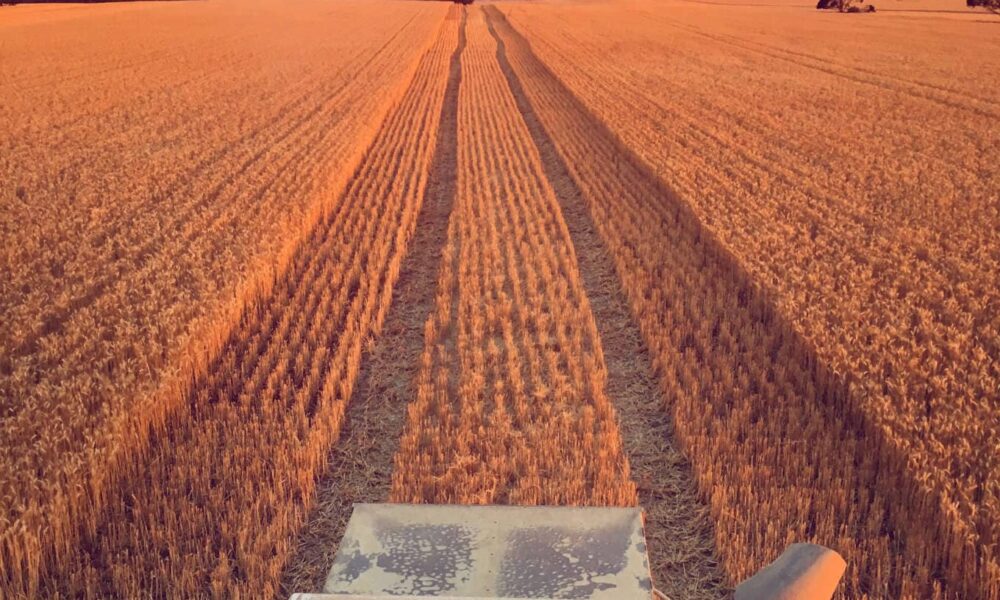

Market morsel: The sun is rising on good times.

Market Morsel

At present, the wheat market is looking up. I thought it was an opportune time to bullet point the main drivers at present:

- The winter wheat crop in Russia is being planted into dry ground (see here). There was rain in recent days. Unfortunately, for them, it was not as widespread or as heavy as expected.

- Our antipodean cousins in Argentina are experiencing dry times which has resulted in a drastic reduction in their wheat for the coming harvest (see here)

- The price of corn in China has risen dramatically (analysis to follow). At present, the corn balance sheet in China seems very tight. Their demand for corn as a result of floods and depleted stocks has been insatiable in recent times.

- The US winter wheat region has like Russia also experienced dry weather. In the next week, the USDA will start to release condition reports in the coming weeks which will provide more insight.

