Market Morsel: Moist to dry or not?

Market Morsel

As a business, we spend a lot of time out and about presenting on markets and discussing markets with various companies. Often there will always be a question prefaced with ‘using your crystal ball’.

The reality is that no one knows what will happen in the world, we operate in an industry which is impacted by so many factors from the weather to what Putin decides to do after his cornflakes. What we can do is keep informed about what is happening and create strategies to minimise risk.

At a conference yesterday I was asked about what will happen with the weather in 2023. Well, anyone’s guess is as good as mine.

The last three seasons on a national basis have been enjoyable, with La Nina providing the moisture.

This year could be dry, it could be wet, or it could be average. Who knows!? All we do know is that it is highly unusual to have three wet years in a row, something Matt wrote about here. Four wet years in a row has never occurred. That being said – we live in a world that can cause surprises.

What we can do is start to protect the price.

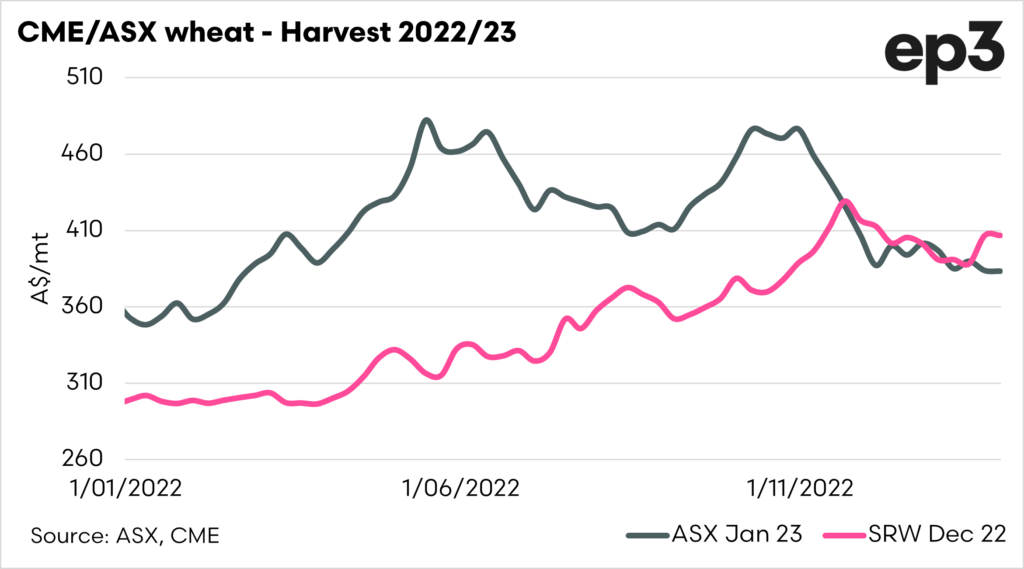

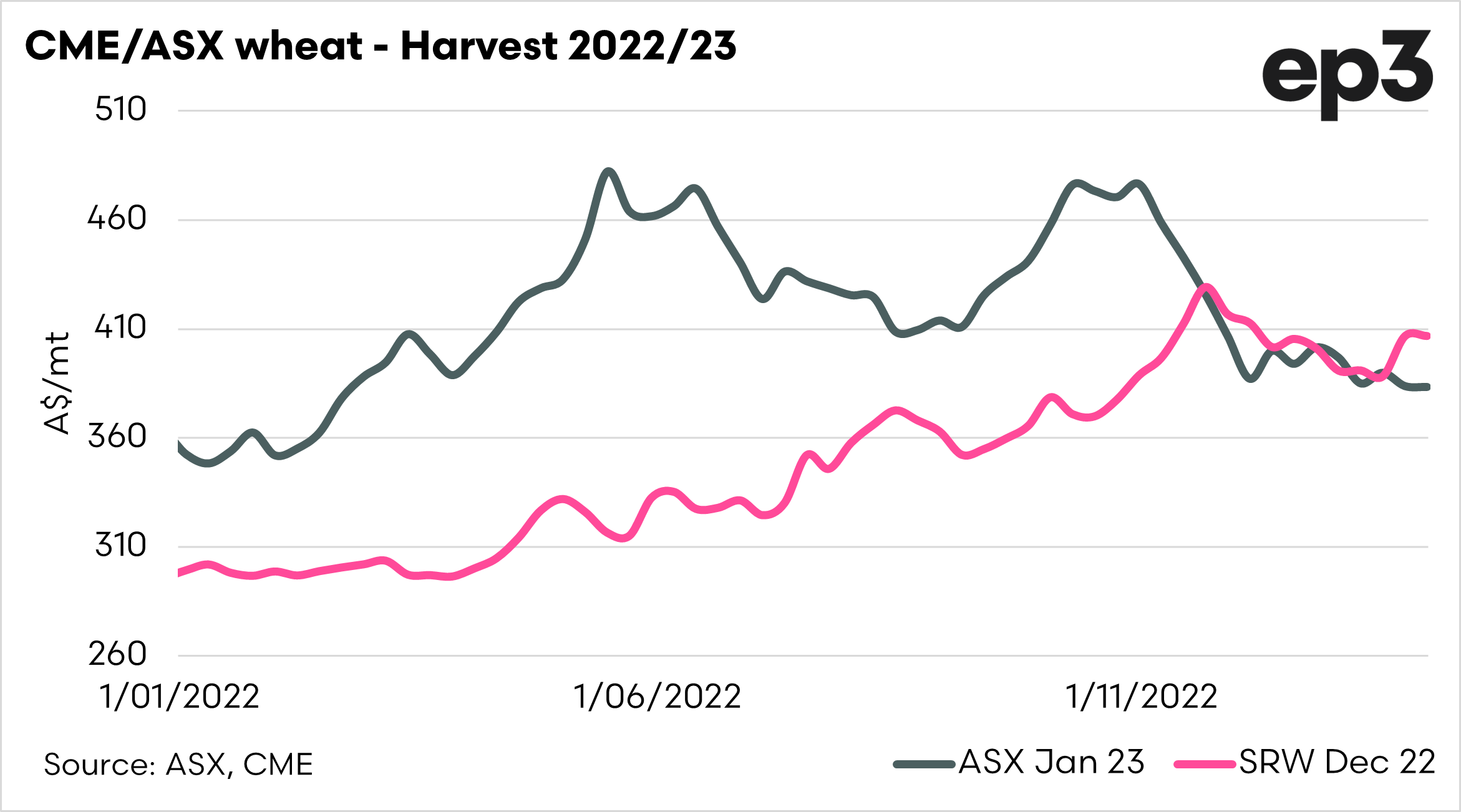

At the moment, one of the ways of protecting price is to use the ASX wheat contract. The ASX wheat contract is offering A$407/mt for the next harvest. If this is a number that is attractive to you as an enterprise, you can start to nibble away at the coming harvests marketing.

