Speculating on the value of commitment

The Snapshot

- Examining the speculator sentiment of the market provides an insight into whether they are bullish or bearish.

- The commitment of traders (COT) report provides an overview of the futures markets.

- When we examine the COT report we add up the short and long position of the speculators in order to get an indication of their net position.

- If the position is negative, the sentiment is bearish (and vice versa).

- Don’t fall into the trap of believing that speculators are always right. They are not masters of the universe.

- The speculators provide liquidity and can move the market sharply. However, speculator driven rallies tend to be short-lived. The fundamentals always return to the fore.

The Detail

As a grower, you are naturally ‘net long’. You are going to grow a commodity which will at some point in time be sold, you have a supply (long) of a commodity. Conversely, if you are a consumer of grain, you are generally ‘net short’, you need to buy a commodity.

A speculator can be either long or short. Speculators trade the market based upon their viewpoint. They have no interest in the physical production or consumption of the commodity, they just want to make money from a position.

Many hold a negative view of speculators, as they believe that they cause a distortion of the market. However, speculators serve a valuable purpose for the market. They provide liquidity which makes it possible to easily enter and exit the market place.

Gaining an understanding of how speculators are positioned is valuable. It provides us with a market signal and gives an insight into their sentiment of the market. The Commodity Futures Trading Commission (CFTC) provides a weekly report called the commitment of traders (COT), which provides this insight.

The COT report is released every week, on a Friday. The weekly data is the positions held as of Tuesday; therefore, there is a delay.

The full report provides details on how many contracts are short (sold) or long (bought) positions for a range of different trader types. The type of trader that we are interested in viewing is the ‘managed money’, which is a proxy for speculators.

When we examine the report, we add the sold and bought positions for futures (and options), to provide a net position. This gives us an indication of the overall market sentiment. When the market has a negative position, then the speculators overall are bearish on the market, and vice versa when positive.

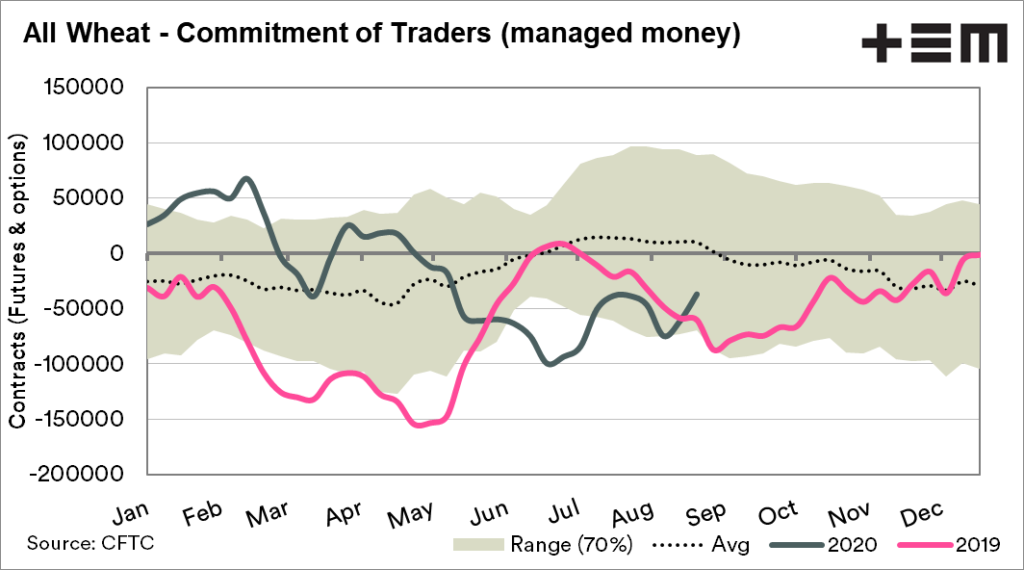

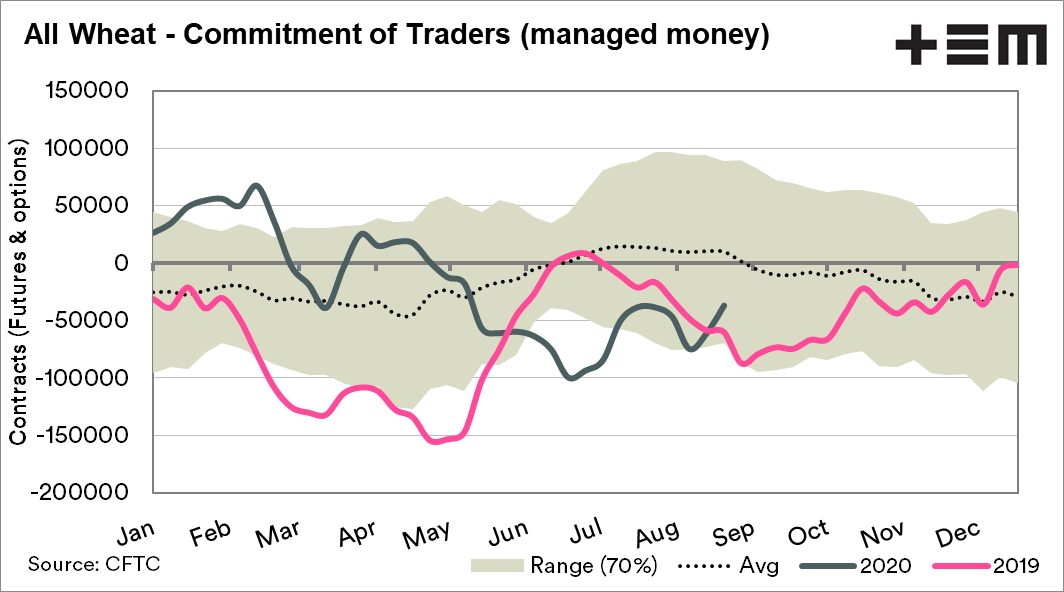

In the chart below, the combined position for Minneapolis, Kansas and Chicago wheat derivatives is displayed. In recent weeks we can see that speculators have increased their long position, as an example last week they were -60807 contracts short, this week they are -36915 contracts short.

