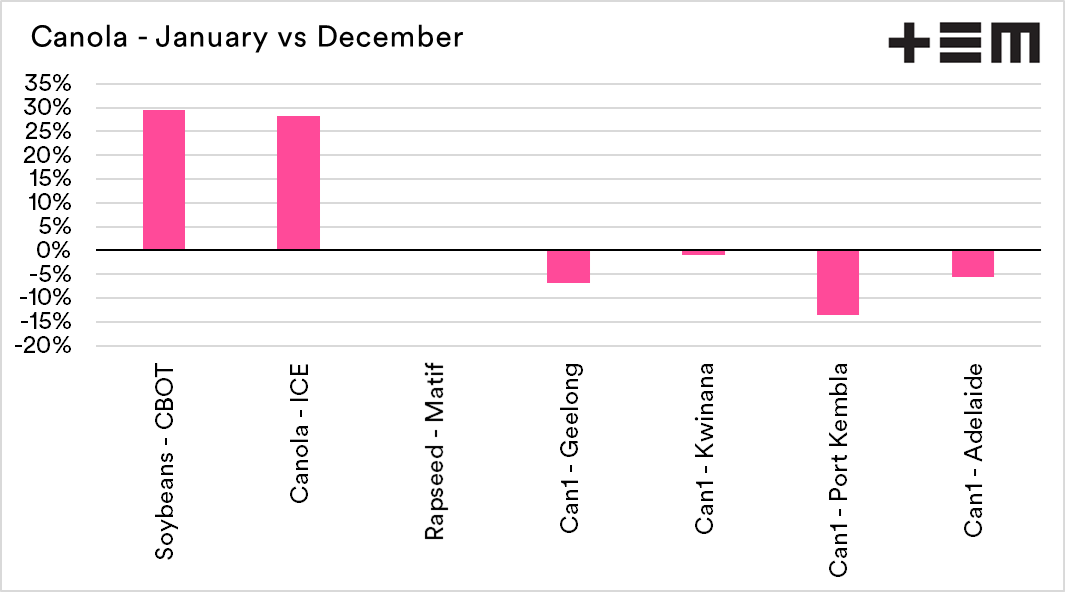

- Canola prices have fallen in Australia as drought premiums erode.

- The rise in commodities prices overseas due to supply issues has dampened the large crop’s effect on local pricing.

The Detail

In January, COVID-19 was a new virus that hadn’t yet been detected outwith China. At the time, many people said ‘it’s just the flu’ and that it wouldn’t impact markets.

The reality was very much different. Regardless of debates on the severity of the disease, the impact has been tremendous. At the start of the virus, there were two commodities groups which we were sure would come under pressure, energy and wool.

We expected energy to fall as global growth shrank, and travel declined. On the other hand, wool is mainly in China, and with factories shuttering around the country, it was clear that the prices would fall.

The other commodities, it was not so clear cut. The world hasn’t had a significant pandemic (ex HIV/AIDS) since the Spanish flu. There was no history to learn from, and it wasn’t clear whether it was bullish or bearish for pricing.

The fundamentals of supply and demand have more influenced overall prices. There have been short periods when some countries were ‘bulk buying’, but mostly the pandemic hasn’t been the most significant influence on pricing.

We thought it was worthwhile looking at a selection of commodities to see the change in price from the start of the year, before COVID-19 (See charts below)

Energy

The price of fuel has dropped significantly. In Australia, all diesel prices are down between 20-25%. A bonus for farmers with large fuel bills.

There are some hopes for a turnaround in the global economy. Therefore, increased demand for energy. The big question is when. There were some positive tones in November/December regarding vaccines; the reality is that large parts of the developed world are back in lockdown.

Wheat

Wheat prices were largely in drought mode until close to our harvest. The move into surplus has meant that Australian basis has declined markedly. The biggest falls have been in the areas where last year the deficit in production was highest.

At the same time, prices overseas have risen. If production overseas hadn’t come under some pressure, then our prices would be lower. As we move into 2021, La Nina’s impact, and its potential to dry out large grain-growing regions could be positive for pricing.

Oilseeds

The oilseed complex has been complex this year. ICE canola and CBOT soybeans have been on a rapid rise. China has hoovered up the soybeans, and Canadian production has been poor.

Our prices have fallen at a local level, with the same pattern as wheat – higher falls where drought premiums had boosted prices.

I wrote a piece about canola and whether it was time to hold last week (see here)