Market Morsel: Wheat goes up must come down.

Market Morsel

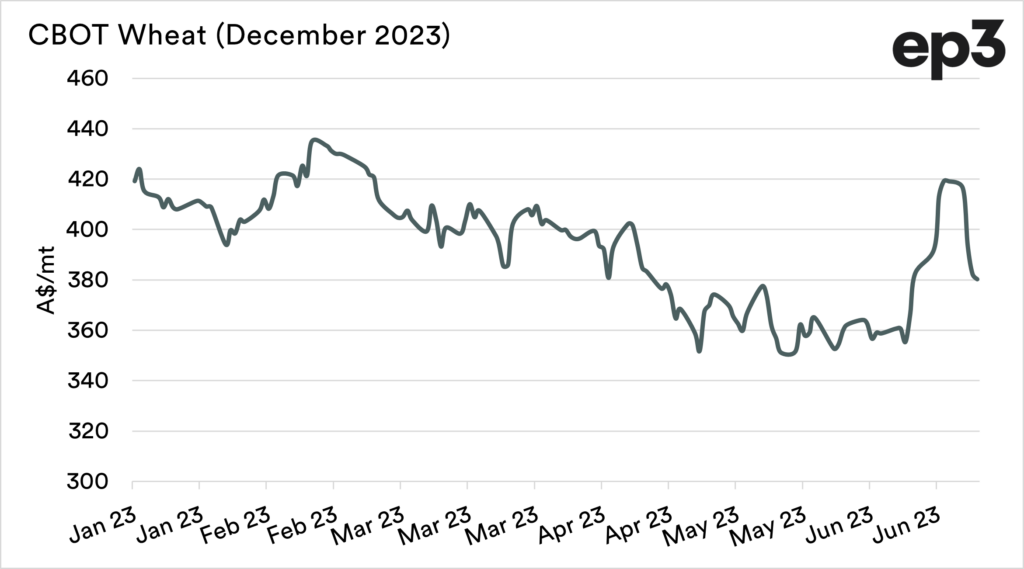

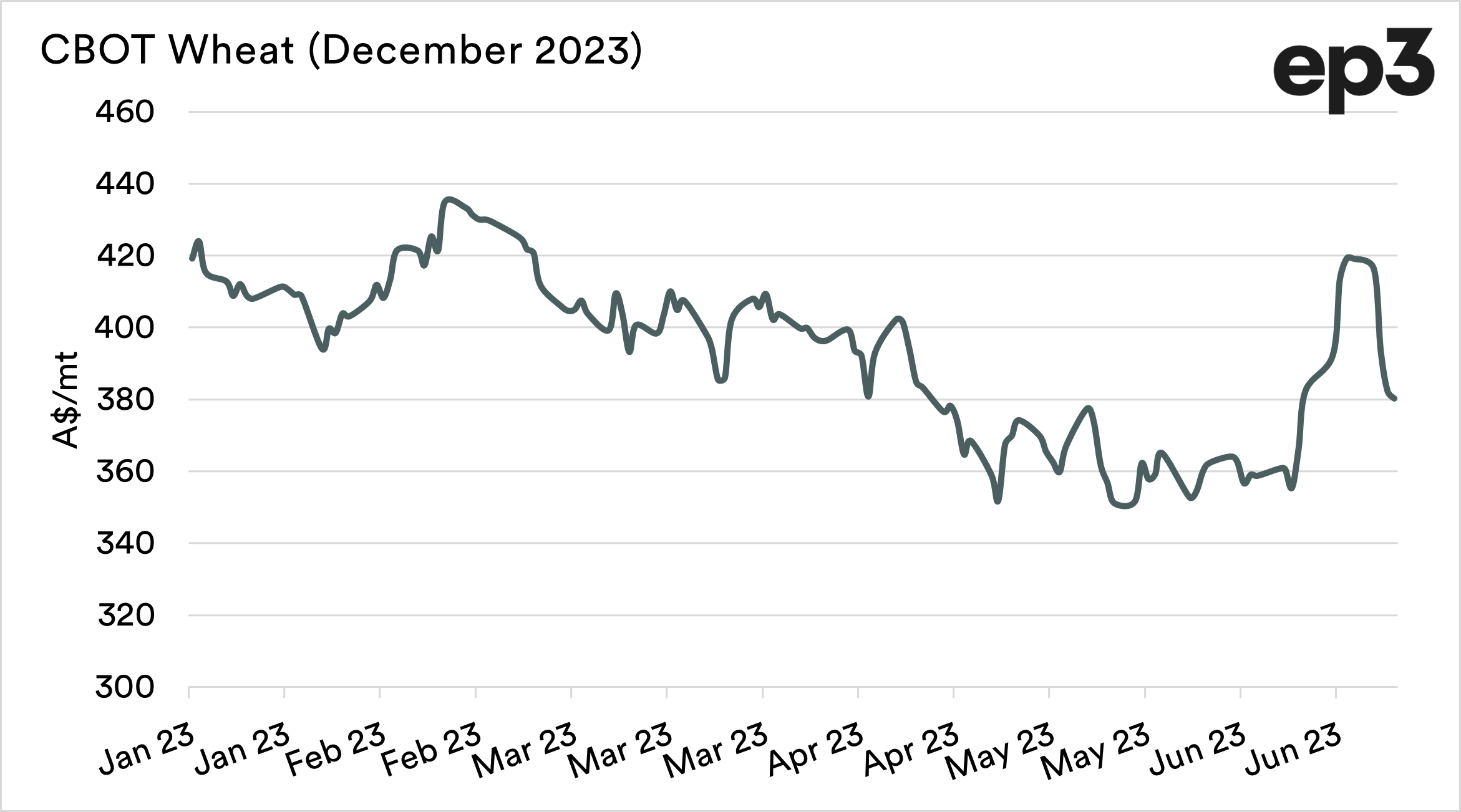

This time of year always seems to provide opportunities for pricing. However, they can be short-lived. We discuss this a lot; in fact, this was the subject of the first grain article on EP3 (well, technically TEM), which can be read here.

