Market Morsel: Canola, first off, first sold?

Market Morsel

Canola has been the breadwinner in recent years, or is that the oilwinner? Enough with the terrible puns.

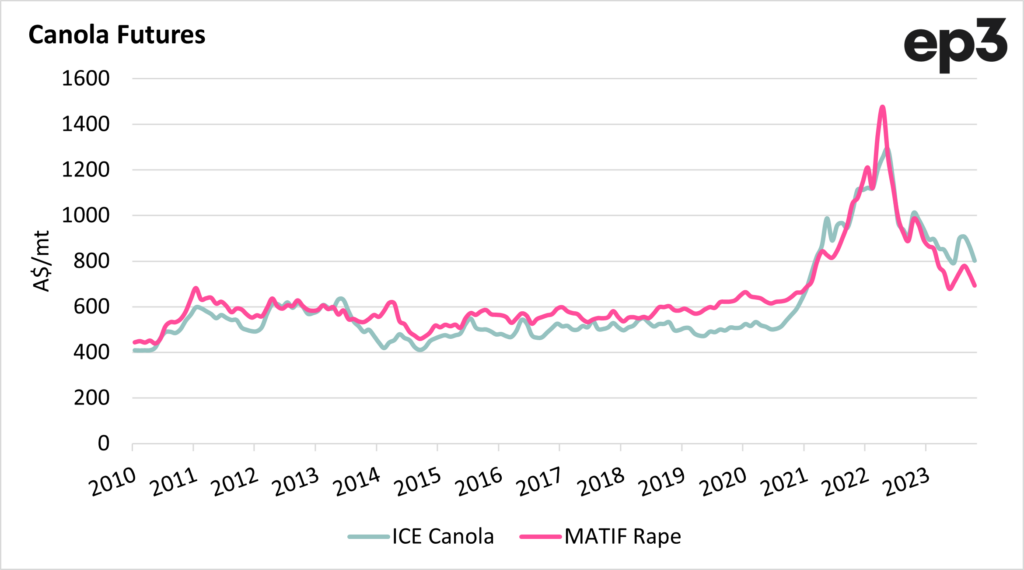

The canola market globally has slid. The first chart below shows the canola futures as a monthly average from 2010 to the present. We have just experienced a couple of years of tremendous growth in pricing. We warned many times that this was not the ‘new, new’.

A large part of the huge rise was the drought in Canada. When production came back online and surplus volumes became available, it would come back to a more normal level.

We can see that the actual market is still at the top end of what would have previously been the long-term.

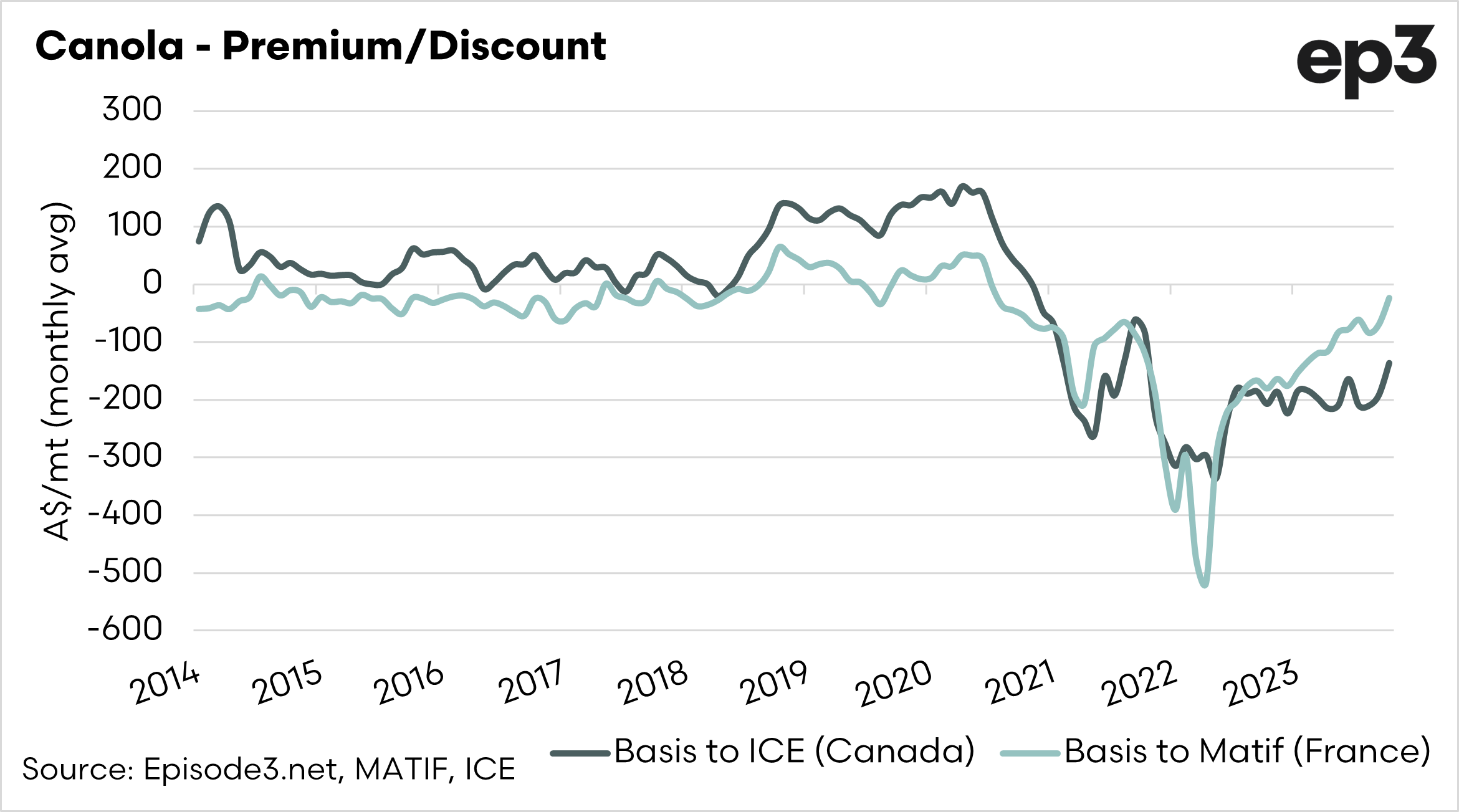

Let’s look at our basis level. If we examine Port Kembla, near where a huge chunk of domestic demand is located in Australia, we can see our canola moving back towards premium levels.

Typically, Australian canola would not have a huge premium against French rapeseed(unless we are in a drought). However, we tend to price higher than Canola from Canada, that is, unless they are in drought.

In recent years, we have switched from a period of Canada in drought, causing them to have a premium, to Australia being in surplus, causing us to have a discount.

We are now slowly moving back closer to more traditional levels.

If we look at the oilseeds markets at the moment, we have US soybeans gaining some ground in recent days as demand for meal increases as a result of a dry season in Argentina. If we look further afield from the ag sector, energy prices remain strong as a result of the continued potential for increased hostilities in the Middle East.

As the rest of the world is nearly finished with its harvest, I think the energy sector may be the biggest driver.