Market Morsel: Wake me up next month.

Market Morsel

The monthly WASDE report is out, and so it’s time for a summary:

Wheat:

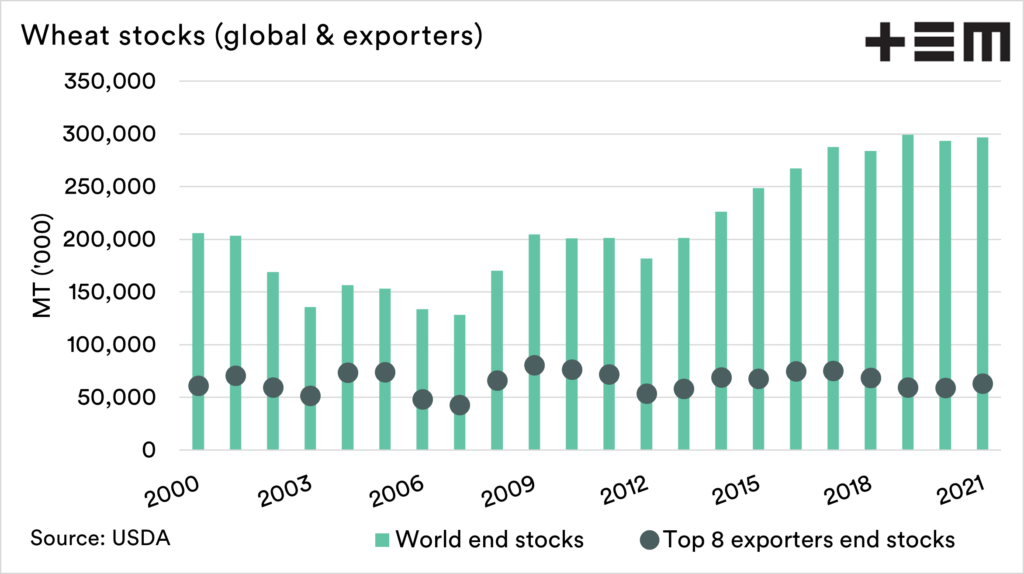

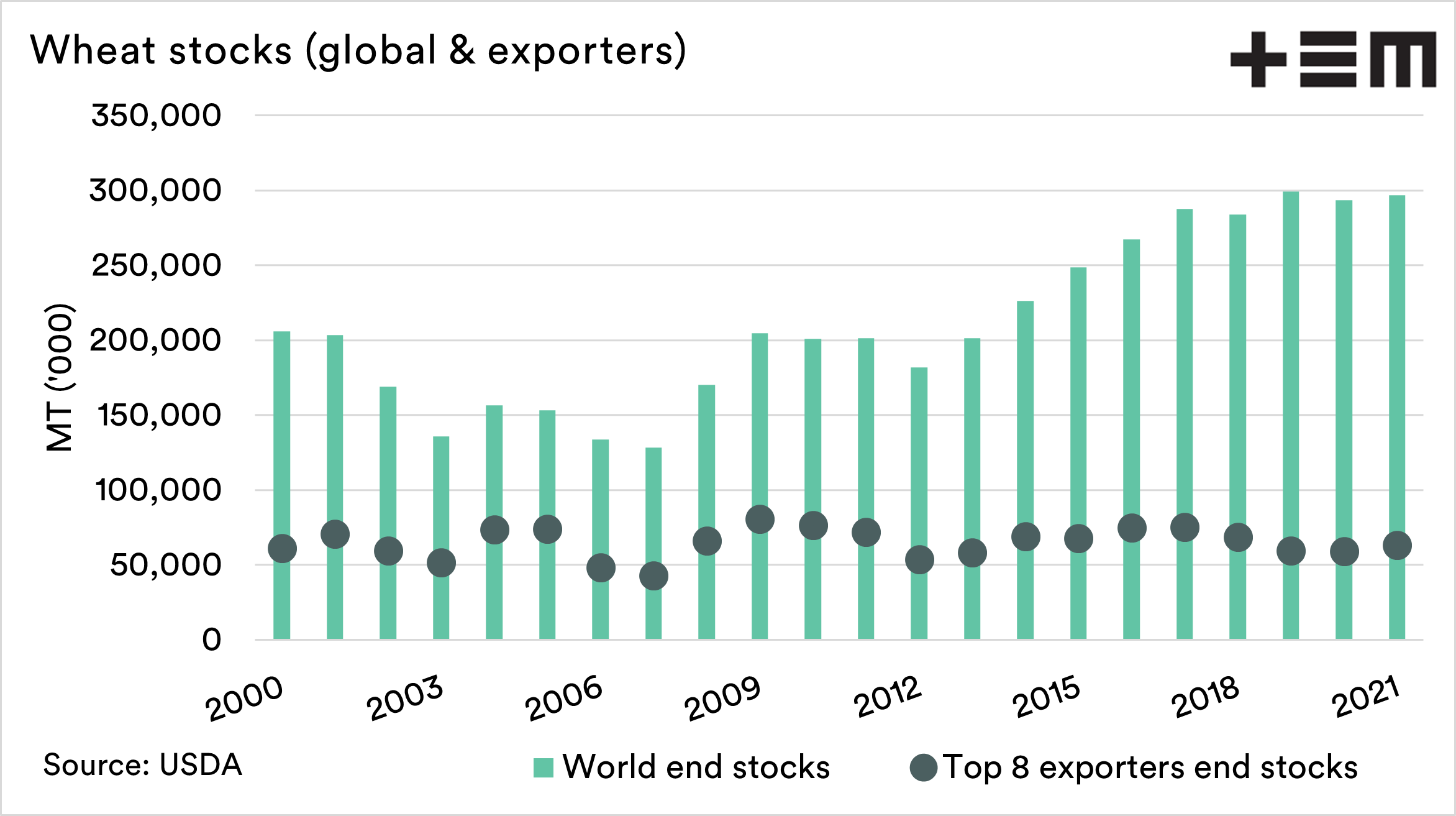

Overall, there wasn’t a huge amount of change in the picture for wheat from last month. The world ending stocks were raised 2mmt to 296mmt. This would be the second-highest stocks of wheat in history (1st being 2019 at 299mmt).

There were some revisions to production around the world for the coming crop. Russia was increased from 85mmt to 86mmt. This is a large increase compared to on the ground forecasts we have seen from our man on the ground (see here).

Europe was also revised higher from 134mmt to 137.5mmt. Australia was left unchanged at 27mmt; at present, we think 27-28.5mmt is an appropriate number for the current conditions.

When we look at the top 8 exporters, we can see that their wheat stocks have risen from 59mmt to 63mmt at the end of this season. This is the highest level since 2018.

Corn:

