Market Morsel: Betting on wheat

Market Morsel

As a grower, you are naturally ‘net long’. You are going to grow a commodity which will at some point in time be sold, you have a supply (long) of a commodity. Conversely, if you are a consumer of grain, you are generally ‘net short’, you need to buy a commodity.

A speculator can be either long or short. Speculators trade the market based upon their viewpoint. They have no interest in the physical production or consumption of the commodity, they just want to make money from a position.

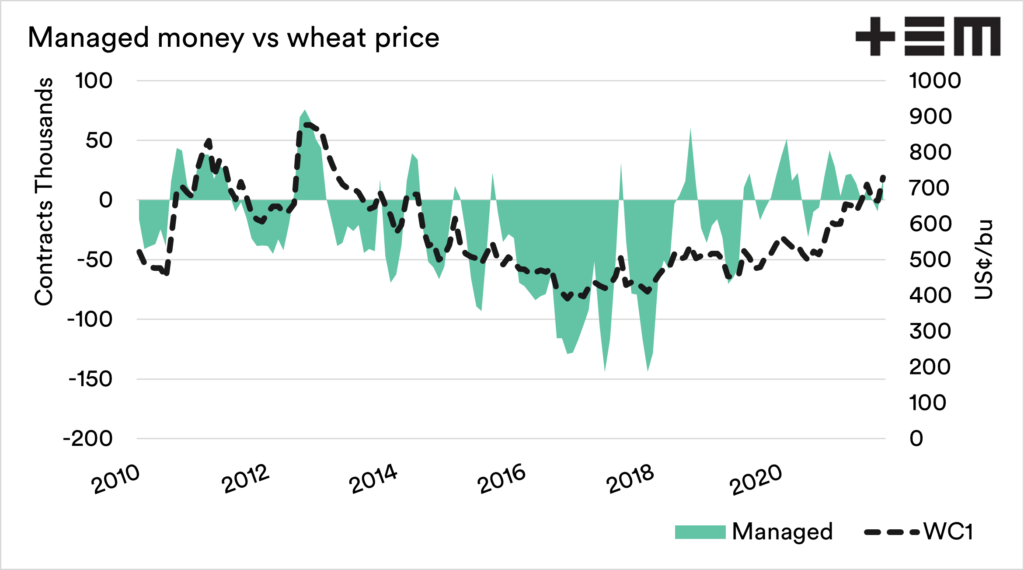

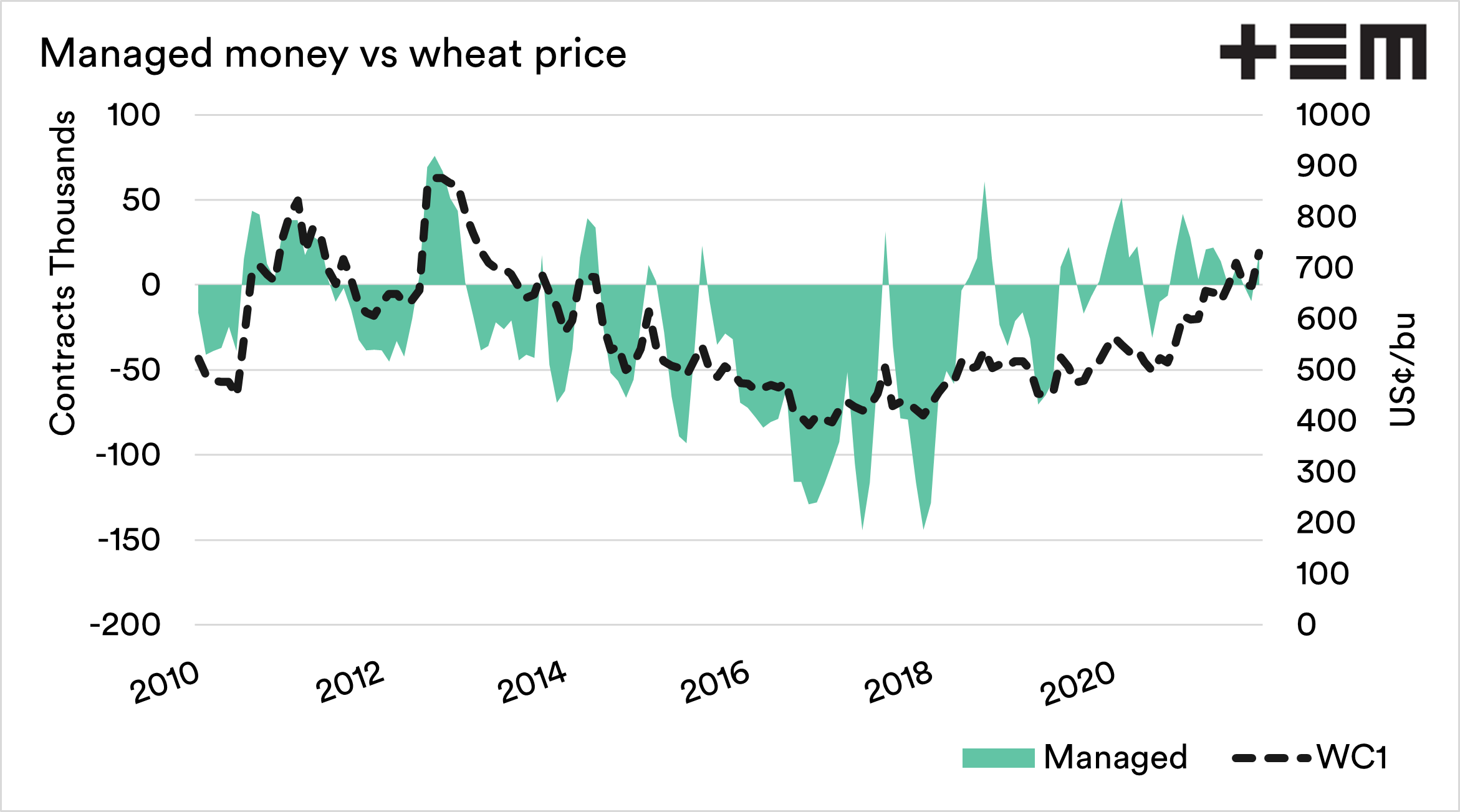

The commitment of traders report is a valuable piece of data to keep an eye on. It provides an overview of the position of market participants.

