Market Morsel: Heavy is the head that weighs the wheat.

Market Morsel

One of the most important factors to understand in wheat marketing is the basis. We discuss it a lot, as it is what can give you a little cherry on top of the cream.

In quick terms, basis is the difference in price between two markets (premium or discount). The basis is primarily driven by supply (see here). When we have a poor crop, our premium to overseas pricing rises. When we have a big crop, like we did last year, we find our premium dropping.

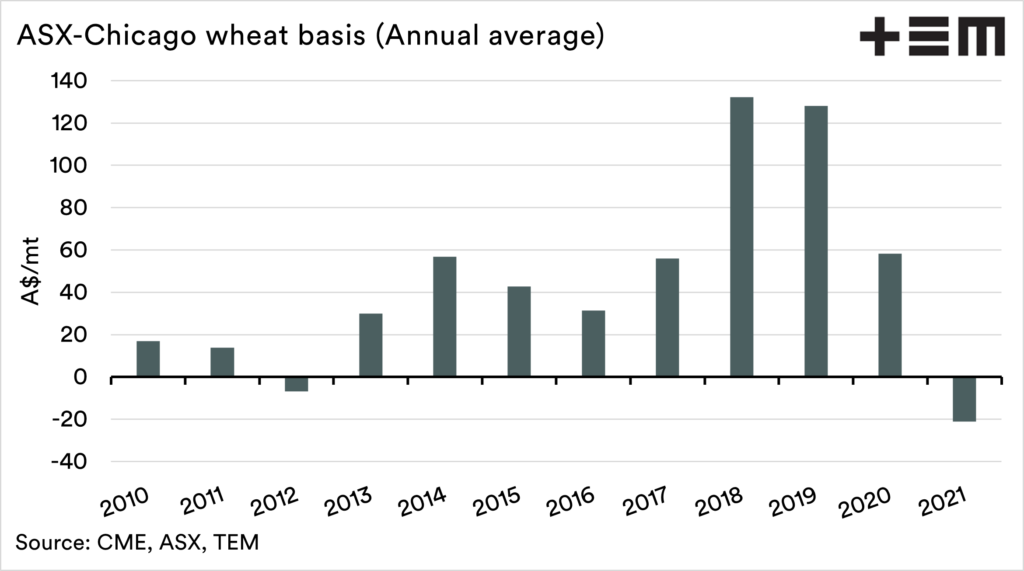

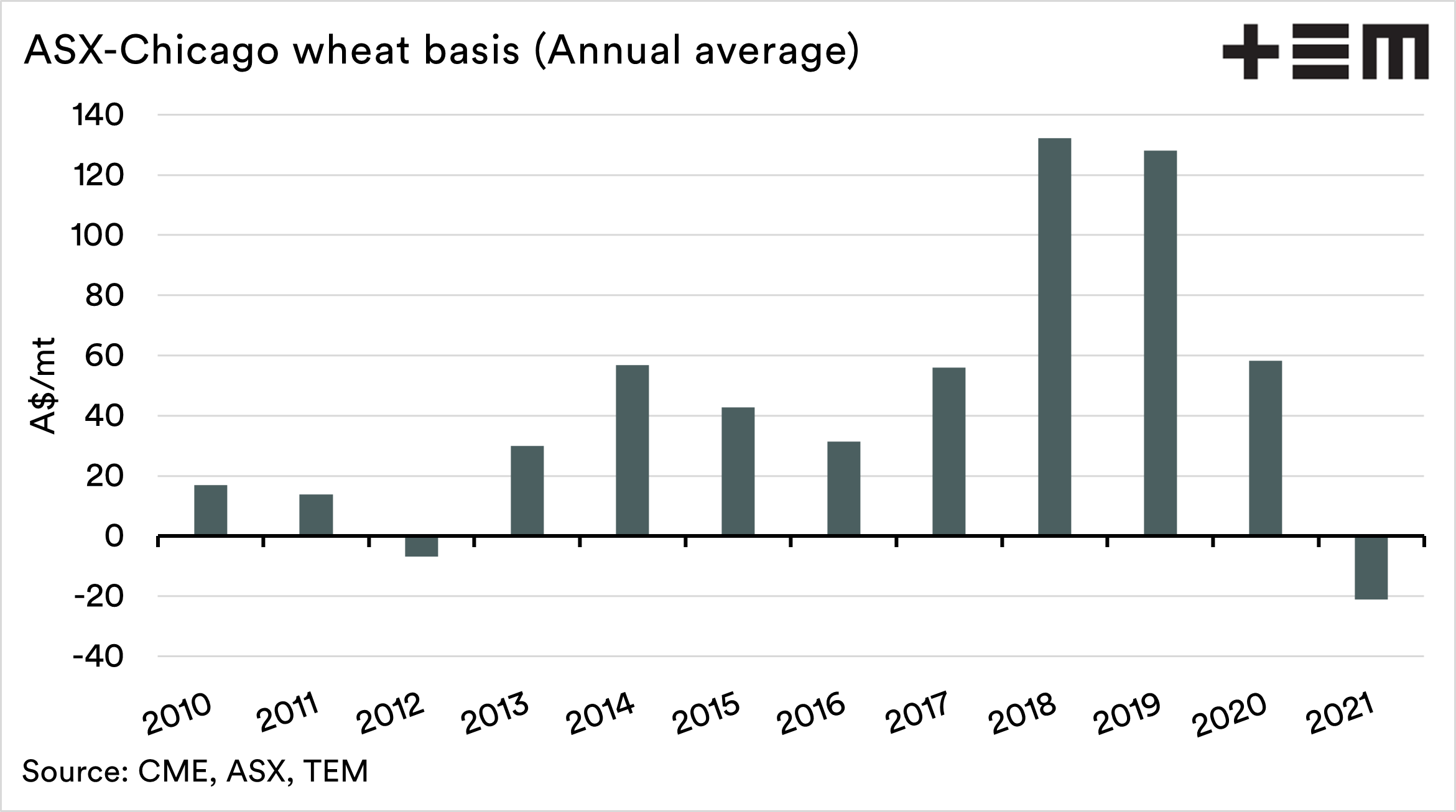

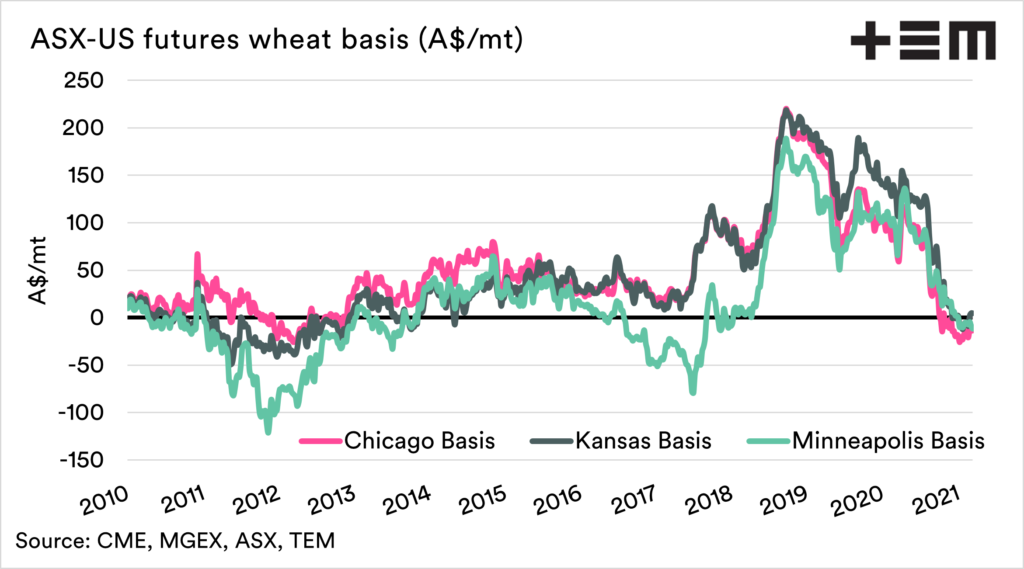

The first chart below shows the annual average basis between ASX wheat futures and CBOT wheat futures (spot contracts). At the mid-point of the year, ASX is trading at a discount of A$21/mt to CBOT. This is the lowest we have experienced since 2010.

