Wowser at the bowser, Winner in the wheat.

The Snapshot

- Diesel prices have risen to the highest level since 2008

- This is driven by the increase in crude oil pricing.

- Crude oil drives ethanol pricing in the US.

- Ethanol pricing has an impact on corn pricing.

- Corn pricing has an impact on wheat pricing.

- Therefore higher crude oil pricing can lead to higher wheat pricing in Australia.

The Detail

A couple of weeks ago, in our fuel update, I wrote about the advance of fuel prices (see here). The current fuel pricing in Australia is at the highest level since 2008.

The increase in the cost of diesel will directly contribute to higher production costs for grain growers. As many will be aware, I always like to find a positive when possible. Is there a way that high fuel/crude prices are good for grain growers?

My favourite thing about commodities is how connected they are. So let’s go down a little logic rabbit hole.

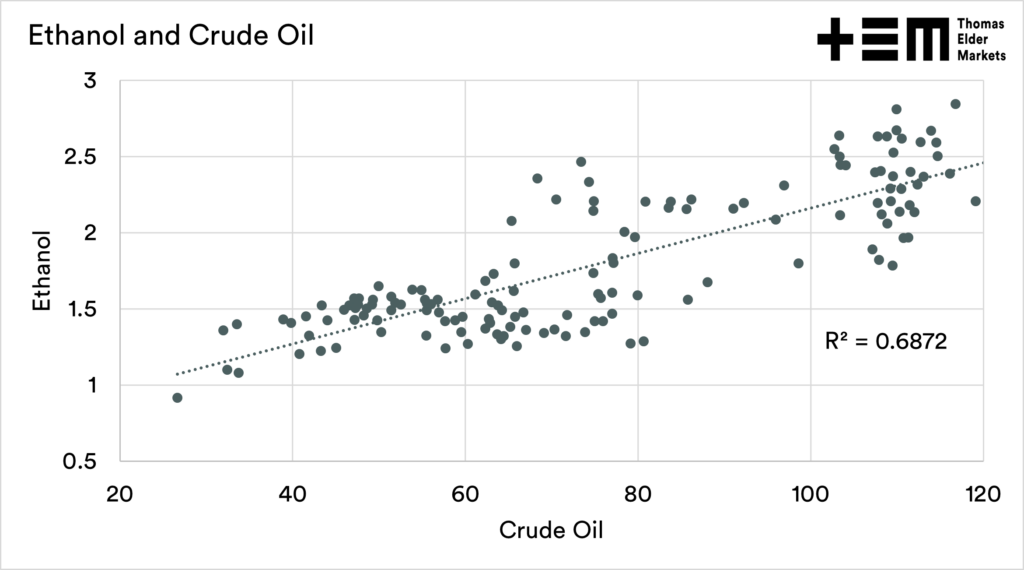

