Opportunities in a volatile period

The Snapshot

- The middle of the year is when the majority (90%) of the worlds wheat is harvested.

- If there are any production issues with the major northern hemisphere producers, then this can lead to sharp movements in price

- Pricing volatility of CBOT wheat futures tends to reach its zenith during July.

- In the five seasons leading to 2020, the highest futures price of the year was achieved in June/July.

The Detail

In Australia, we have only just parked the seeding equipment, and are starting to spray the crop. However, we are in the middle of the most critical period for determining the pricing of grain for the next year.

On a per-capita basis, Australia produces the most significant volume of wheat in the world. At 1mt per person, we provide more than enough to meet demand. This is a considerable amount when you compare to the likes of the United States at 170kg per person.

Australia has a domestic demand for wheat averaging 7.2mmt, based on the average of the past decade. After this demand is met, the nation adds a significant volume onto the export market, the exception being during droughts. Even so, Australia is still a minnow producing only 3% of the world’s crop.

So with us only just in the early stages of the growing phase, why is the current period of paramount importance?

Approximately 90% of the world’s wheat crop is grown in the northern hemisphere and will be harvested between now and October. Due to the large volume of grain due to be harvested in the coming months, all eyes are on our northern cousins.

If a disaster occurs, especially in one of the critical regions such as the black sea or North America, then it will have a correspondingly significant impact upon prices.

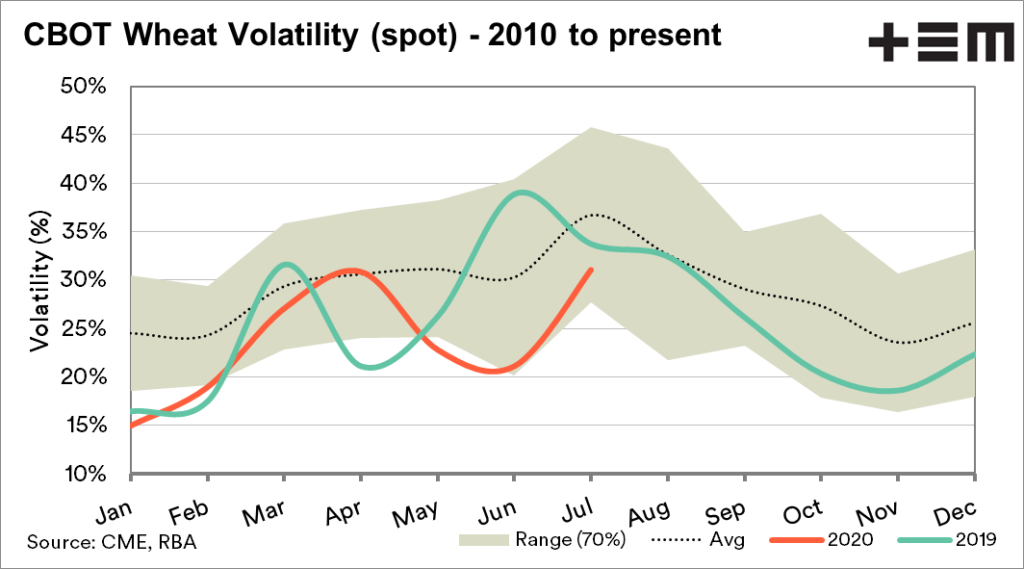

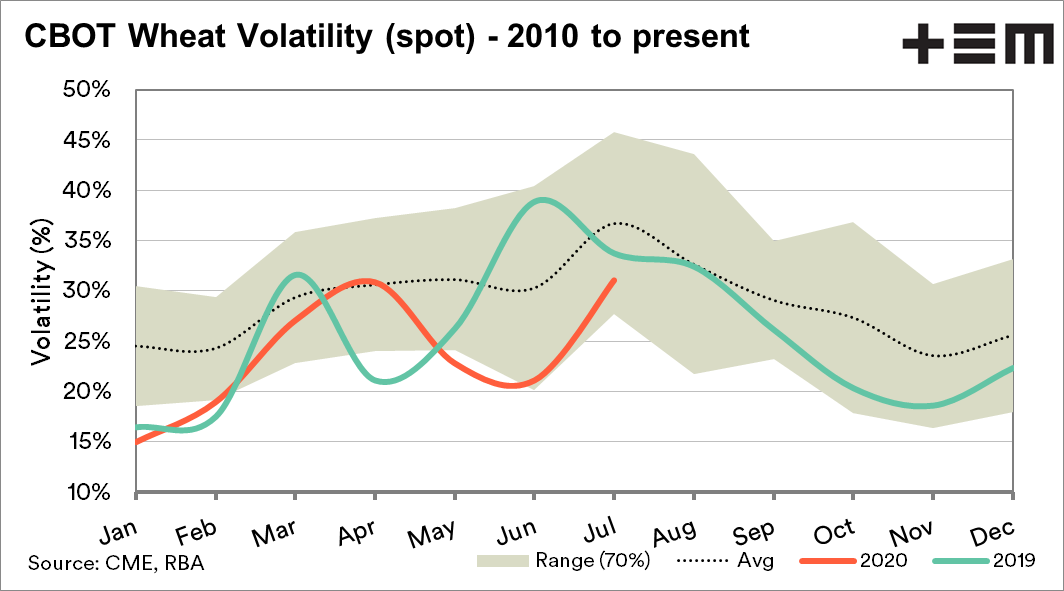

If we use CBOT as an indicator of global wheat markets, the volatility increases towards the middle of the year. The chart below shows the volatility range since 2010, and it is clear that volatility reaches its peak during July.

This volatility occurs because any news report of worsening crop conditions (or improving) leads to movements in pricing. At times this movement can occur as speculators look to take profits, which can lead to short term corrections.

It is important to note that volatility does not equal higher prices; it refers to the range of trading. So far in July, volatility has been lower than the expected range. At this stage of the month, pricing has generally been in a positive direction; therefore, lower volatility as the market is not going up and down.

This upward movement is caused by reductions in corn planting levels in the US, and deteriorating expectations of the Russian and European wheat crops. It is important to remember that global stocks of wheat are record high and that a market that goes up can also quickly correct itself.

In the preceding five seasons to 2020 the highest futures prices of the year were achieved during June/July. After strong rallies, the drag of strong balance sheets had a gravity effect and dragged them back lower.

At the time of writing, the marketing is taking off like a rocket. However, rockets always return to earth! At this stage of the season, there is still an extended marketing period for your crop. One option is to market in bite sizes and based on recent seasons taking a small portion during a July rally is not a bad idea. As the old proverb goes ‘a bird in the hand, is worth two in the bush.’