Market Morsel: Germany to hurt our canola price?

Market Morsel

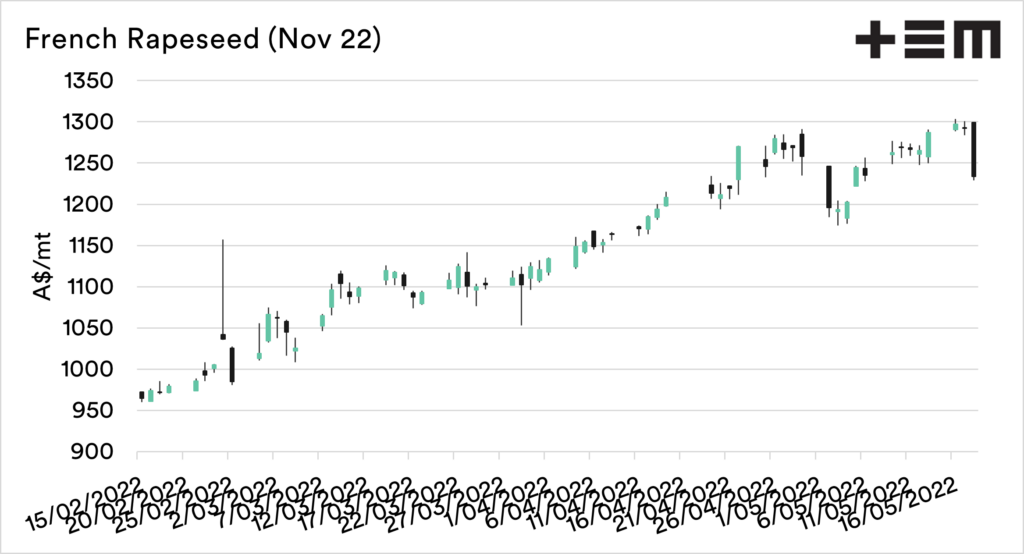

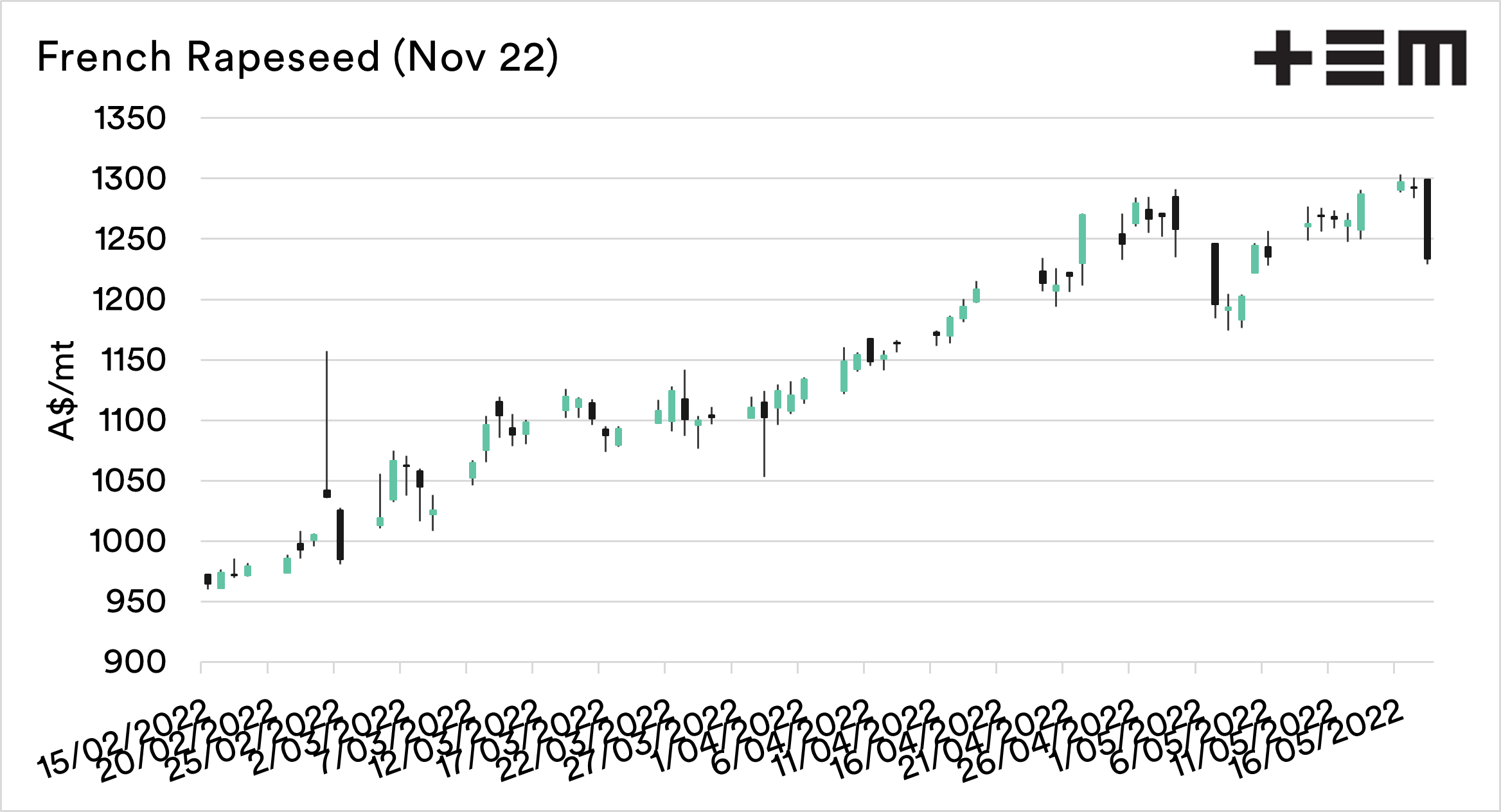

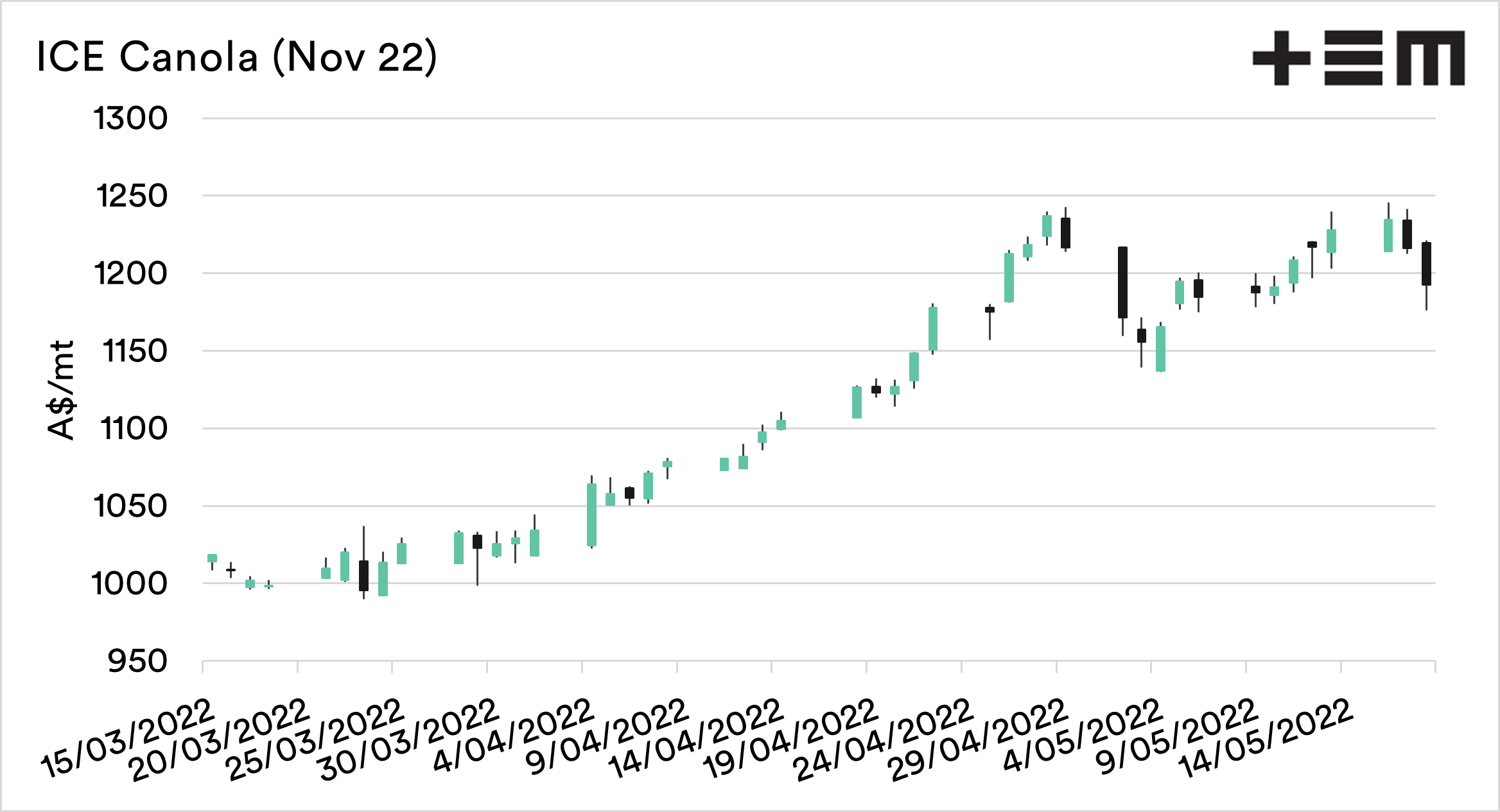

The canola/rapeseed market took a thumping last night. ICE canola (Canada) futures were down A$23, and Matif (French) rapeseed down A$59.

What drove this down?

The biggest bear factor in the canola market had to be through government intervention, and it may be here soon. Unfortunately, government factors are hard to predict.

One of the factors driving the market south, especially in Europe, is the move to reduce the usage of vegetable oils in fuel. There have always been arguments that food should not be used in energy, and this argument is exacerbated during times of food shortage.

I wrote about this concern as a likely bearish and one of the only bearish factors in oilseeds back in April (see here).

The EU Commission gave member states the opportunity to set their own mandates for biofuel in recent months due to the continued high prices for oils and lack of access after the invasion of Ukraine.

Germany is looking to reduce their inclusion. Whatever your views on the food vs fuel debate, biofuels have been beneficial for canola pricing.

If this eventuates, it will be a bearish or negative factor for pricing. The question is how significant overall, with such a tight environment. It is important to note that Europe has been a large market for our canola.