Market Morsel: Crude oil crash could be an omen for grains.

Market Morsel

Crude oil is one of the key drivers of the grain market.

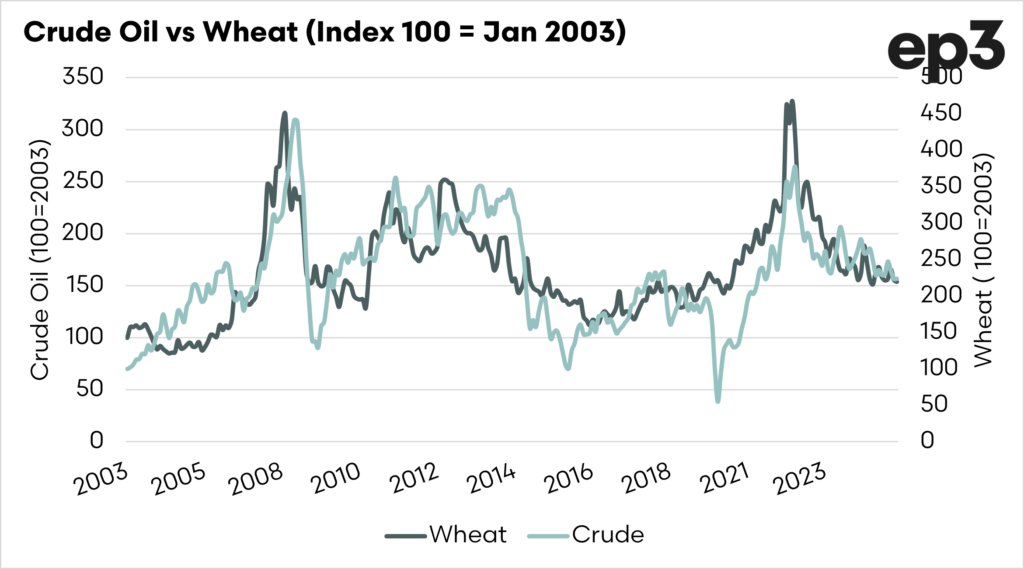

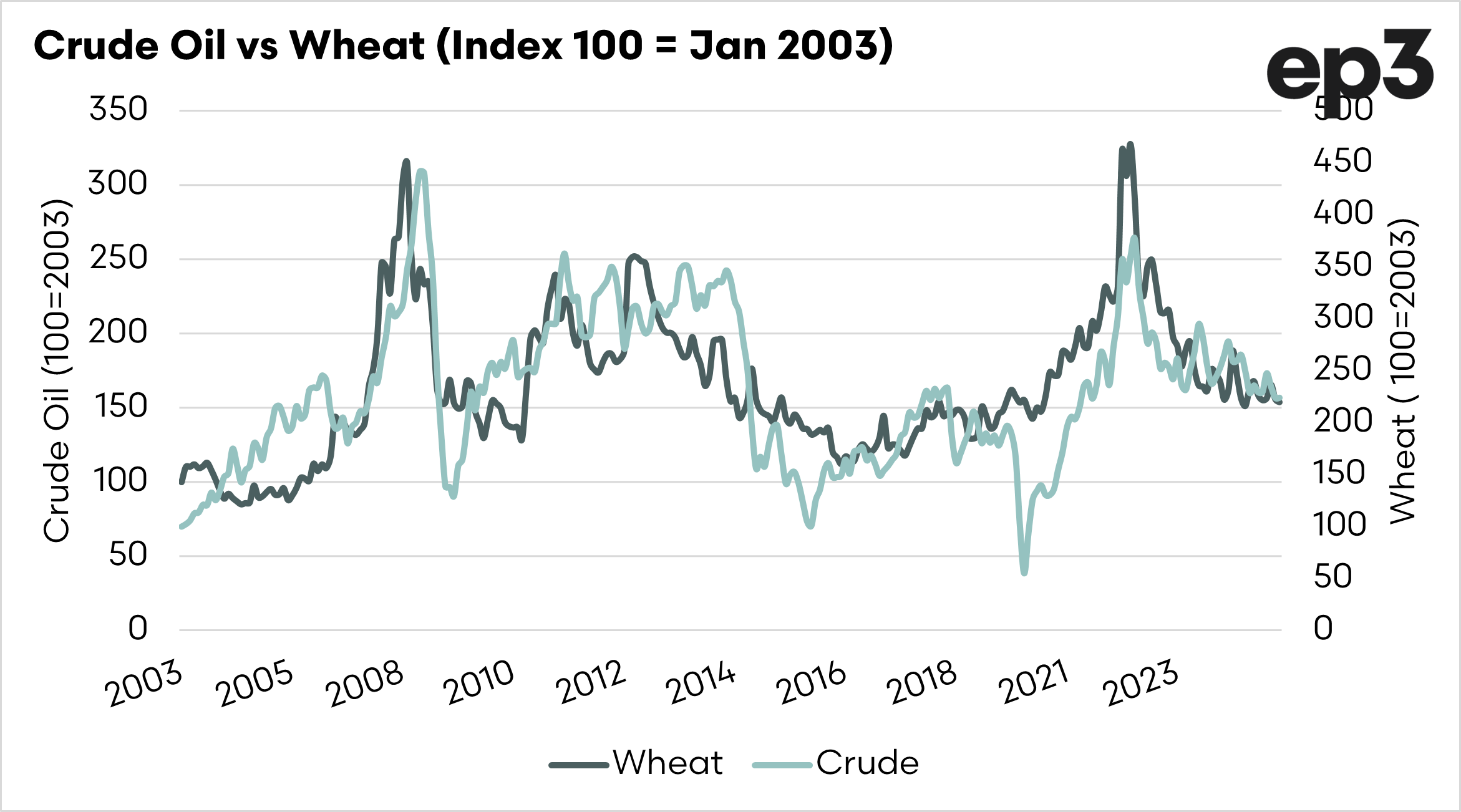

Crude oil and wheat prices often move together because of the strong link between energy costs and agricultural production. This relationship means that oil price volatility can ripple through to food markets, both positively and negatively.