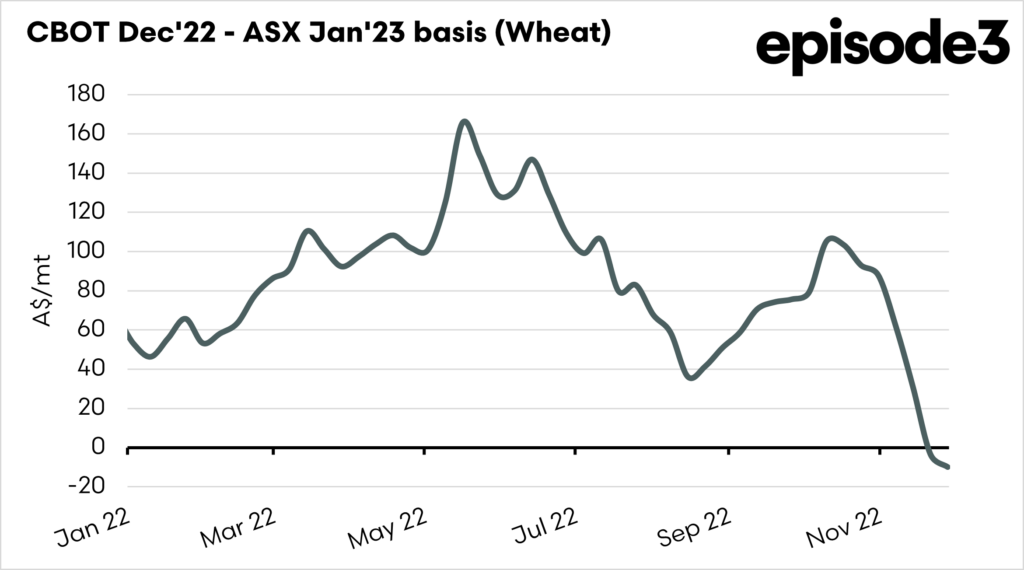

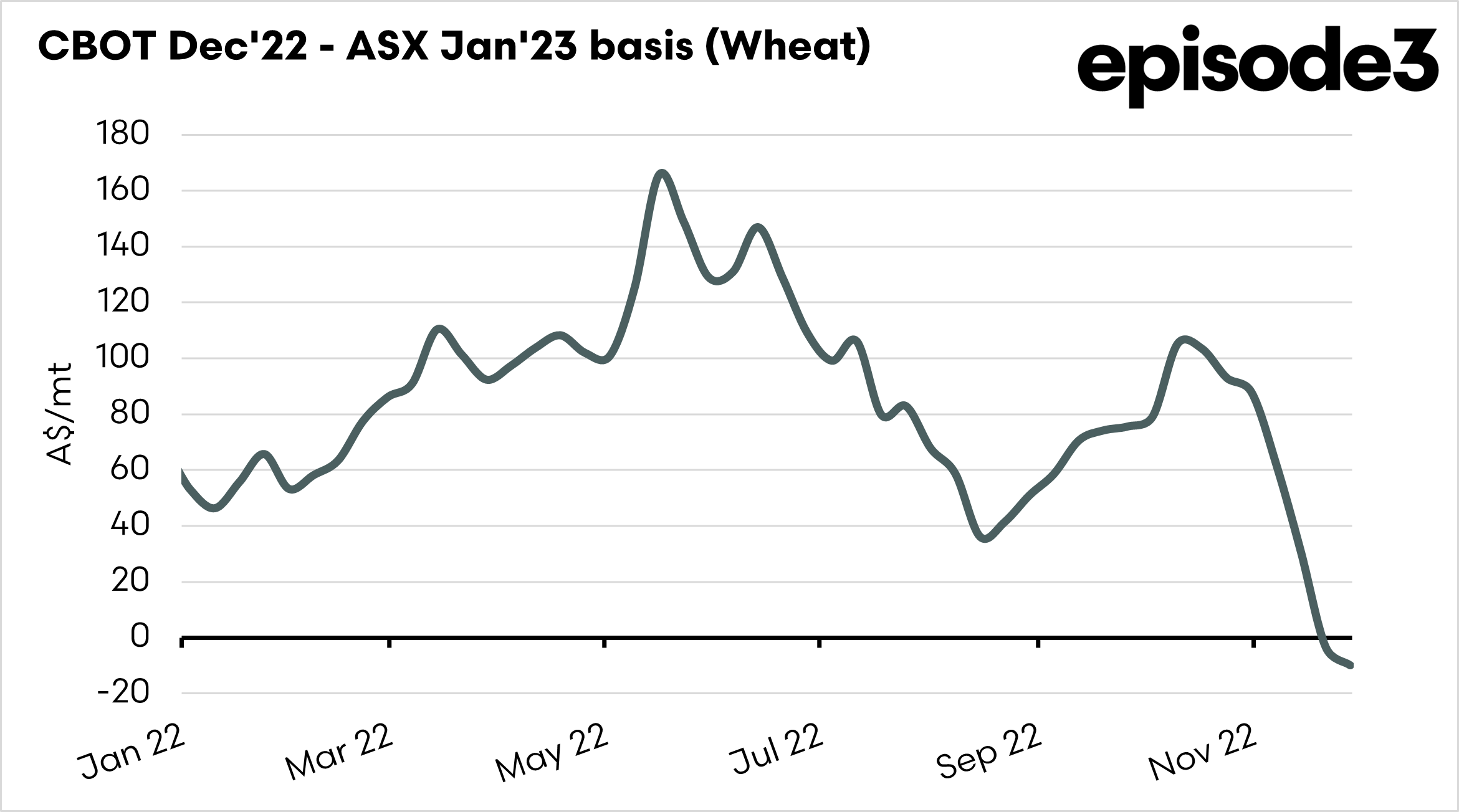

This is a large drop from the highs in October but remains a historically high number. The important point to note is that the current pricing for next year is showing a negative basis. This is generally unusual because we don’t know yet whether Australia will be a bumper or bust for 2023/24.

If you were to lock in an ASX contract or a physical contract with one of your local accumulators, you would be locking in the basis – which at the current time is negative.

If you were to lock in a Chicago (or other) contract, you would be left exposed to the basis. Bear in mind this could end up positive in the event of a smaller crop or a larger discount if we hit that fourth bumper.

There is a lot to think about, but we need to keep an eye on the pricing signals. Luckily the BOM are not showing the likelihood of an El Nino anytime soon. Although if locally conditions dry out, then we could see prices rally! A long way to go.