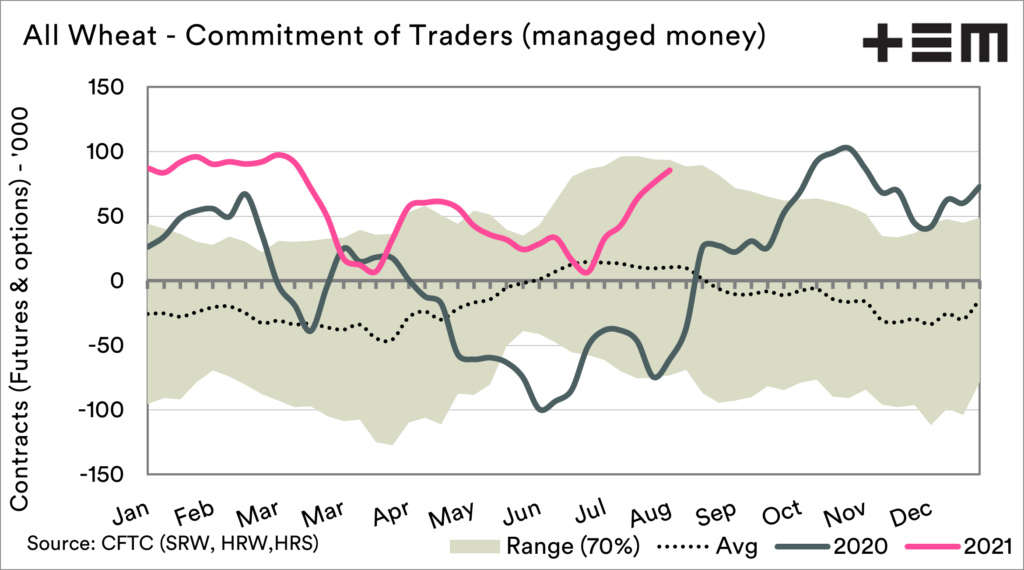

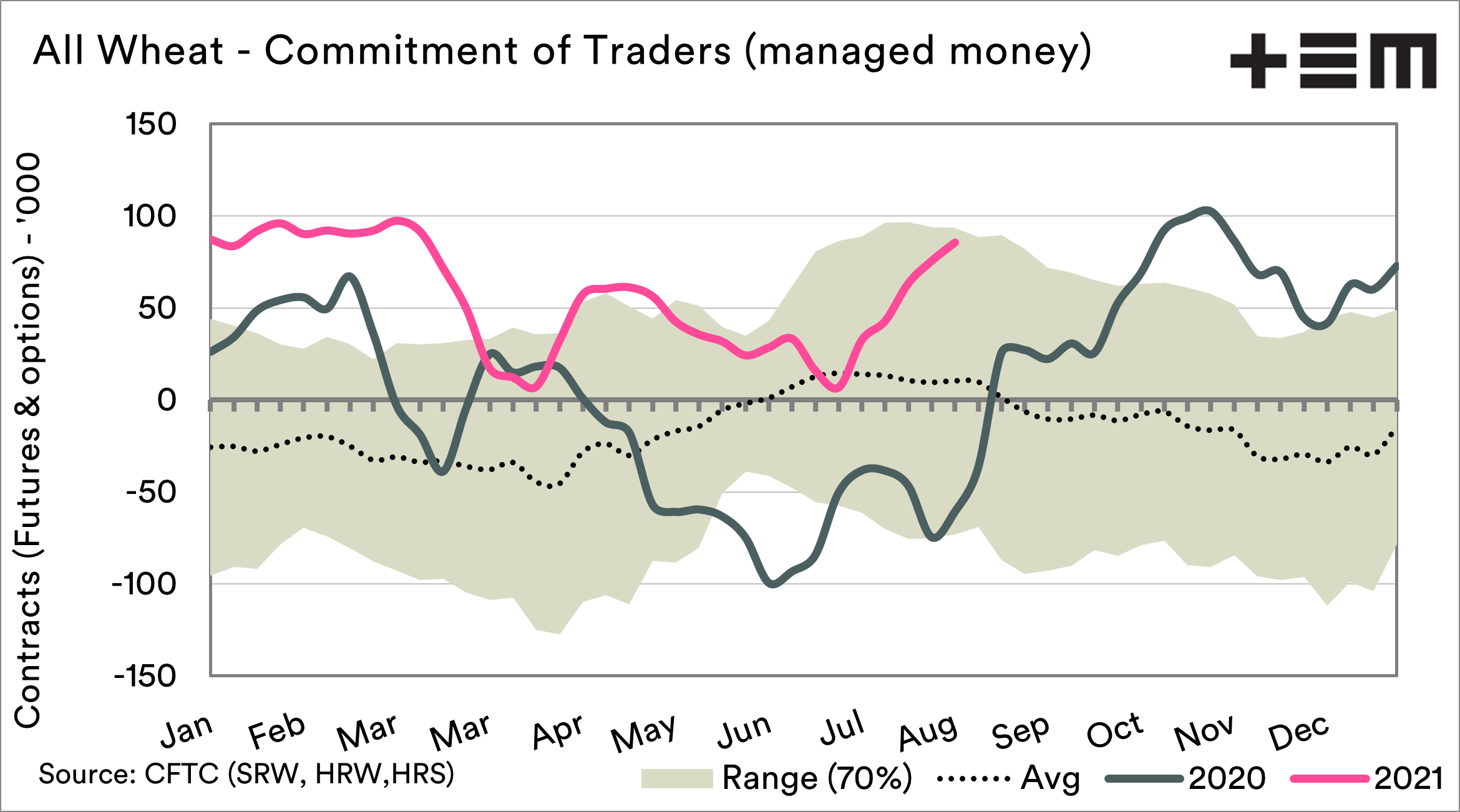

The first chart below shows the seasonality of speculators position for all the combined wheat futures (Kansas, Chicago and Minneapolis). When the line is above 0, they are overall betting on a higher market, and vice versa.

At present, speculators are betting on increasing values, i.e. buying and hoping to sell for more later.

It’s important always to remember that speculators can easily close their positions, and corrections are common.

At the moment, they are happy to bet on wheat. Combined with some of the fundamental factors (see here), there are some attractive pricing opportunities.