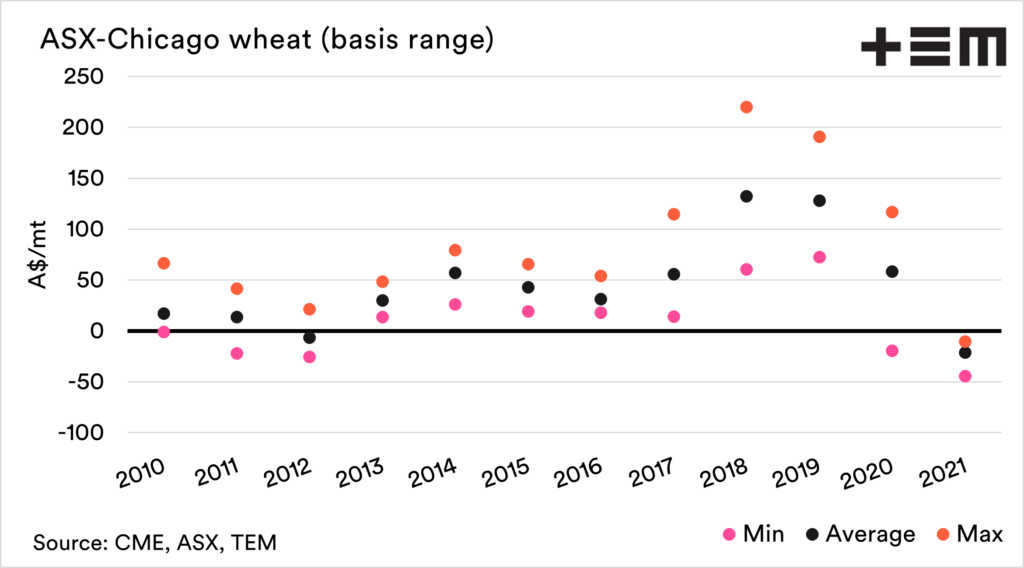

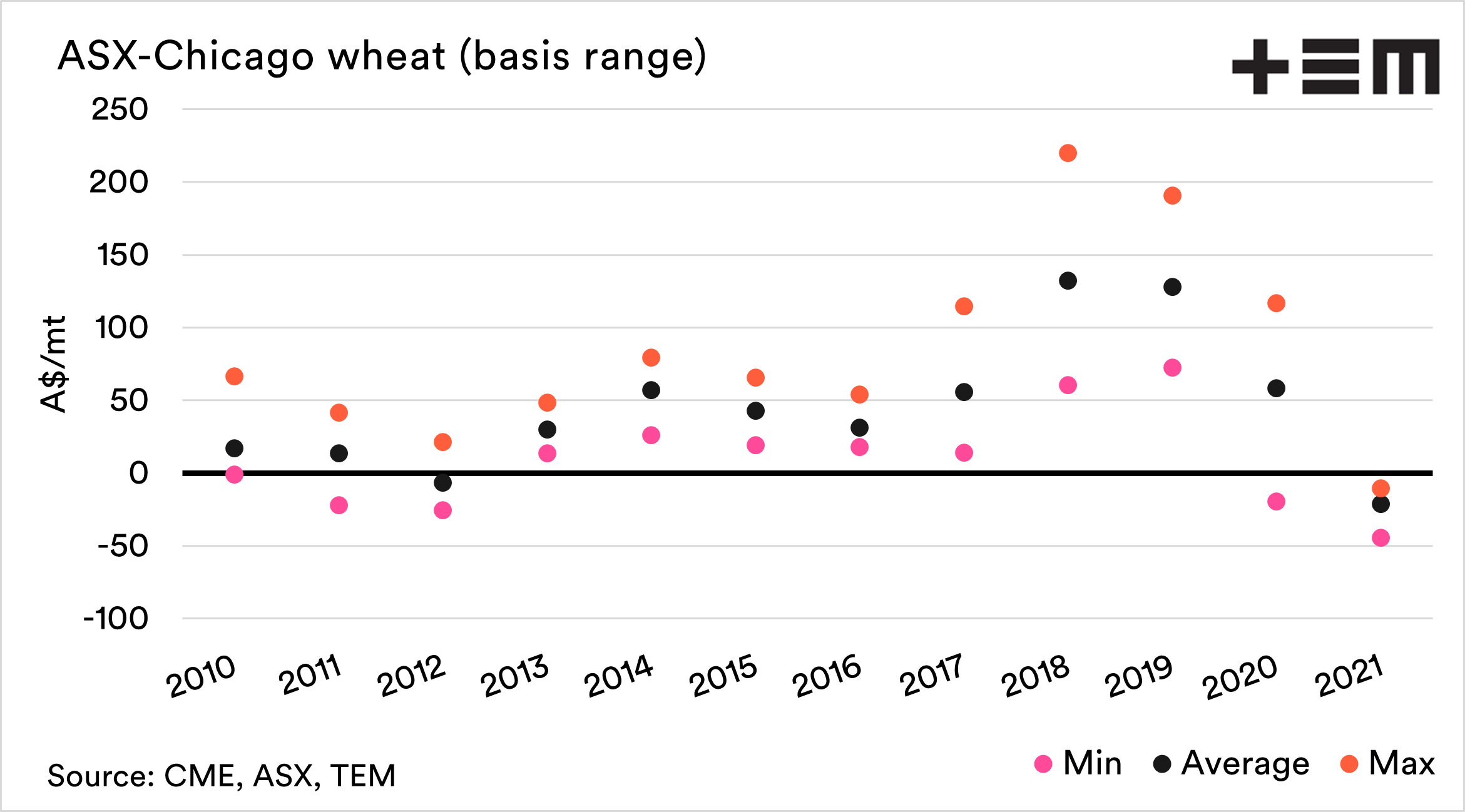

The second chart shows the min, max and average basis for each of the years since 2010. This year the basis level has stayed in a far more consistent range than in previous years, where the basis has been quite volatile (especially 2017 -2020)