Grains are used heavily in biofuels, and when crude oil falls in price, the price of biofuels falls, and therefore, the price of grains (wheat/corn) in turn, will follow. This relationship can be seen in the first chart and something we have chatted about in the past; see here, for a good explanation.

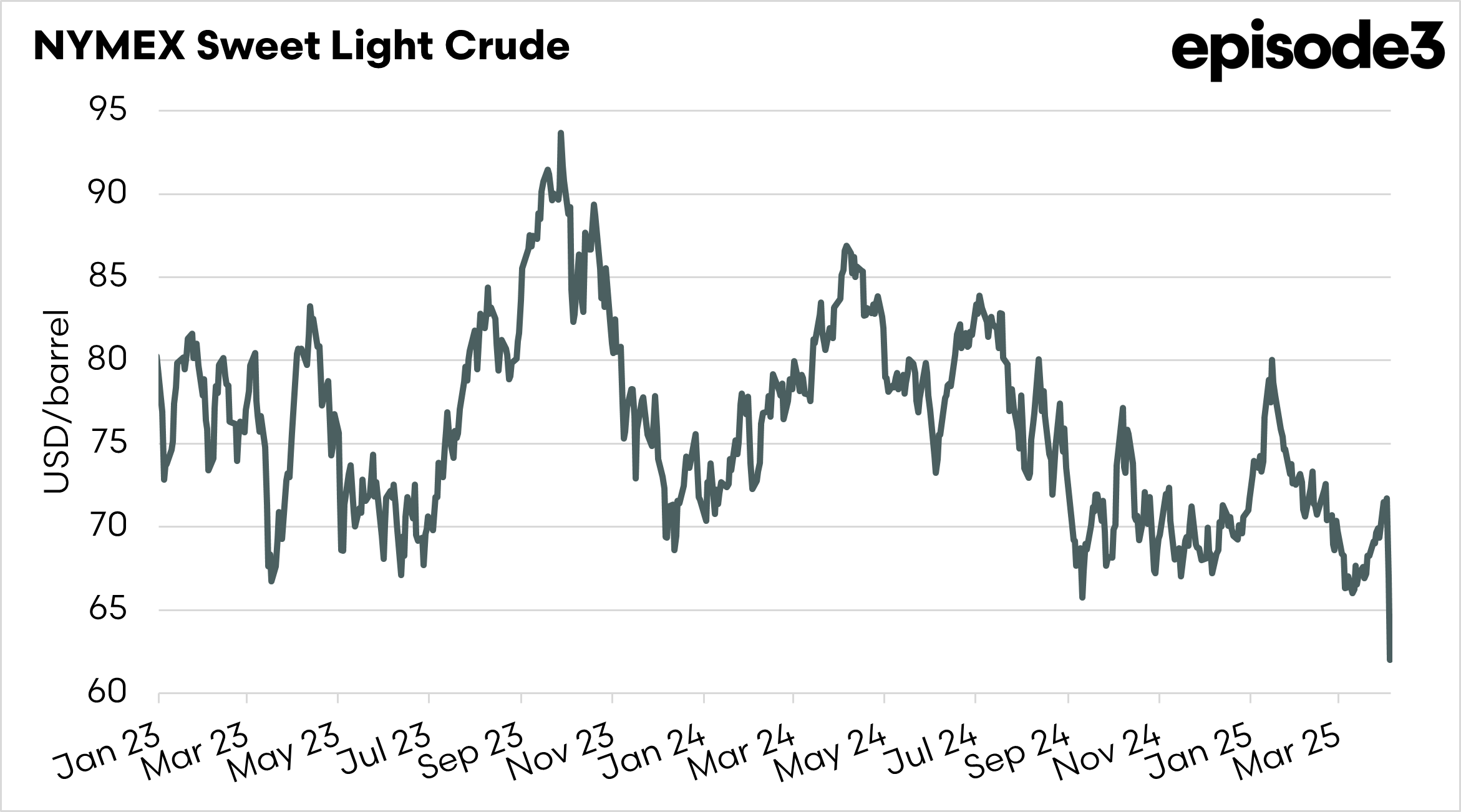

Crude oil is a good lead economic indicator. Crude oil prices are a leading economic indicator because changes in oil prices can signal shifts in inflation, production costs, and consumer spending before broader economic trends become apparent.

The world is concerned about the global economy stalling, largely in part because of the potential of a protracted trade war between major nations. This has caused the crude oil market to get smashed since Trump announced the newest raft of trade tariffs.

If the global economy stalls, it can have an impact on wheat pricing due to lower demand for biofuels. This will cause corn to fall, and wheat will fall in lockstep.