The four angles of Canola pricing

The Snapshot

- Canola prices in Australia on flat price terms are strong at historically high levels.

- Our discount to the rest of the world has grown to historically high levels.

- The large crop coming has seen prices fall, more so in the West, which has seen A$100 come off pricing.

- It is important to view our prices in relative value to other origins, as it lets us know what is potentially left on the table.

- Our basis is low, in part due to issues overseas and our large crop.

- Farmers will still do well from canola this year despite the discount.

The Detail

Relative value is important. If we pick a commodity, say canola – it is an undifferentiated product. It will largely be the same if you have a handful of canola from Canada or Australia. As an industry we want to know how we are tracking versus our competitors.

Let’s take a look at canola pricing in a couple of different ways.

Flat Price

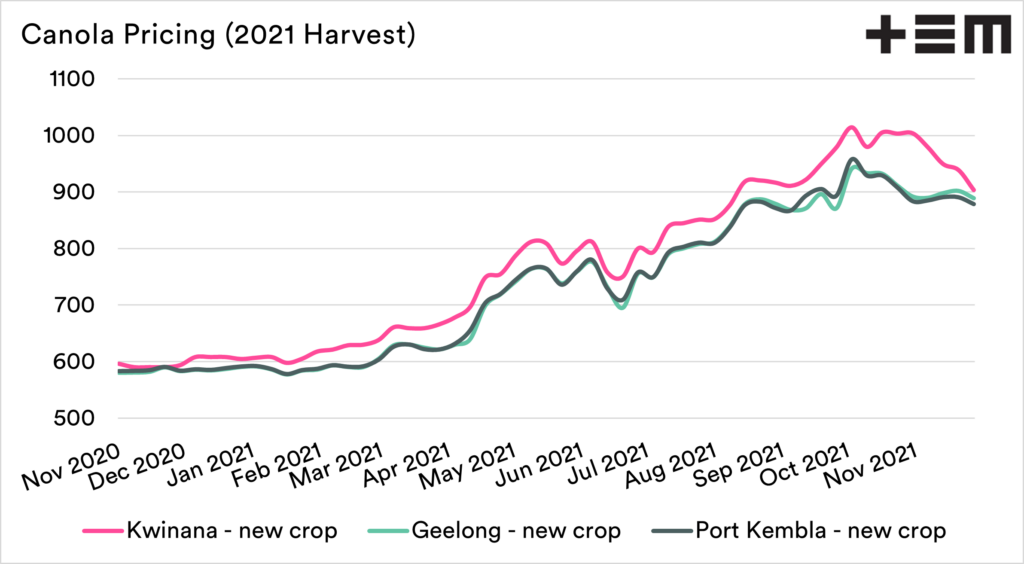

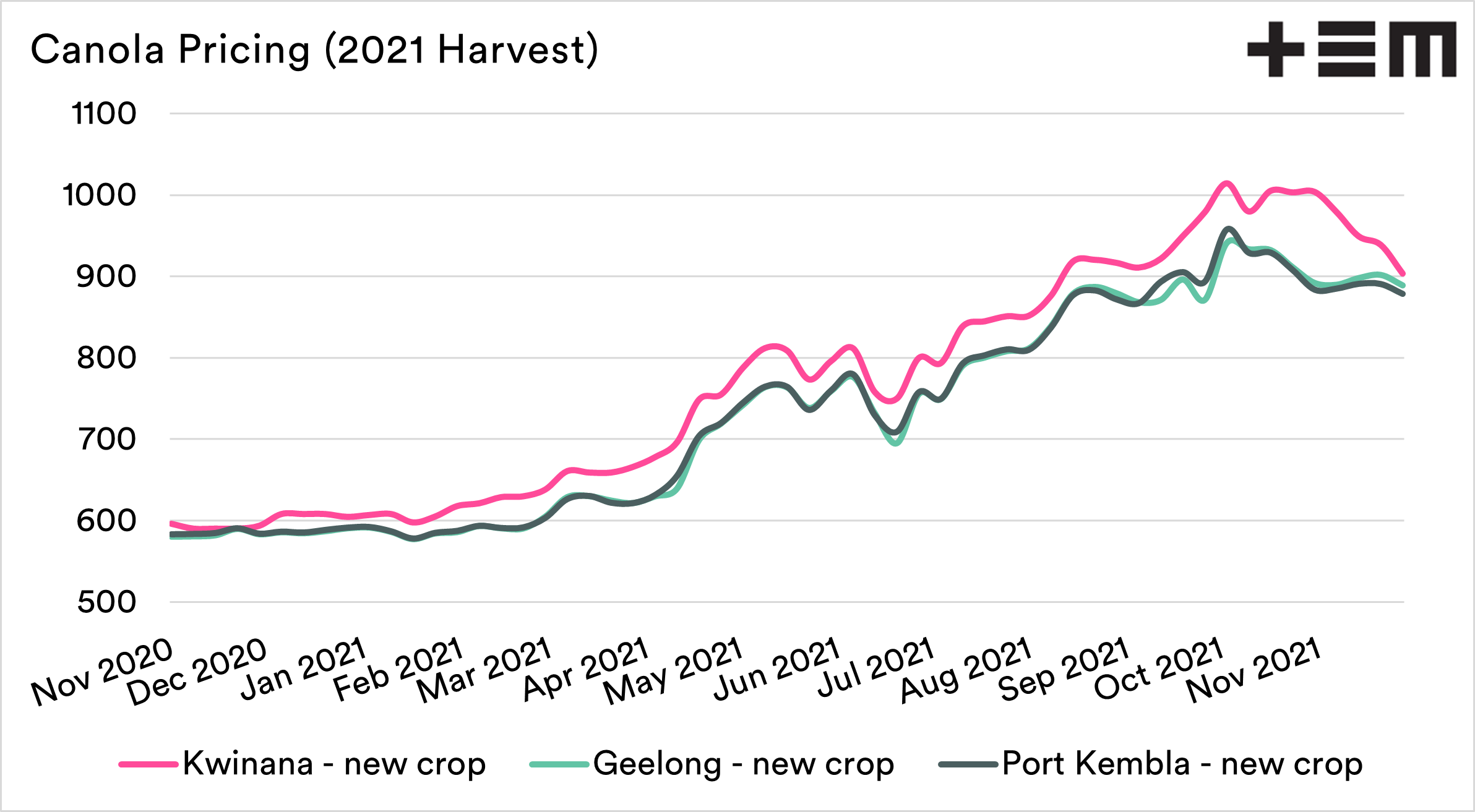

The flat price is the price that a farmer receives. This includes all the components of the pricing of canola (basis, futures & FX). It is generally how most farmers will sell their canola.

The canola price has been on largely an upward trajectory this year, and we have been highlighting since April that prices would be strong if Canada didn’t improve (see here), and they didn’t.

There has been some harvest pressure causing prices to lose some steam, however, the bulk of the drop has been felt in Western Australia, which was an average A$100 lower this week compared to the start of November.

