The canola curve

The Snapshot

- The forward curve represents the horizon for a futures markets. It shows each trading expiry date.

- The market can be in either contango or backwardation.

- A market in contango is where the forward months are trading at a premium to present; backwardation is the opposite.

- A futures market tends to be in contango, where a premium or carry is paid for forward months.

- At the moment the canola/rapeseed futures market is in backwardation.

- This suggests that the market is keen to have ownership now as opposed to a years time.

The Details

One of our subscribers was asking about the current canola futures market and the fact that it is in backwardation. I thought it was a worthwhile time to take a look at the forward curve, as a refresher, this time on the canola market.

A tool worth using is the forward curve. The forward curve is a chart which we will often refer to in EP3 articles, as it provides a quick view of the market. The forward curve details the price for each of the contract expiry date for the futures contract of a commodity.

The curve gives an instant snapshot of where you could theoretically buy or sell the commodity.

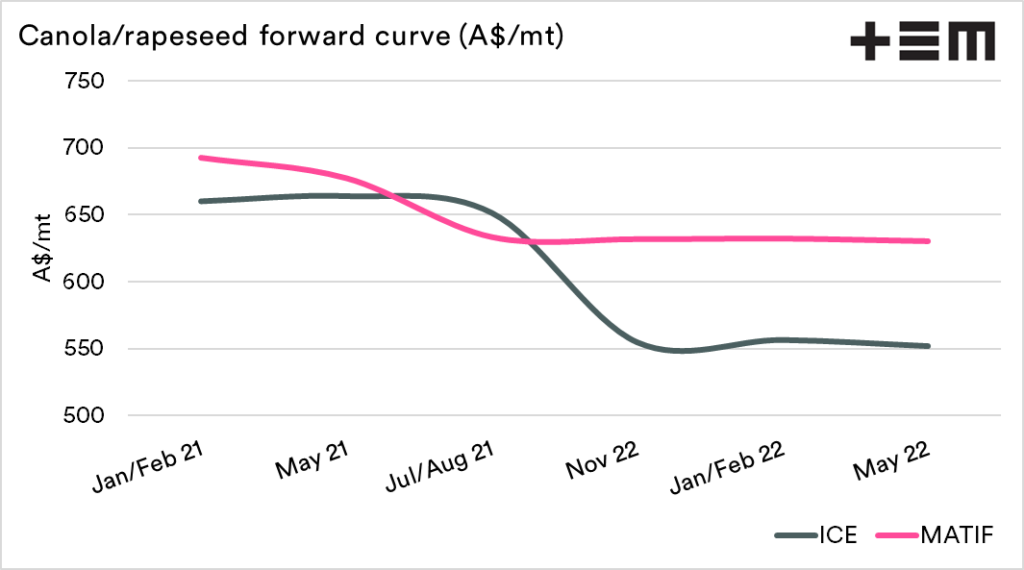

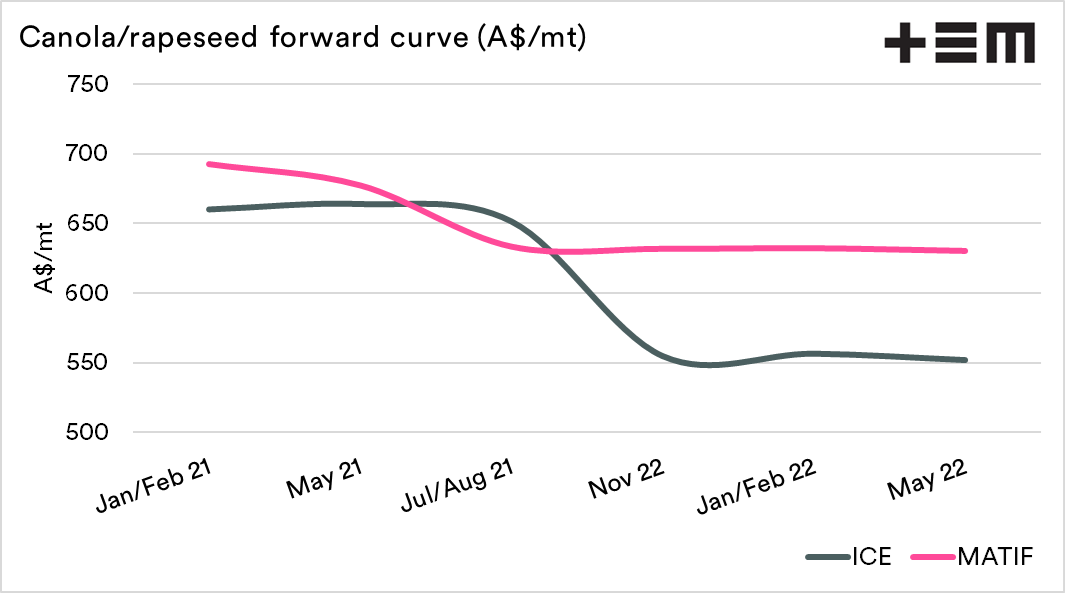

The chart below details the forward curve for both canola (ICE) and rapeseed (MATIF) expressed in A$/mt. As we can see, both futures markets are discounted for future months. This means the market is in backwardation – more to follow on that.

The ICE market has a particularly big inverse, and that can be explained due to their current low production (see here). In theory, the trade believes that production will revert to normal next year, therefore does not want to pay a premium.

Contango and backwardation

Contango:

A forward curve is in contango when the forward futures months are at a premium to the spot level. In the above chart, the market is in contango, as each of the months ahead is higher than the September contract.

The futures market in contango is effectively paying a premium for the seller to carry the crop.

Backwardation:

As you might expect, backwardation is the opposite of contango. The forward curve is in backwardation when the forward market is trading at a discount to the spot market.

When in backwardation, the market is effectively wanting access to grain as soon as possible and does not want to pay you to carry the grain.

What does it mean?

Just because the market is at an inverse does not mean that the market will fall as we move forward. As we move forward in the year, the futures price could either converge up or down dependent largely on conditions in the coming crop.

At present, it doesn’t necessarily show a price that is particularly attractive to hedge, unlike when the market is displaying a strong forward premium.