Grain Prices: Things are looking good for pricing.

Pricing Update

As we move throughout the year, we will be focusing on the new crop more and more, and so on a regular basis, we will be putting an update on what is happening in the local market, with a focus on being quick to read.

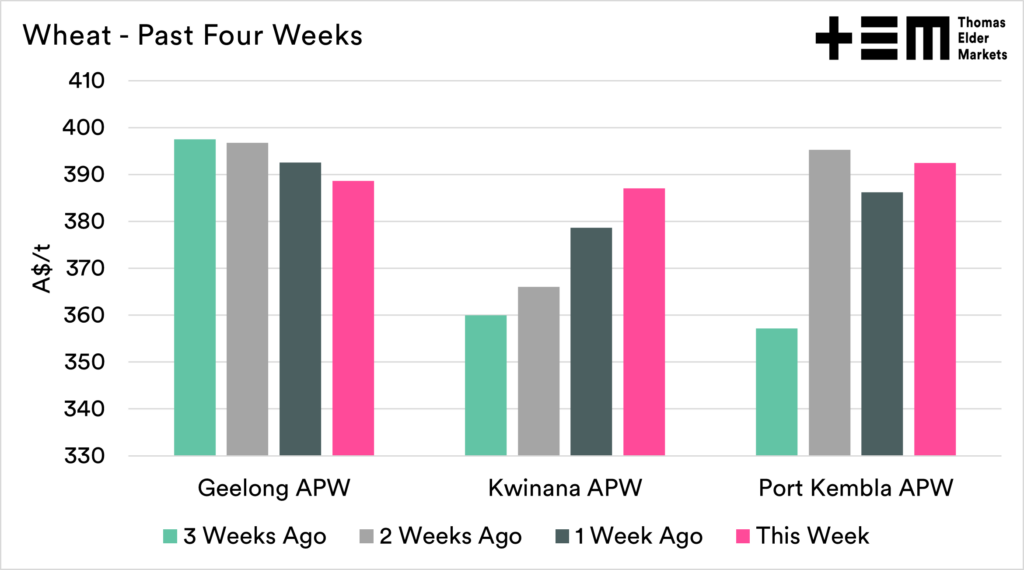

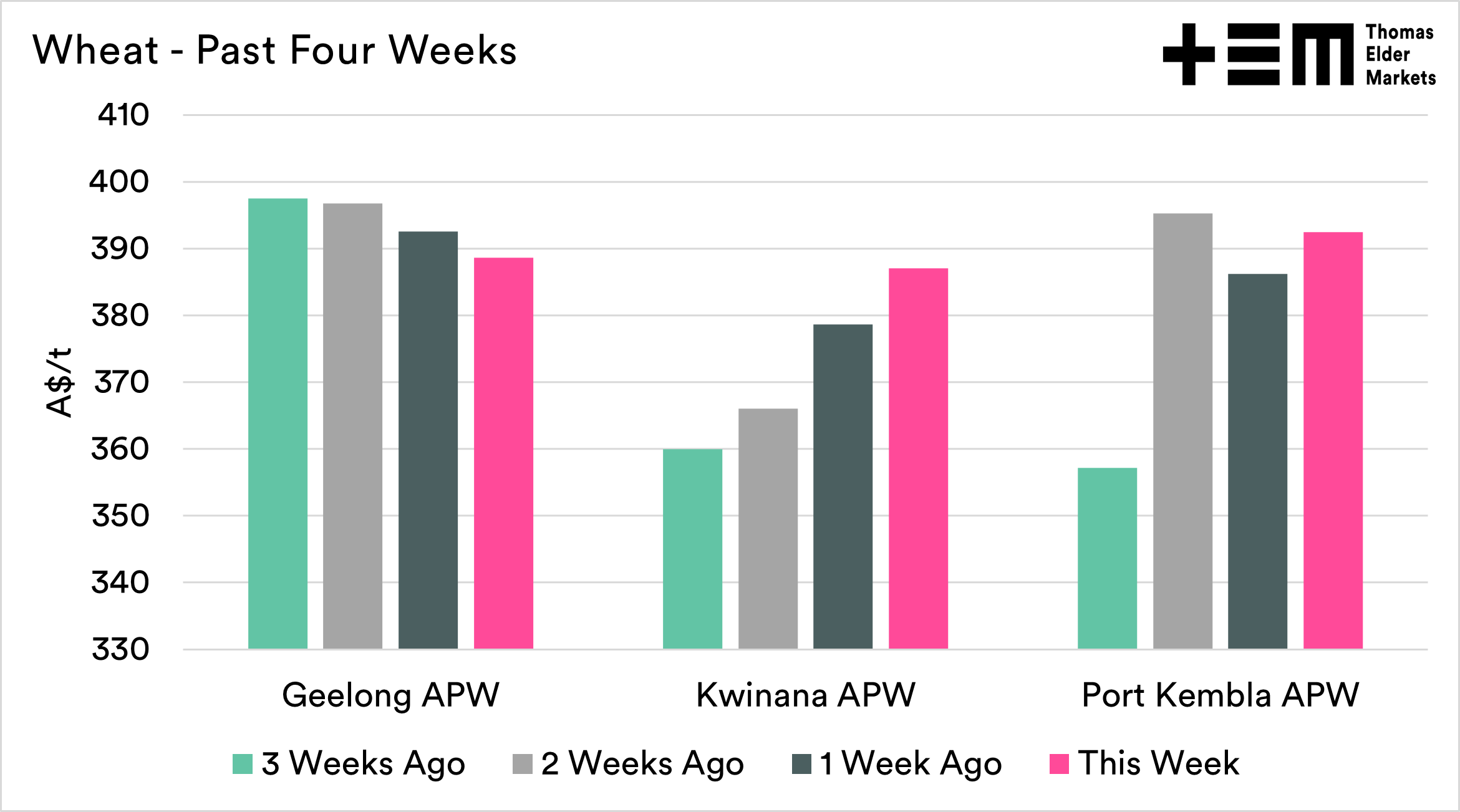

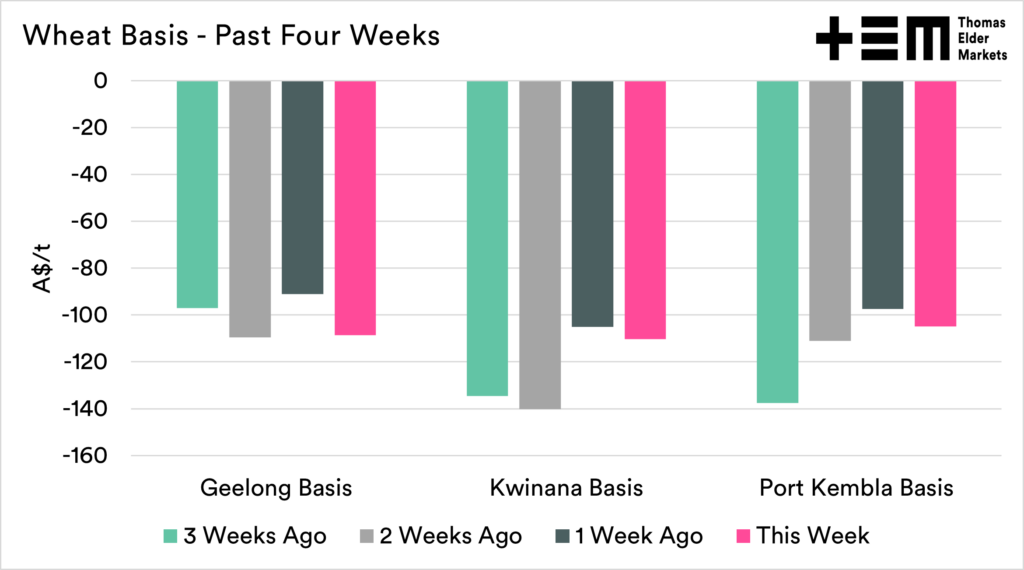

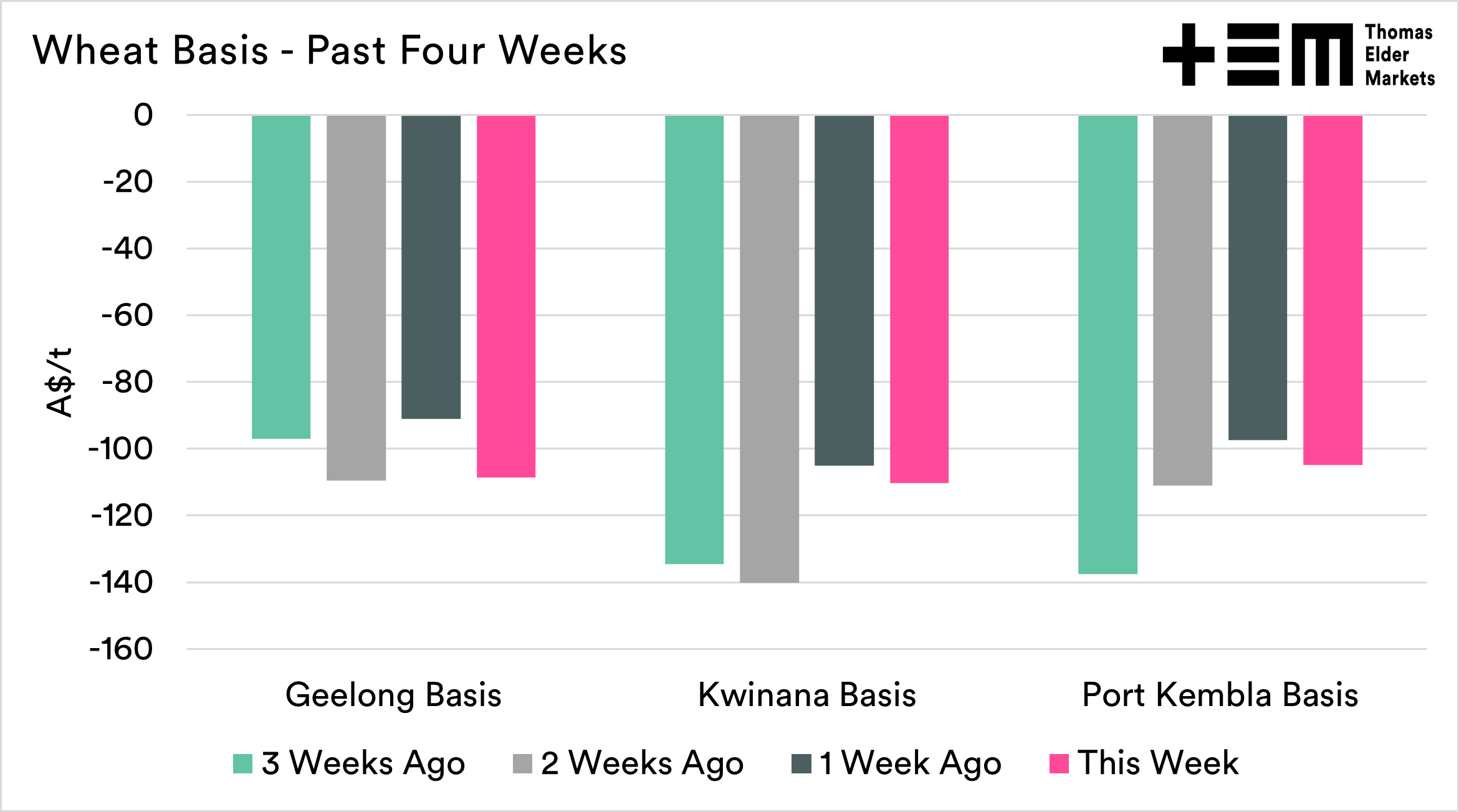

The charts in this report are all the weekly averages, so won’t reflect a particular day but the average of the week as we look towards trends. In this update, we will focus on three zones, Kwinana, Geelong and Port Kembla, as they give a reasonable spread around the country. We may add more in the following updates.

If forward selling, remember that you are replacing price risk with production risk. Be mindful of this when allocating volumes.

