The Dark Side of Grain Pricing.

The Snapshot

- Grain prices in Australia are strong, compared to historical levels.

- Relative to Chicago wheat futures, Australian levels are at the largest discount since at least 2002.

- There are reasons behind this, including logistics and quality.

- Basis levels for the crop being planted are also at extreme levels, despite no immediate logistical challenges.

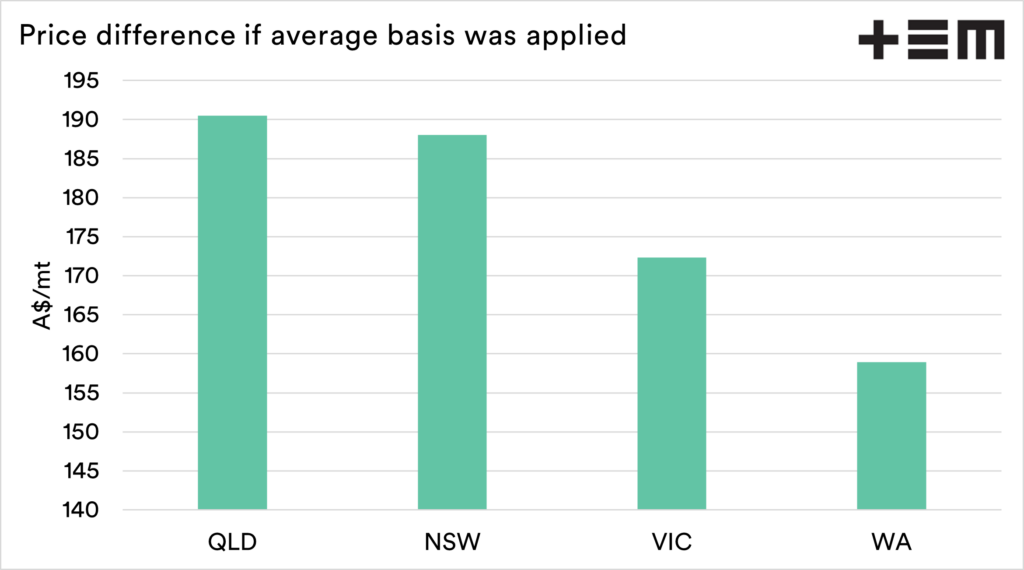

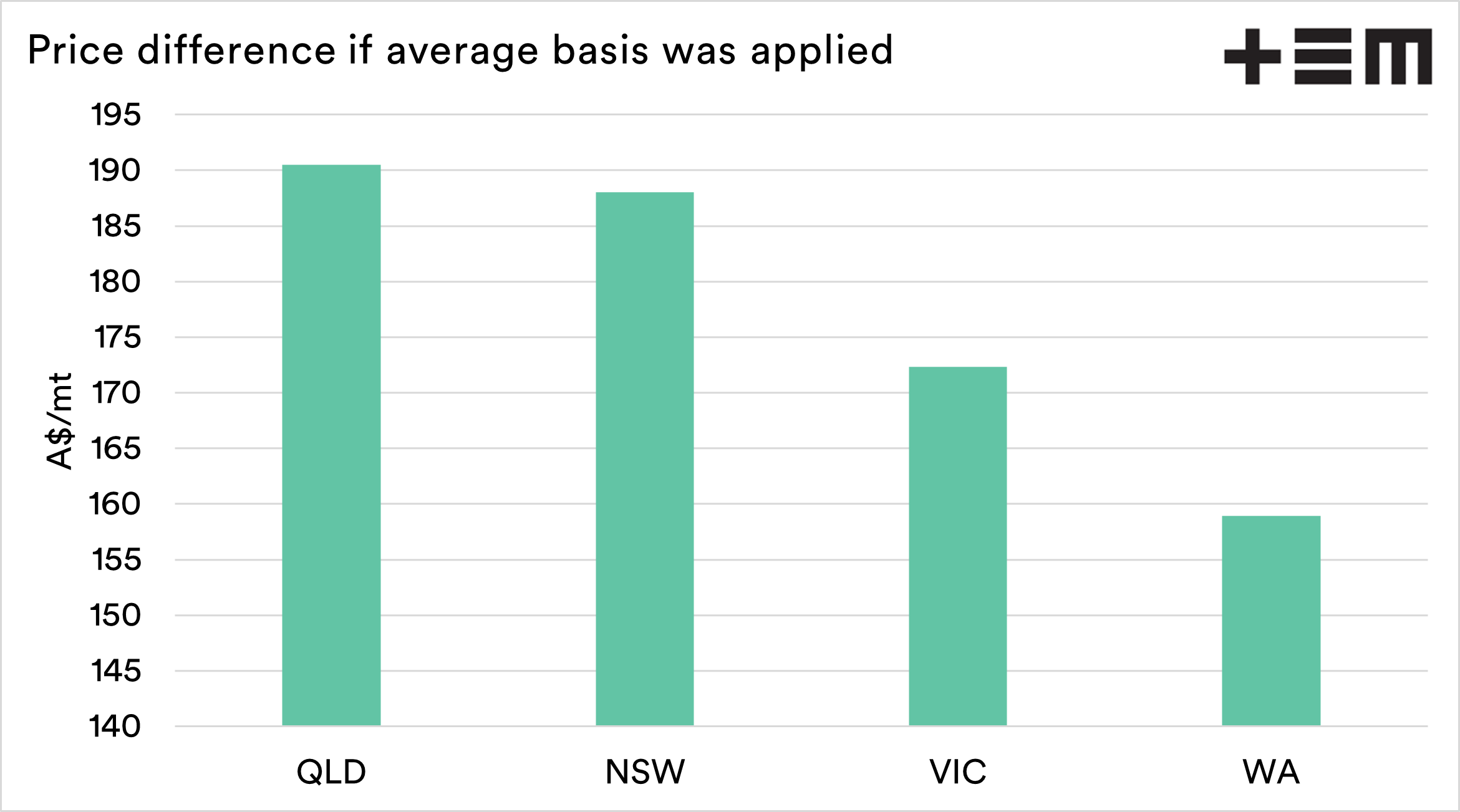

- Hypothetically if basis levels were back at average levels, we would see a A$150-190 higher return.

The Detail

Right through this year, and most of last, we have been talking about the discount that Australian wheat is facing versus the rest of the world. As we start approaching the middle of the year, we thought it was time to revisit how we compare.

I have chosen to look at AGP1 for this analysis, as we have a long time series of data, and a large proportion of the crop was downgraded this season.