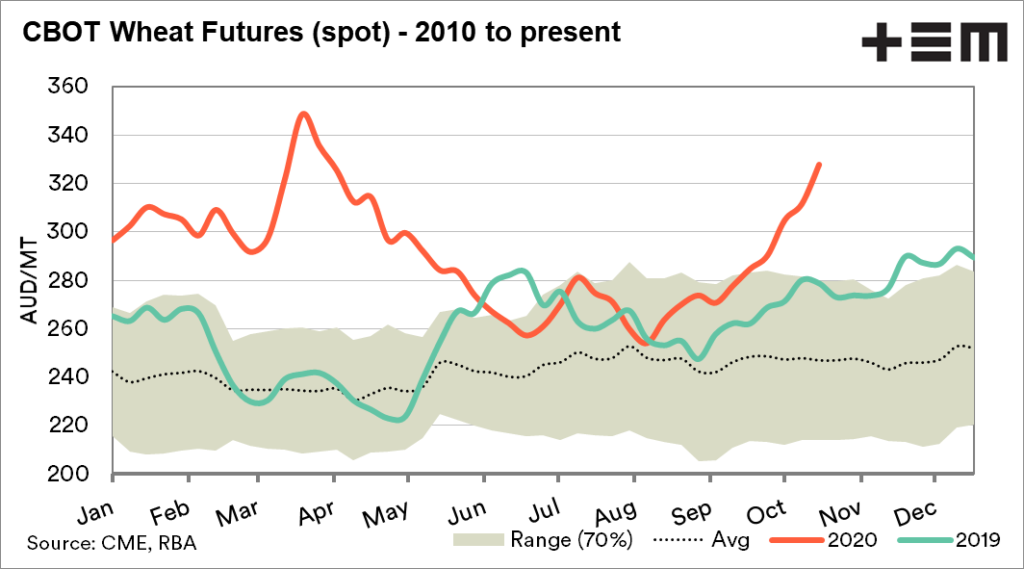

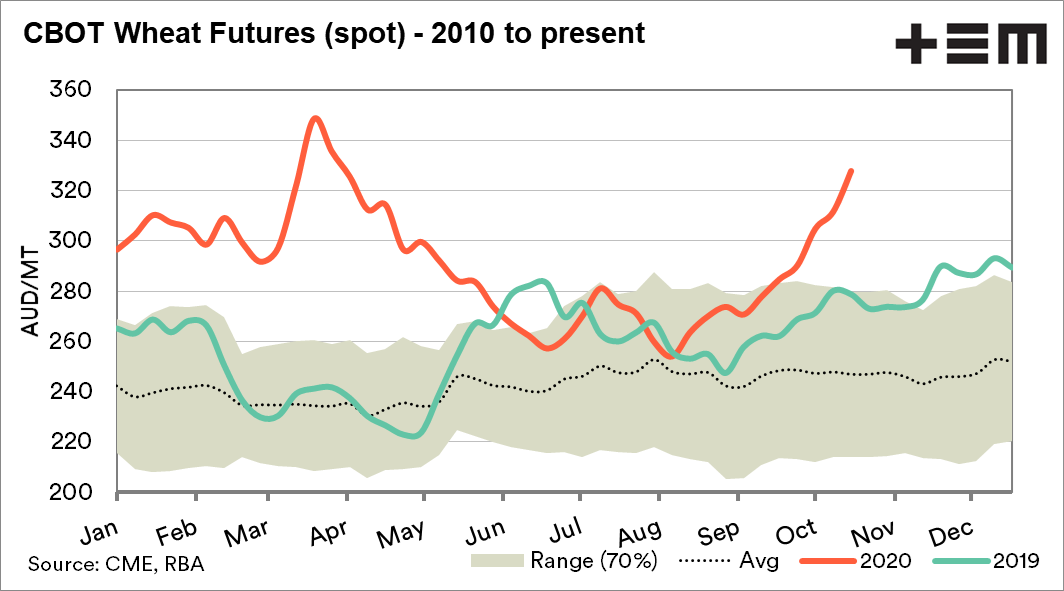

All in all, the market has experienced a strong rally during September and into October. At present CBOT wheat futures converted to A$ has risen well above the seasonal levels, yet still not as high as the March/April covid rally.

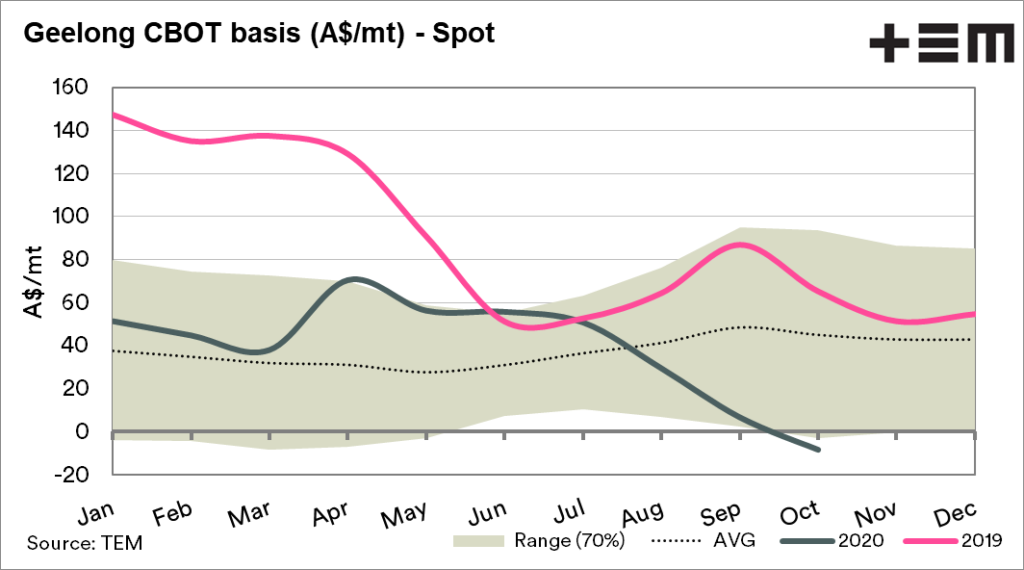

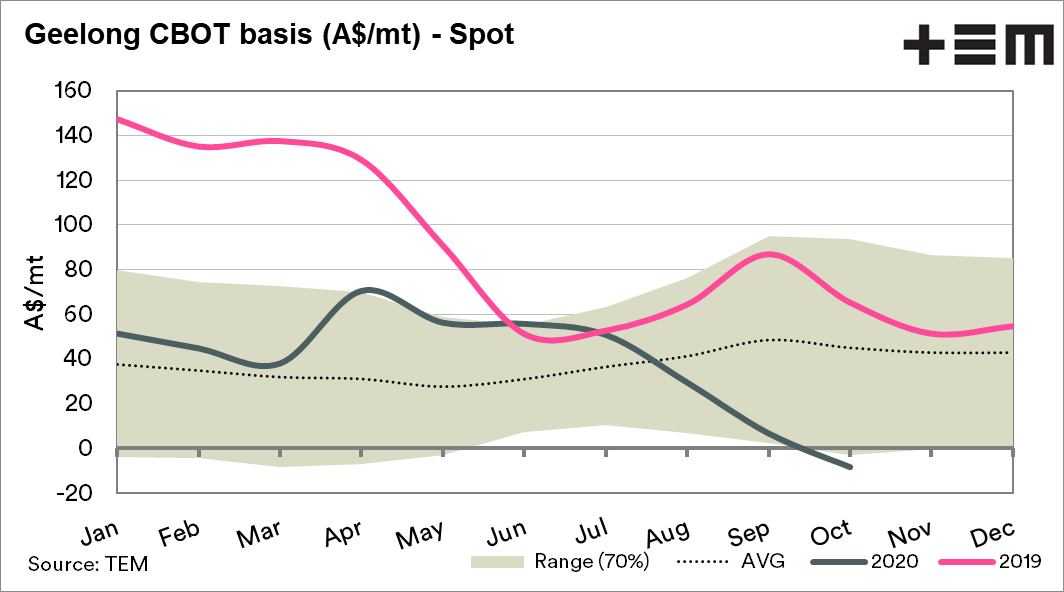

This is an opportune time for the overseas wheat market to rally. As we move towards a generous national crop, the basis level has reduced. At present basis is at negative at numerous port zones. This was something to be expected this season.

The good news is that the flat price remains strong as a result of events overseas, at a time of decent production. It is important to remember that markets don’t have an infinite upside. It may be worthwhile making sales at these levels in tranches as we move forward.