Market Morsel: What price is on offer for next year?

Market Morsel

It is crucial when grain marketing to have multi-year horizons and plans. There are times when the forward market will provide opportunities to lock in reasonable prices; at other times, it is better to step back from the market.

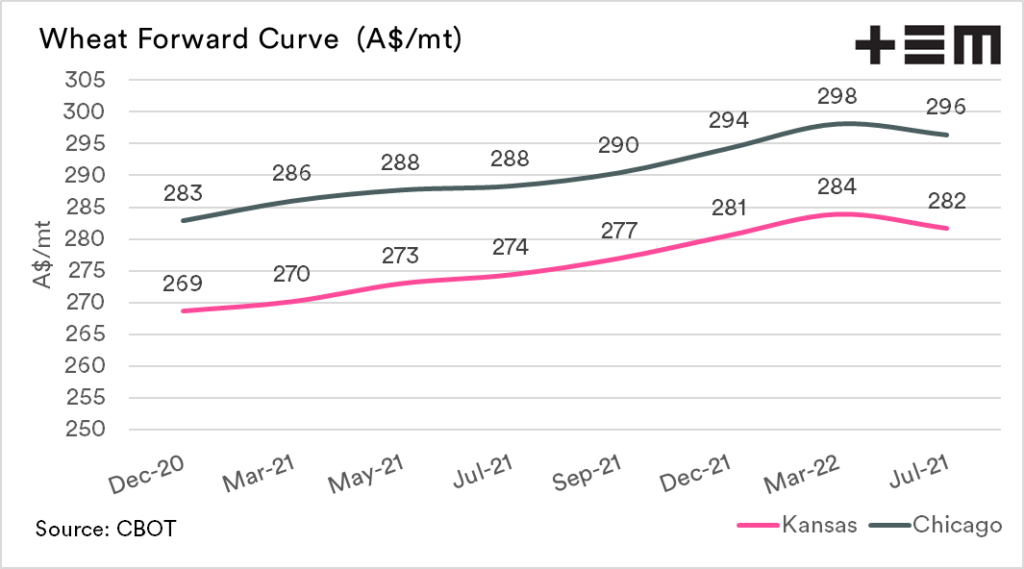

Our price in Australia is based on fx, futures and basis. When examining pricing on the far horizon, you should be starting with the futures forward curve.

Chicago futures for December 2021 are offering A$294, and Kansas A$281. Typically basis in Australia would be positive unless there is a big crop. In all likelihood taking out a swap at this level would result in a price above A$300 based on previous levels.

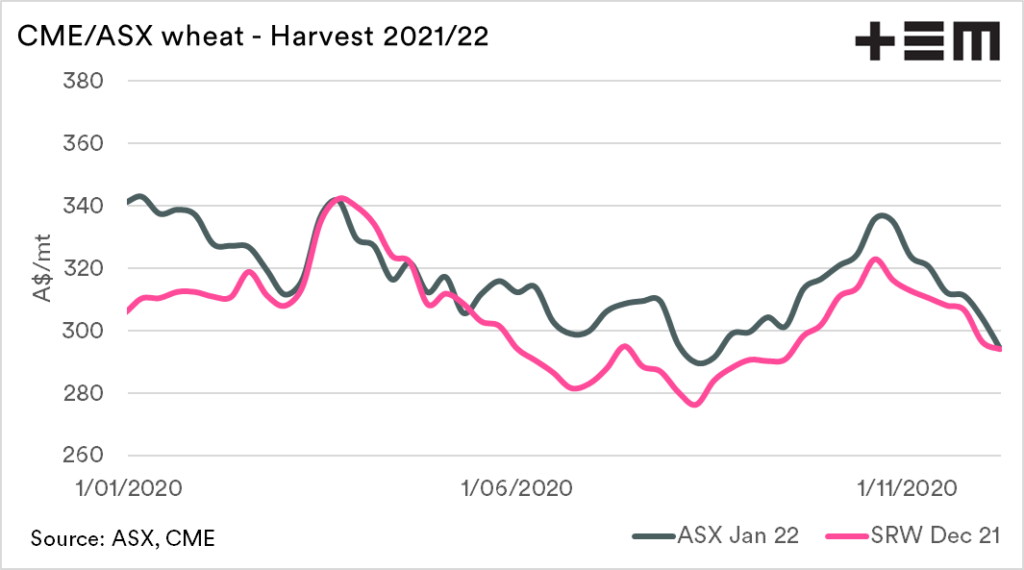

The ASX wheat futures contract for January 2022 is matching CBOT December pricing levels at A$294. The basis between the two contracts is virtually zero.

You now have to decide whether locking in prices at these levels is appropriate for your business. Our view is that parcels should be relatively small this far out.

An explanation of the forward curve is here