Market Morsel: Where to hedge wheat?

Market Morsel

Price risk management is crucial to both sellers and buyers of grain. If you are a seller, you want to protect against prices falling, and vice versa for buyers.

There are many ways to protect from price risk, and one of them is through the use of futures contracts. These tools are generally underutilised by Australian producers but are a valuable resource.

Two old adages apply in hedging. Correlation does not equal causation, and past performance is not an indicator of future performance. That being said, it is always worthwhile looking into the data to see which hedging tools have traditional had the strongest correlation.

If the hedging tool has a strong correlation, it is more likely to relate to your own price risk. There is no point in protecting price risk with a product that moves in the opposite direction to your own local pricing.

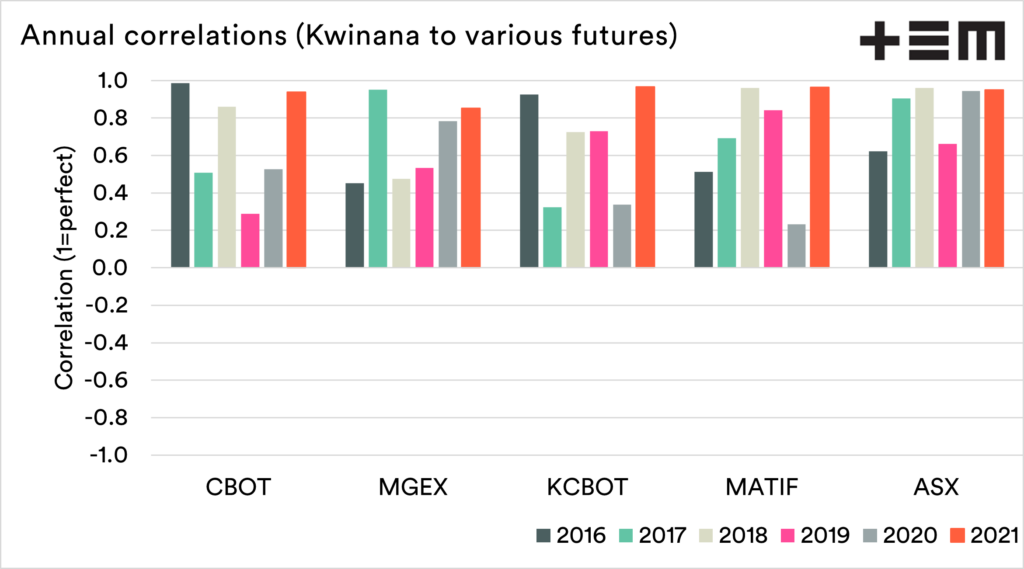

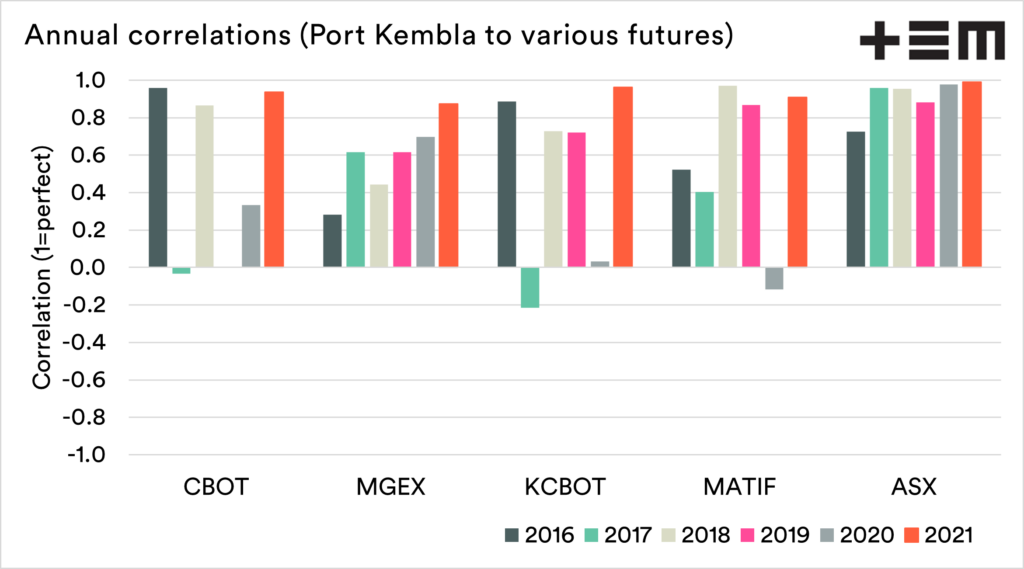

The charts below show the annual correlation between Kwinana and Port Kembla to various futures markets. A perfect correlation is 1. These are taken as a monthly price.

Consistently ASX has the closest correlation over time for both. It is important to remember when using ASX, you are effectively locking in a domestic contract, with a large proportion of your basis priced in.