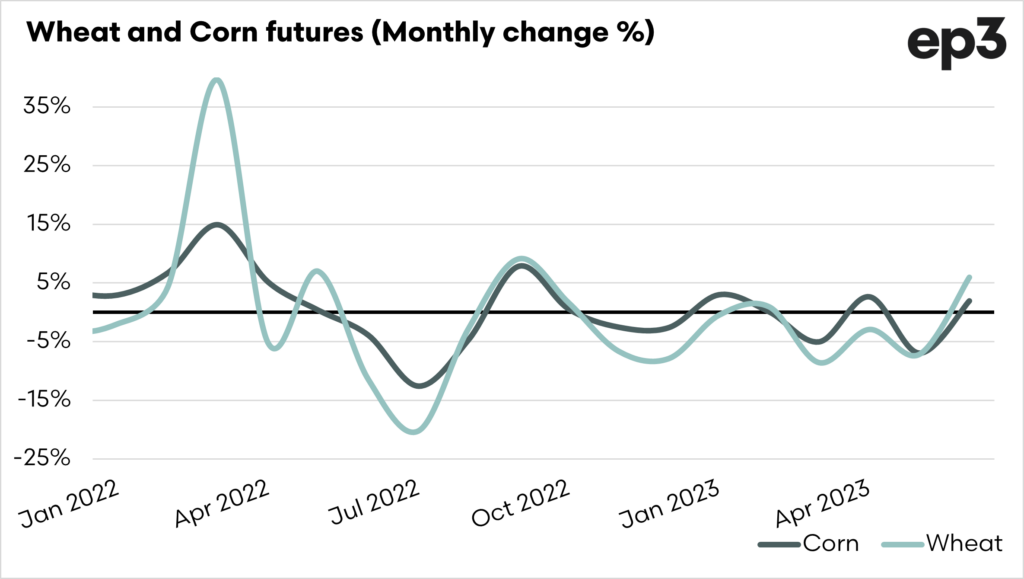

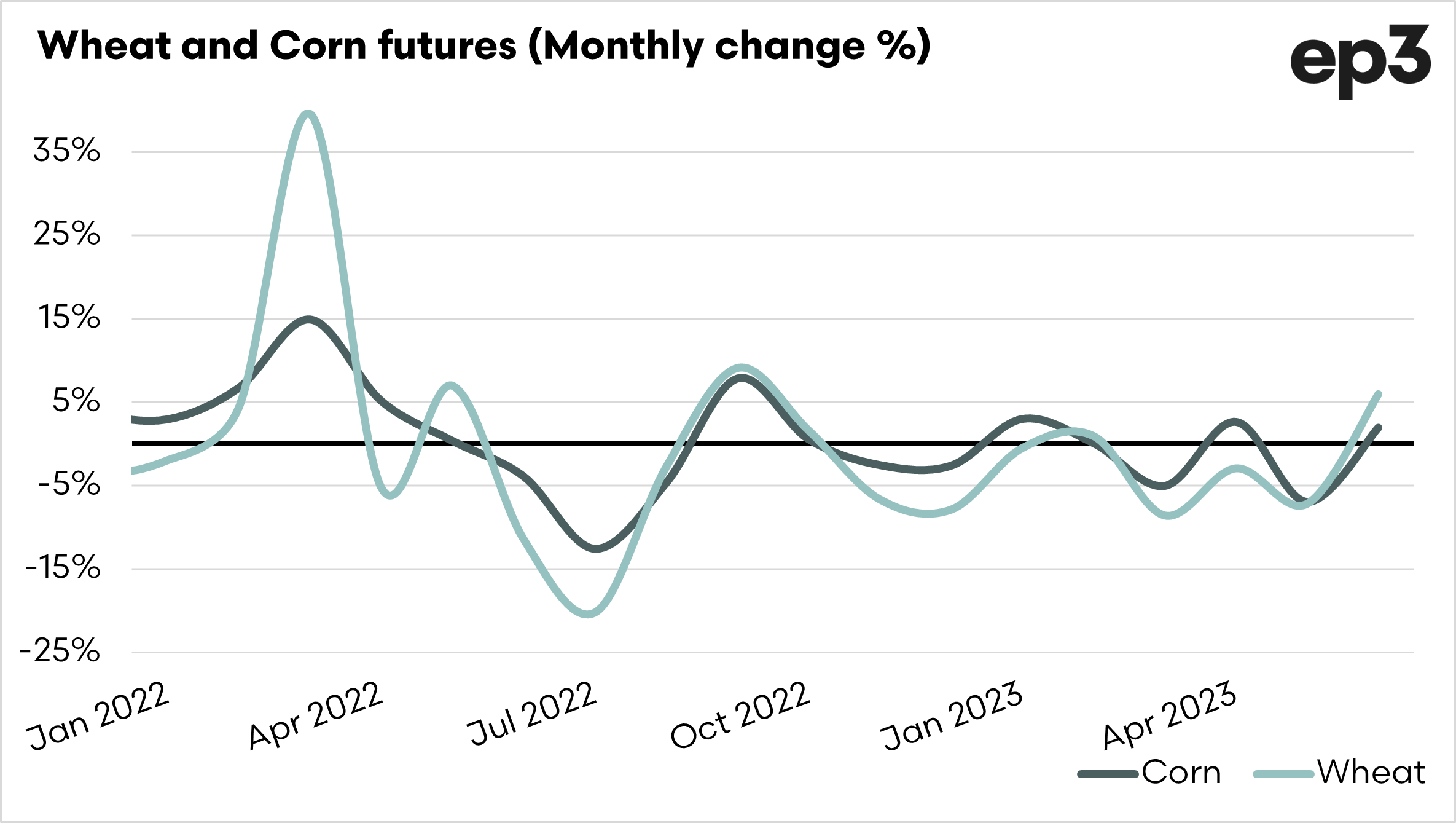

Remember one important thing. Volatility does not equal higher pricing (or lower). It is about the movement, up and down. The world is growing its largest volume of crops during these winter months, and markets can get spooked.

So the market has lost most of last week’s gains this week. Let’s look at why.

The big driver in recent weeks was the drought conditions pulling down. We had discussed this in recent articles. In recent days rain has fallen on the plains across Midwest. It is expected by analysts and the trade that this might stabilise the crop. It will still be on a bit of a knife edge going forward.

The deteriorating corn conditions resulted in speculators having to cover their shorts, which resulted in a short covering rally, which can result in those very sharp rallies.

Opportunities will come and go quickly in a market like we have at the moment. Wheat will likely get it’s biggest pushes from corn.