Russia versus Australia.

The Snapshot

- One of the largest drivers in recent times has been the volume of wheat available from Russia.

- Russia has come a long way from being a net importer of wheat, to now being the most important.

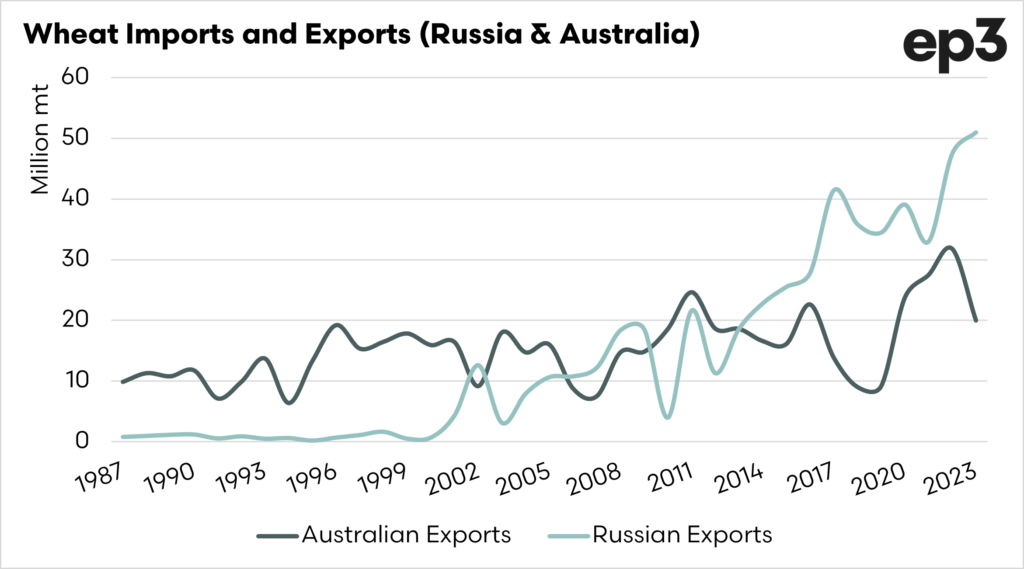

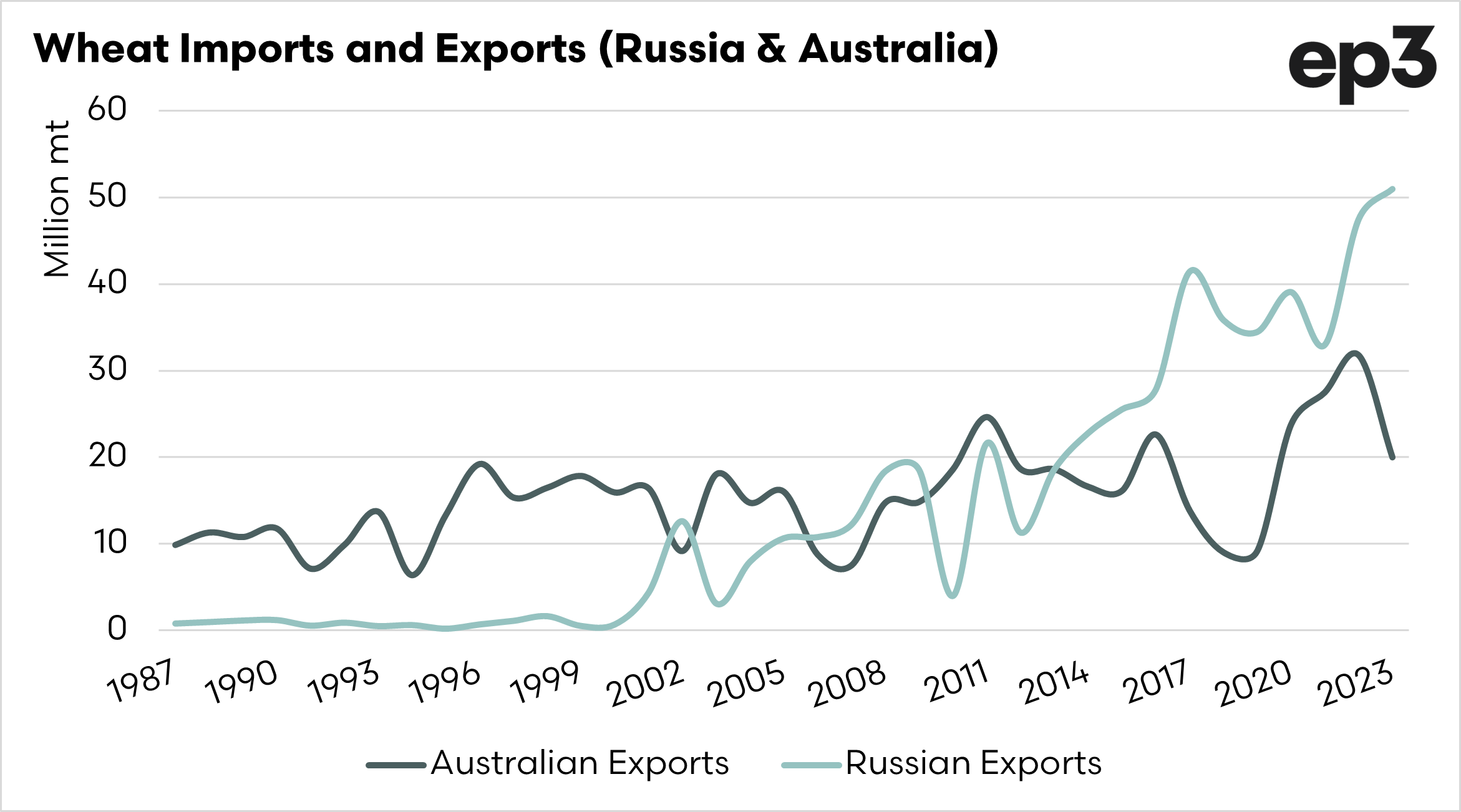

- Last year Russia was responsible for around ¼ of global wheat exports. Australia was important, but lower at 9%.