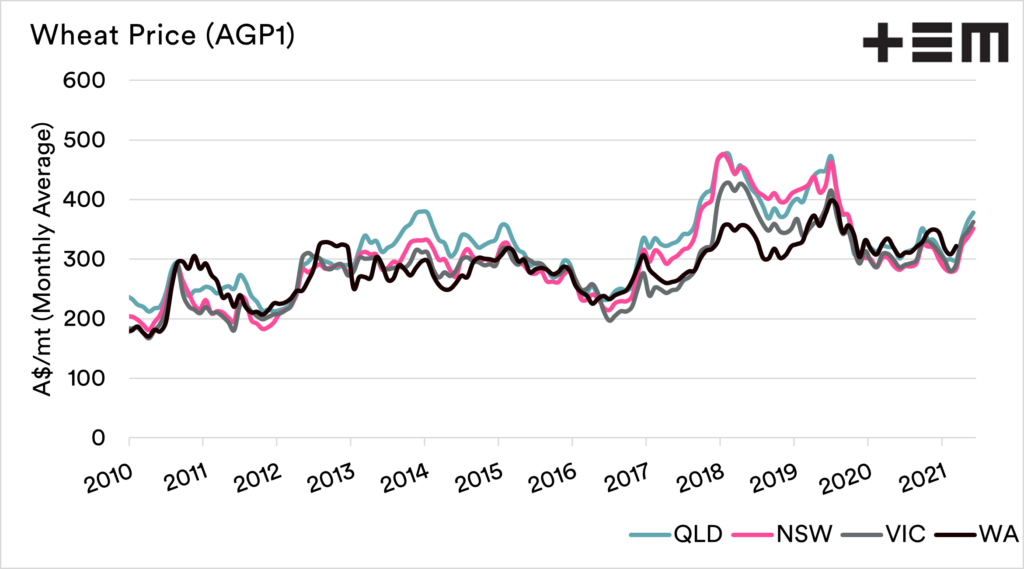

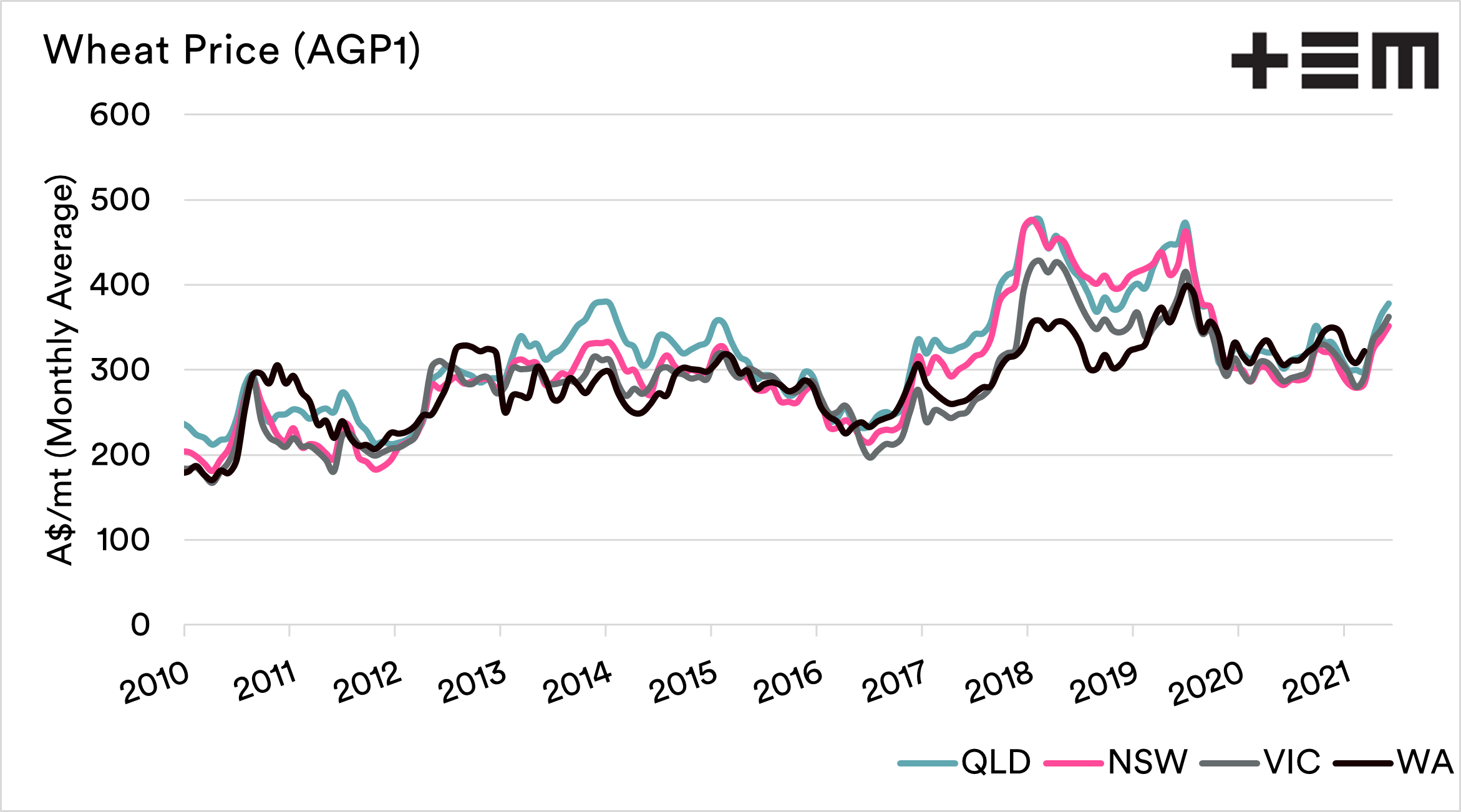

Let’s take a look at the chart below. It shows the monthly average price of AGP1 from 2010 to the present. The prices being paid at the moment are not too shabby, in fact, they are considerably higher than the average for the period (forget about inflation).