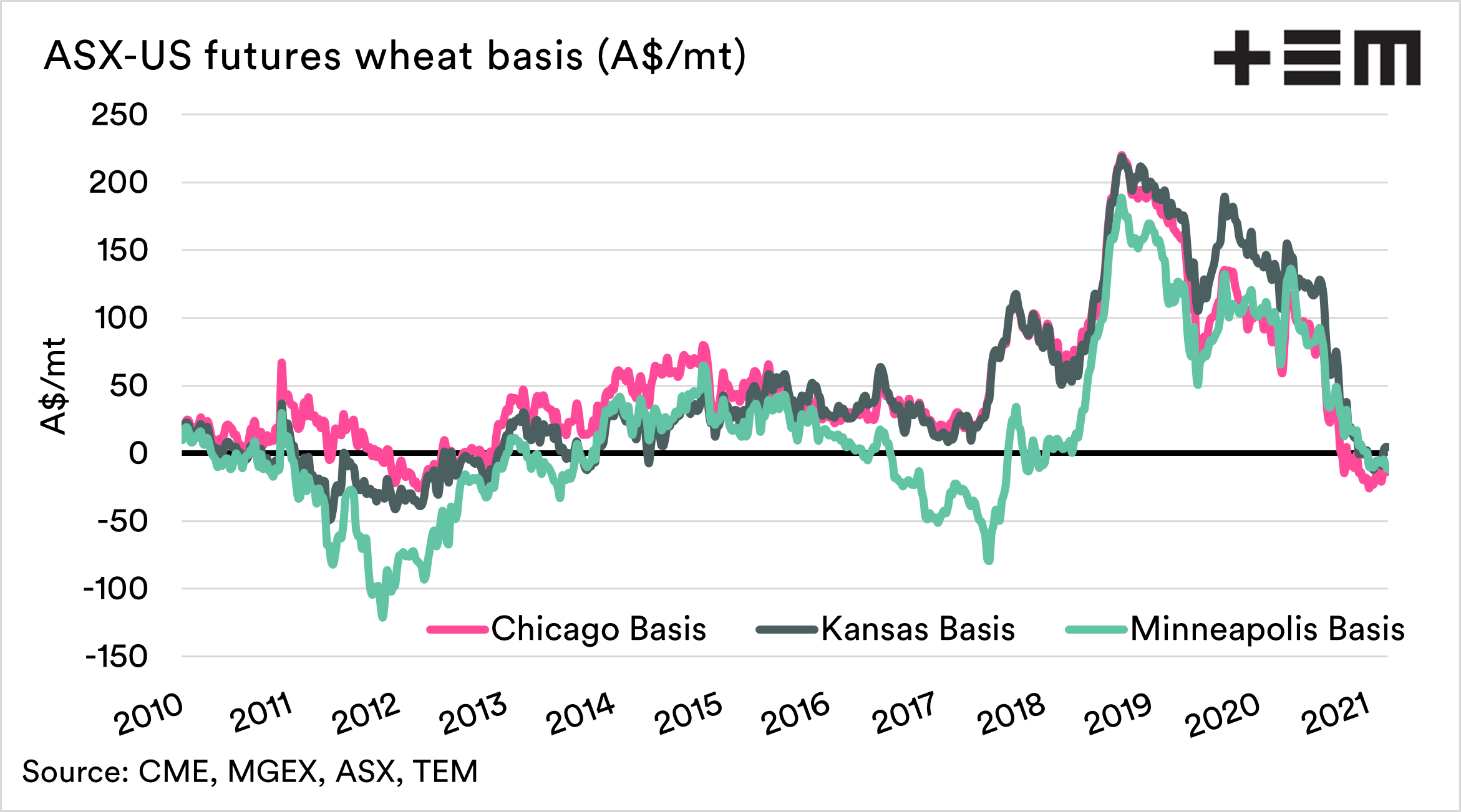

There is more than one futures exchange to hedge wheat; in the third chart, the basis between ASX and Kansas, Minneapolis and Chicago is displayed. In the past ten years, ASX has experienced longer periods of discount to Minneapolis, when spring wheat crops conditions in the US have deteriorated.

This year the forecasts are for another strong crop (all going well). This is likely to keep a lid on basis levels, and could result in Australia experiencing a longer period of discount to US futures than is typically expected.

At present, we are thankful that overseas values are strong, and keeping our flat price in Australia at solid levels.

To get the 101 on basis click here