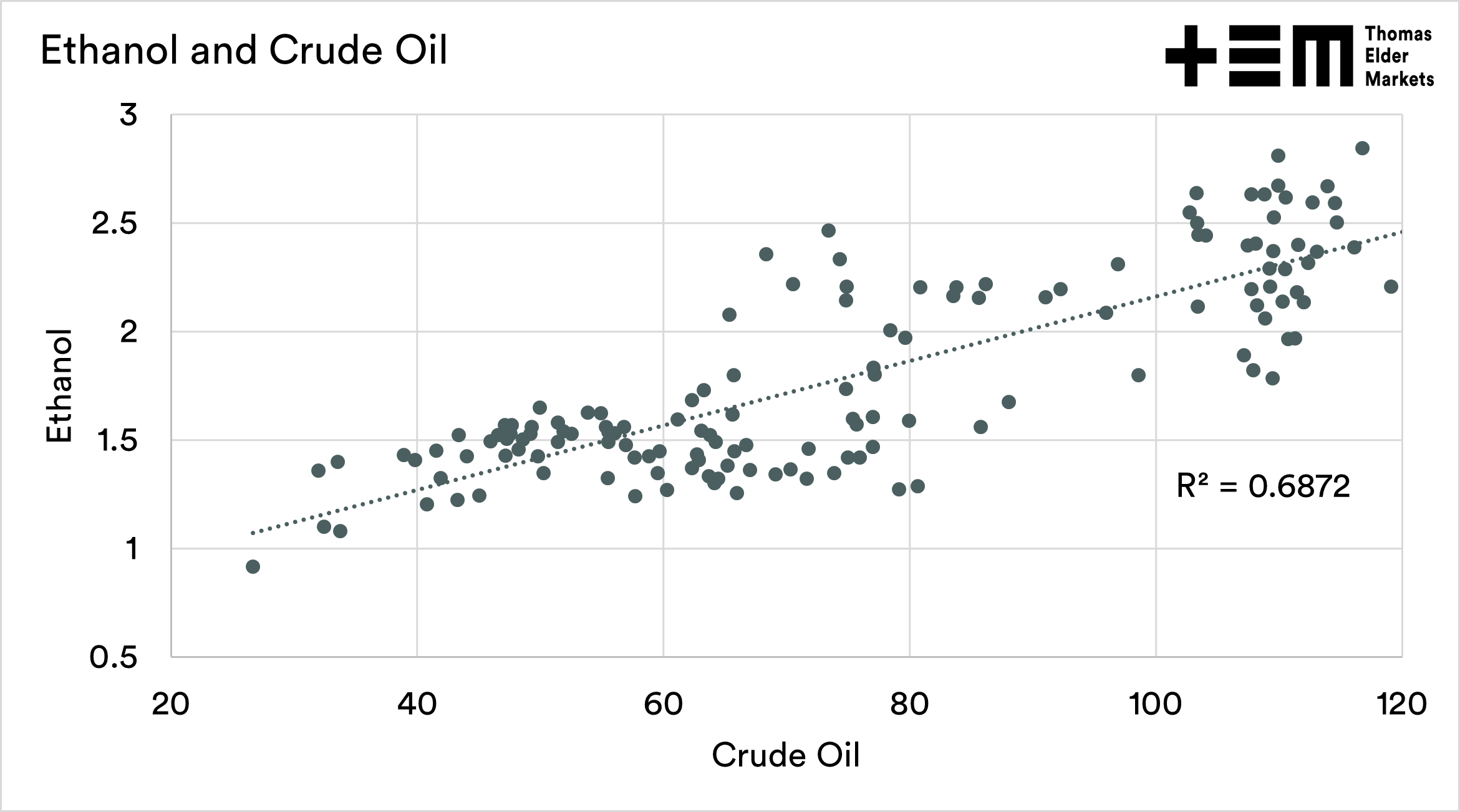

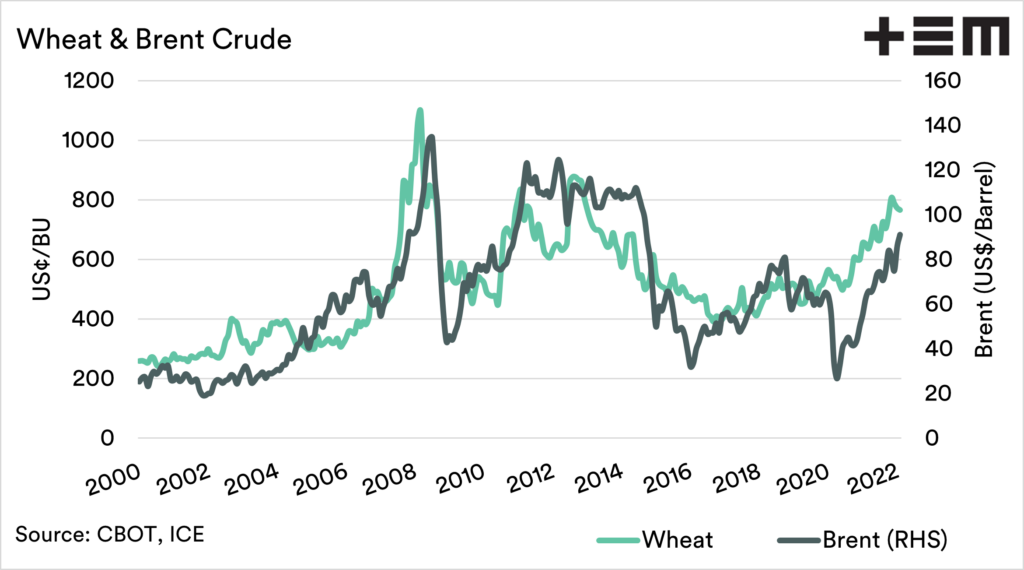

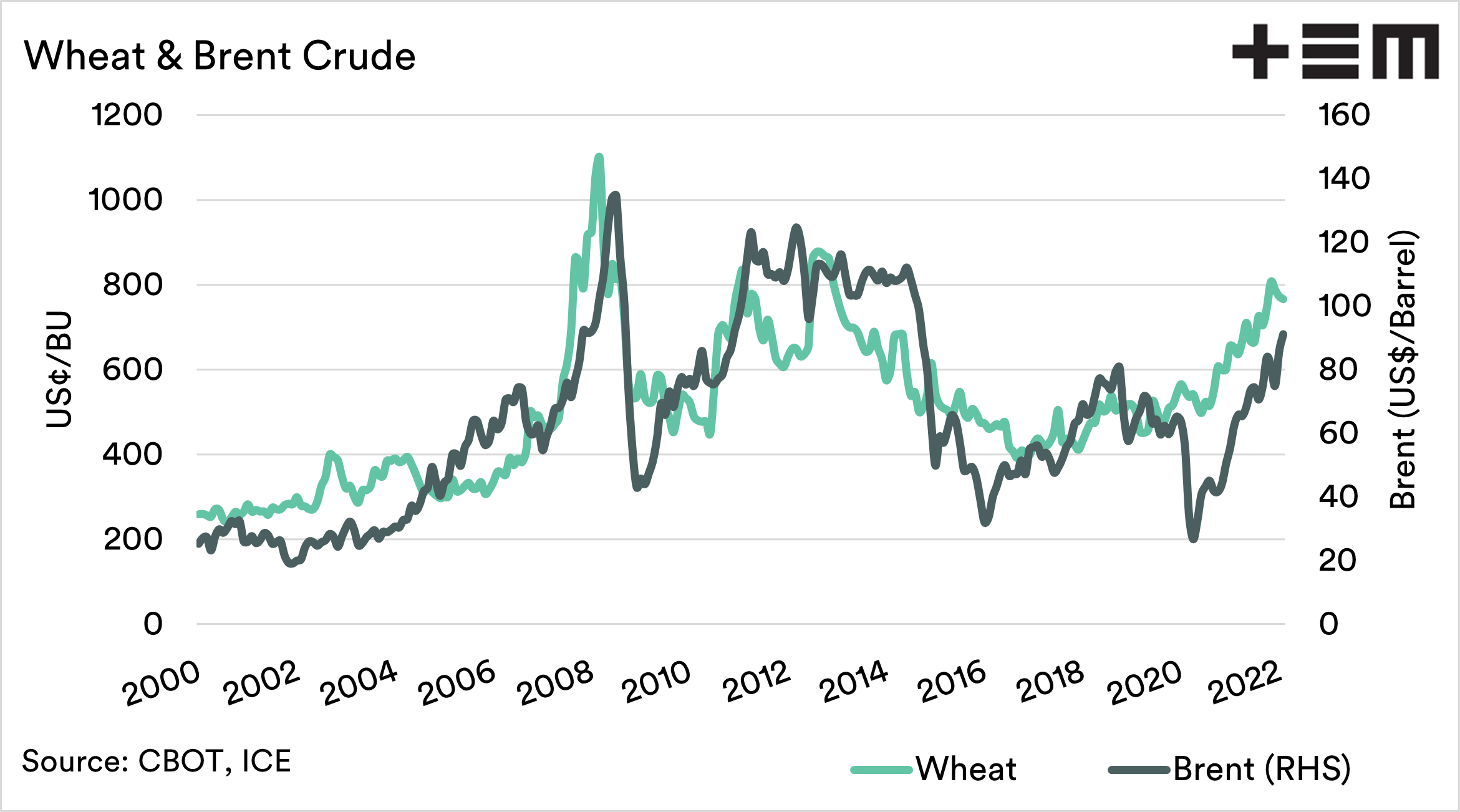

Crude oil is refined into road fuel. In the past twenty years, huge corn volumes in the US have been converted to ethanol. Ethanol is mixed with fossil fuels to power vehicles. There is a close relationship between crude oil pricing and ethanol, which can be seen in the chart below. If crude oil pricing increases, it can lead to increased ethanol.