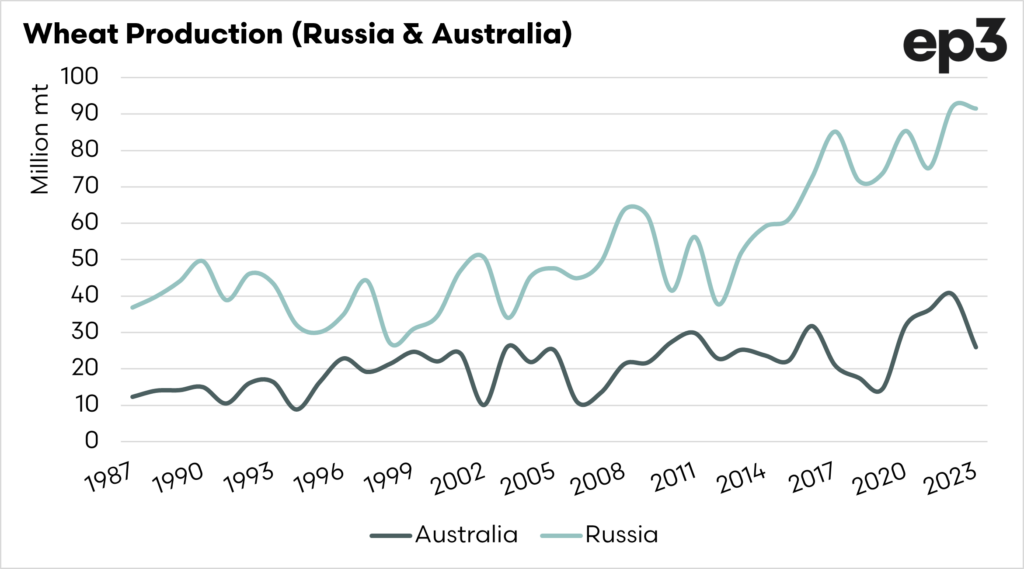

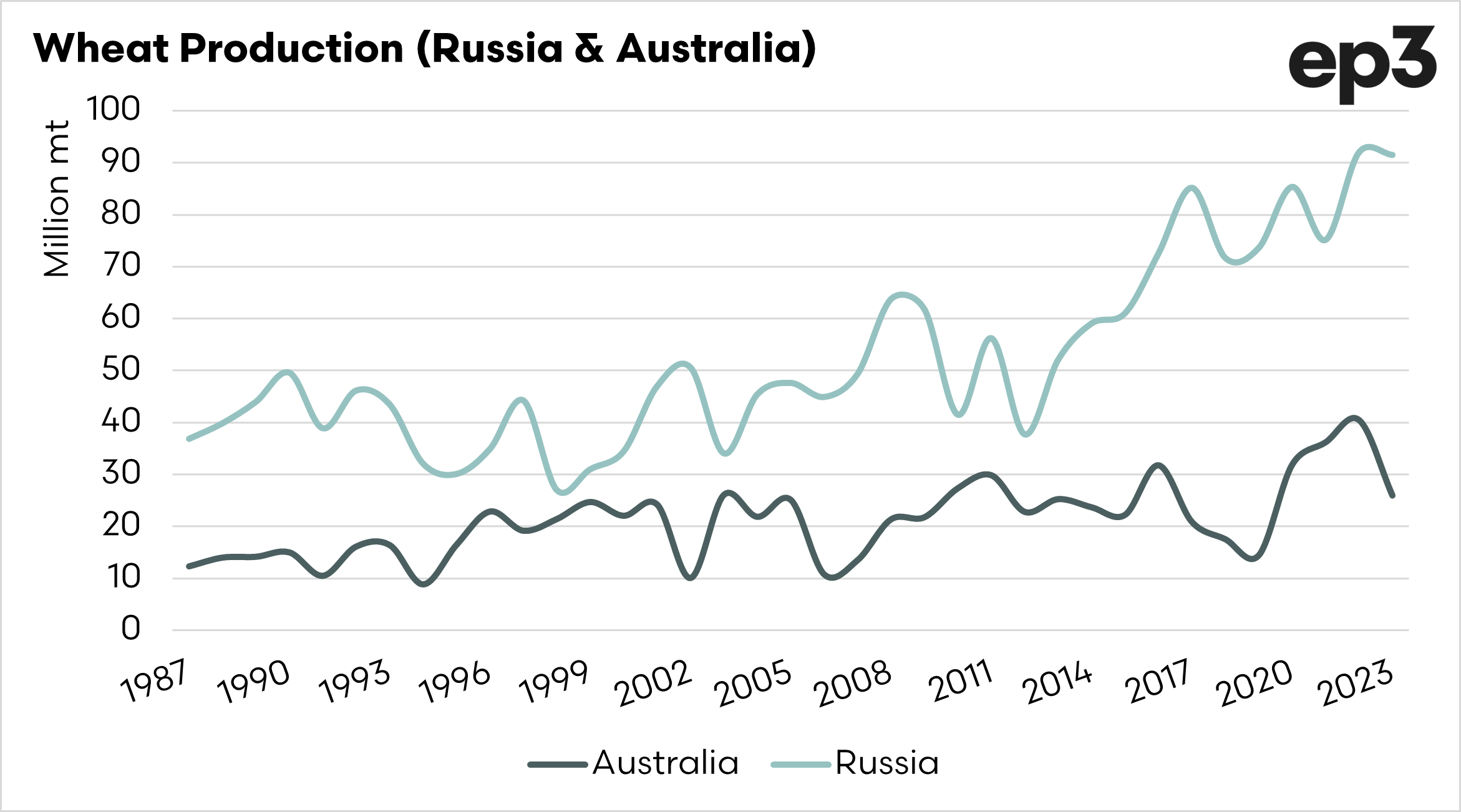

- Russian wheat production has increased by 97% since the turn of the century, while Australia has only increased by 43%.

- Russia was starting from a much lower base.

- Russia will continue to drive the wheat market for a long time.

- It is worrying that the world is so reliant on a nation that is quite volatile.

The Detail

One of the biggest downward drivers in the wheat market in recent months has been cheaper wheat coming out of Russia. I thought it was worthwhile having a quick look at the advance of Russia and some comparisons to Australia.

