Market Morsel: Betting against wheat?

Market Morsel

Speculators have a big impact on commodity markets. They are important as they bring liquidity to the marketplace and ensure enough flow that you can quickly get in and out of contracts. This tends to speed up the movement in the market and help it find its value.

The commitment of traders report comes out once per week. It is a valuable tool for understanding how different actors in the grain trade view the market. The main category of interest is managed money, which is considered a proxy for speculators.

If management money is long, i.e. have bought contracts, they are bullish on the market, making money if the market continues to rise. Conversely, if they are short, then they are bearish as they will make money on a falling market. It is important to note that the data is released on Saturday, but is indicative of positions on Tuesday.

Let’s take a look at how they are positioned this week.

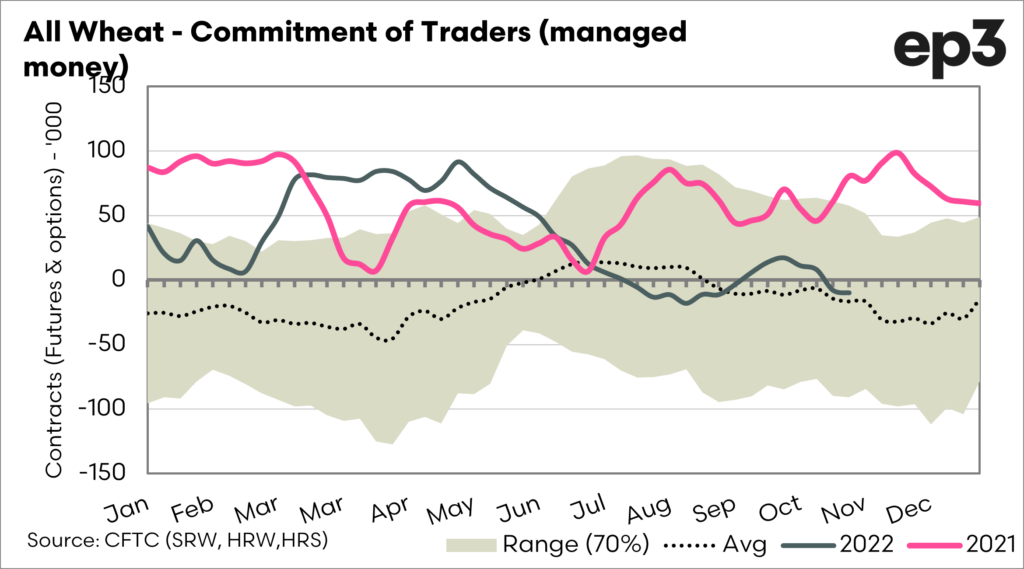

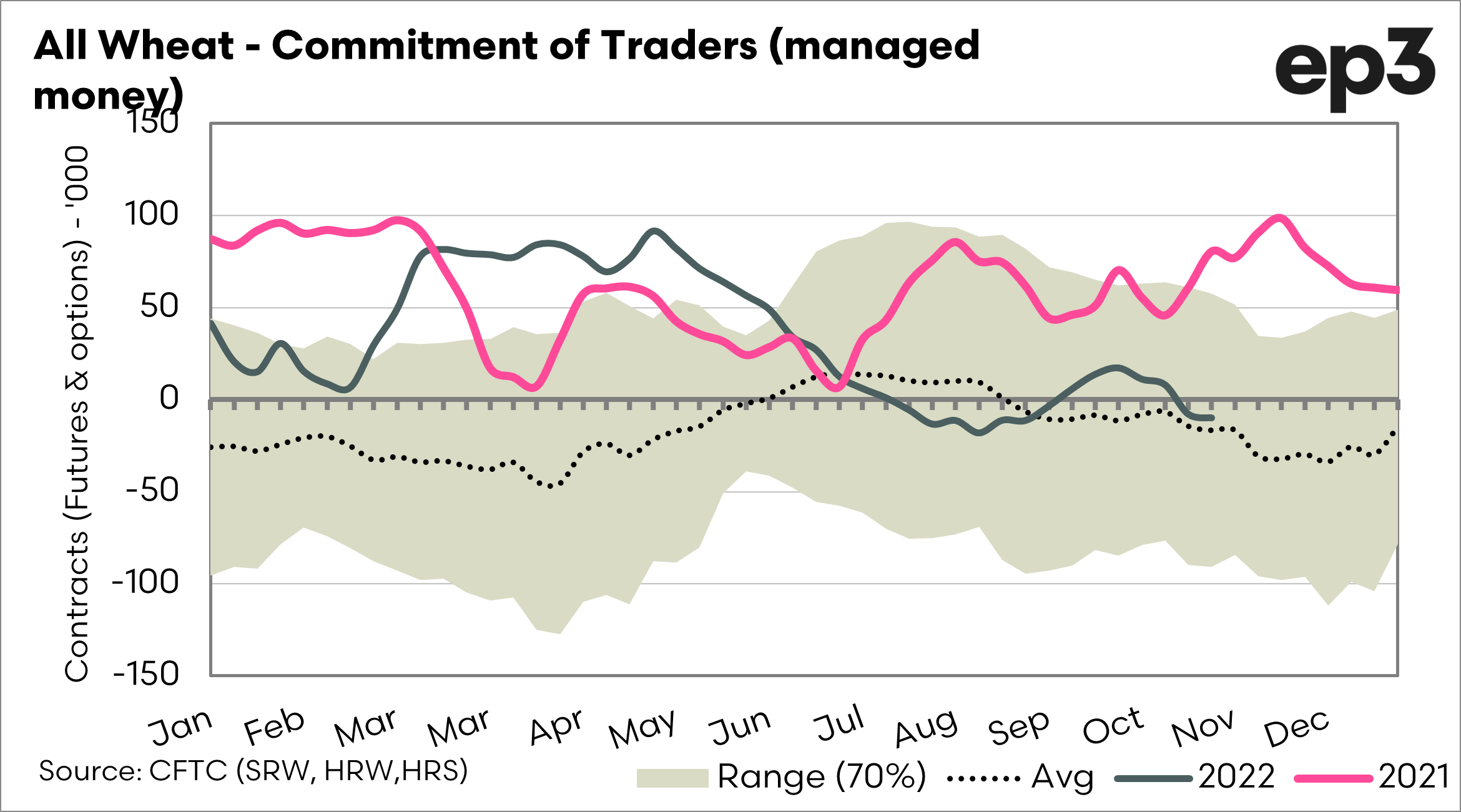

Chart 1. This chart displays the seasonality of the speculator’s position. In this chart, I have combined all the US futures contracts (Kansas, Minneapolis and Chicago). Early this year, they had a combined net position that was long (‘betting’ on a higher market).

In recent months they have moved to a slight overall short position. This is despite the recent issues in the black sea and emerging issues in the southern hemisphere (drought in Argentina, wet in Australia).