Wheat

The wheat market really continues to be a mixed bag in Australia, dependent upon the state. At the moment though it’s important to note that the market doesn’t necessarily have a huge amount of liquidity and many buyers. As we move through the year that will improve, and we will see more consistency.

The crop conditions in the US Winter wheat crop surprised many this week, as the USDA released the first overall US number. I don’t really understand why it is has caused such a reaction, as the data for many of the main states has been out for some time, and we have already covered (here & here).

Maybe folks had their eyes only on the black sea and weren’t focusing on the granular data. The world needs wheat, and this year the US crop is not starting well, as any of our readers will be aware of. A worsening condition will assist pricing.

The unjust invasion of Ukraine remains the main driver of the market, the big news out of that area is the volume of grain still leaving Russia, as Russia clearly still has some grain mates. The export blockage of grain in the black sea hasn’t been as complete as many feared, although Ukrainian exports have clearly been more fully impacted.

The loss of export volume has meant that Egypt is looking further afield to India. Egypt has left India out of tenders for wheat due to phytosanitary concerns (Karnal Bunt), but due to limited options, they are not open to possible relaxation of import controls.

Our basis to CBOT wheat remains at a very large discount around the country. At the moment the market is pricing in a very large crop, but who knows.

Overall, prices are poor relative to overseas futures, but at still strong from a historical flat price perspective.

