Market Morsel: Not now, next?

Market Morsel

The situation in Ukraine is horrific, and hopefully, peace can be restored. The market is pricing in the uncertainty in the region.

In an earlier article today (see here), I wrote briefly about the opportunities for the immediate market and how the pricing in the futures market might not flow through to physical on a 1 for 1 basis. The forward market has presented some opportunities.

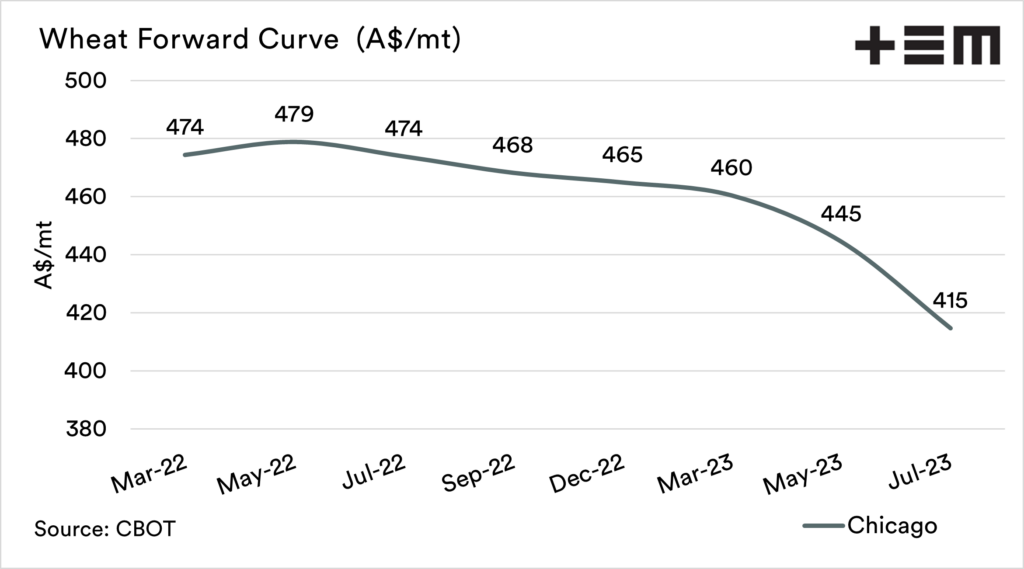

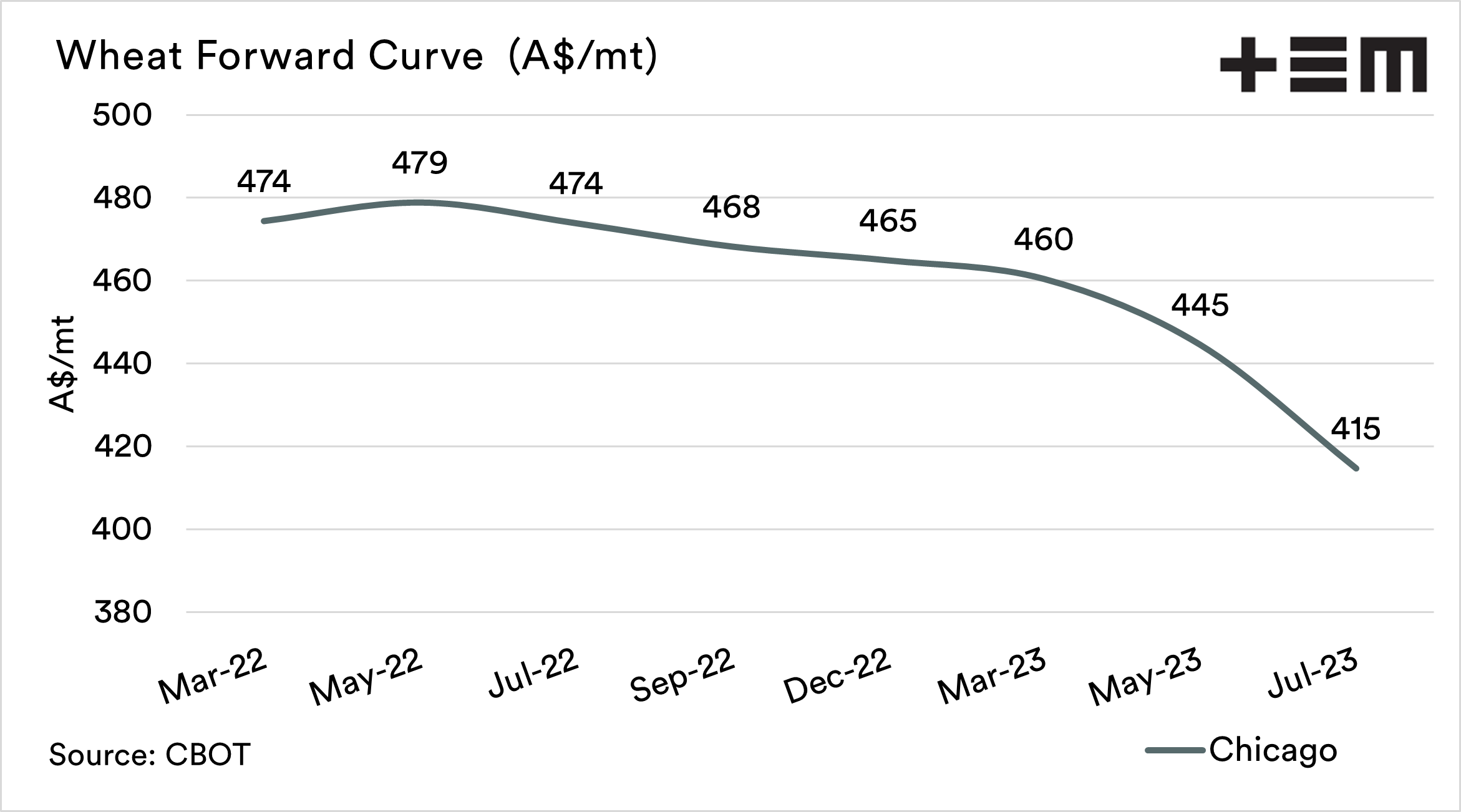

The forward curve is now offering approximately A$465 for December. This allows the grower to sell some of their futures/fx for a historically high number. If this is not a record value for a December contract in February, I’ll be surprised.