Futures

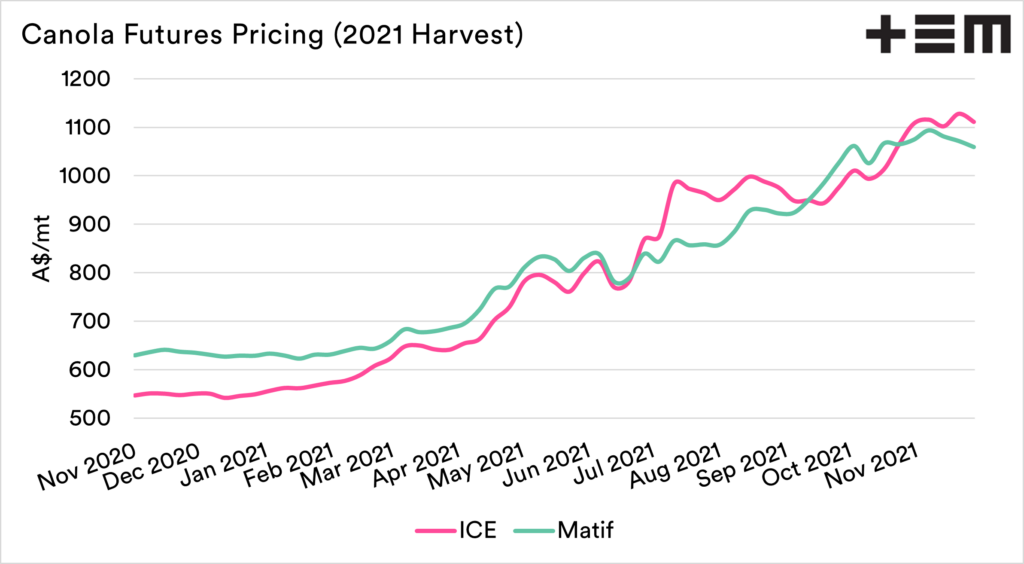

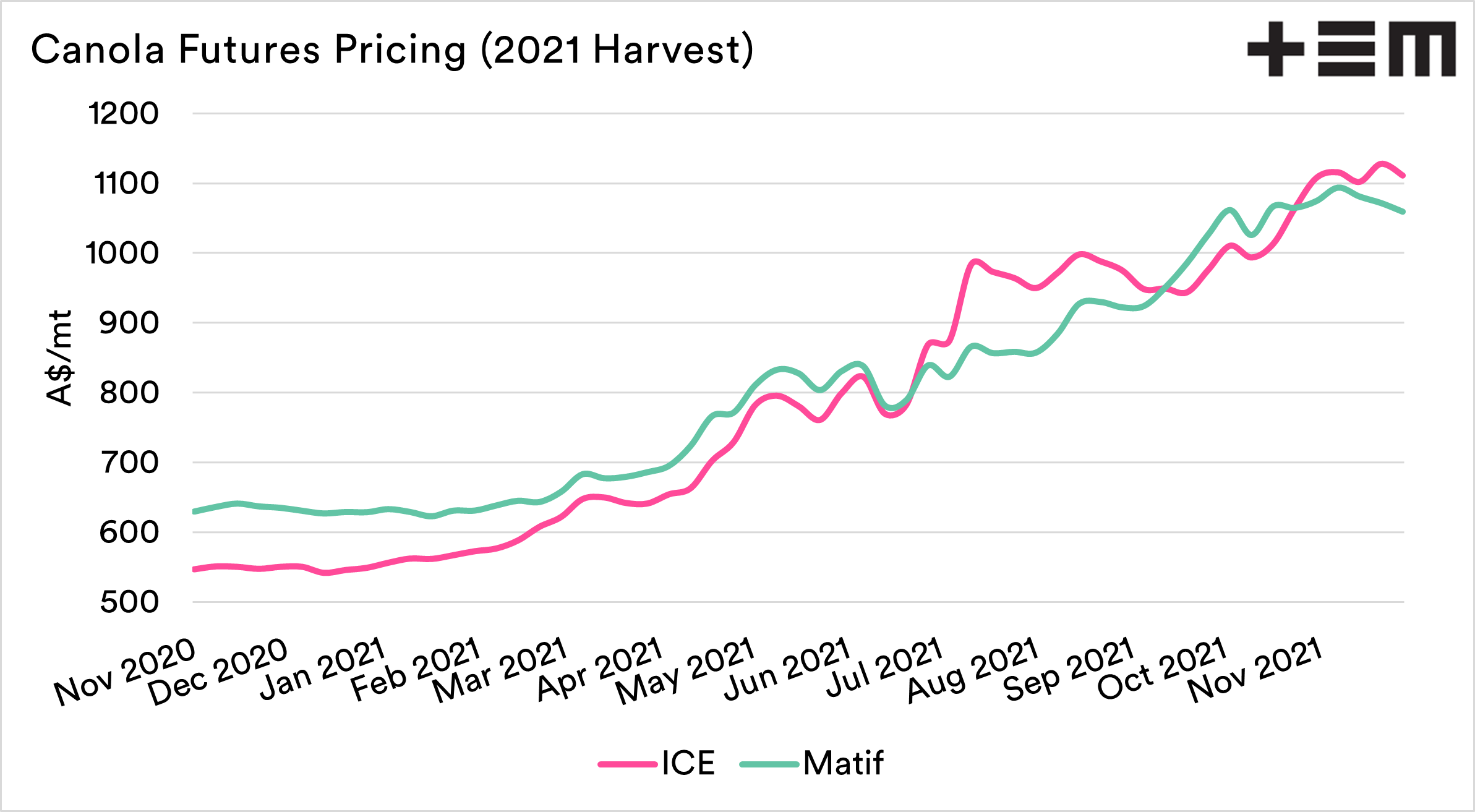

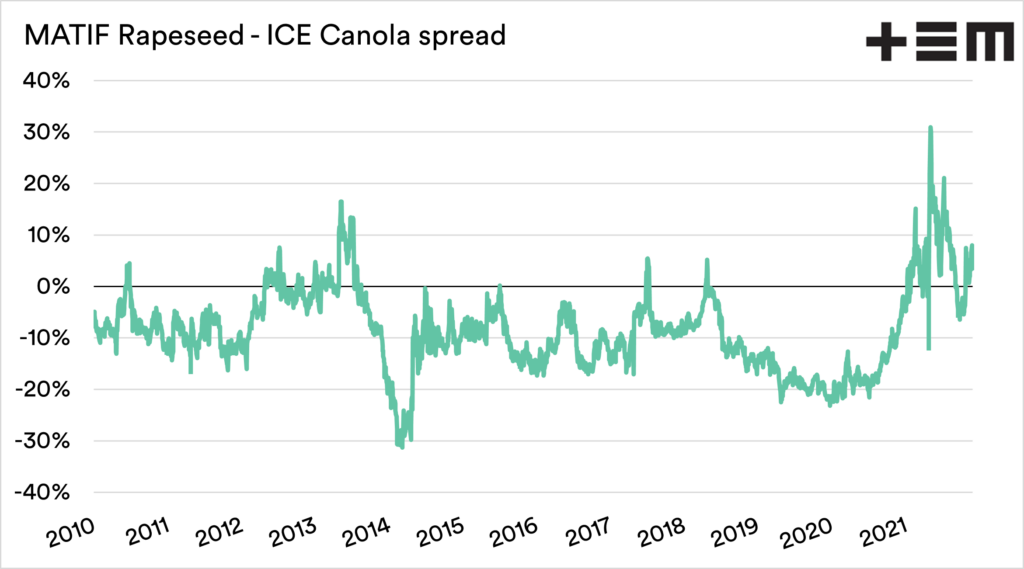

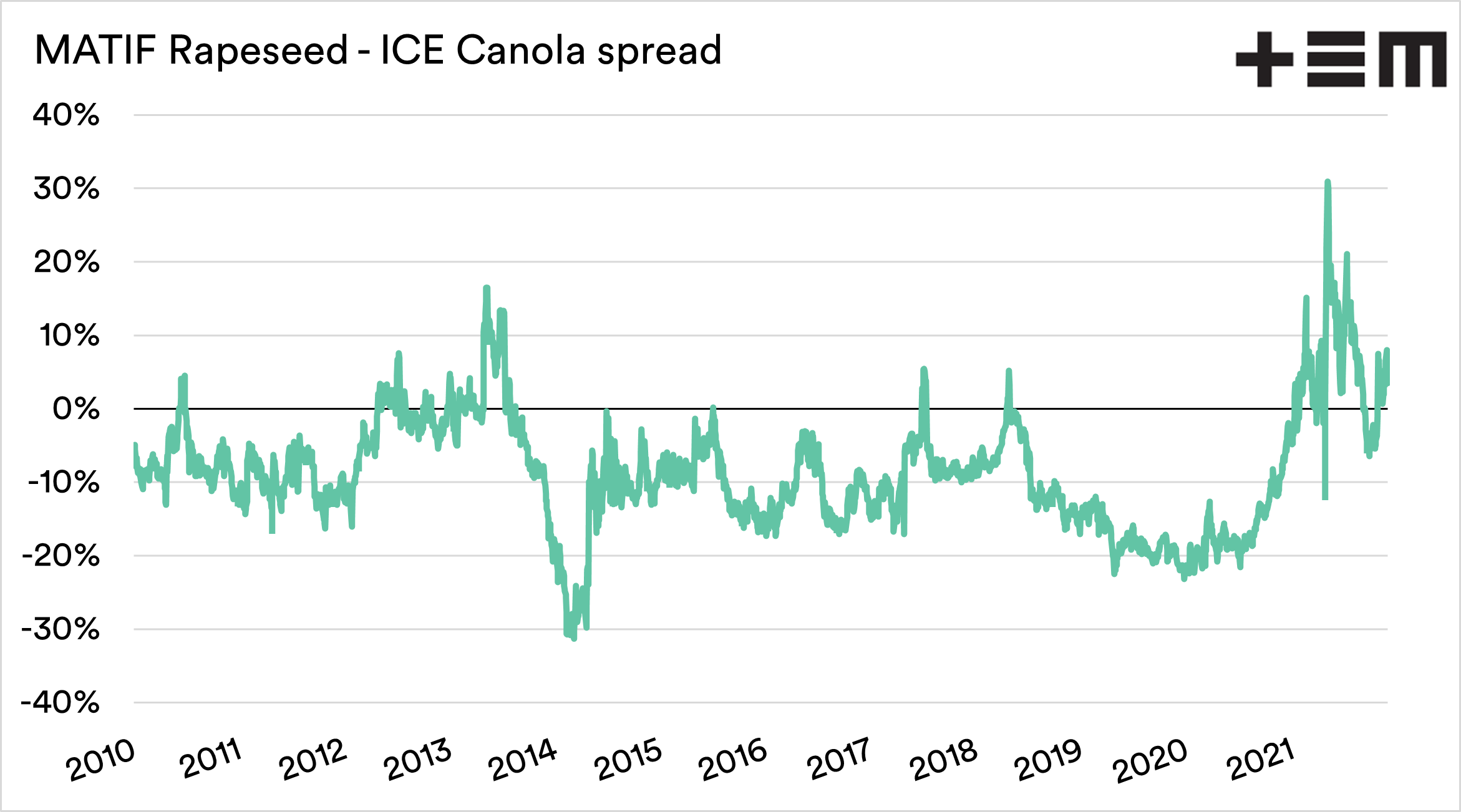

The canola futures market is primarily dominated by two contracts, MATIF