Market Morsel: Trimming the hedge for Harvest?

Market Morsel

The majority of our focus on grains will be on the new crop; as we get into seeding, we need to think of the opportunities ahead of us.

Every week we cover the physical market (see here). Typically, most Australian farmers do not use any form of derivatives, whether that is swap, direct futures, or options. What are they offering this year?

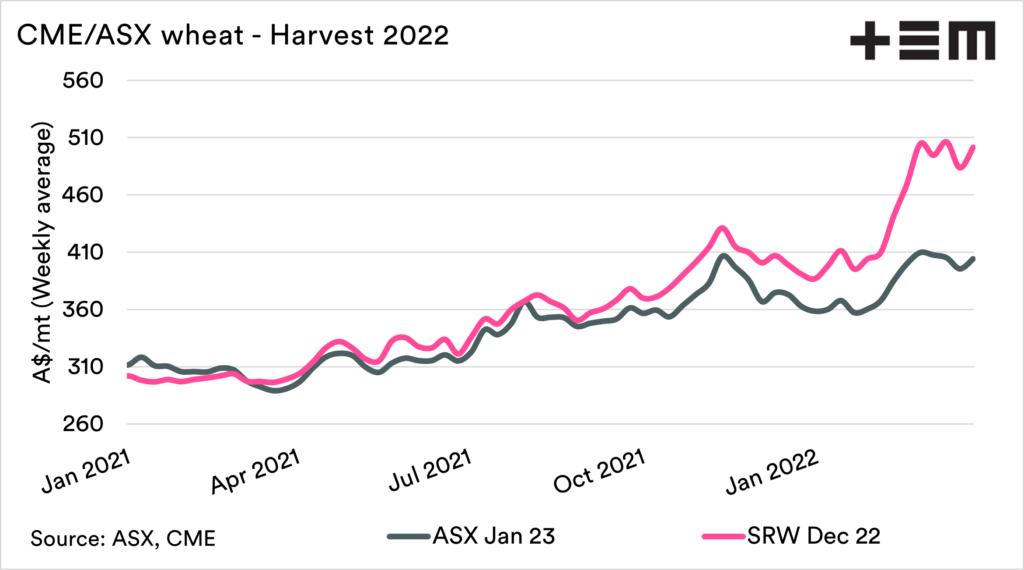

The first chart below shows the current pricing levels for both Chicago and ASX, for the coming harvest (Dec/Jan). The ASX contract offers just over A$400. As an Australian-based contract, this provides you with a large proportion of the basis locked in.

The unfortunate thing is that the basis level is currently heavily negative. The Chicago wheat contract has averaged A$502 for the week so far. If you lock in the ASX, you effectively bank a A$97 discount.

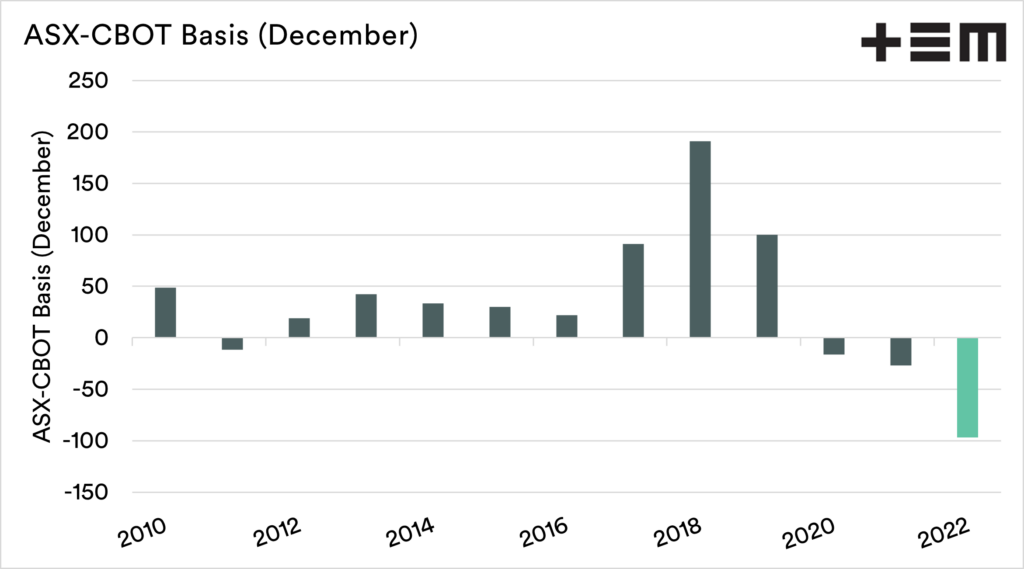

As mentioned in the previous section, the basis currently on offer for harvest is around A$100. The second chart below shows the historical average basis in December since 2010. A basis of A$100 is an extreme level, as seen in the second chart.

Through locking in ASX, you lock in a huge discount. If you were to lock in the overseas futures component, you would at least have the opportunity to benefit if the basis level improves closer to normal levels.

At its most basic, locking in the ASX will protect you from further falls in basis. Locking in Chicago gives you exposure to basis. It’s all down to your risk profile to determine which is better for you.