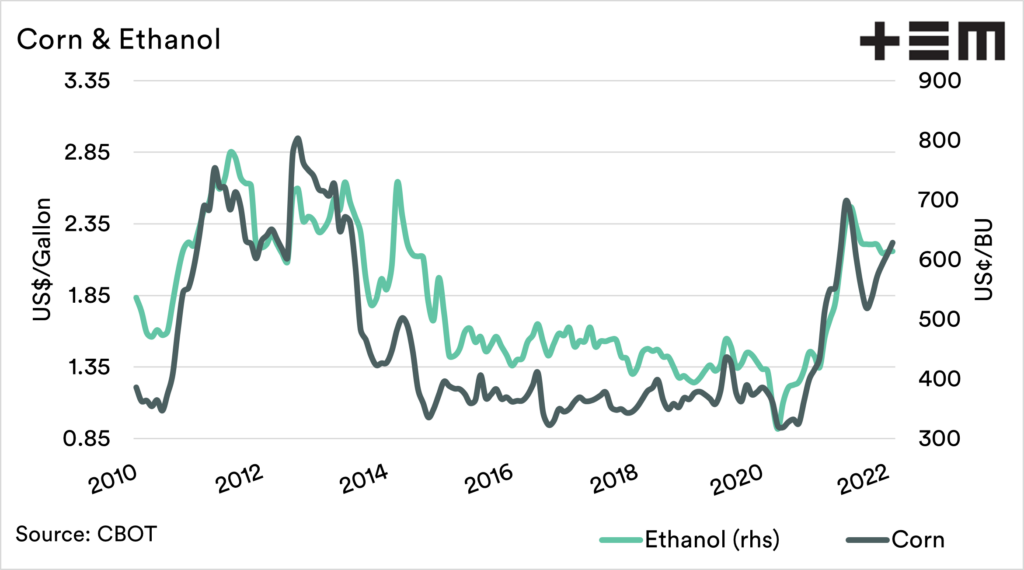

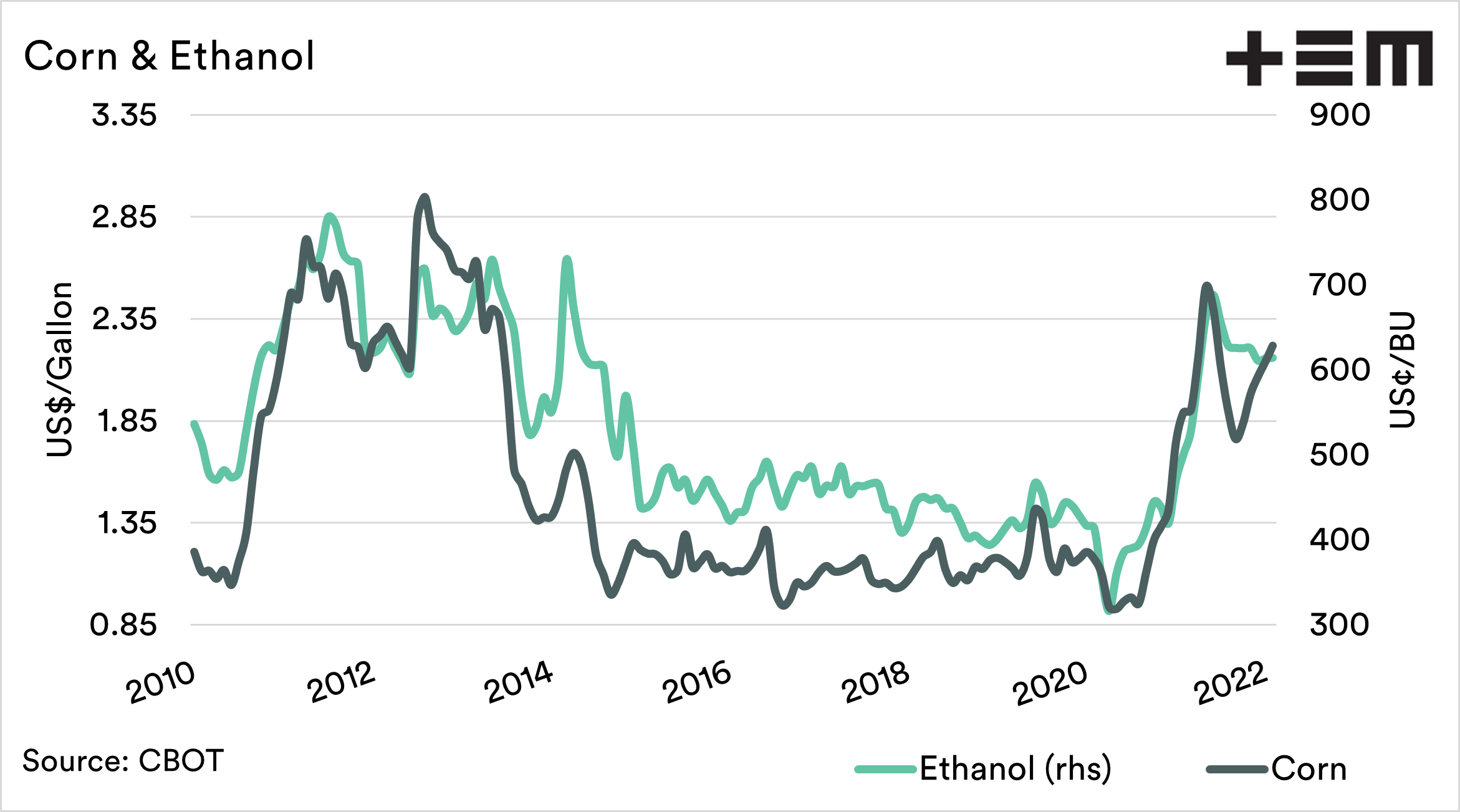

In the US, approximately 40% of corn is converted to ethanol. This is a huge volume considering that the US is the worlds largest producer. These two commodities have a very close relationship to each other. As demand for ethanol moves up and down, so does the corn price.

This can be seen in the chart below.

