Market Morsel: The shoeshine boy told me to buy ags

Market Morsel

You might hate them, and want them to be removed from the market when selling down the market. At the moment, you can’t help but love speculators when they are piling in and buying up agricultural commodities.

There is an old story, whether true or not, that JFK Sr claimed that he knew it was time to get out of the stock market in 1929 when the shoeshine boy gave him tips on the stock market. This was an indicator that the bull run was over.

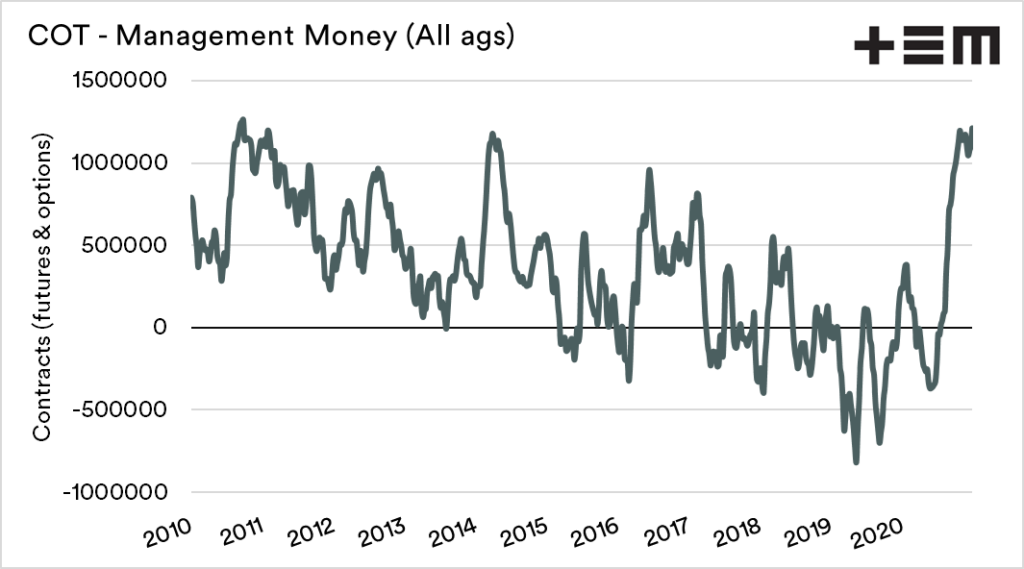

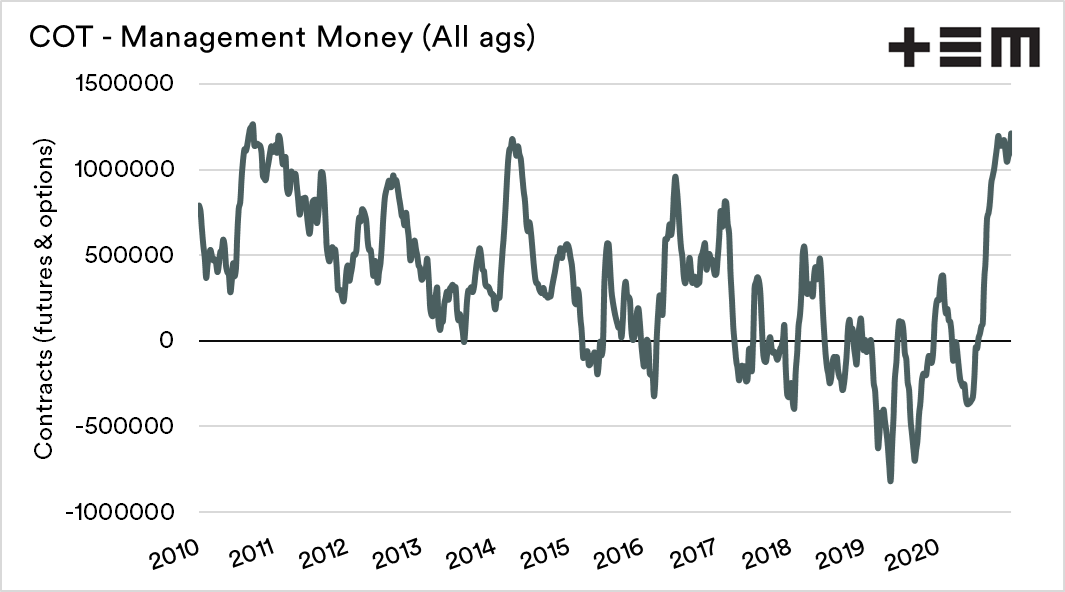

The first chart below shows the net position of speculators across all agricultural commodities from wheat to milk. A value above zero shows that they are overall bullish (betting on a rising market), and below zero they are bearish (betting on a falling market).