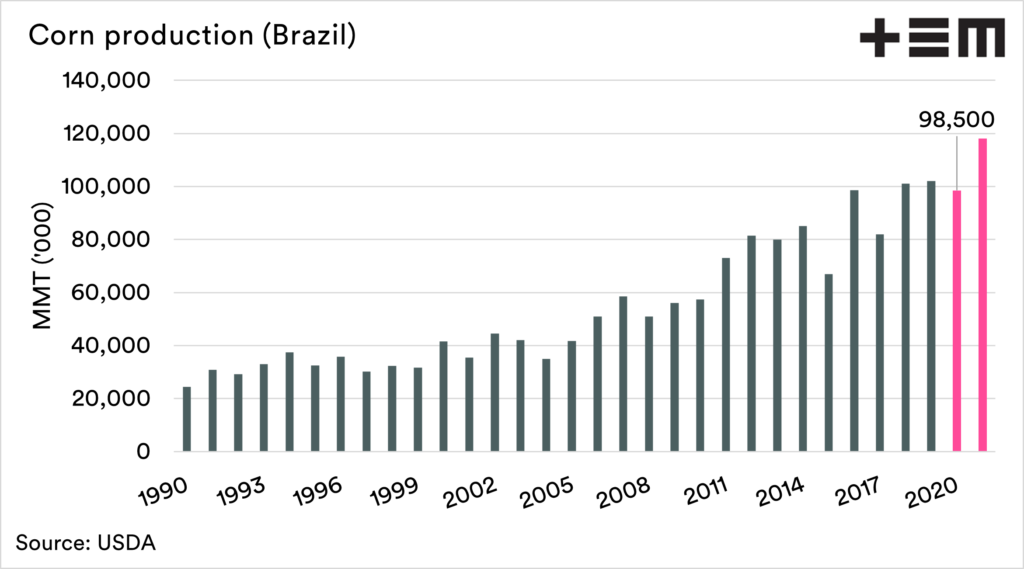

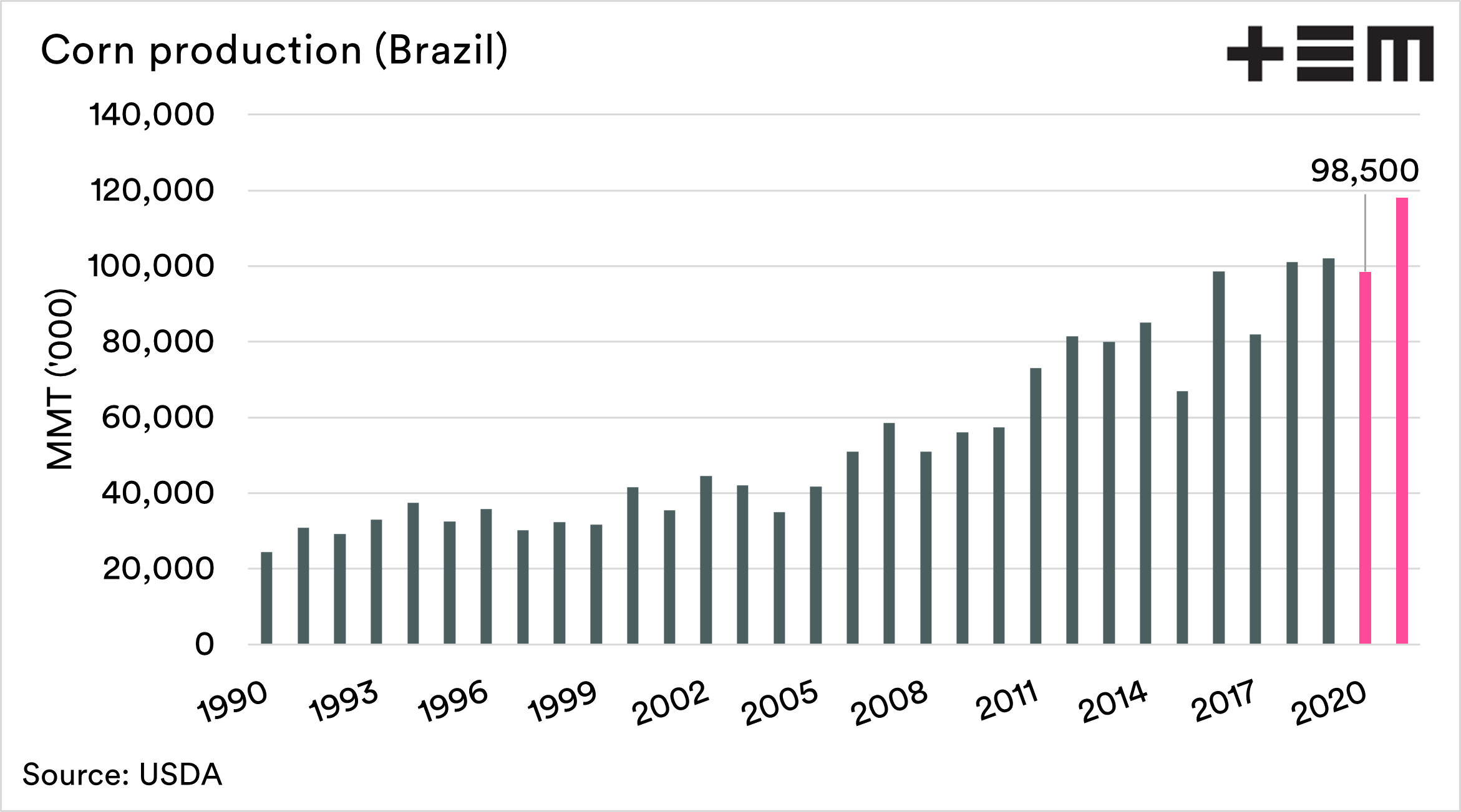

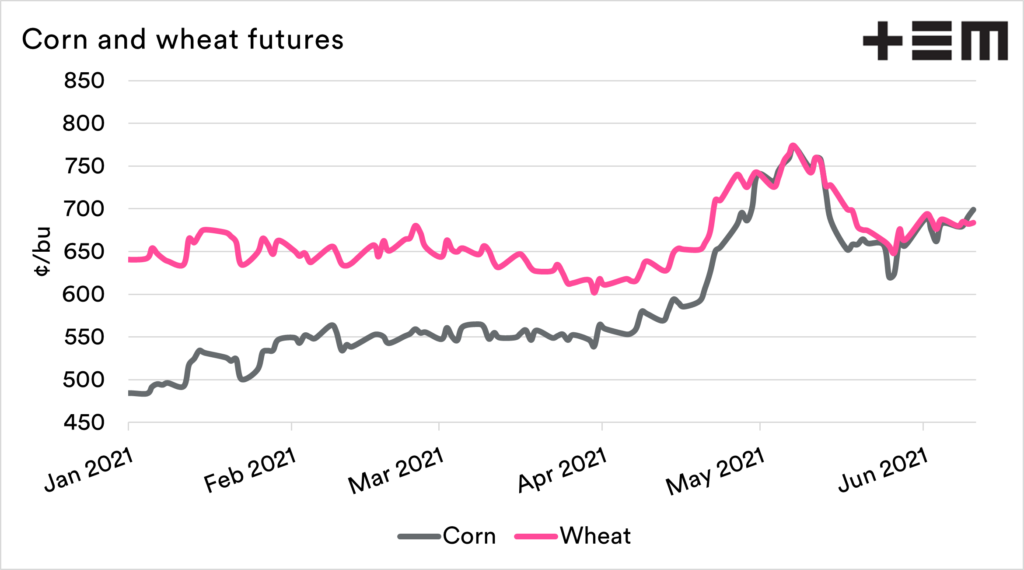

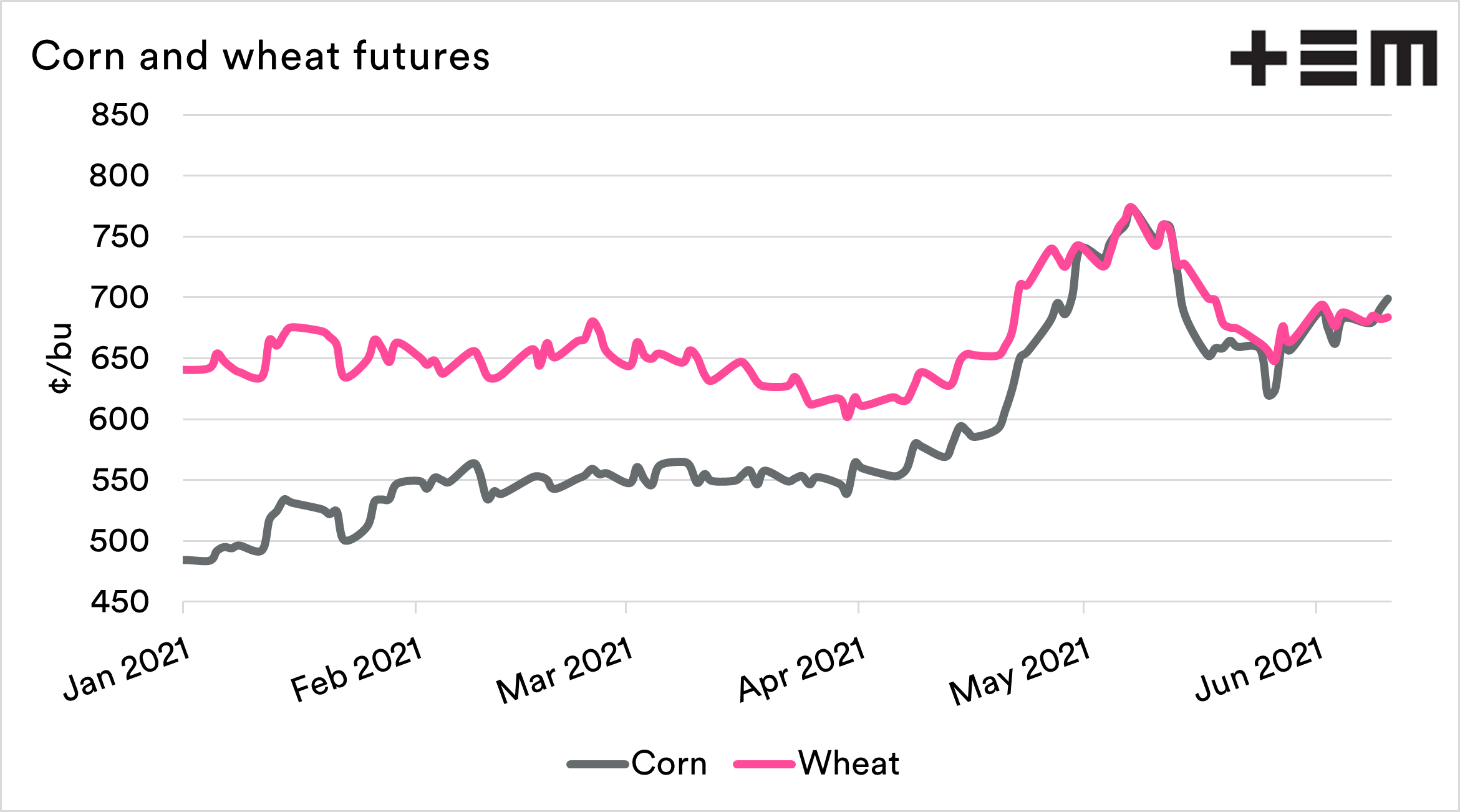

As we have mentioned countless times, the wheat picture is for high production and stocks, and it is corn that will drive our markets higher.

Forecasts for the current Brazilian crop have seen downward revisions to 98.5mmt. This is largely in line with expectations after poor weather. Currently, CONAB has production at 96.3mmt.

The revisions in Brazil have reduced starting stocks for this season, and largely usage is unchanged, resulting in reduced end stocks from 292mmt to 289mmt.

Oilseeds:

Oilseeds remain the commodity that currently has the most bullish undertones. The biggest move in oilseeds was that soybean stocks at the end of the current season rose higher than industry estimates to 92.55mmt. This was due to higher starting stocks from last season due to lower domestic crush in the US.

