Market Morsel: What are good prospects doing to pricing?

Market Morsel

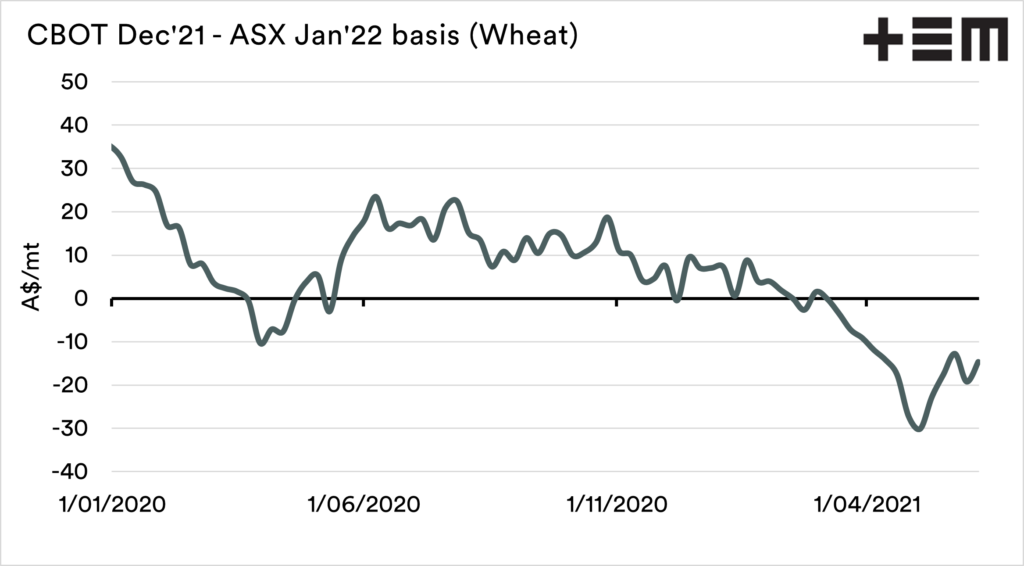

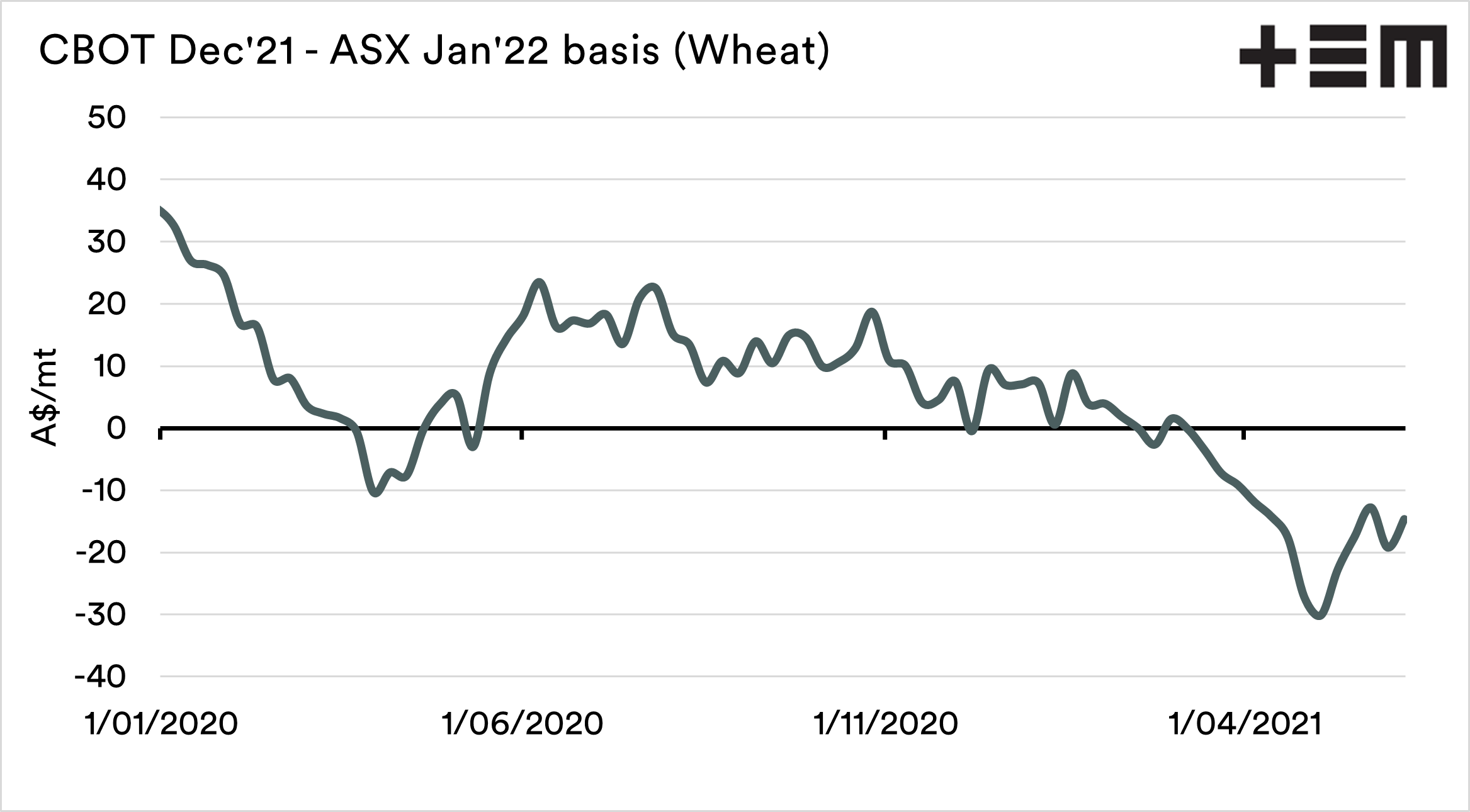

The big crop last year, in combination with a decent outlook for the coming harvest is having some pressure on our basis or our premium to overseas pricing.

A good place to look at to get a holistic view of the national crop and its value is the relationship between the ASX and CBOT contract. Whilst the ASX is an east coast contract; it gives a good representation of national value.

