Market Morsel: India ‘may’ not reduce duty on chickpeas

Market Morsel

India is the largest producer, consumer and, more often than not, the largest importer of desi chickpeas; locally known as Chana or Bengal Gram or simply Gram.

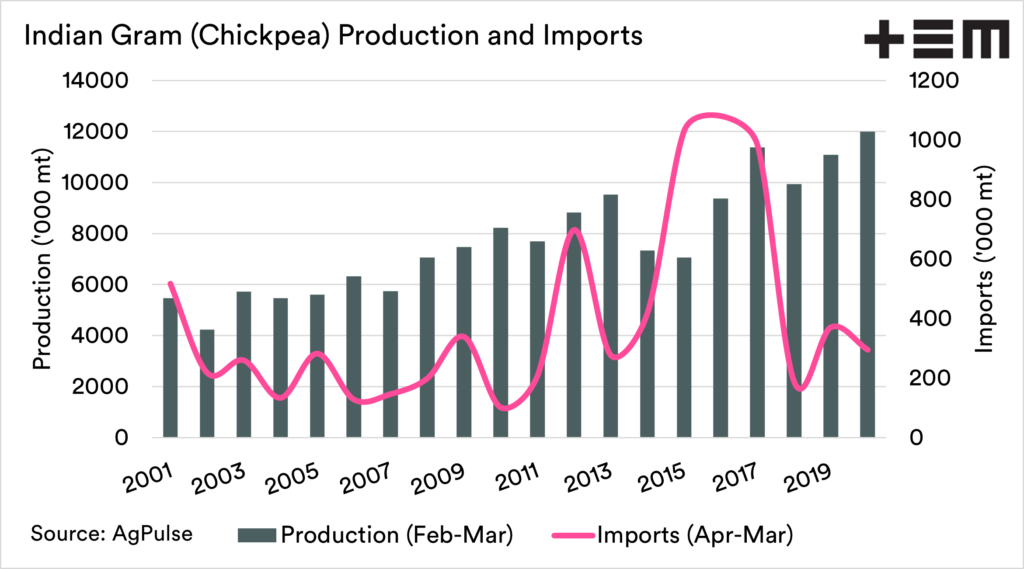

After two low production years, the country imported more than 3 MMT of chickpeas in three local marketing years between Apr’2015 and Mar’2018, accounting for over a third of the global trade for Chickpeas. With bigger domestic pulses crop in sight, the Indian government started taking measures in the middle of 2017 to curb the imports and chickpea trade became a victim of the heavy import duty, ranging from 40% to 66% from the major origins. Only the LDC countries are subjected to tariff-free trade since then. Consequently, the trade volume shrank.

India harvests its chickpea crop during Feb-Apr period, and the 2021 crop is subject to heavy scrutiny. The government estimates have ranged from 11.62 MMT to 12.61 MMT to now 11.99 MMT; the final estimate will be released later this month. Private estimates have ranged from 6 MMT to 9 MMT; creating a large gap in the supply side of the equation.

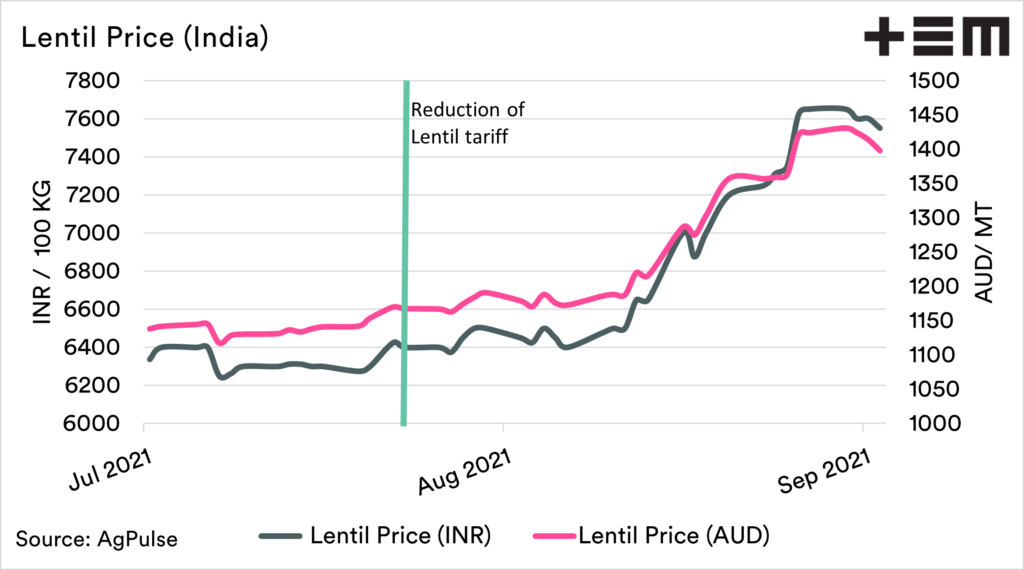

To keep the prices in check, the federal authorities have taken many policy changes in the recent past. These have included stock limits, relaxation of same, easing import curbs, signing MoU’s with African countries and finally reducing import duty on lentils. This has given rise to speculation that the country ‘may’ ease import restrictions on chickpeas and/or field peas.

Lentil duty reduction, at a time of tight global supplies, has led to higher prices in international markets, resulting in amplified domestic values, without India importing substantial quantity. The step by the Indian government benefitted only the lentil origins, while Indian consumers are faced with elevated prices for their ‘masoor dal.’

A similar case is for yellow peas and desi chickpeas. A drought-affected Canadian pea crop has led to a tight global balance sheet, and prices are on the rise. For desi chickpea, the 2020 failed crop in Pakistan led the country to import large volumes of Australian crop, and Bangladesh demand remains consistent. Early Ramadan will keep the chickpea demand from these two countries high in the initial months of Australian harvest.

A case in point is at the time of heightened demand from Pakistan and Bangladesh amid normal Aussie chickpea crop, how prudent it will be for India to be a buyer in international markets. We see Australian 2020 chickpea production at 900 KMT and 2021 production between 1 and 1.3 MMT for the record.

Current CFR India indications for Australian chickpeas are for US$700/T, making landed prices without any duty nearly equal to the domestic prices. For desi chickpea markets, other than Australia, India is already importing a large share, and if the tariff barriers are lowered, global prices will rise to disallow any Indian imports.

We, at AgPulse, see slim chances of the Indian government easing duties on the import of desi chickpeas until its 2021/22 crop is harvested.

Gaurav will be publishing regular articles on pulse markets in agreement with EP3 and if you are interested in discussing the underlying fundamental story in different pulses, reach out to him at gaurav@agpulse.net or subscribe to the weekly reports via http://agpulse.net