Market Morsel: Forward thoughts on wheat

Market Morsel

The seed has been planted and into good moisture for many. Let’s take a look at what the futures market has in store for this year and next.

Futures/swaps have a bad name at present, especially in the west, after recent events. However, they have a place in the mix of marketing choices.

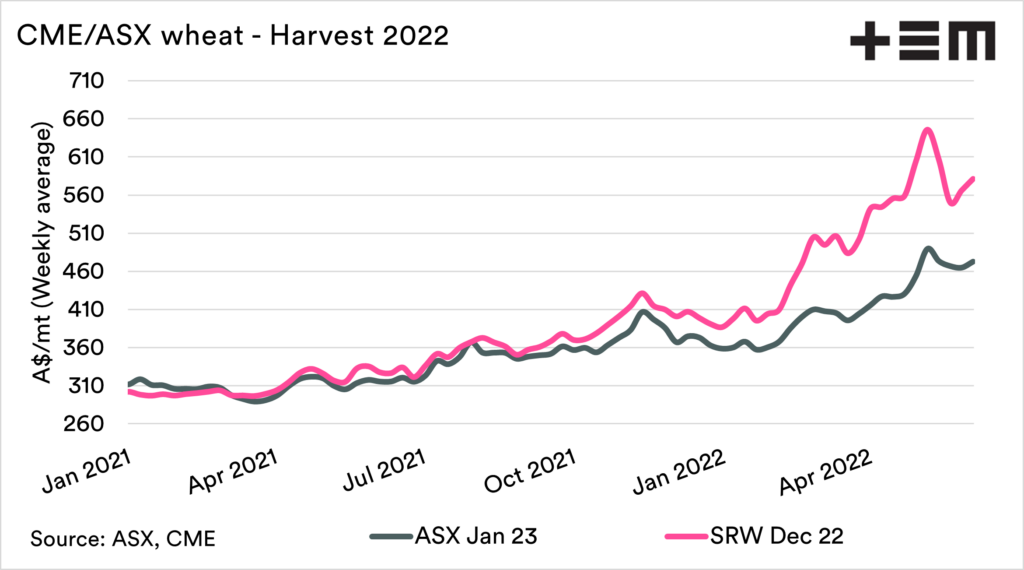

Let’s look at what Australian wheat is doing. The ASX contract for the new crop has averaged A$473 during this week. This is a high price, historically speaking. It still has a very large negative basis to CBOT wheat for the corresponding period, trading at A$581 (weekly average).

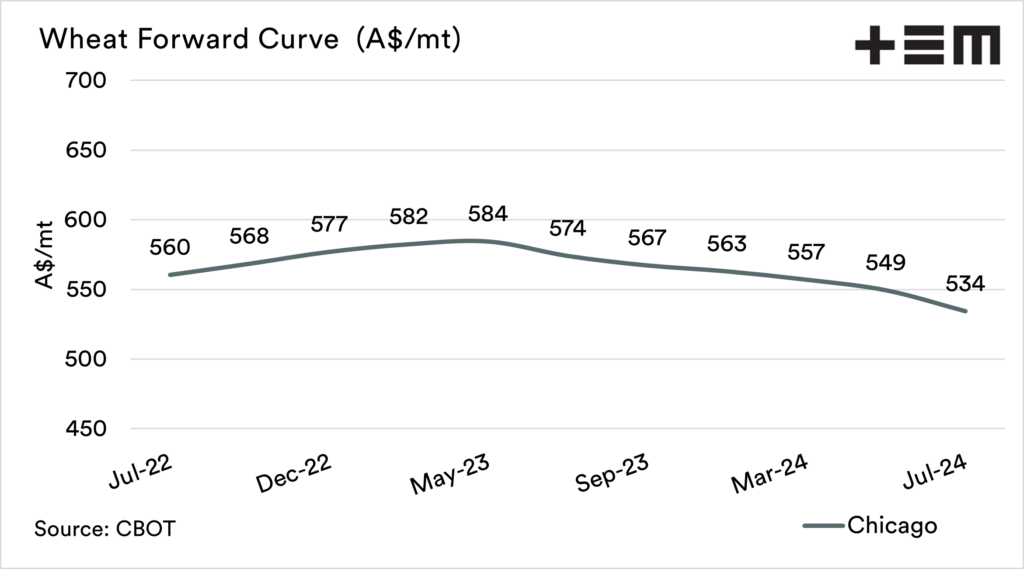

The second chart below shows the forward curve for CBOT wheat in A$ terms. As of this morning, the contracts are all above A$560 right through to December 2023.

One argument is that locking in Chicago futures at these levels will give the potential for basis to return to a premium – and you can get the ‘cream on top’. No strategy always works, and active management is required when using futures/swaps. They are not set and forget products.

The reality is that typically Australian growers have received a positive basis; whilst we have big crops, we may continue to be discounted. Will it return to a premium? Maybe aye, maybe no.

Locking in futures for later this year or next has risks. It always has. The upside is that at least the flat price is strong despite the big basis discount.

Always get advice etc, blah blah blah.