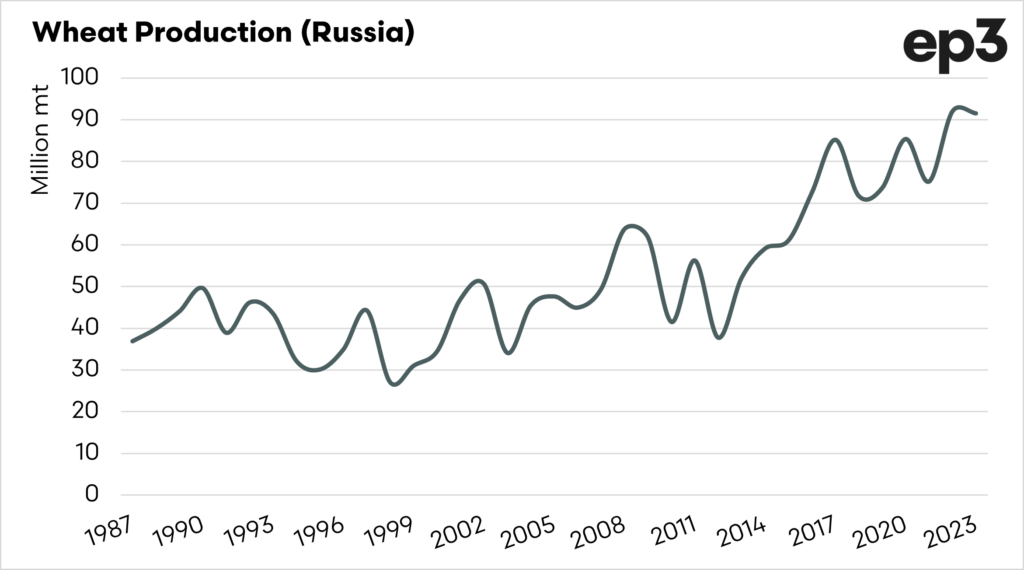

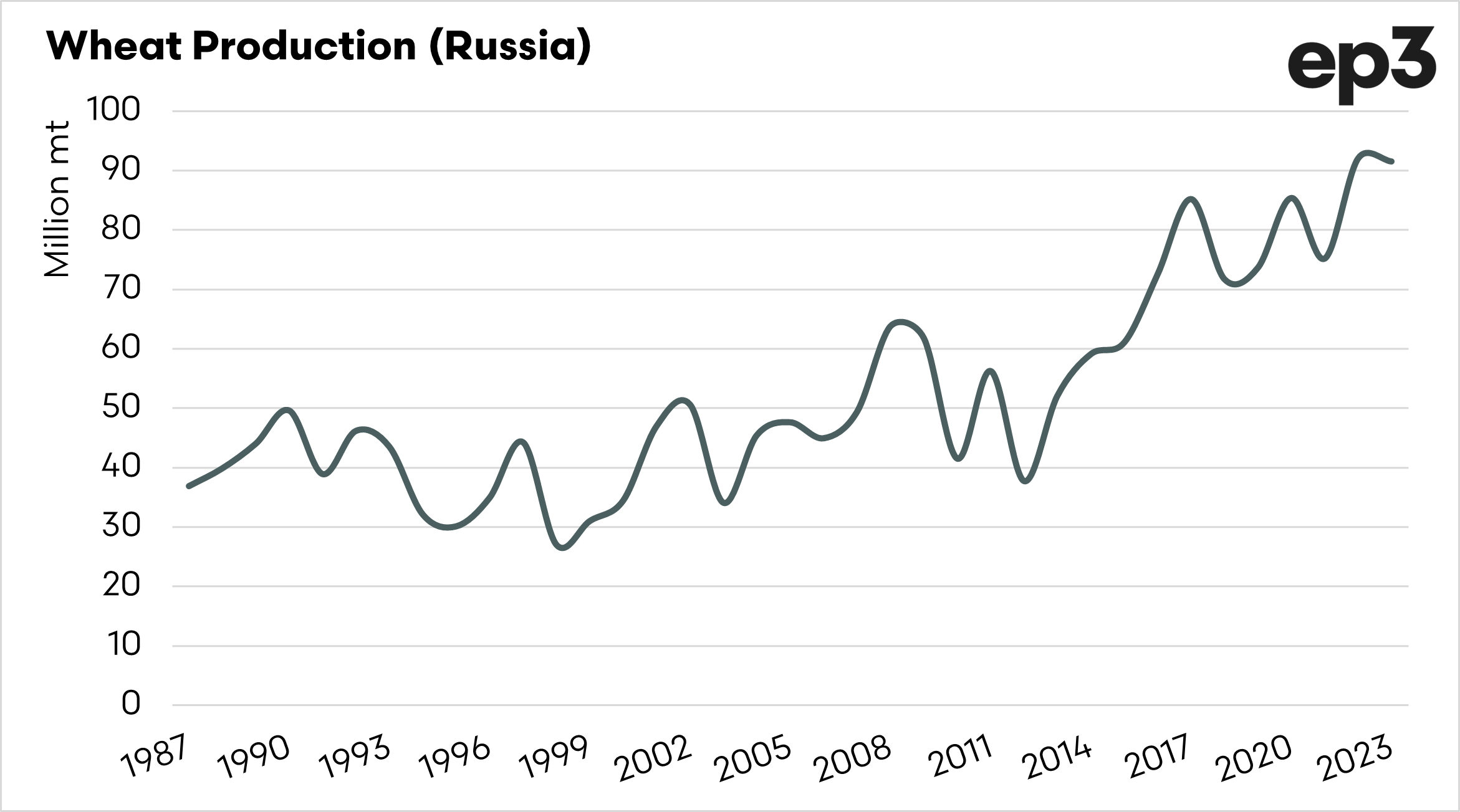

Russia has come a long way in a relatively short period. In 1988, Russia produced 36mmt during the last two years, and despite the ongoing war, Russia has produced over 90mmt.

There are a number of reasons for this, some key ones below:

- Privatisation: During the USSR, huge state-run farms were the norm, leading to many inefficiencies. The privatisation of these assets lead to great efficiencies and great yields.

- Technology: Russia post-USSR had access to all the technologies available to farmers in the Western world.

- Higher area: Russia has massively expanded its grain-growing area.

The most impressive change in the Russian wheat industry has not been production but the advance of Russia as an export nation. That change is what puts them in direct competition with Australia.

Russia’s population is approximately 143m, around 5m lower than during the early nineties.

