Market Morsel: You look really rice; I want you.

Market Morsel

In commodity markets, substitutability is important. As we have covered many times in the past, many commodities have a certain amount of replaceability.

This is especially so in the grain and oilseed markets. We see close relationships between all sorts of commodities.

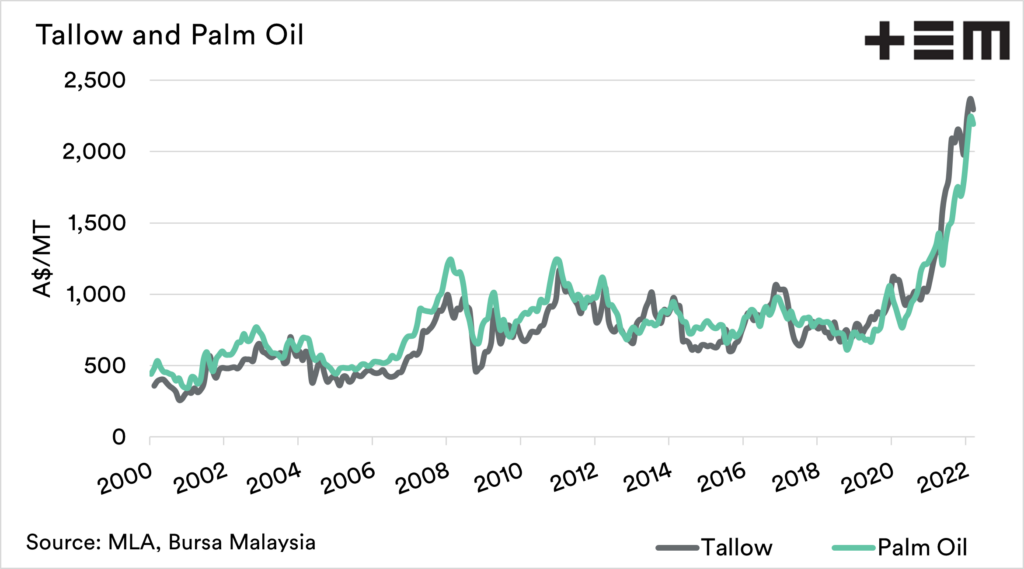

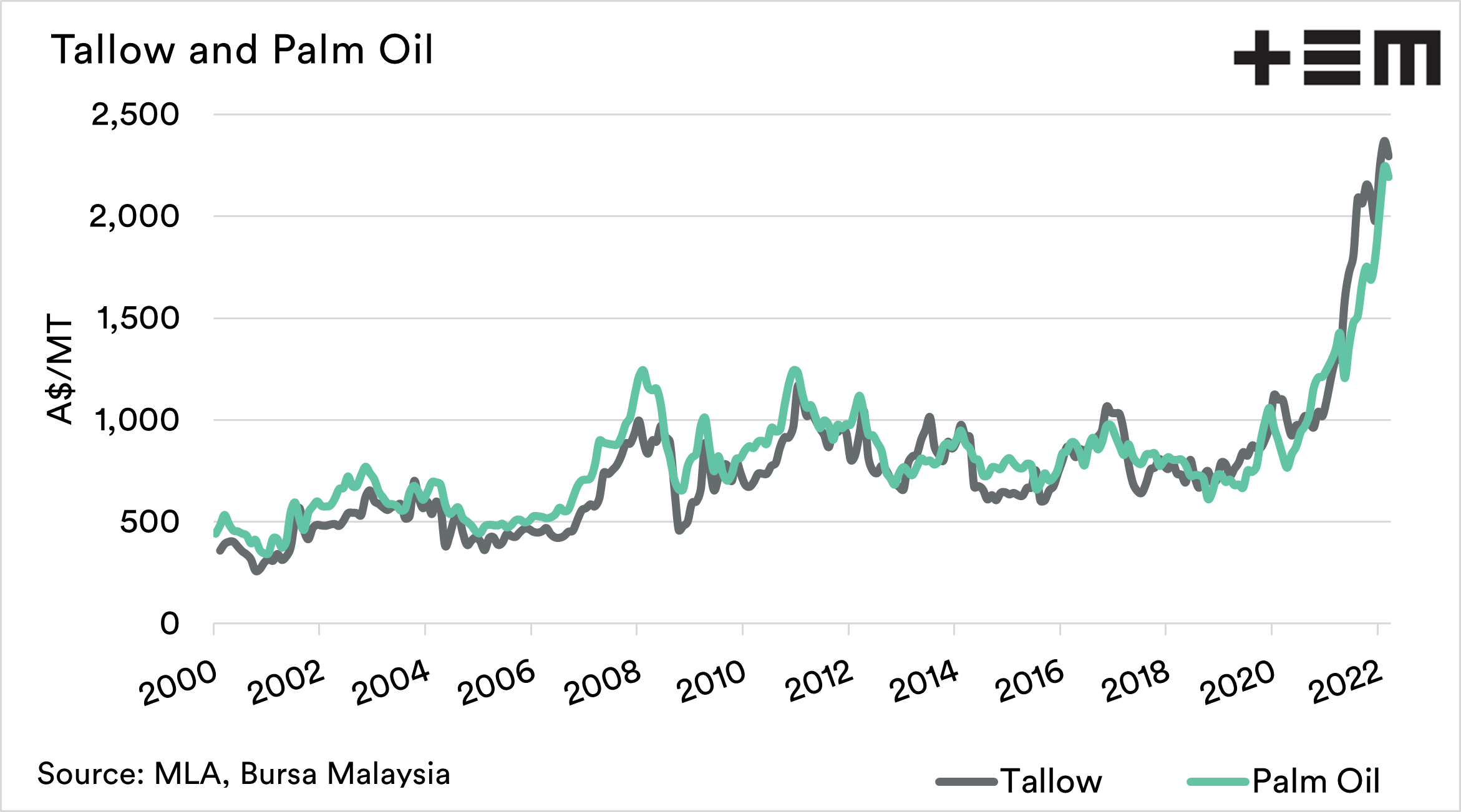

I like the below example of tallow and palm oil. We can see from the chart that the two commodities track one another with a strong relationship. This is because they are ultimately replaceable with one another eg you can fry chips in either. If one becomes too expensive relative to the other, it will be substituted.

Another example is in grains; many feed consumers, such as pigs, will move from wheat to barley when prices of barley fall. When barley falls relative to wheat, inclusion rates of barley will increase.

There is another commodity which is now coming into the mix. In Asia, rice is abundant.

Asian feed buyers are struggling with the huge costs of traditional grains such as barley, corn and wheat. They are now looking at their inclusions of rice in feed rations.

It is important to note that rice does not have the nutritional benefits of the other grains and cannot fully replace the traditional grains, but it can reduce the feed cost.