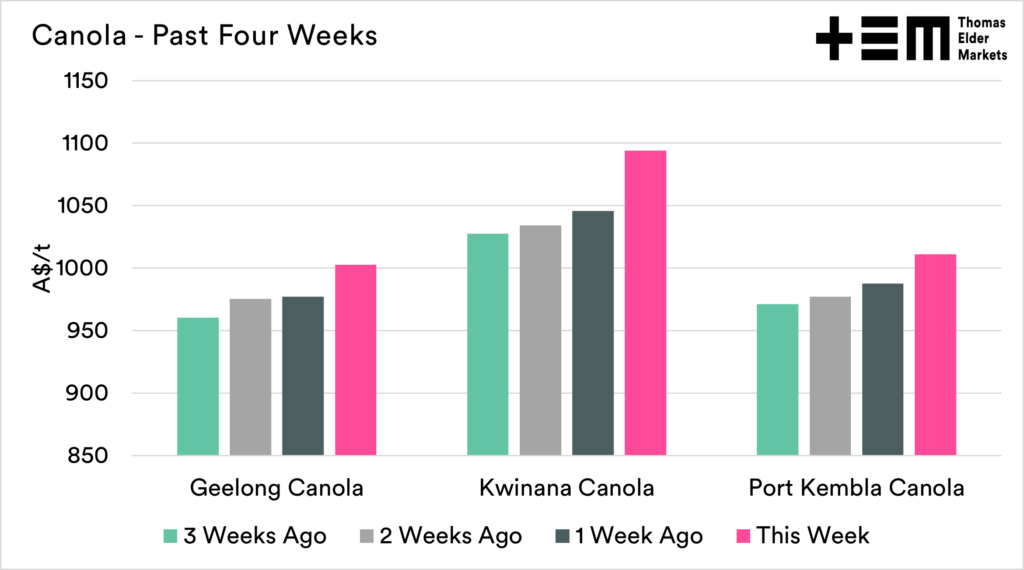

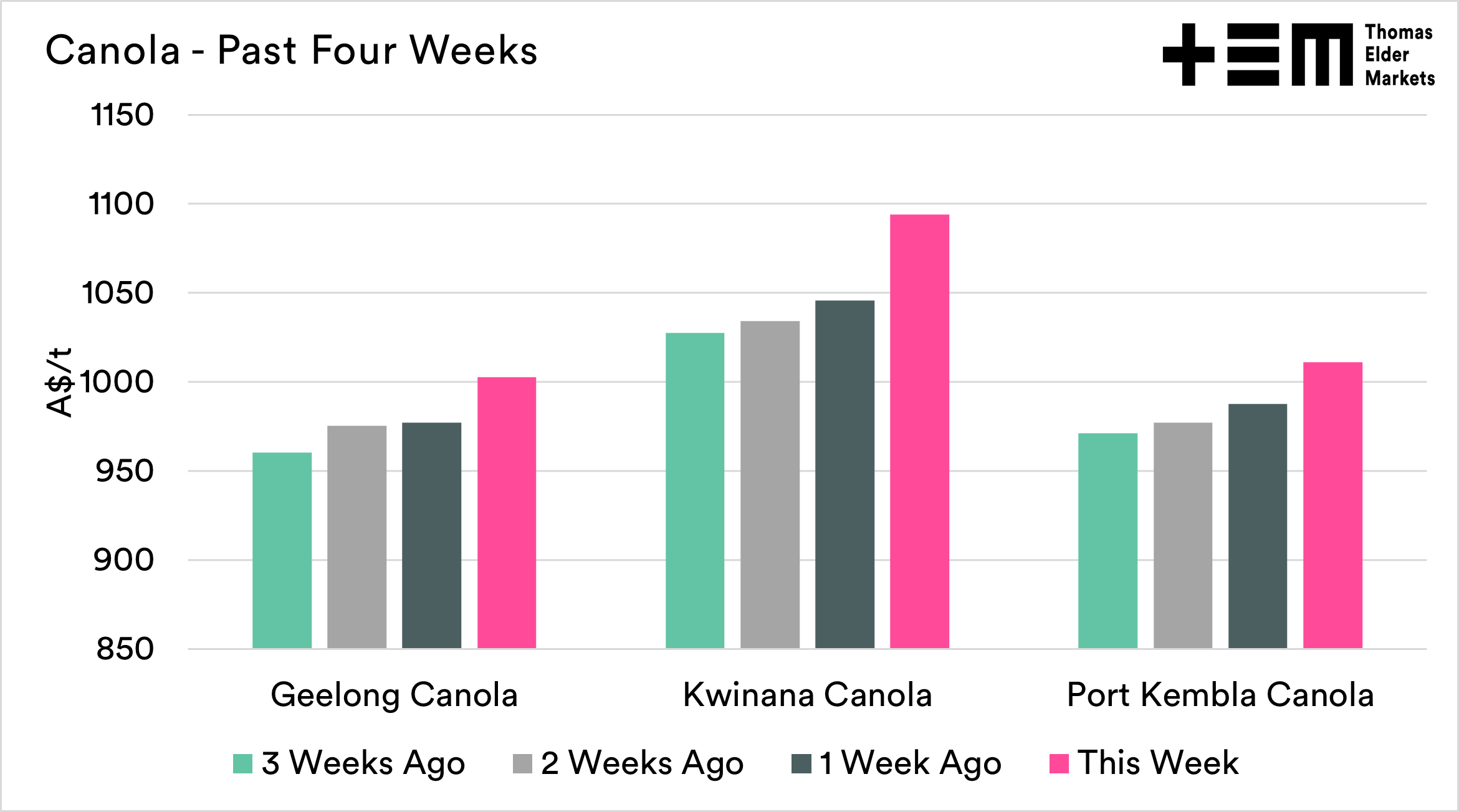

Canola

The canola market in Australia continues to go gangbusters. The past week has seen a really considerable jump as the market starts to really digest the growing concerns for oilseed supply around the world. There are already major disruptions to sunflower oil, which is a very popular vegetable oil for consumer goods. Ukraine usually supplies around 50% of world exports, which is no longer available.