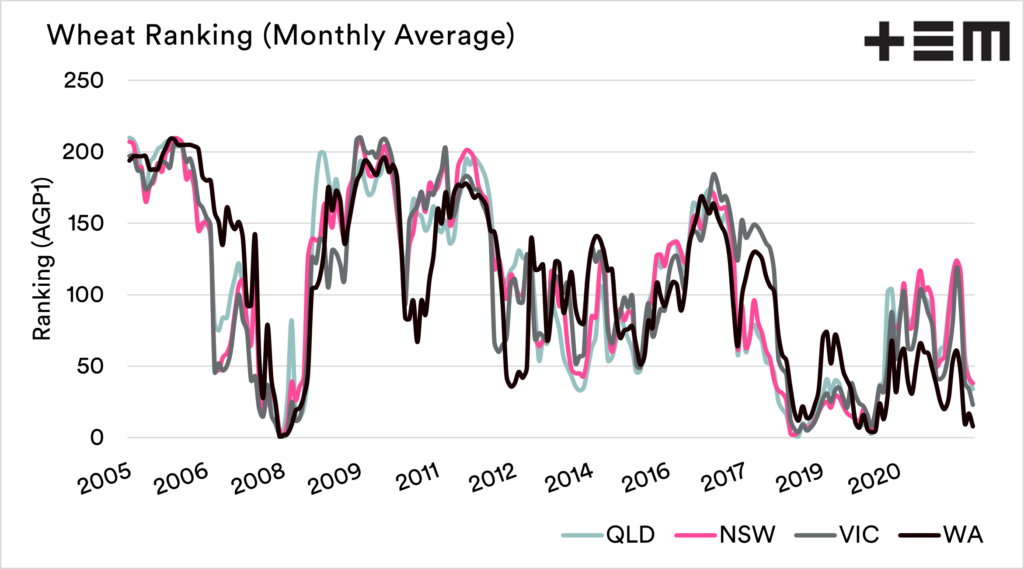

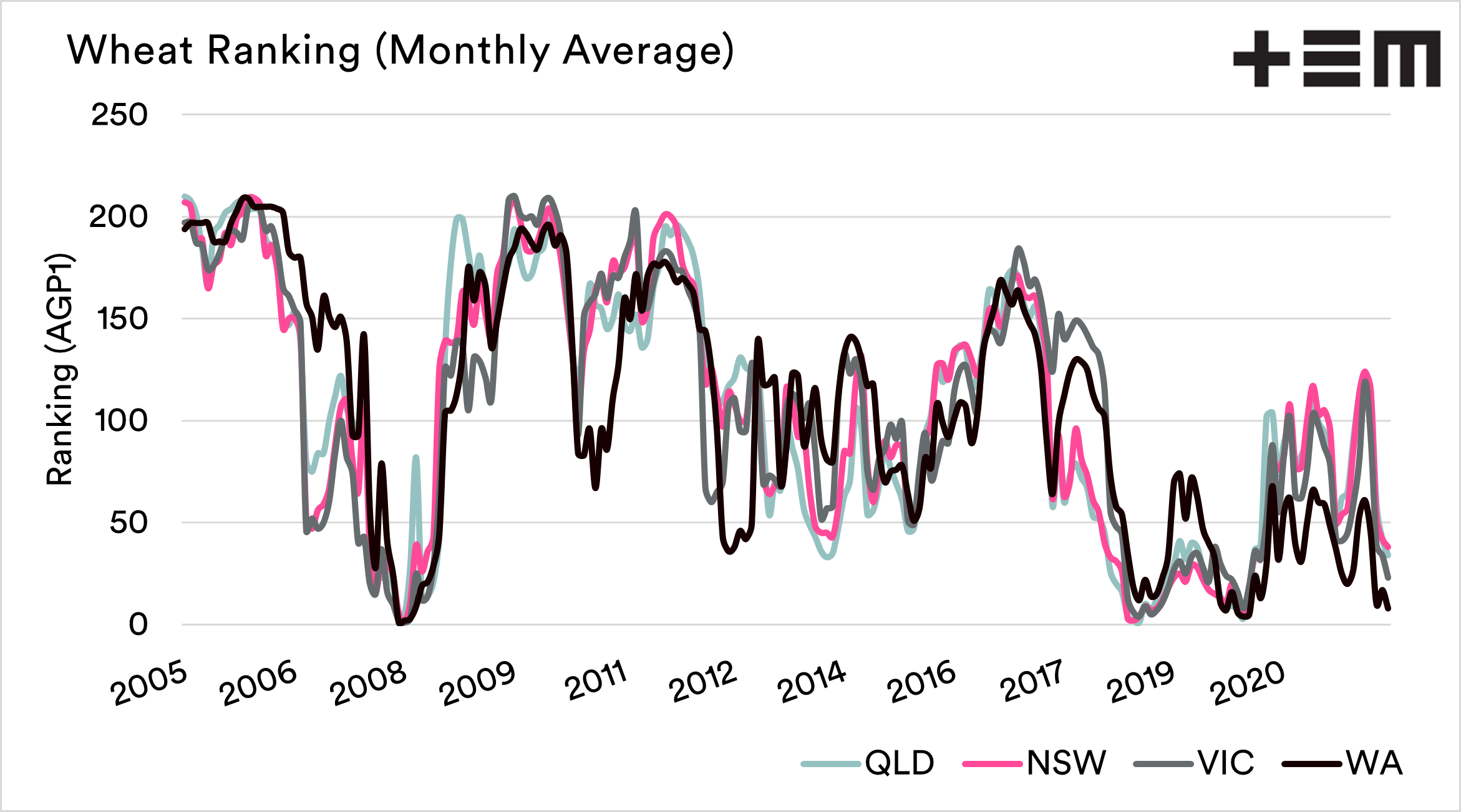

Let’s look at the ranking.

The chart below shows what rank the wheat price was for each month. A lower number equals a higher price and vice versa. Pricing at a flat price level around the country is sitting well. It’s in the top 50 at least.

So in theory pricing is good?