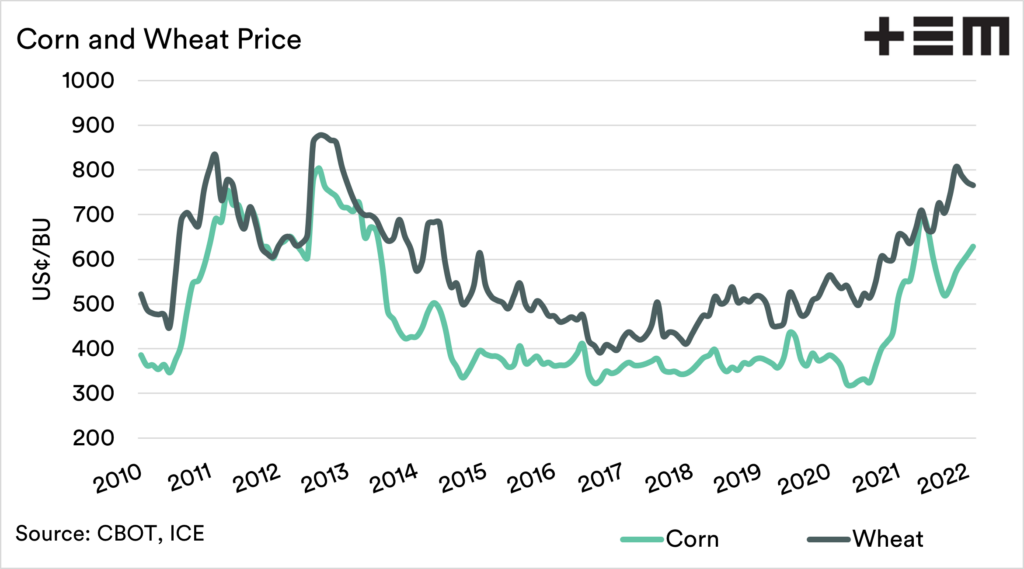

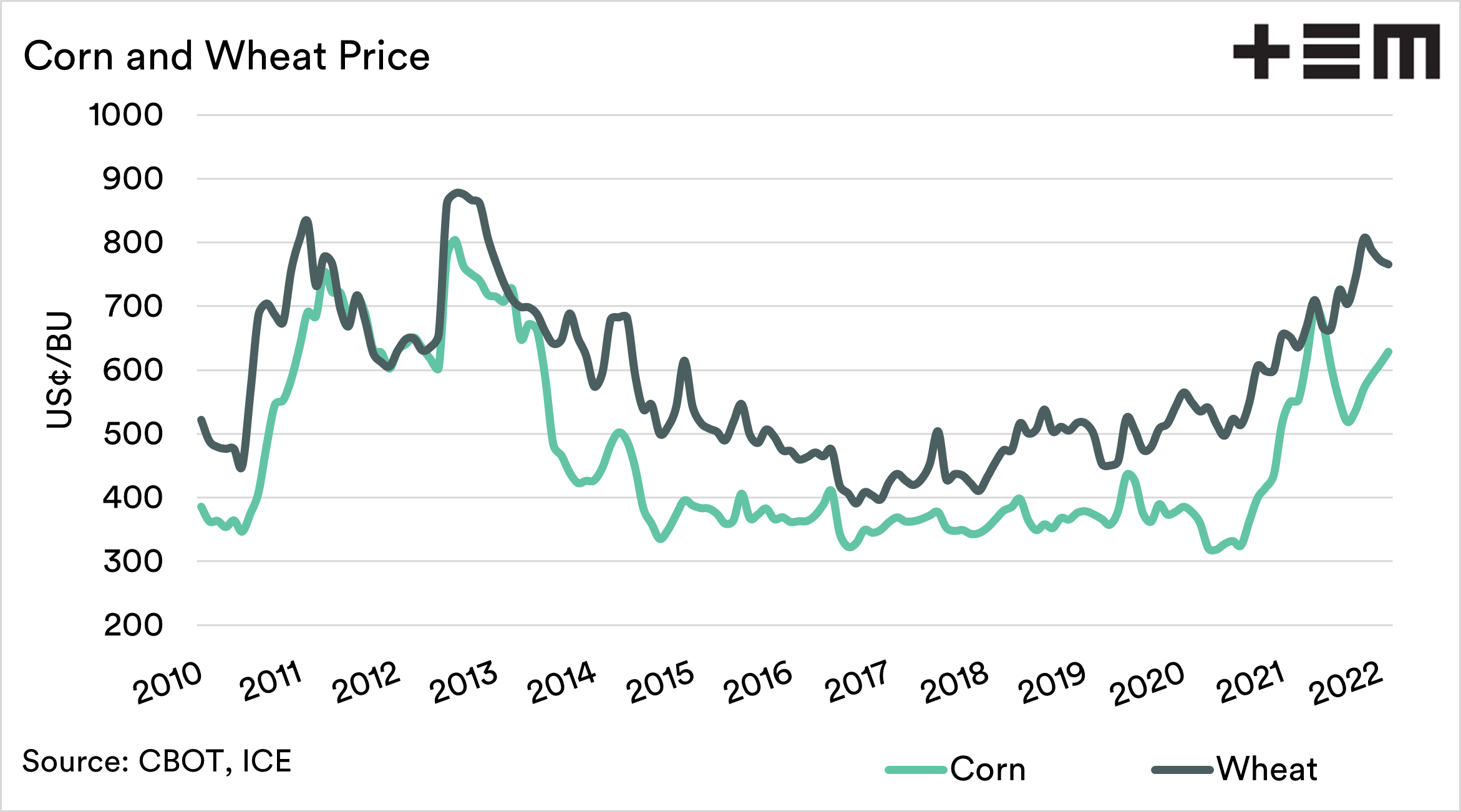

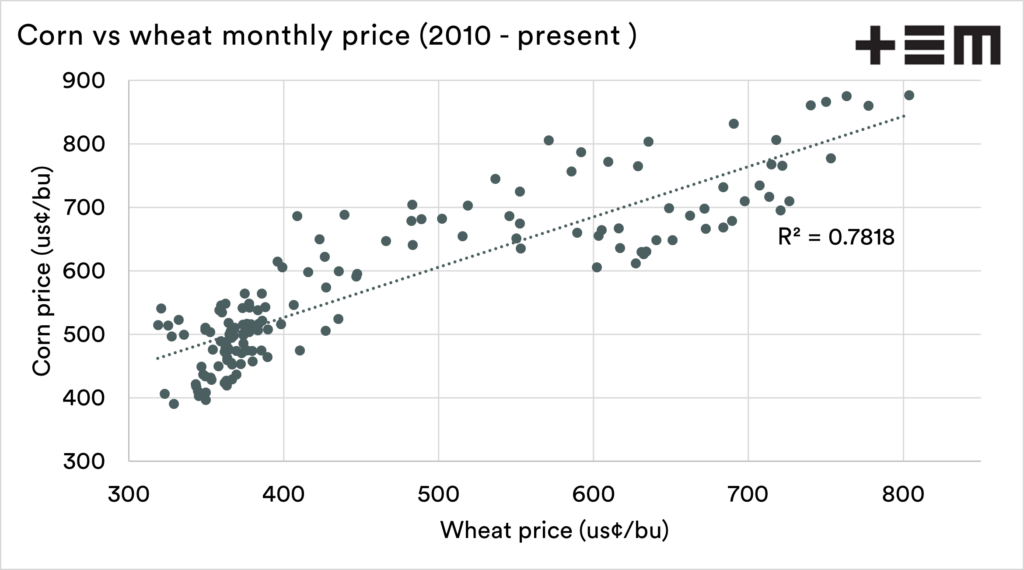

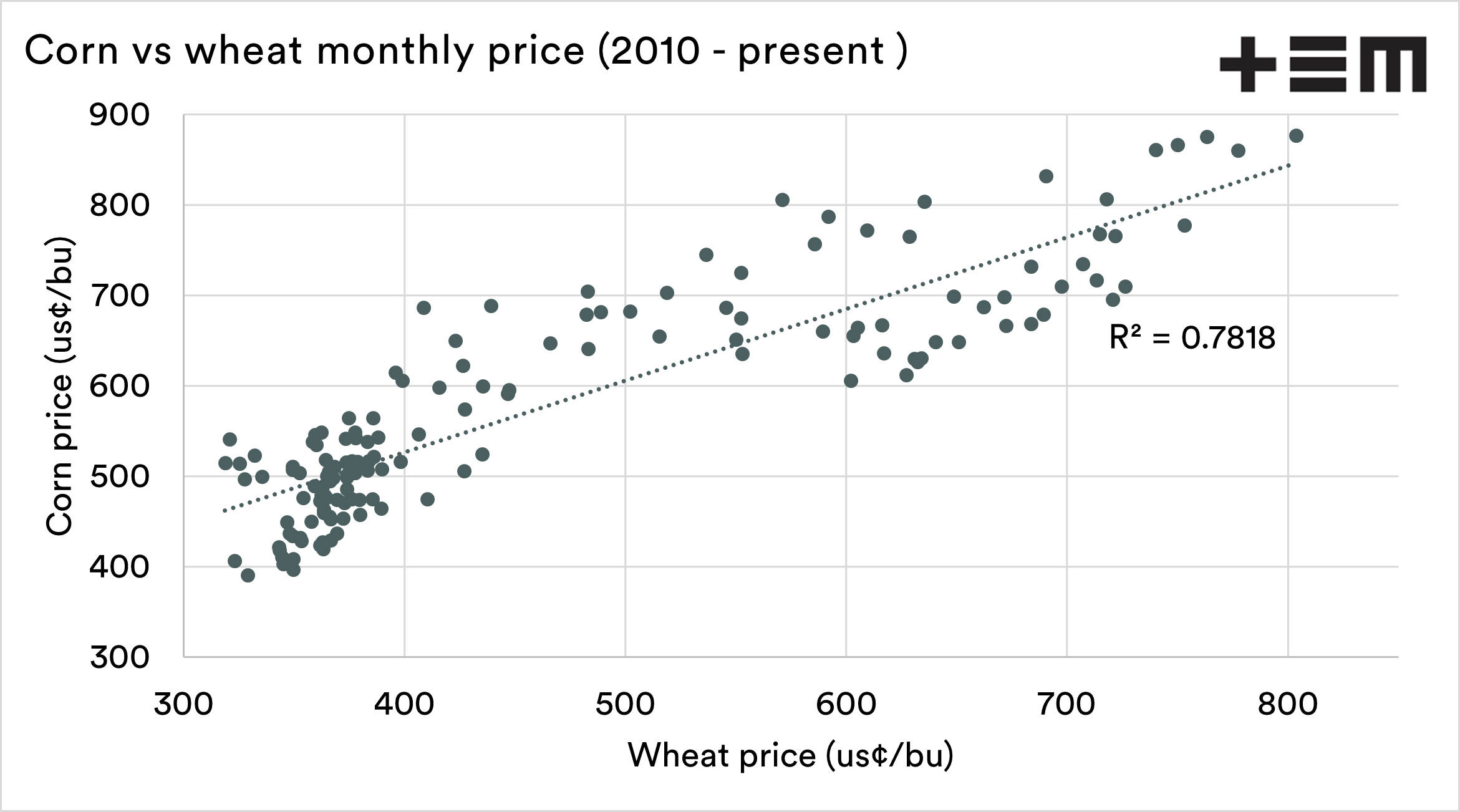

The association between wheat and corn is well documented, and we regularly look at this in our articles. Corn and wheat are interchangeable in many instances (feed).

Over time, movements in the price of these two grains tend to follow one another.

So let’s run it over

There is a linkage between crude oil prices and wheat through its association with corn/ethanol. So there are some potential positive messages from increasing crude oil. It may be that farmers are better off with more expensive fuel if it means higher prices for our grain.

Let’s see how it pans out and whether crude oil continues to strengthen. As a secondary note, if we all switch to electric cars, will that reduce ethanol demand and therefore corn demand……

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.