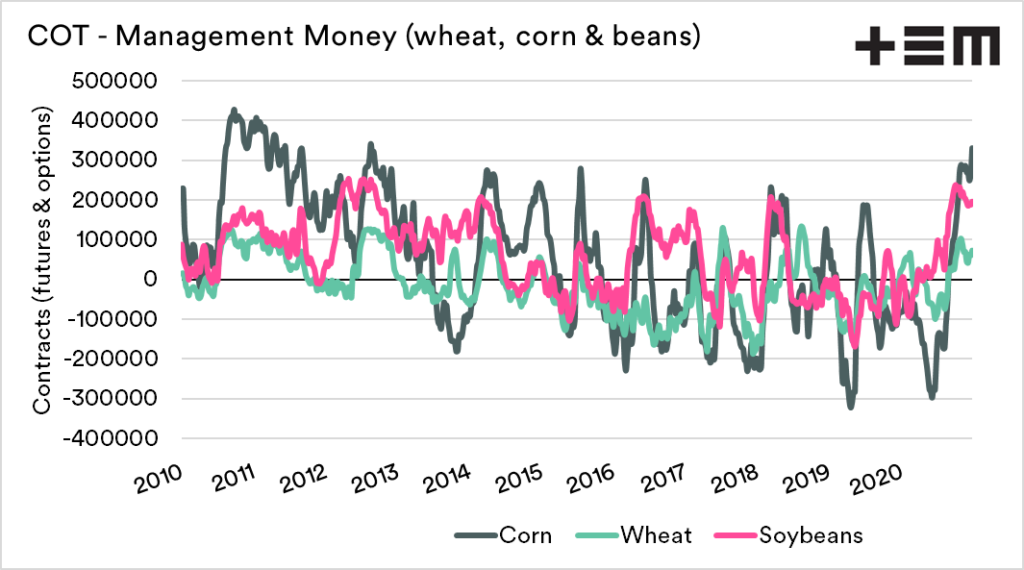

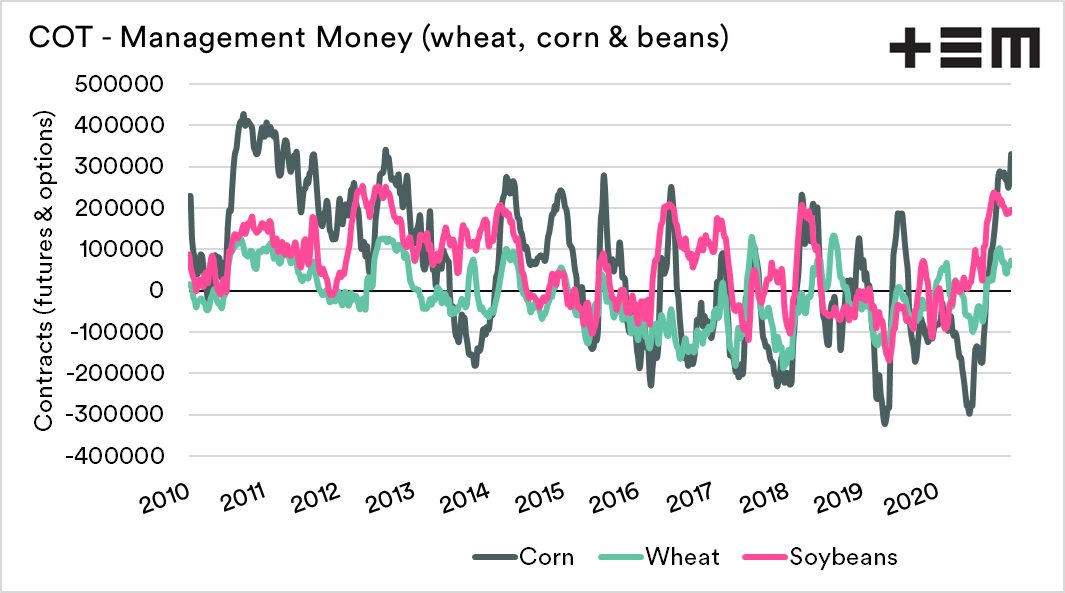

Speculators have gotten an appetite for ag commodities in the last half of 2020. The second chart shows corn, wheat (Chicago, Kansas & Minneapolis) and soybeans. The corn and soybeans net position are extremely bullish.

It is important to note that speculators are not always correct. A market that experiences sharp rises in speculative interest can, and does experience corrections as traders ‘take profits’.

At present, the market is welcoming a lot more ‘outsiders’ who have only a rudimentary knowledge of agricultural markets.

We shall see in the coming weeks whether the bull run is maintained. I would expect some choppiness.

This article “Speculating on the value of commitment”, provides a basic overview of the commitment of traders report.