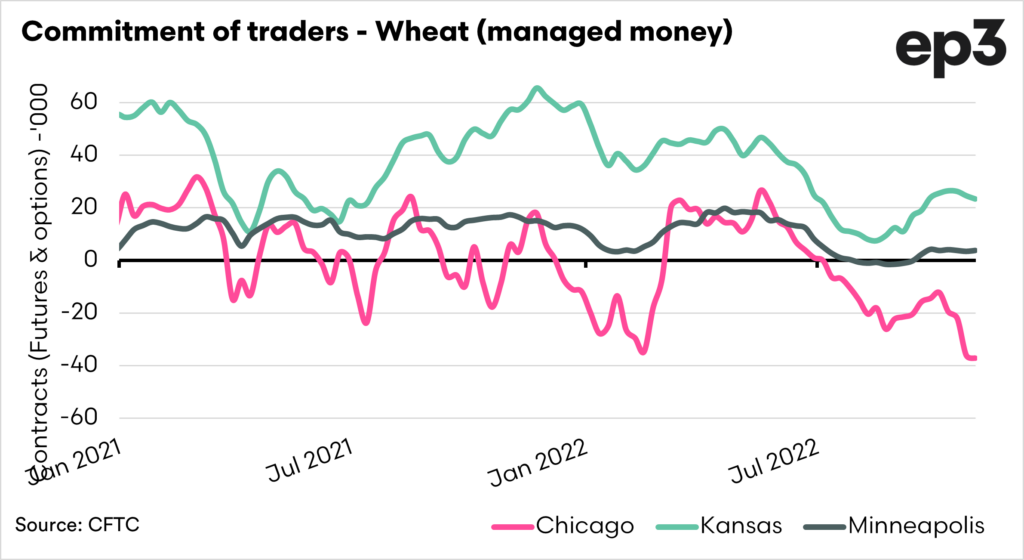

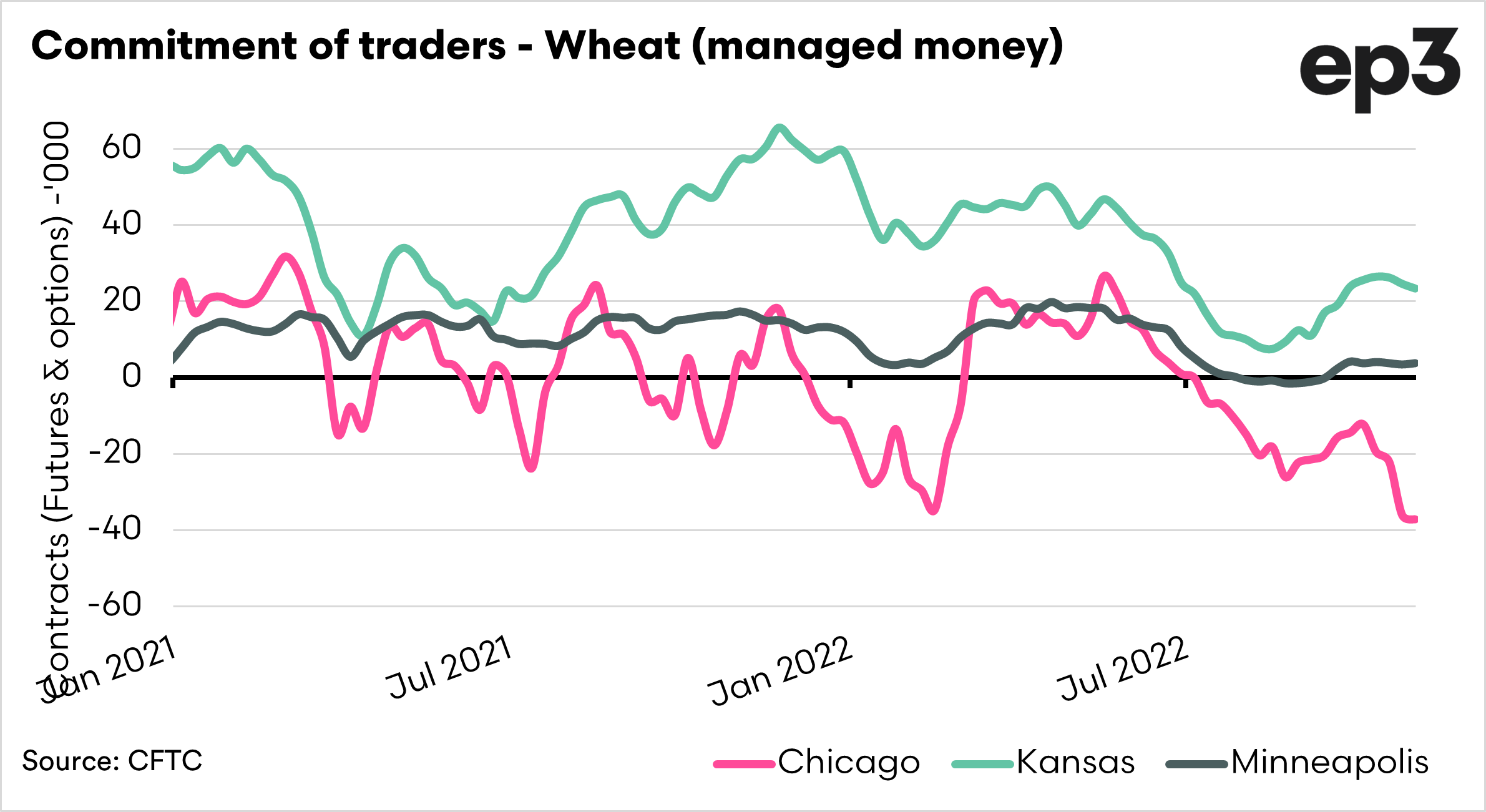

Chart 2. This chart shows the different futures contracts split out. We can see that overall, it is the Chicago contract that is moving to quote a large short. This means that speculators are overall ‘betting’ on a further fall in Chicago futures.

