Market Morsel: Putin weaponising wheat

Market Morsel

The grain export corridor from Ukraine has been one of the main supply risks to global grain in recent months.

I wrote at the end of June about the grain export corridor (read here), but the basics of it are that the deal allowed more than 32mmt of grains to be exported from Ukraine, with ore than half destined for developing nations.

The deal was due to be extended yesterday. Russia has decided against renewing the agreement. In each of the last renewals, there has been uncertainty in the market as Russia continued to provide uncertainty. It looks, though, like the deal is off.

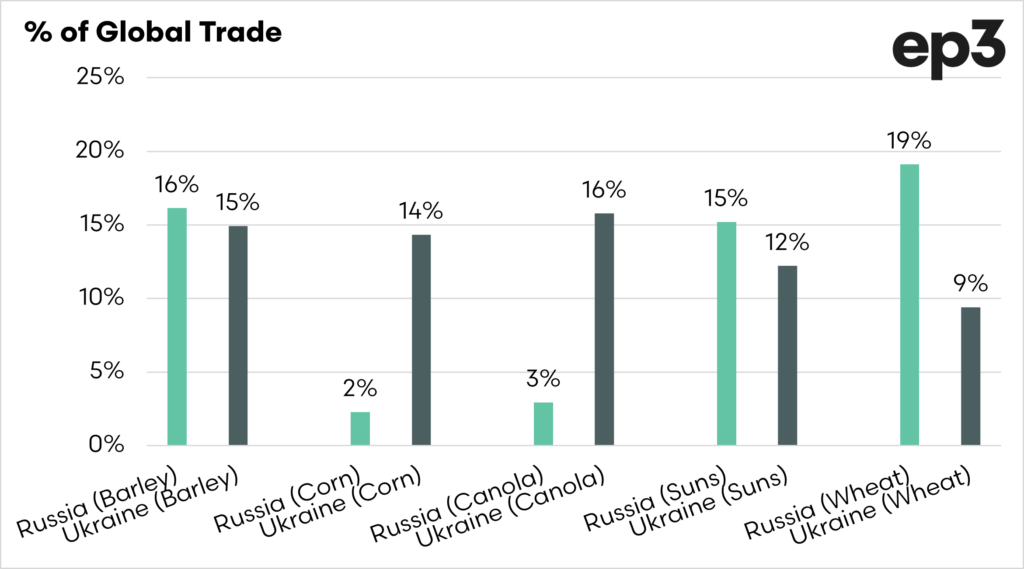

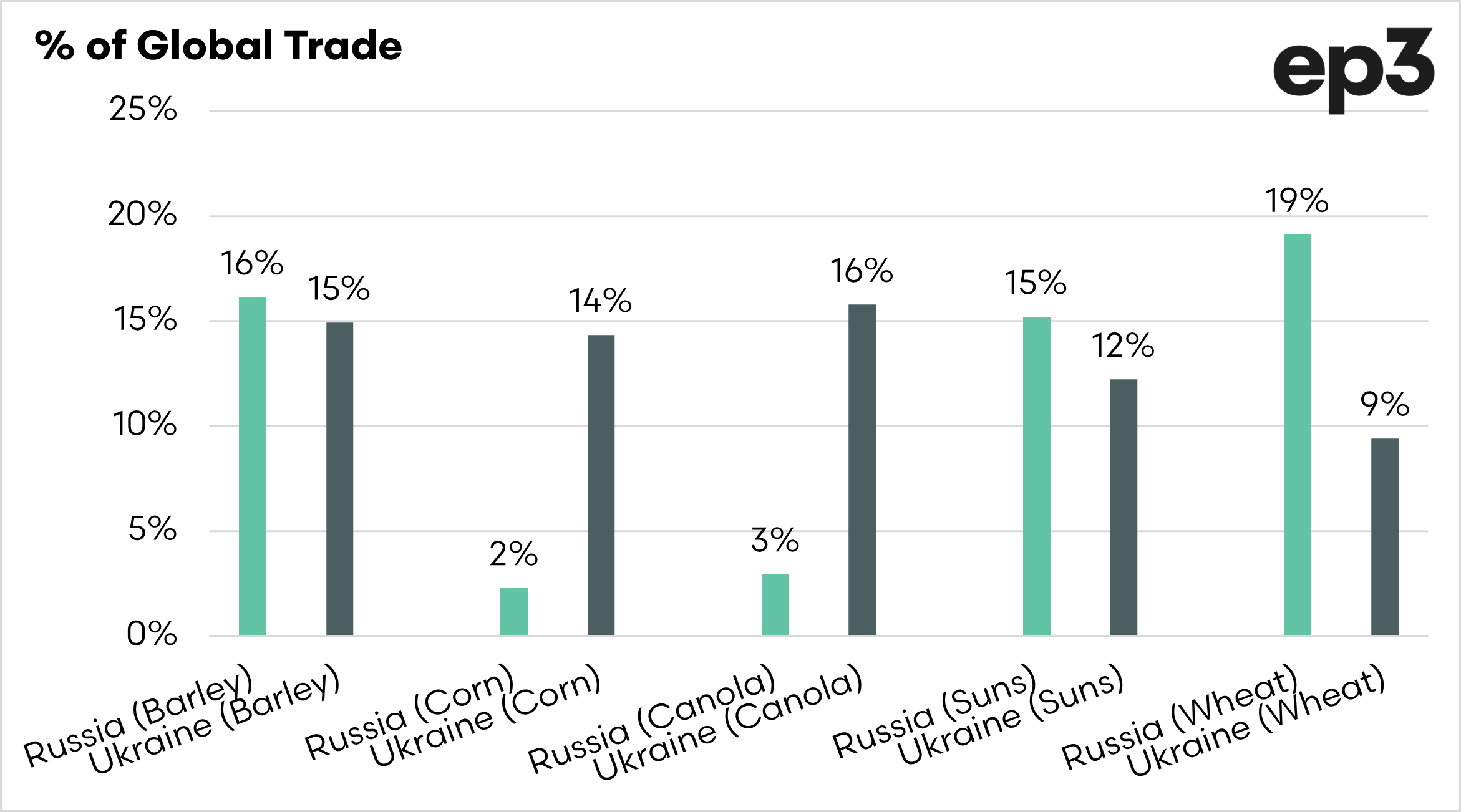

The chart below shows the contribution of Russia and Ukraine to global trade in a range of major commodities.