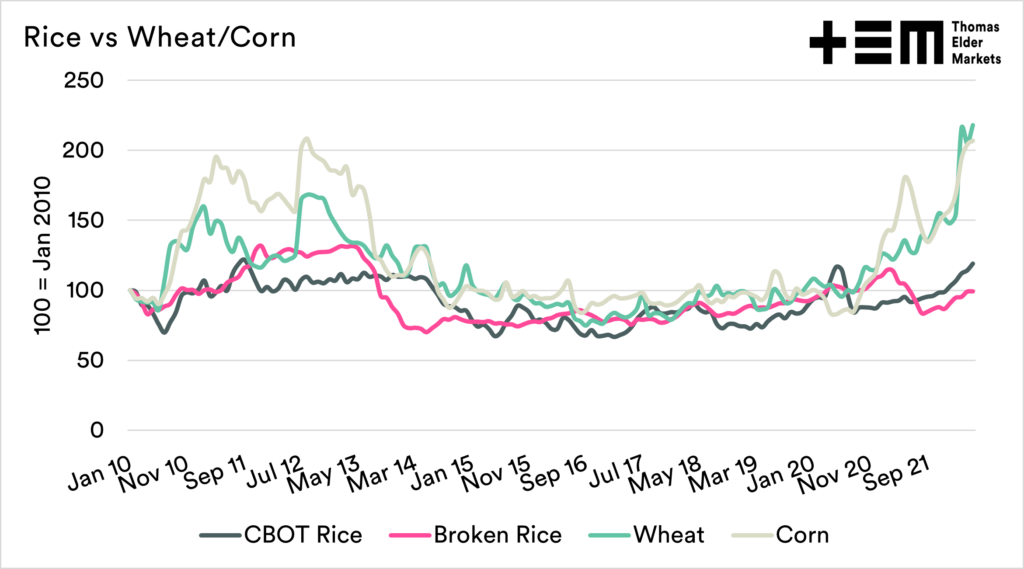

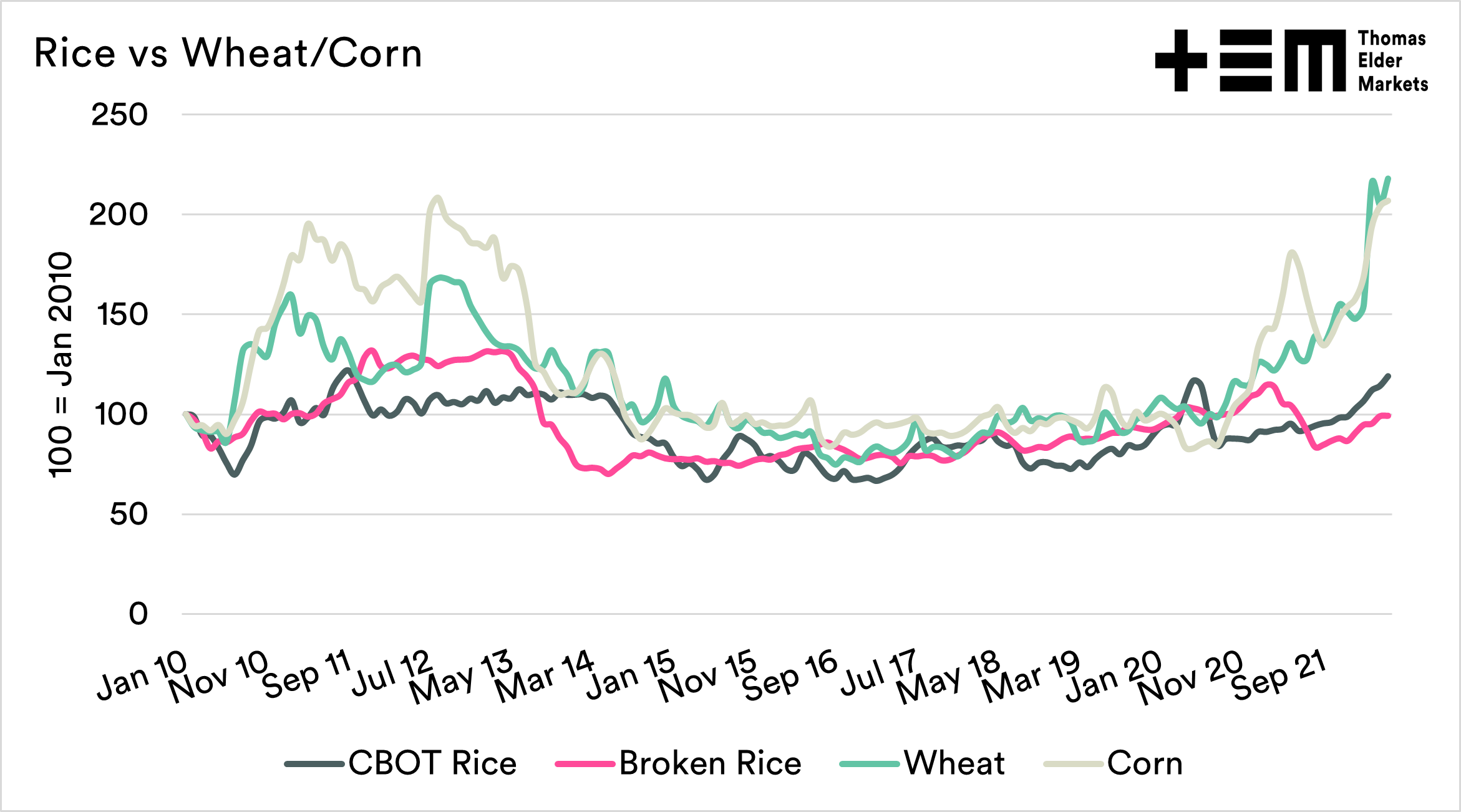

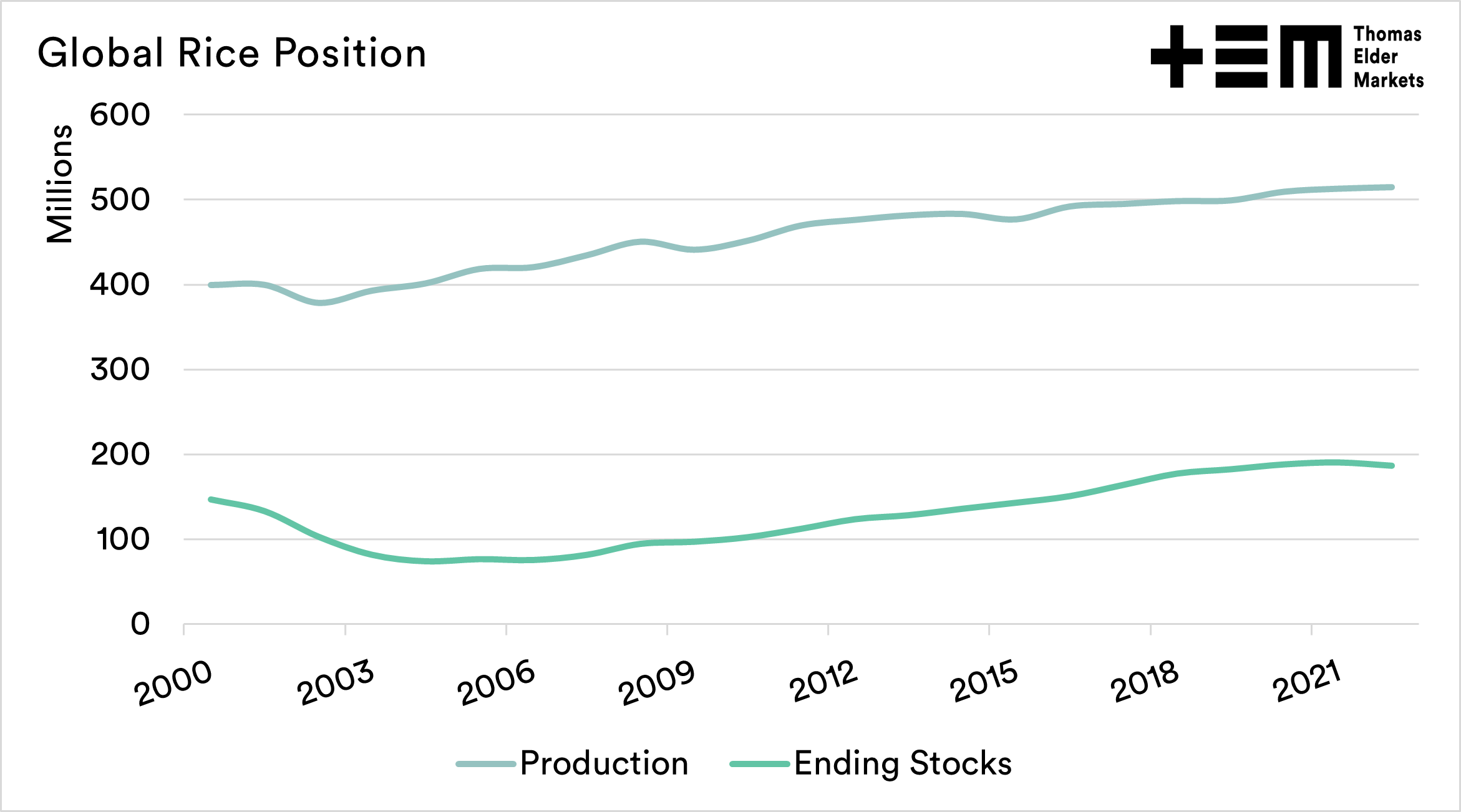

In the second chart, I have created an index of wheat, corn and rice pricing since 2010. One of the important points is that rice prices, whilst they have risen, have not felt the same effect as the other grains.