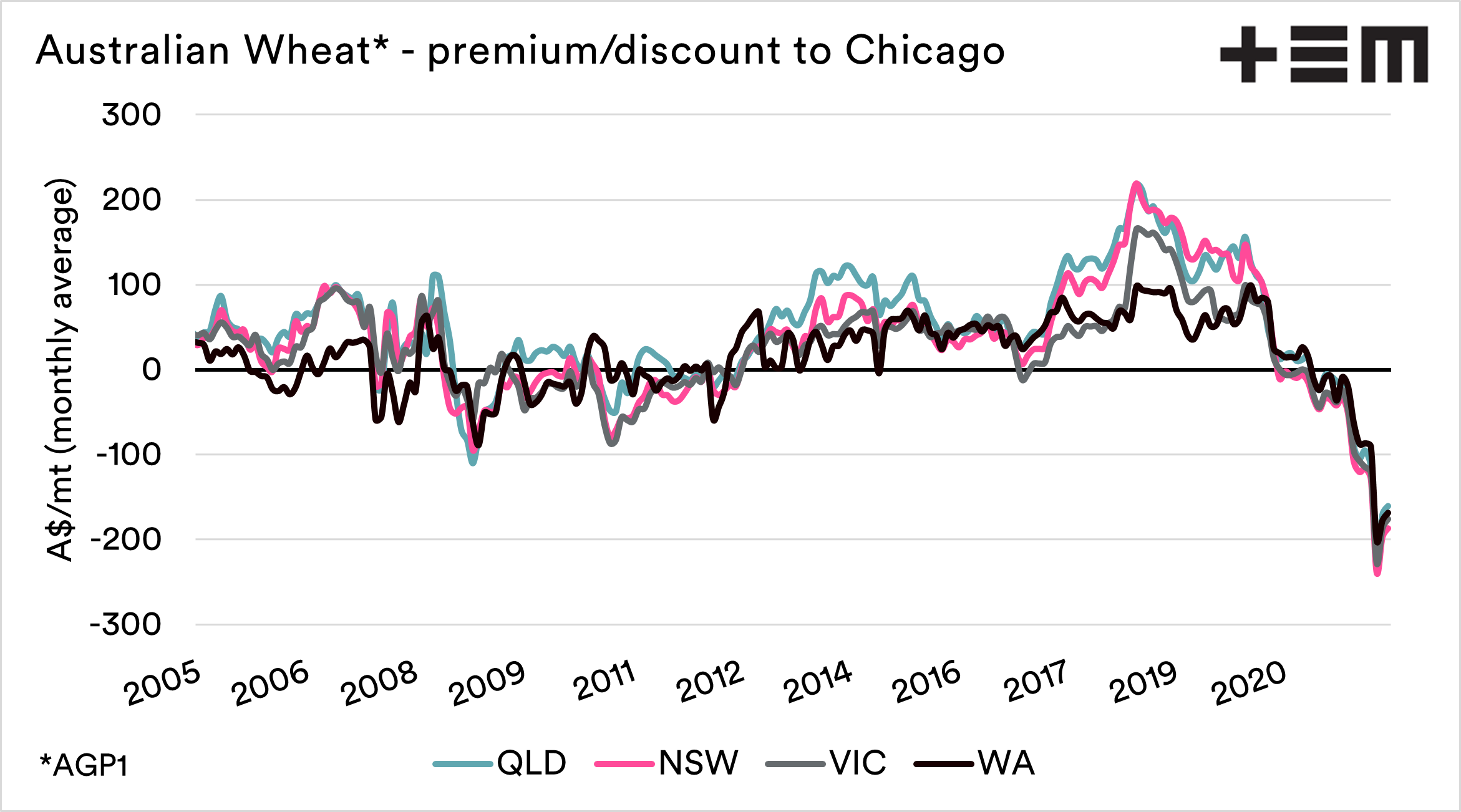

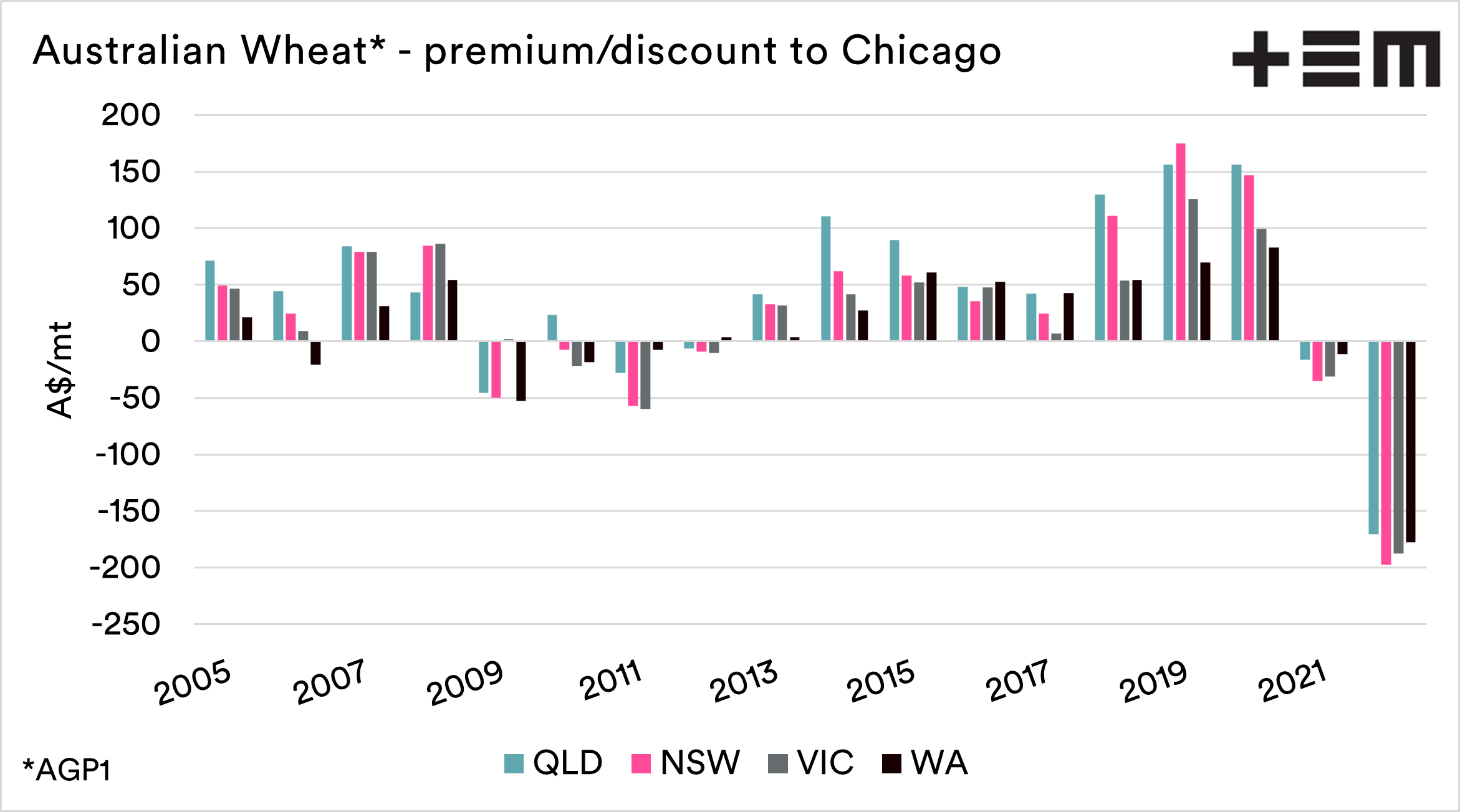

In markets, it is always important to think about relative value. How does our price compare to the other indicators. The charts below show our basis (What is basis? Read here) between AGP1 and CBOT wheat since 2005, on a monthly and annual basis.

We can see that the discount for our lower grade wheat has dropped to significant levels against Chicago wheat compared to what we have seen in the past.

There are reasons for this, which we have covered loads of times over the past months, including logistics and quality. However, even when we had poor quality in previous years we never saw discounting at this level.

This year, it is what it is. Basis has dropped and is generally staying low, despite the massive rises in grain values overseas.

The chart below shows the difference in price between the current basis levels, and the average basis level from 2010 to 2017. I used this period instead of the last decade to remove the higher basis levels caused by the recent drought levels. If basis levels were at average levels, we would be pricing at a significantly higher level than the present.

This chart is hypothetical and should be taken with a pinch of salt. Still, even if the basis were to move to parity instead of the typical premium, we would see a strong increase in farmer returns.

The big question (hope) is whether basis levels in Australia will rise for the new crop. The discount for the new season remains at extreme levels, with most at over A$100/mt discount.

In summary, though, when we look at the pricing, our price received is strong, historically speaking, but relative to the overseas values, it is poor.

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available, and you won’t be bothered for any other reason, we promise. If you like our offering and want to support our work, please remember to share it with your network – the more the merrier.