Market Morsel: What is on offer for next years grains?

Market Morsel

A marketing strategy should consider forward markets, harvest pricing and post-harvest marketing. In this quick article, I’ll take a look at the forward curve for the main futures markets that Australia uses for wheat and canola.

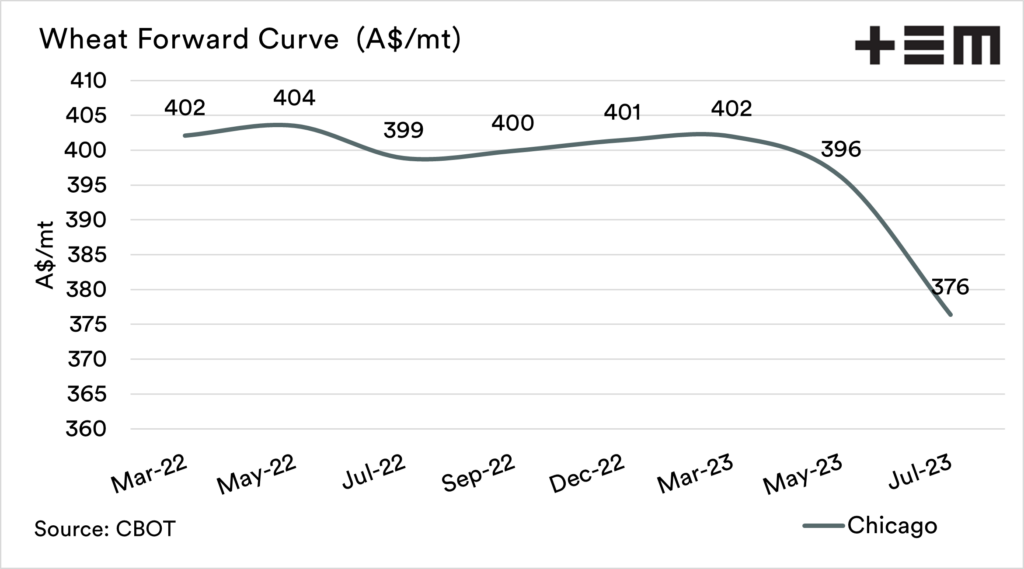

Let’s take a look at wheat first. The forward curve is relatively flat until the start of 2023. At present, if you were to lock in your futures component of pricing for the next harvest, you would have a starting figure of A$401/mt.

This is historically a very strong number. At the moment, we have a negative basis level, but historically we have maintained a premium over Chicago. Does the large crop continue to weigh on pricing until the next harvest, or do we see a return to average levels? The reality is that it is all conjecture, but a starting point in the high 300s is strong compared to history.

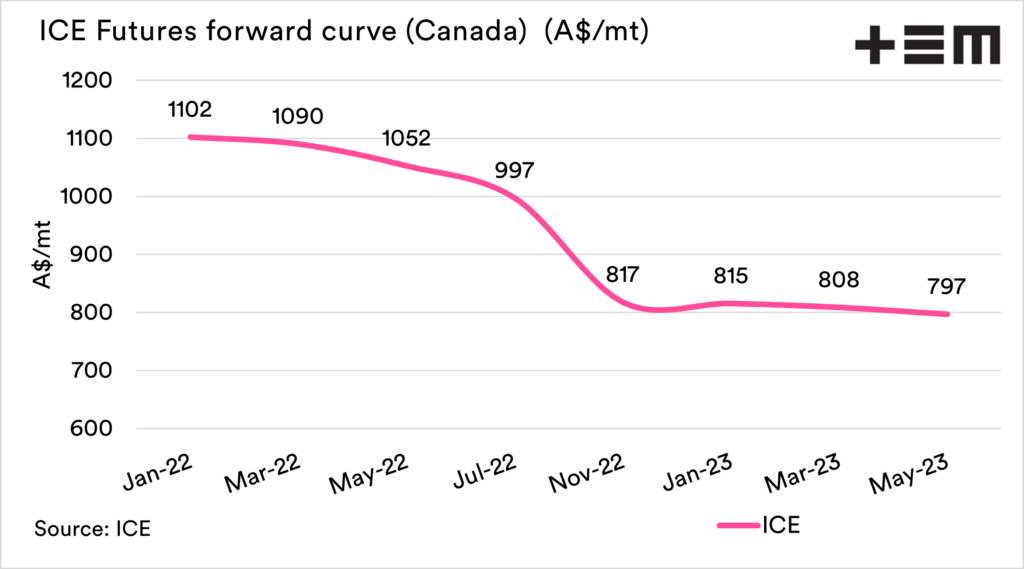

Canola is showing a curve in backwardation. That is where the forward months are at a discount. This shows that the market wants access to canola now. The canola price for the next harvest is A$817. Typically we would trade at a premium to ICE futures, but the Canadian drought has moved us to a very strong discount.

The forward months are at a discount from the current pricing levels, but the market does not know whether Canada will rebound in the coming year. A$800+ is still historically a strong number.

Farmers can start locking in prices for next year at historically attractive levels for both wheat and canola. It is important to think of marketing grain in steps; aiming for the top will result in disaster. Bite a little throughout the year (whilst thinking of production risk).