There are also some concerns about potential moves by governments amending current mandates around the use of biodiesel/ethanol. There has always been a debate about food versus fuel, and it is back at the fore like it was in 2008. There is now lobbying from energy companies for relaxation on blending rates as it becomes an expensive proposition when oilseeds are at high levels.

There was also data out from South America, with the Brazilian soybean crop downgrade further to 122.4mmt, down from 138.2mmt during the previous year. The Argentinian crop is also not in great shape, while it is better than last year, it is only 25% rated good/excellent. The world needed good South American crops, and this is just another bullish factor for oilseeds.

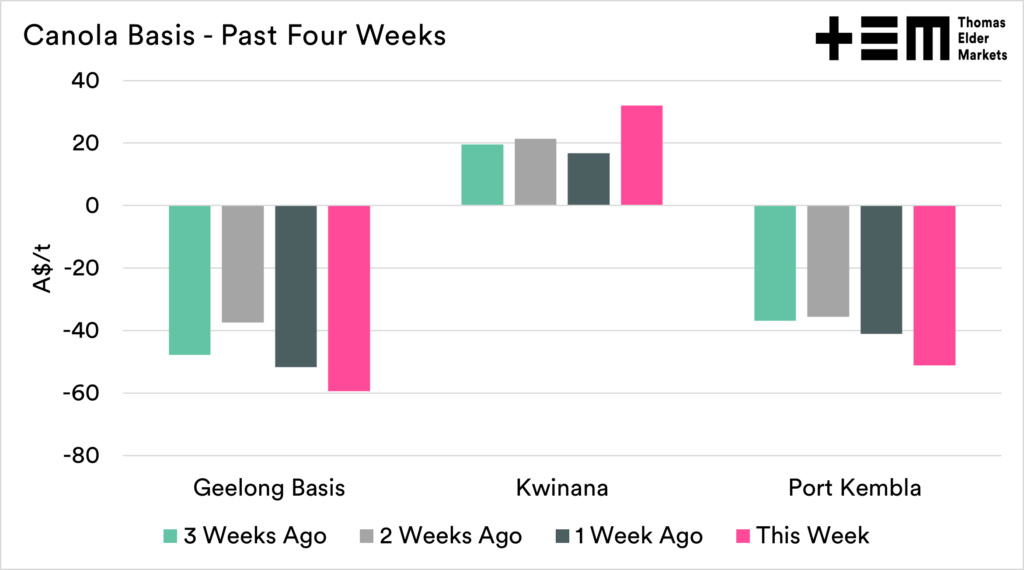

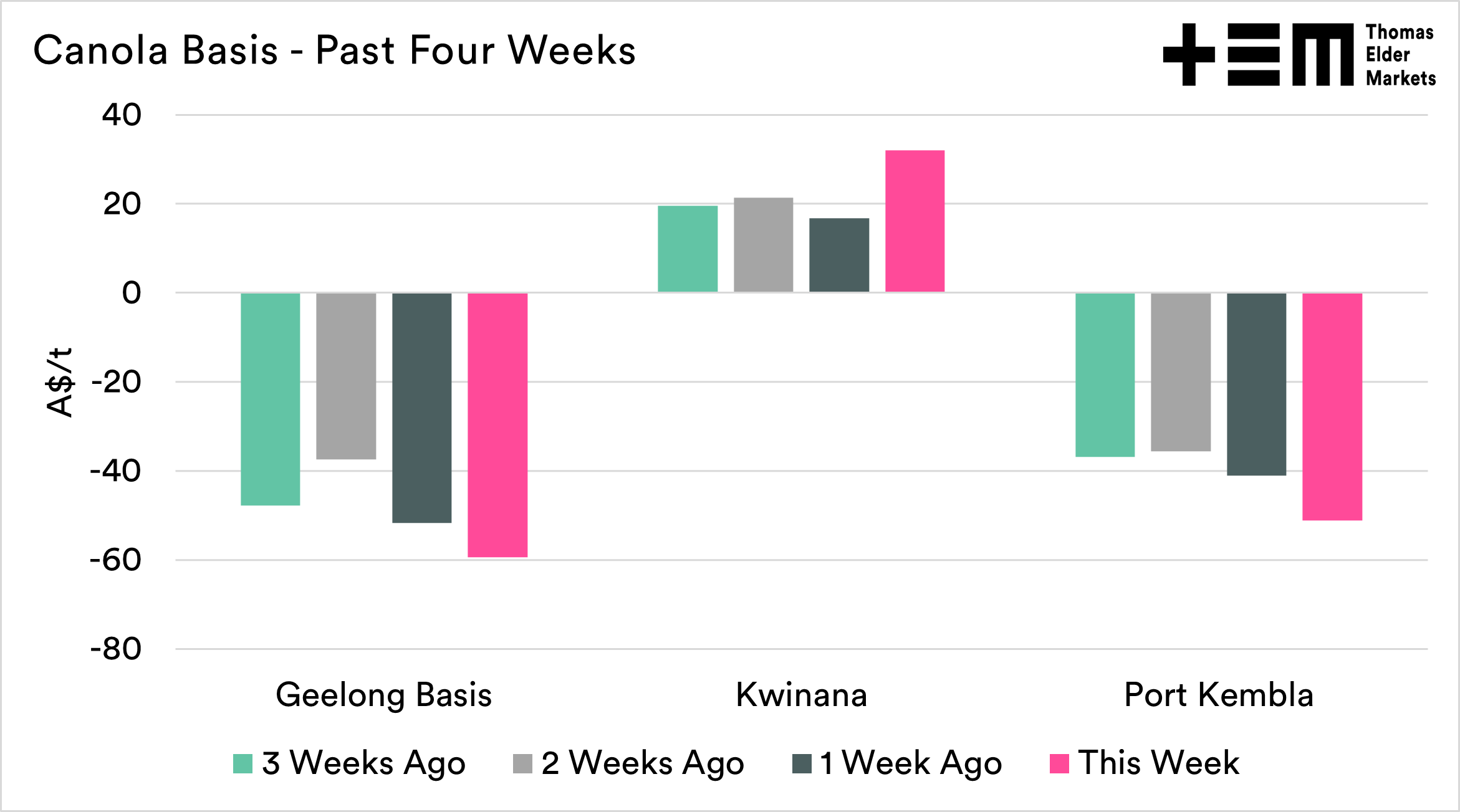

Overall, prices are very strong relative to historical levels, in comparison to futures they are showing improvement, especially in the West.