This shows that speculators have become less bearish.

The speculators in the marketplace have a large influence on the market place by providing liquidity. This liquidity can make the market move very quickly, especially if these speculators have to close their position.

As an example, a speculator who is short of a commodity loses money as prices rise. If there is an event which causes speculators to ‘cover their shorts’, then this can cause a sharp rise as many attempt to close their contracts.

The speculators can move the market in the fullness of time the fundamentals (supply and demand) tend to take control.

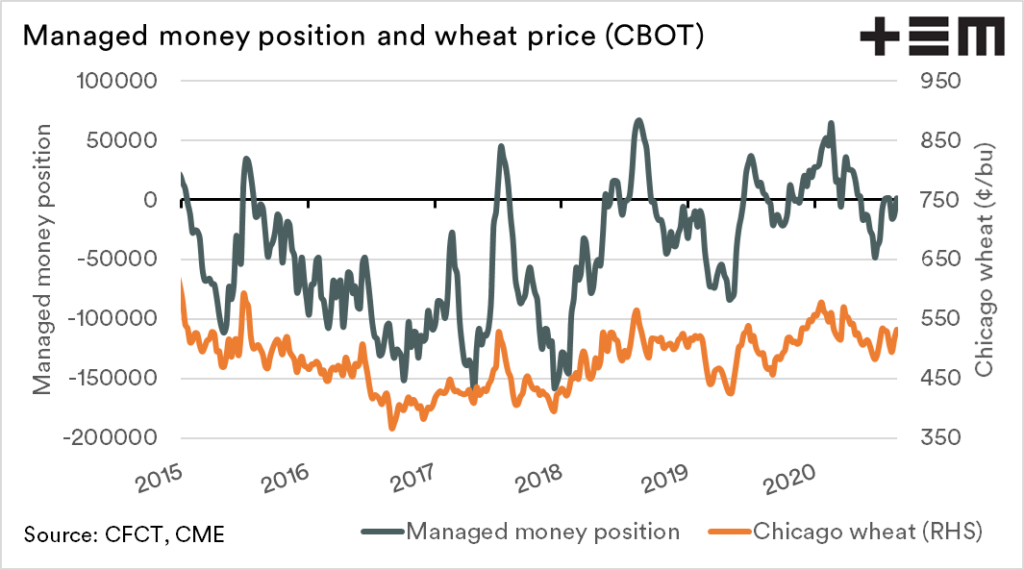

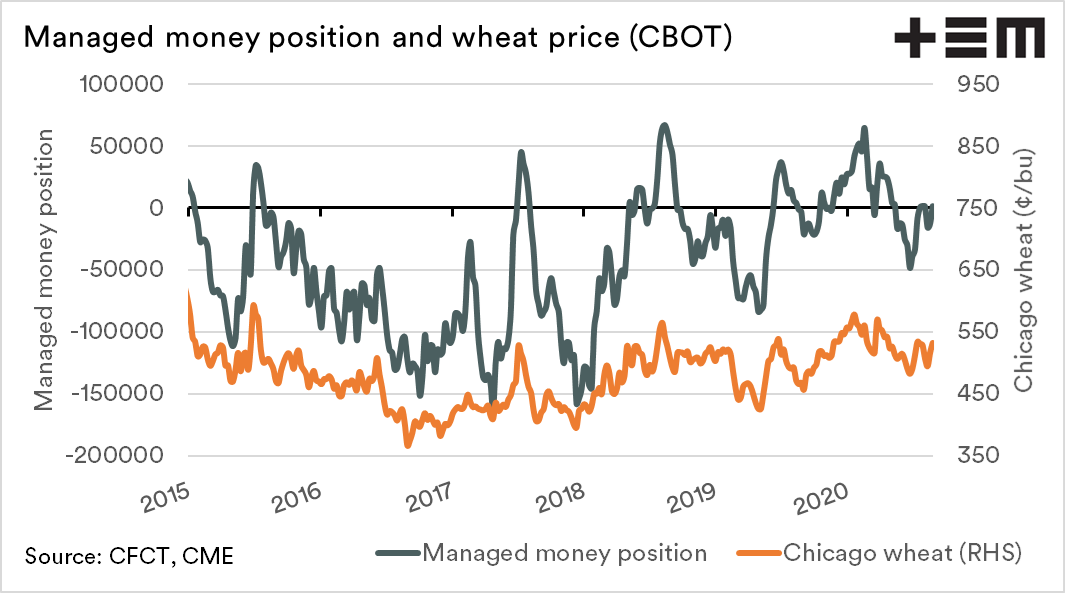

In the chart below, the position of speculators and the Chicago wheat price is displayed. There are periods where the speculators move to ‘net long’ positions, which coincides with large rises in pricing.

It won’t surprise anyone who read ‘Opportunities in a volatile period’, that these spikes tend to occur around in July/August.

It is important to note that the speculators are not masters of the universe. They don’t always get it right. Just because the sentiment by speculators turns bullish doesn’t mean that it will persist, or that prices will stay higher.