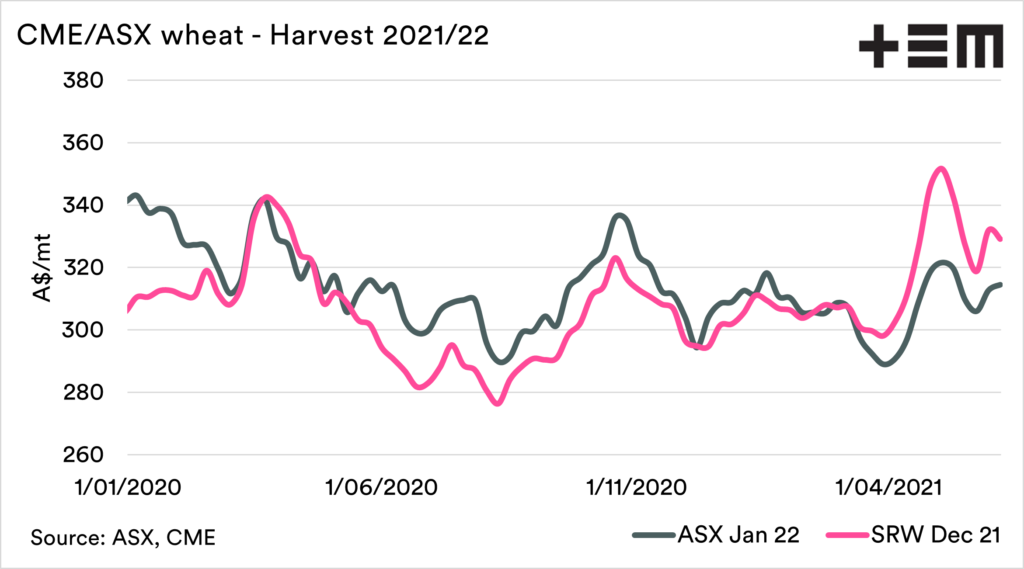

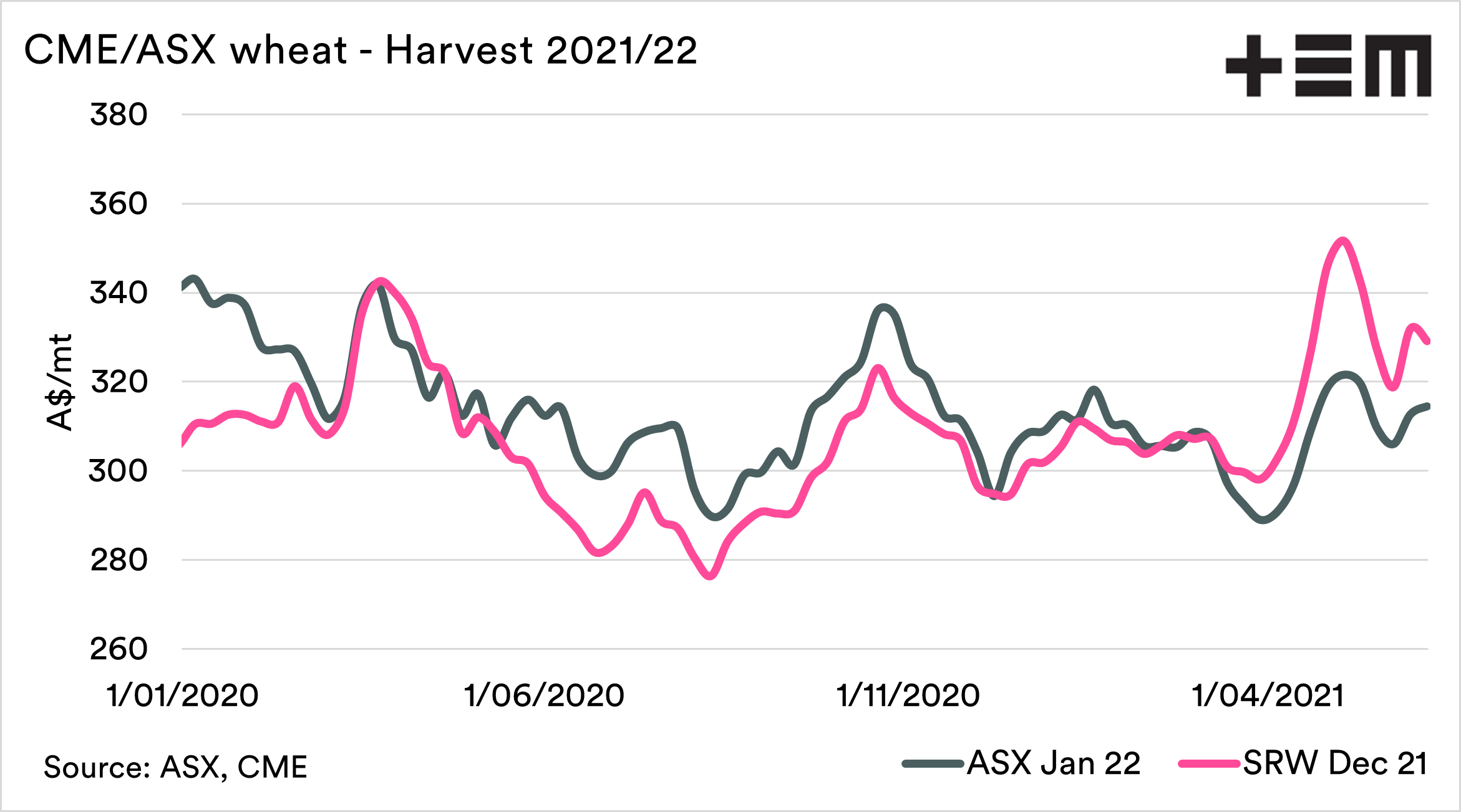

The first chart below shows the ASX contract for January vs the CBOT contract for December both converted into A$. As we can see, CBOT has moved to a premium in recent months.

This means we are currently trading at a negative basis, to understand basis read ‘what is basis’.

The coming crop of wheat is at 27.8mmt, which, whilst a big drop year on year, remains well above the decade average of 24.5mmt. This means that we are likely to have a lower than average basis or stay negative for longer.