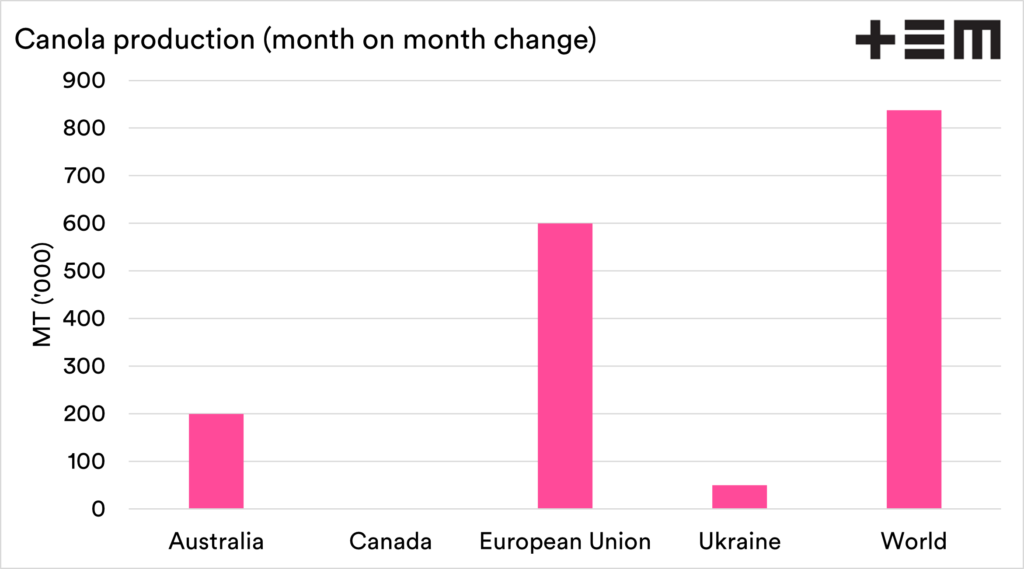

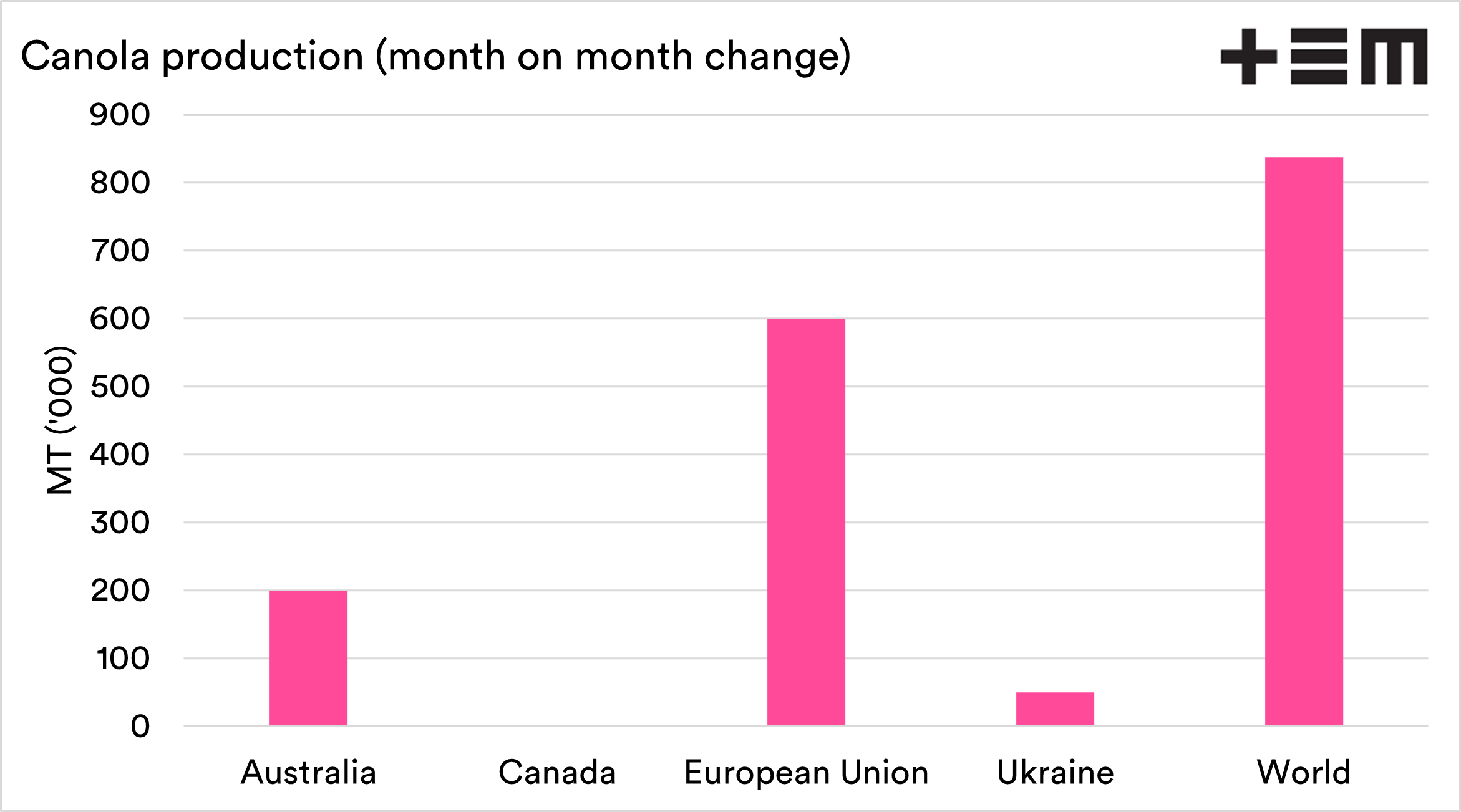

There were upwards revisions in production for Australia on the canola front from 3.5mmt to 3.7mmt, which is still below the ABARES estimate of 4.2mmt. Timely weather in the EU also resulted in a 600kmt rise.

Our old mates in Canada struggling through difficult weather in recent times saw no increase.

Summary:

The reality is that there were many little bits of tinkering in this report, more so in relation to old crop that has flowed through to new season stocks.

Futures traded in a relatively wide trading range. However, wheat closed essentially unchanged, and corn was up slightly.