Barley

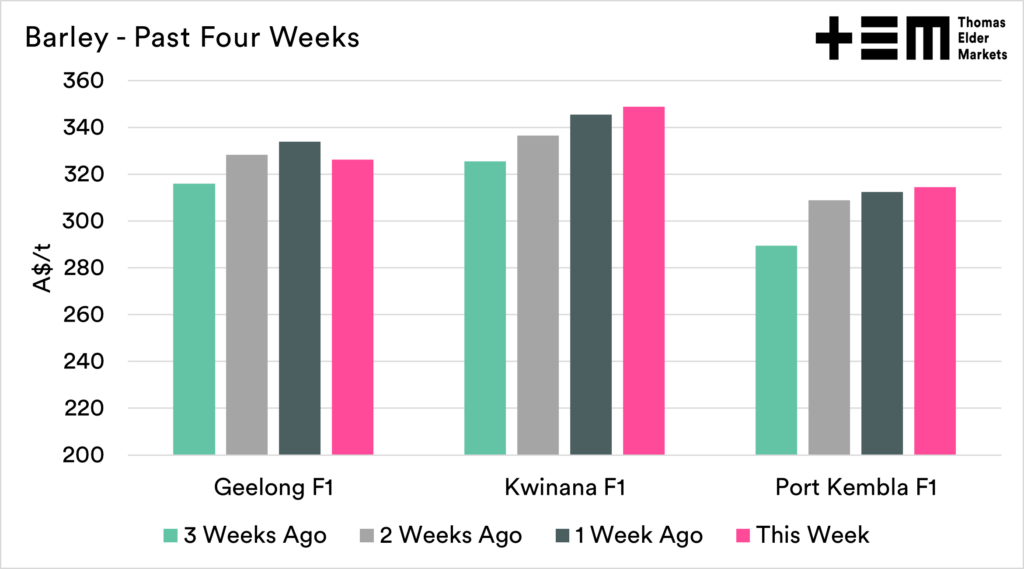

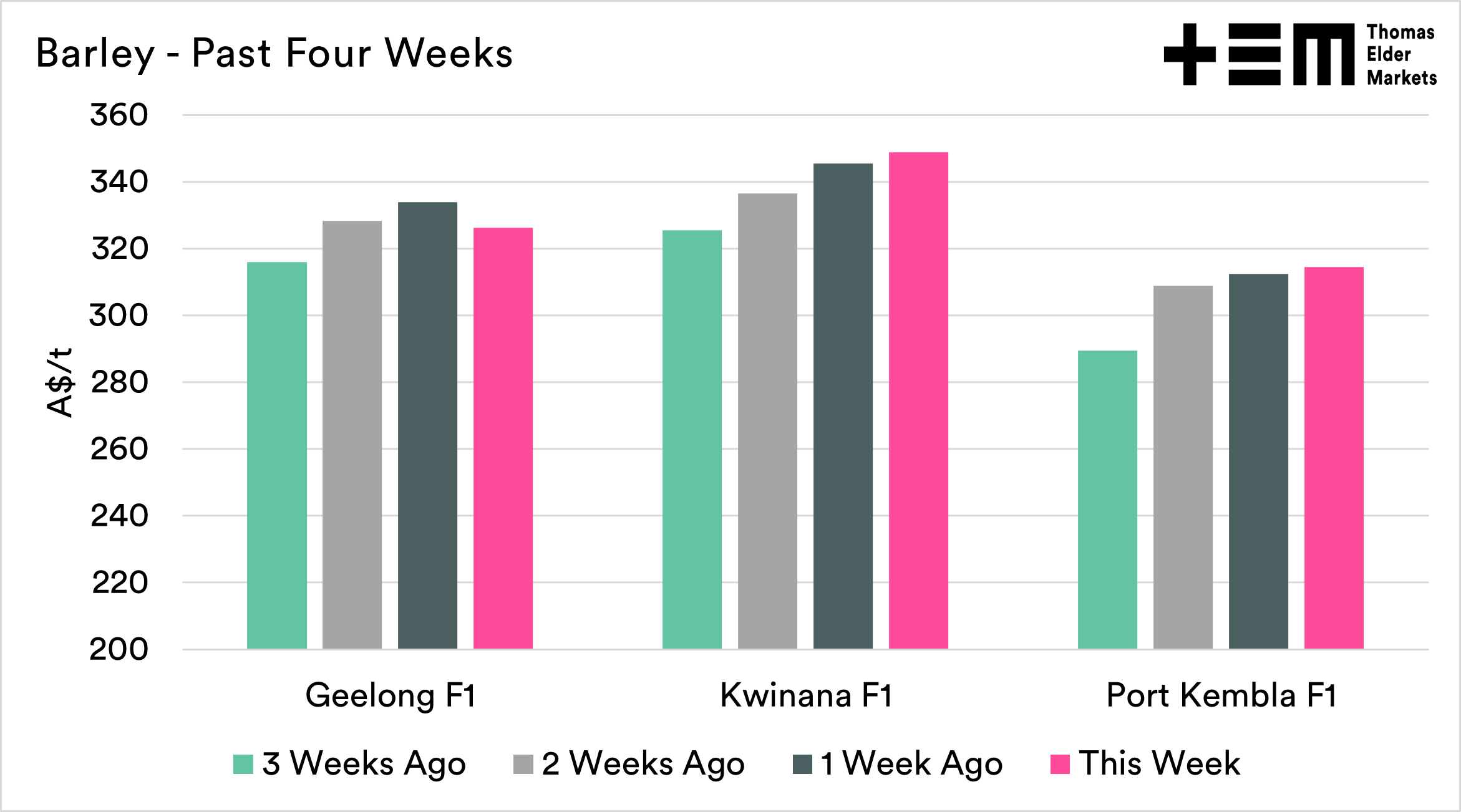

Barley

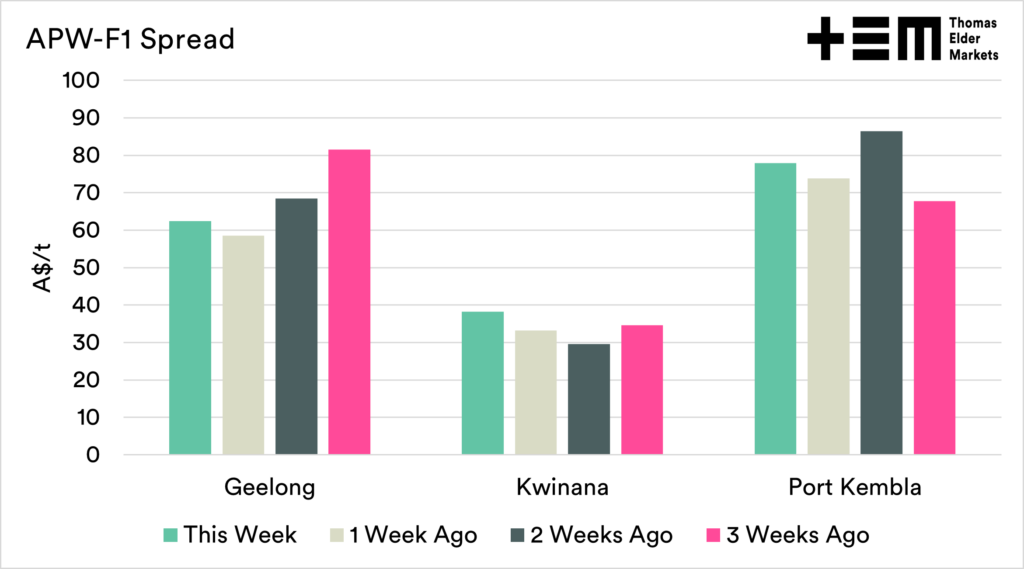

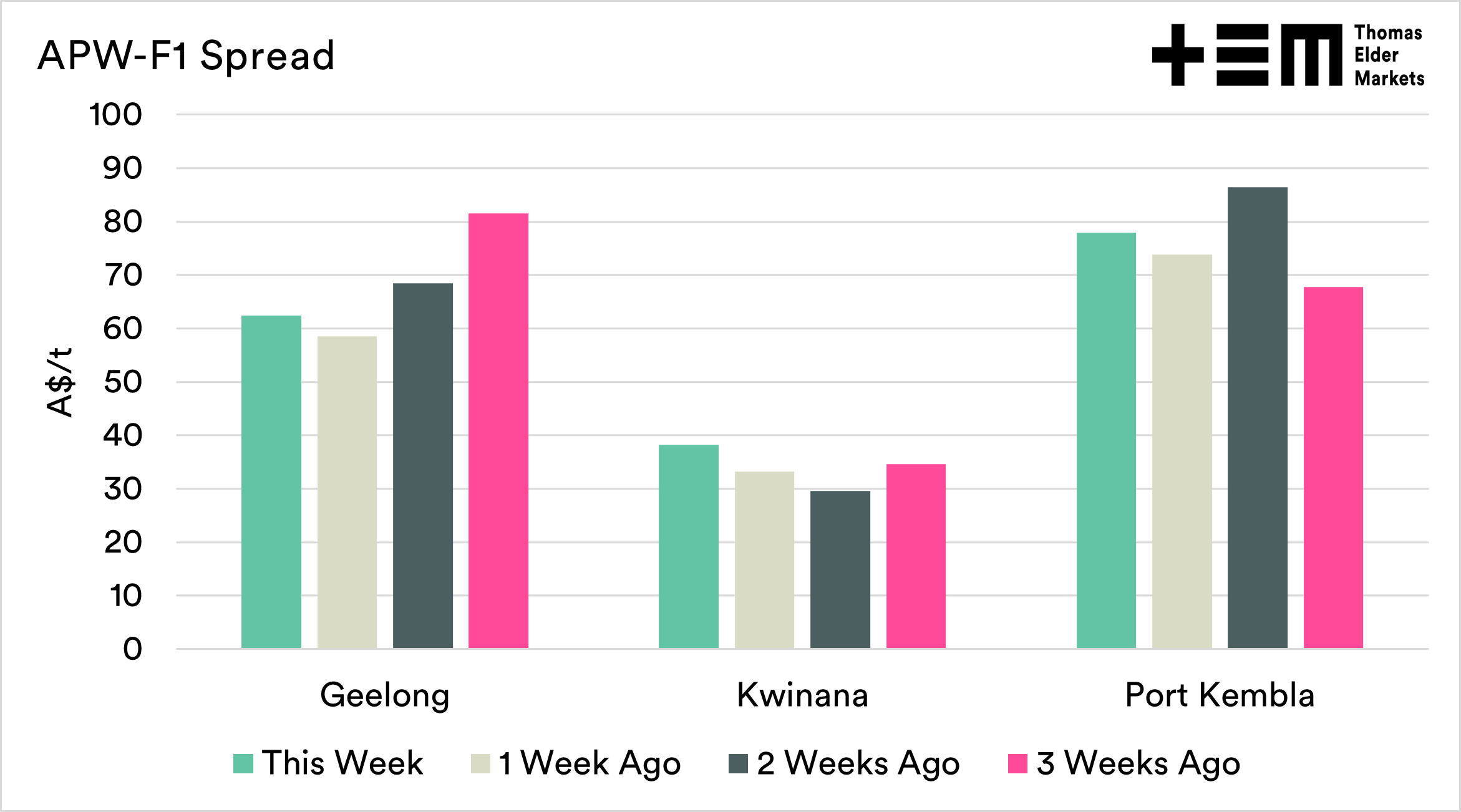

Barley has shown strong improvement in recent weeks, in Geelong it lost some value. Kwinana continues to be the start improver across all the major grains. The spread between wheat and barley remains heavily discounted in the east coast, on the west coast it is narrowing closer to historical levels.

Corn as a feedsource is a big competitor, and barley is often a substitute (but not a great hedge). The Argentinian crop conditions for corn are the worst since 2017, however Brazil is having a decent year on corn. The newest CONAB data forecasts at 115.6mmt crop, the largest on record.

While it is too early to have too much focus on the US corn crop, the drought conditions if they persist could be beneficial for the entire grain complex pricing.

Overall, barley prices good relatively to historical values, but are still quite discounted to overseas values and wheat.