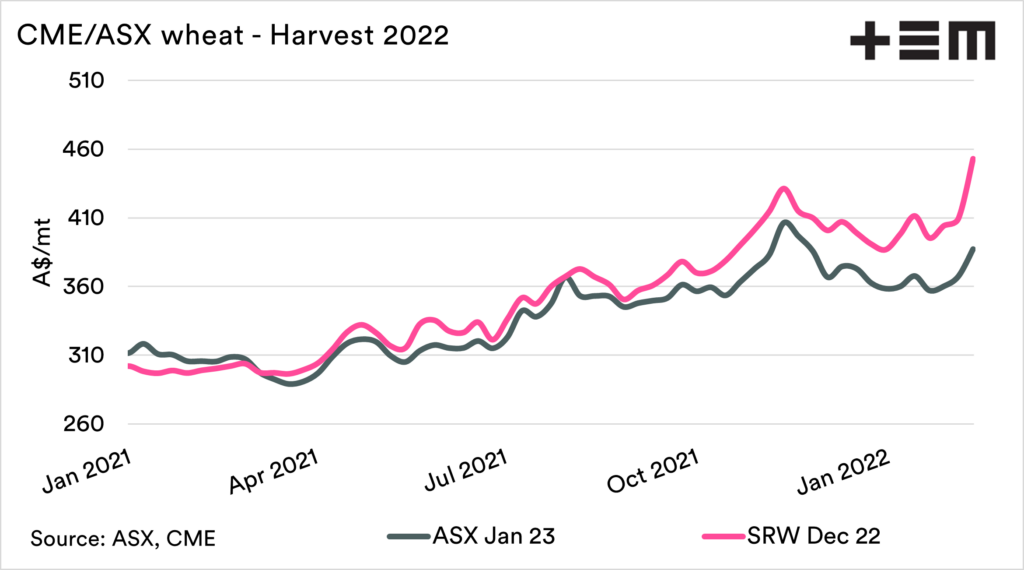

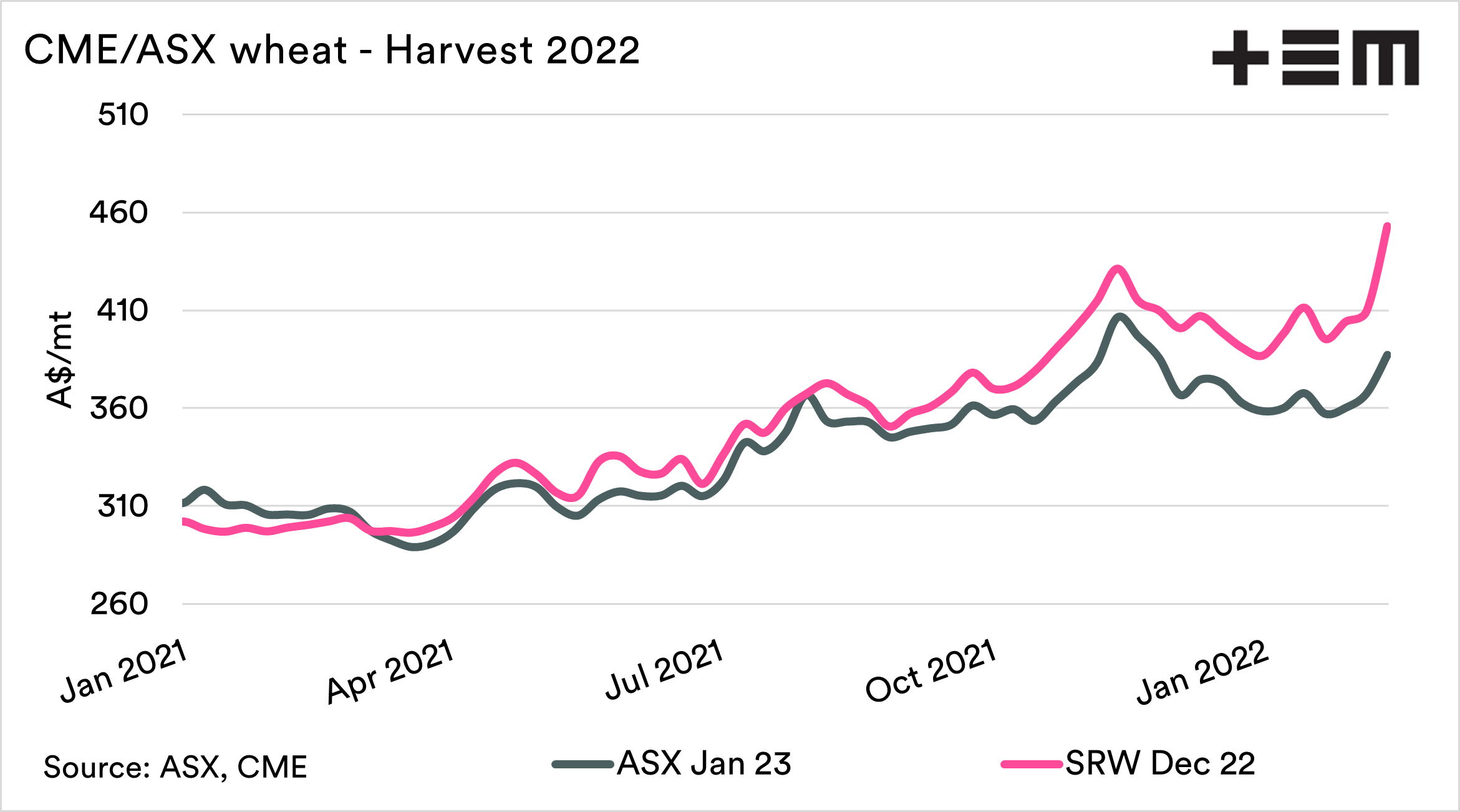

The basis level will be the next part to work out. As I have mentioned many times, the basis this year is low, if not record low now.

This can be seen in the second chart below, which displays ASX and CBOT wheat for the coming harvest, and we can see a growing discount as overseas values rally.

Currently, ASX is pricing in a large crop. The crop does have good potential with good subsoil moisture in many areas. The word potential is key; there is still a long way until the crop is grown. Is CBOT and leaving basis open more attractive than the ASX contract.

There are two things to consider:

- Does basis improve on the lead up to harvest, allowing you to lock in a better price?

- What is the severity of the impact of the Russian invasion? If the invasion is short-lived and supply chains get back on track, the rally in futures may come under pressure.

It’s extremely hard to know what to do at the moment, but ‘little and often’ might be worthwhile to participate in the very high futures levels. The pricing in wheat at present is very strong; it’s a balance now between risk and reward.