Market Morsel: Tariff timing is everything

Market Morsel

India provides some relief to lentil tariffs, but is the timing off?

Pulses are a commodity subset which we will cover when something relevant happens. It turns out that today there are two factors that I wanted to look into. Firstly the Hallmark segregation (see here) and the reduction in Indian tariffs.

The closest that I come to being a vegan is my favourite Indian dish, dahl. Luckily for lentil producers, dahl is also one of the favoured dishes in the worlds second-most populous country. Our trade in recent years has been impacted by the dreaded word by all export dominated industries: import tariffs.

In late 2017 India introduced tariffs (and taxes) on lentils (& Chickpeas) which represented an overall rate of 33% (tariff & tax). This tariff effectively put a roadblock in the way of trade into India.

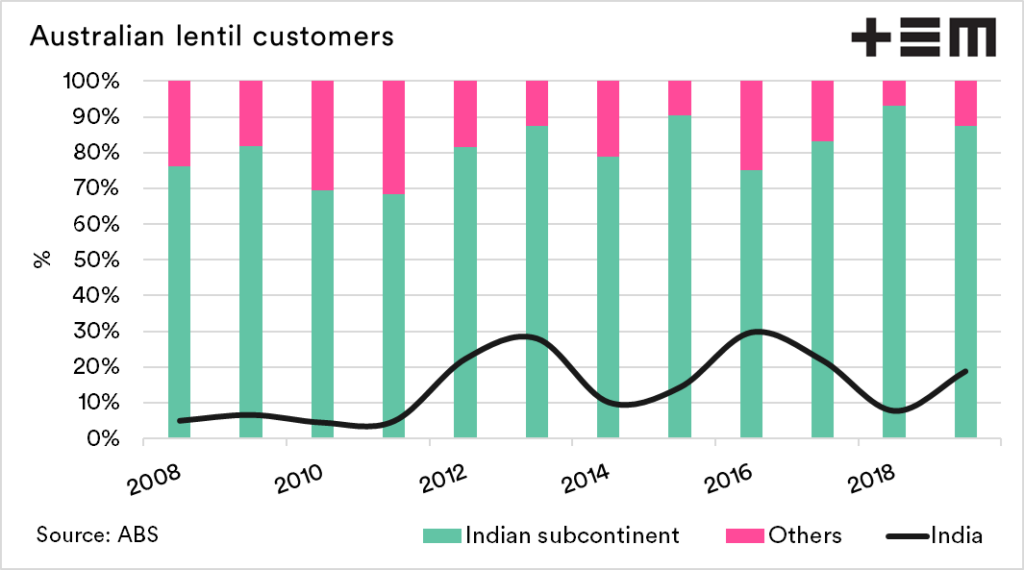

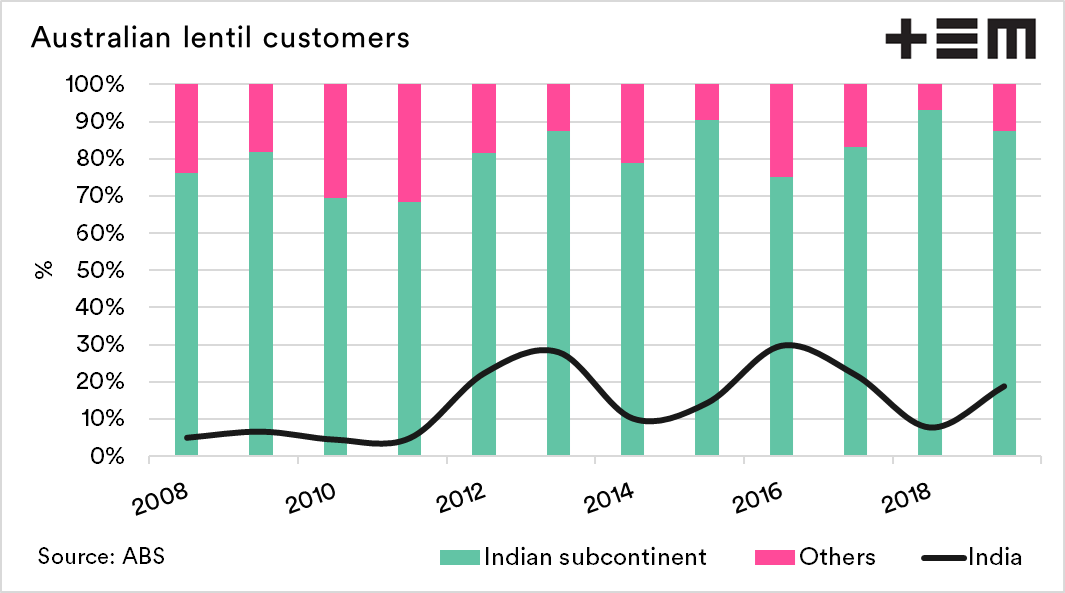

In general, the Indian subcontinent (Bangladesh, India, Pakistan & Sri Lanka) is the most important customer for our lentils. On average, during the last decade, this region took approximately 80% of our lentil exports, the rest is generally destined for the middle east (Egypt, Turkey & UAE).

India was a significant market for our exports. Over the past decade, they took around 15% of our exports but were as high as 30% (2016). One ‘benefit’ of the trade disruption has been the diversification of our trade flows, with Bangladesh especially taking larger volumes, which over time will reduce the impact of single country disruptions.

At present pricing levels are remaining relatively strong, albeit not at the heady heights of the middle of the last decade.

The tariff was put in place primarily to protect Indian farmers from imports. In June the Indian government announced that the tariff would reduce to 11% until the end of August. The reduction was to ease domestic pricing, as imports would result in a lowering of the price in India, therefore reducing the cost to consumers.

The majority of the countries farmers would have sold their lentils by this period. The impact would be felt on the traders, but in all likelihood, not the vast numbers of farmers. There was silence from India at the start of September when the tariffs reverted back to 33%, however on Friday they announced that the lower tariff would apply until 1st November.

The reality is that this current relief rate isn’t much of a benefit to Australian farmers, as the pantry is pretty bare locally ahead of the coming harvest. If the relief is extended beyond 1st November, then it will be a good factor for pricing signals.

NB Lentil tariff relief was extended during October until the end of 2020.