A large proportion of the exports from Ukraine are via sea, and removing this, removes a large volume of supply, especially to the developing countries in Africa and the middle east.

Russia has suspended the deal as they believe their demands for less restrictions on their own food and fertilizer exports. These commodities aren’t sanctioned, but Russia has no access to SWIFT to perform international payments, which makes it hard to pay for logistics.

Russia also wants ammonia to be exportable through a pipeline going through Ukraine to Odesa, a bit of a cheeky demand.

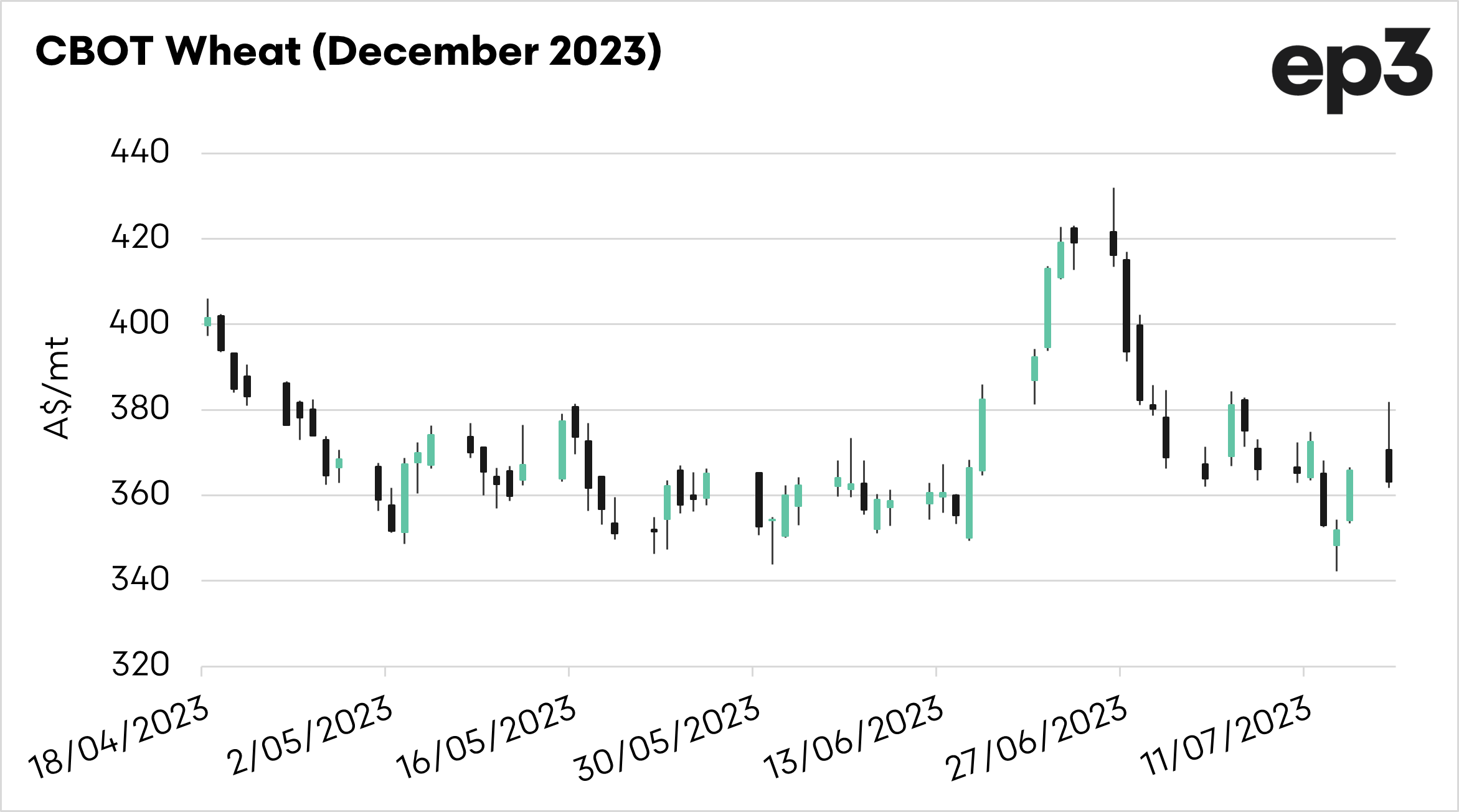

So what happened to the market? CBOT wheat rallied as the deal was off, and we saw a large jump in future levels. However, by the time the market had closed – all of the grains were gone.

So why isn’t the market taking off like a rocket? A few theories are going around, but it could be down to the fact that many believe Russia will come back to the table or that the impact will be minimal, as we have already been through a year of disrupted logistics.

The market may continue to react to the news as it continues. Still, the biggest impact will be on consumers in poorer countries relying on wheat for daily bread.

It’s one to keep an eye on.