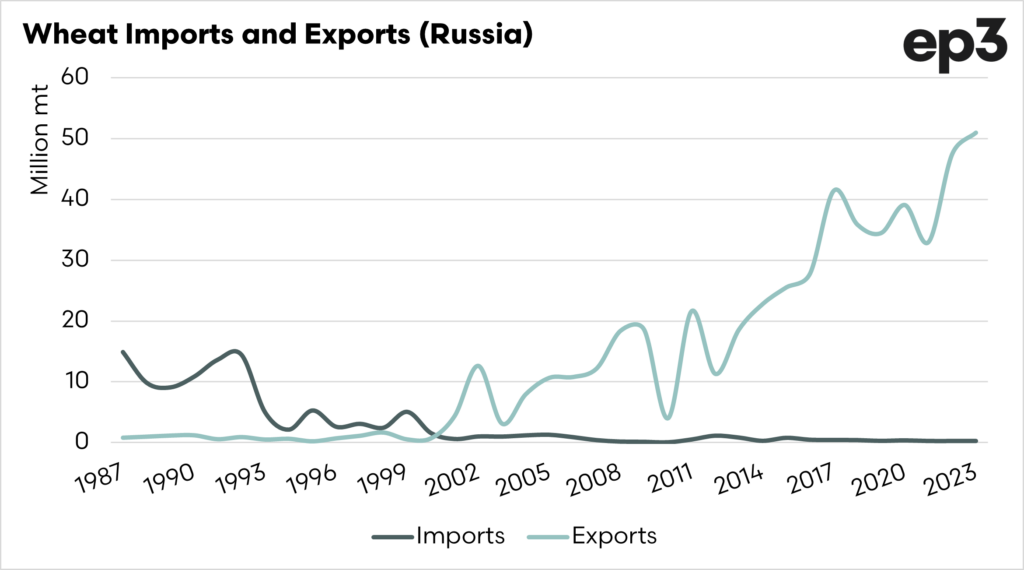

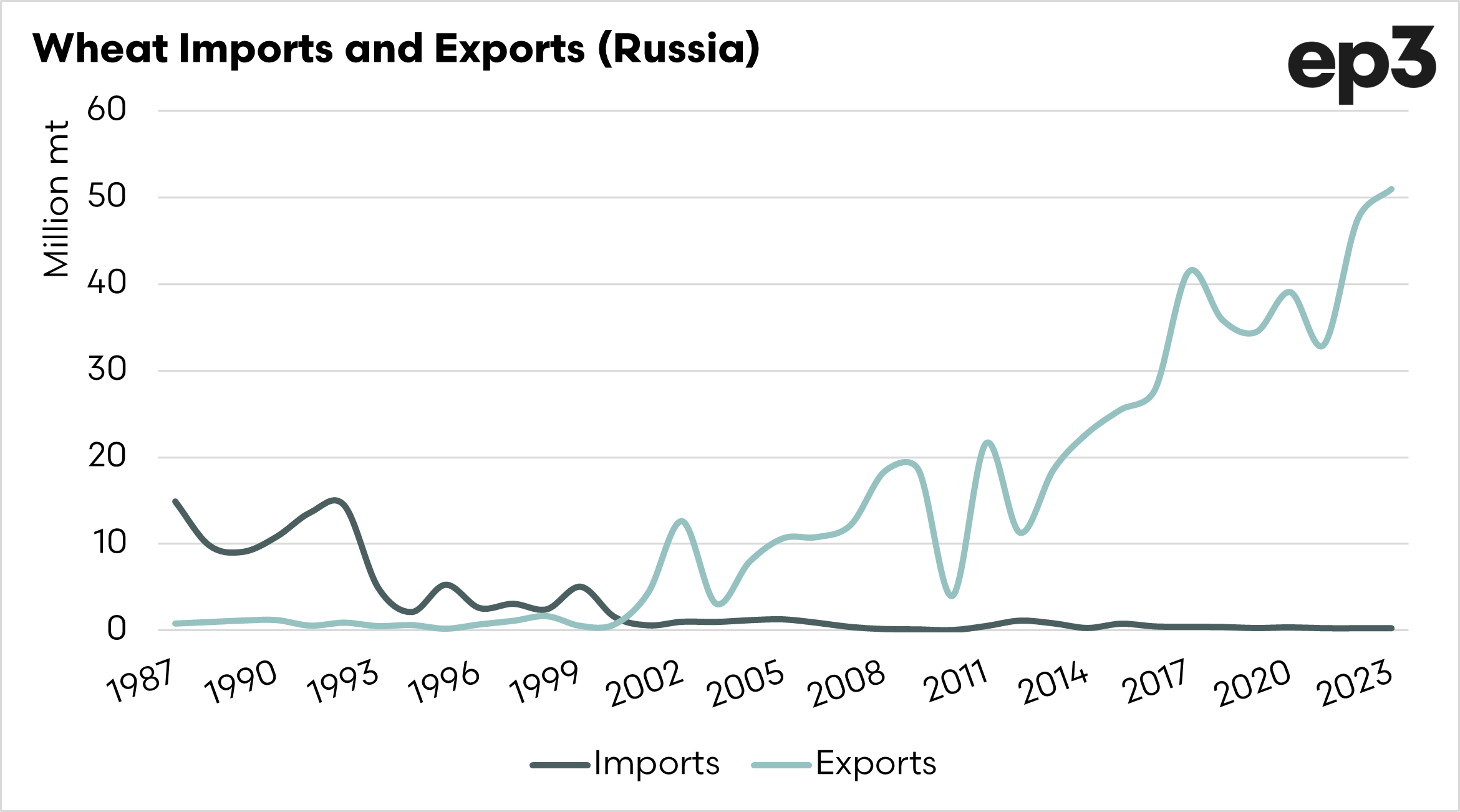

The chart above shows the imports and exports of wheat from Russia since 1987. It was not until 2000 that Russia exported more wheat than it imported. Prior to this, Russia was reliant on wheat imports.

According to the USDA, Russian wheat exports hit a record 51mmt last year. This is approximately a quarter of all the wheat exported around the world. So this really highlights why the black sea region is so important for global wheat trade flows.

So how do we compare against Russia?

The above chart displays the production of wheat in Russia and Australia. The advance in Russia has clearly been far higher in the past twenty-odd years than in Australia. However, before we start berating ourselves, Russia has started from a much lower base.

They had more land available to access and could introduce technology, which we already had.

Let’s compare production from the first five years of this century and the last five years. Australia has increased production by 43%, while Russia has increased production by 97%.

Wheat exports from Australia have averaged 17mmt since 2000, with some exceptional levels of exports in the recent record seasons.

When we have periods of drought, our exports can drop to below 10mmt, which will require some of our key destinations to purchase from other origins. This occurred in 2018 and 2019 when Australia could not fulfil Indonesia, and larger purchases came from the black sea.

It will be interesting to see if productivity gains outweigh increases in domestic consumption in the coming decade and whether our export volumes increase. Recent record seasons were caused largely in part by almost perfect weather across much of the wheat belt. We can’t rely on the weather always being like that.