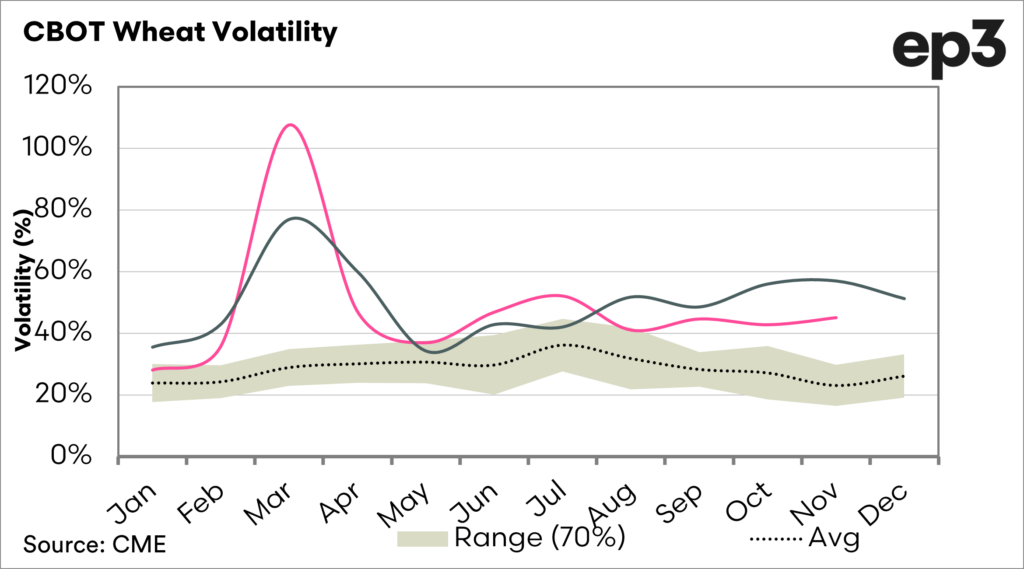

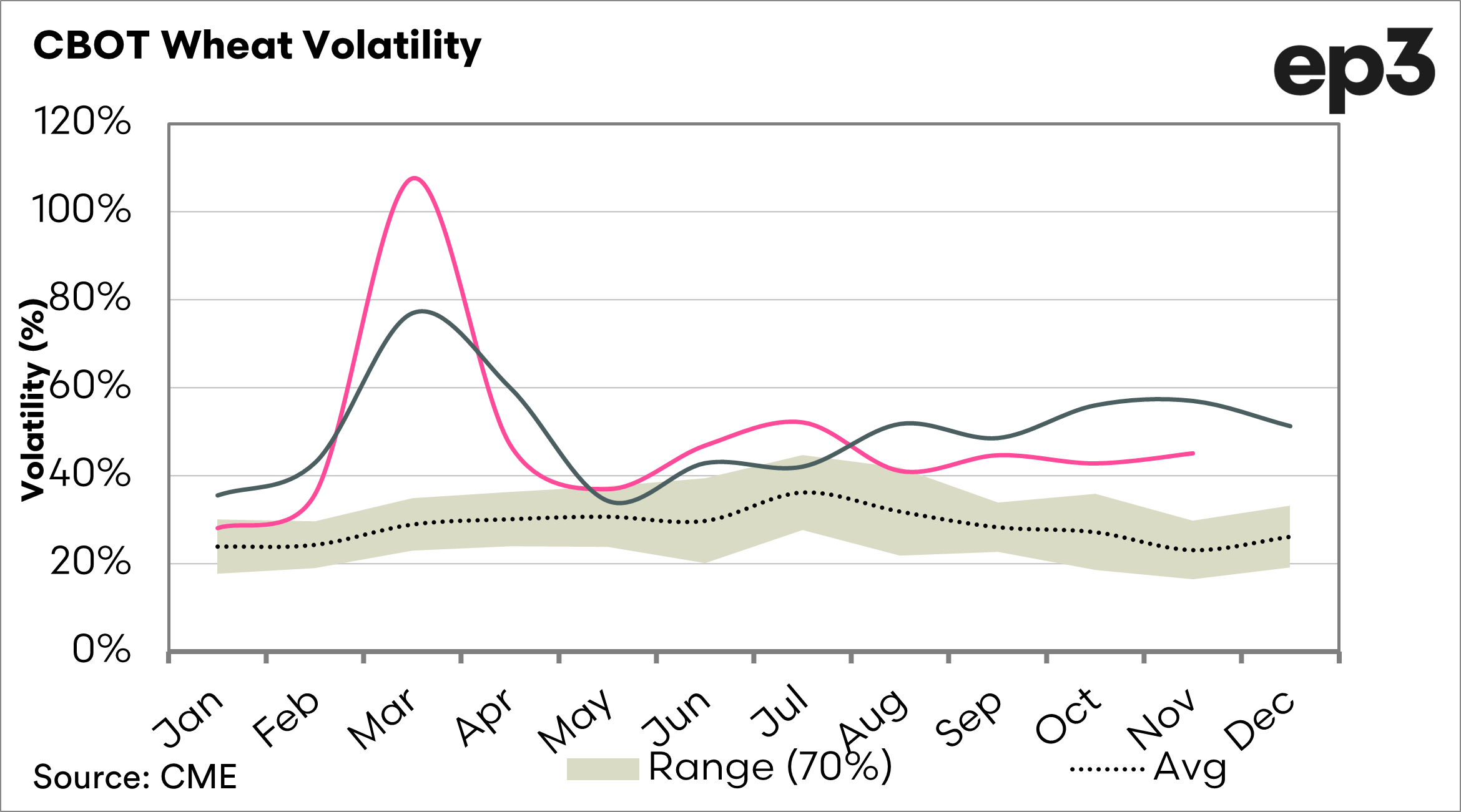

There is a lot of volatility in the marketplace (chart 3), and the market is following a similar trajectory as 2008. It is important to note that speculators don’t always get it right; they can get their ‘bets’ wrong.

The speculators being short means that if there is a major issue, they will want to cover their shorts quickly, which can lead to quick reactions in the marketplace.