Market Morsel: Spreading canola.

Market Morsel

On Tuesday, I wrote about the difference in value between the domestic Australian market (ASX) and the values being achieved in the export market (see here).

Whilst wheat is our most important crop, it is worthwhile taking a look at canola.

In recent years canola prices have been globally strong. This was in part due to the drought conditions in Canada, followed by the invasion of Ukraine. Globally there are three main exporters of canola; Australia, Canada and Ukraine. Two of these nations had major issues in the past two years.

The pricing in Australia has been strong, historically speaking. The relative pricing to the rest of the world has been more subdued. Our prices stayed at historically high discounts to both French and Canadian futures.

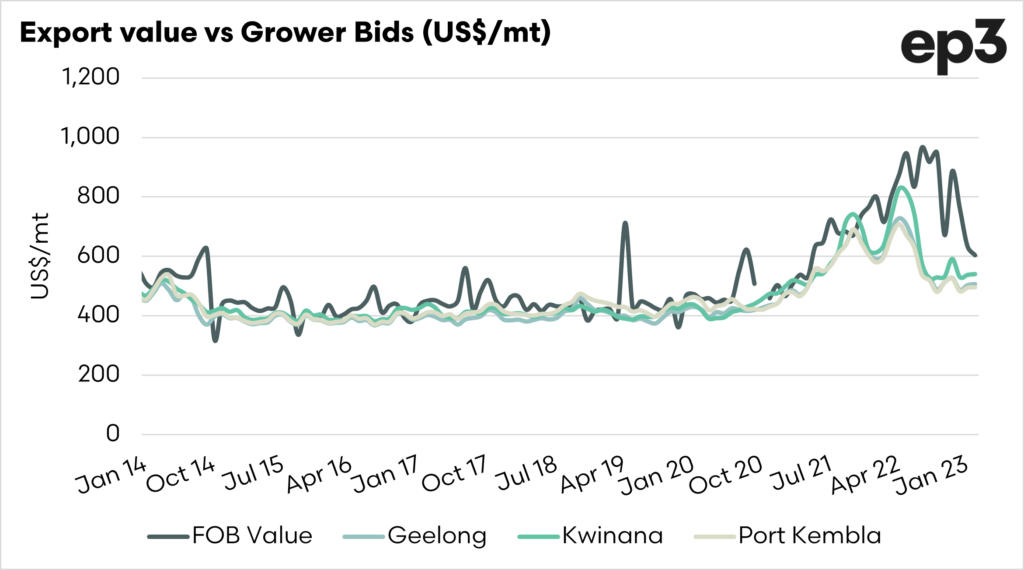

In the same manner, as Tuesday’s piece, we are looking at the average export value versus the spot price of canola.

We are not necessarily concerned with the actual values but more with the deviation from the norm. In the past, the grower bids and export values had a closer relationship. In recent times the spread between them has grown.

As we move into seasons with lower supply availability, we expect that this spread will narrow.