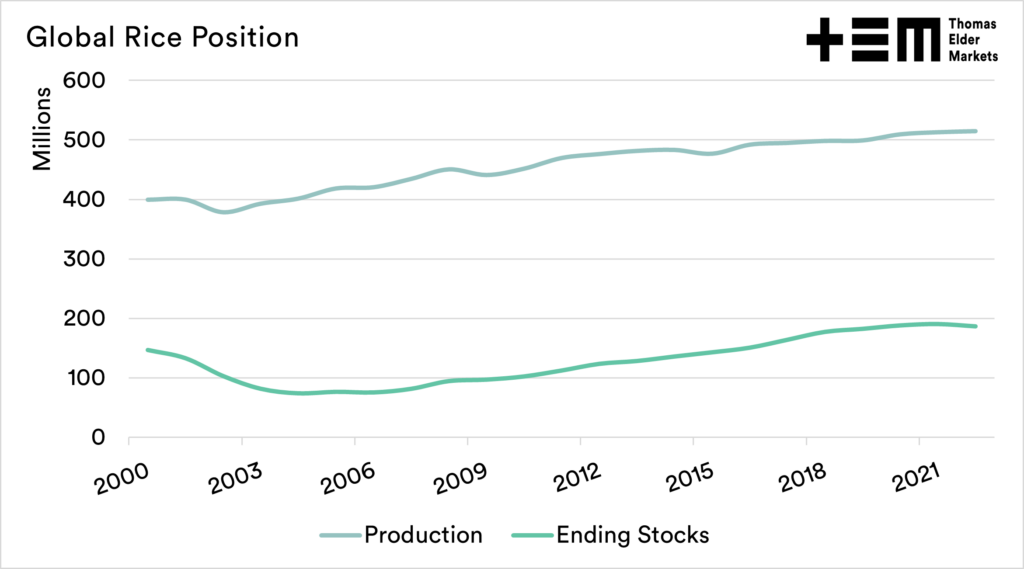

While the other grains have been driven firstly by the invasion of Ukraine, then worsening conditions around the world, which have reduced supplies. Rice, on the hand, has strong fundamentals, with large stocks, which has helped keep prices low relative to the other grains.

With the lower nutrition and dehulling costs, the question is how much rice can make it into the feed ration, and will that offset some demand for the traditional feed grains?

One thing is for certain, feed consumers are massively struggling, and they will be looking at every cost and every opportunity to reduce their outgoings. This will include substition, but also eventually destocking.