Market Morsel: Volatility Returns

Market Morsel

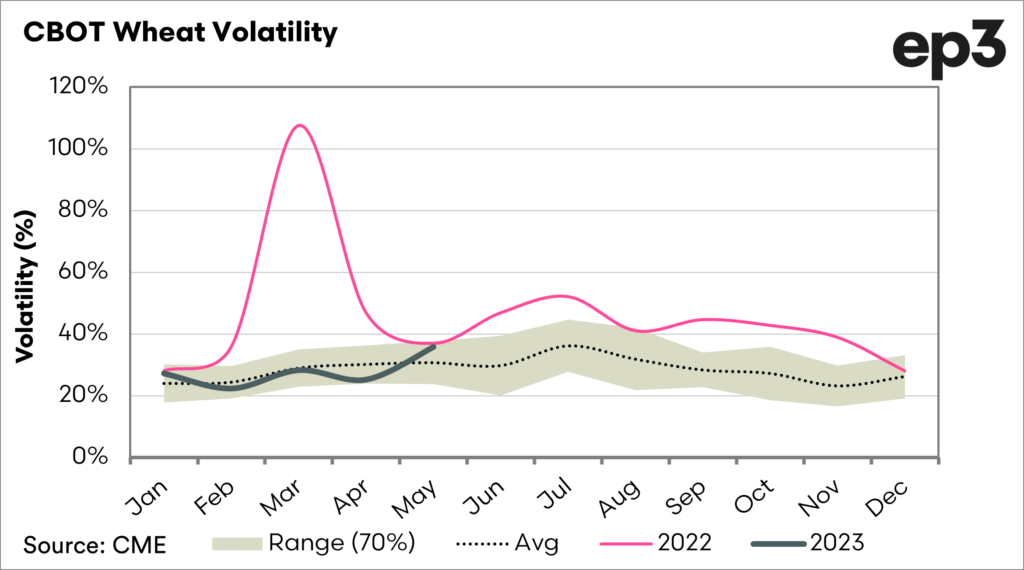

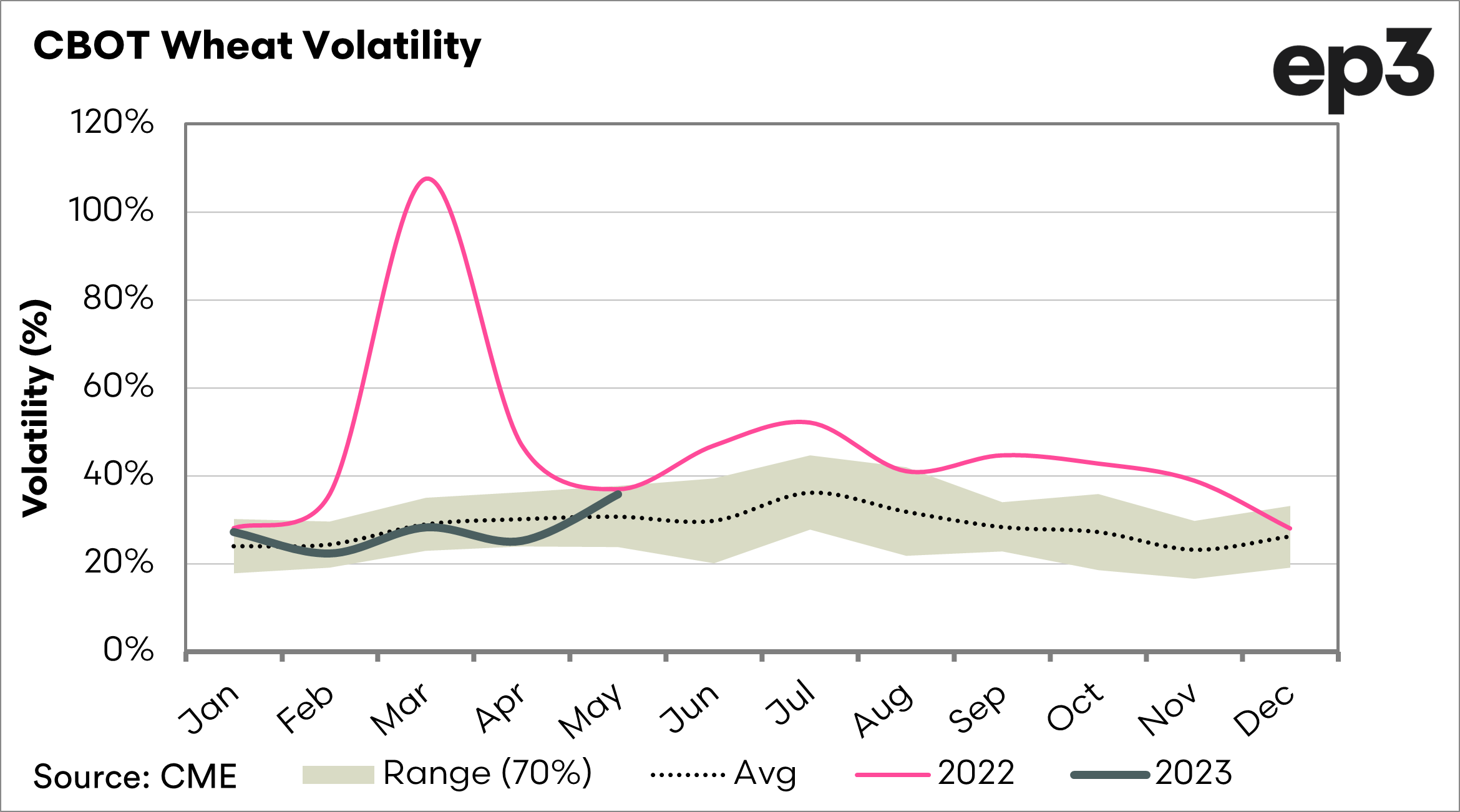

About a month ago, I wrote about volatility in wheat markets and how, on average, it tends to increase as we approach the middle of the year.

This seems to be coming to fruition. The chart below shows the volatility of CBOT wheat futures. Although it’s not a direct Australian price, it is a good proxy when discussing global markets.

For the first four months of the year, the volatility has largely followed the long-term average. During May, the volatility rose to the top end of the standard deviation.

It is important to note that volatility does not equal higher prices, it just means more movement. What has driven this?

- US wheat conditions

- French wheat conditions

- Ukrainian grain export corridor deal