in France and ICE in Canada. The futures price has continued to remain strong in recent months.

The MATIF contract is trading at A$1059/mt and the ICE contract is trading at A$1112 (weekly average).

It is relatively rare to see ICE canola futures trade at a premium to MATIF (or Australian pricing), but the premium over MATIF has been maintained through much of 2021. This is clearly a direct result of drought pricing in Canada.

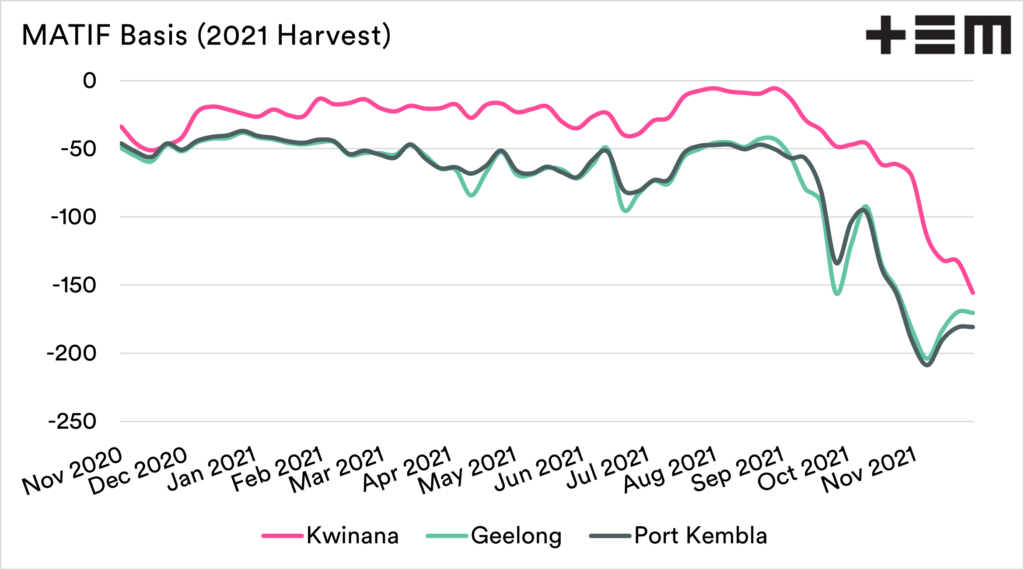

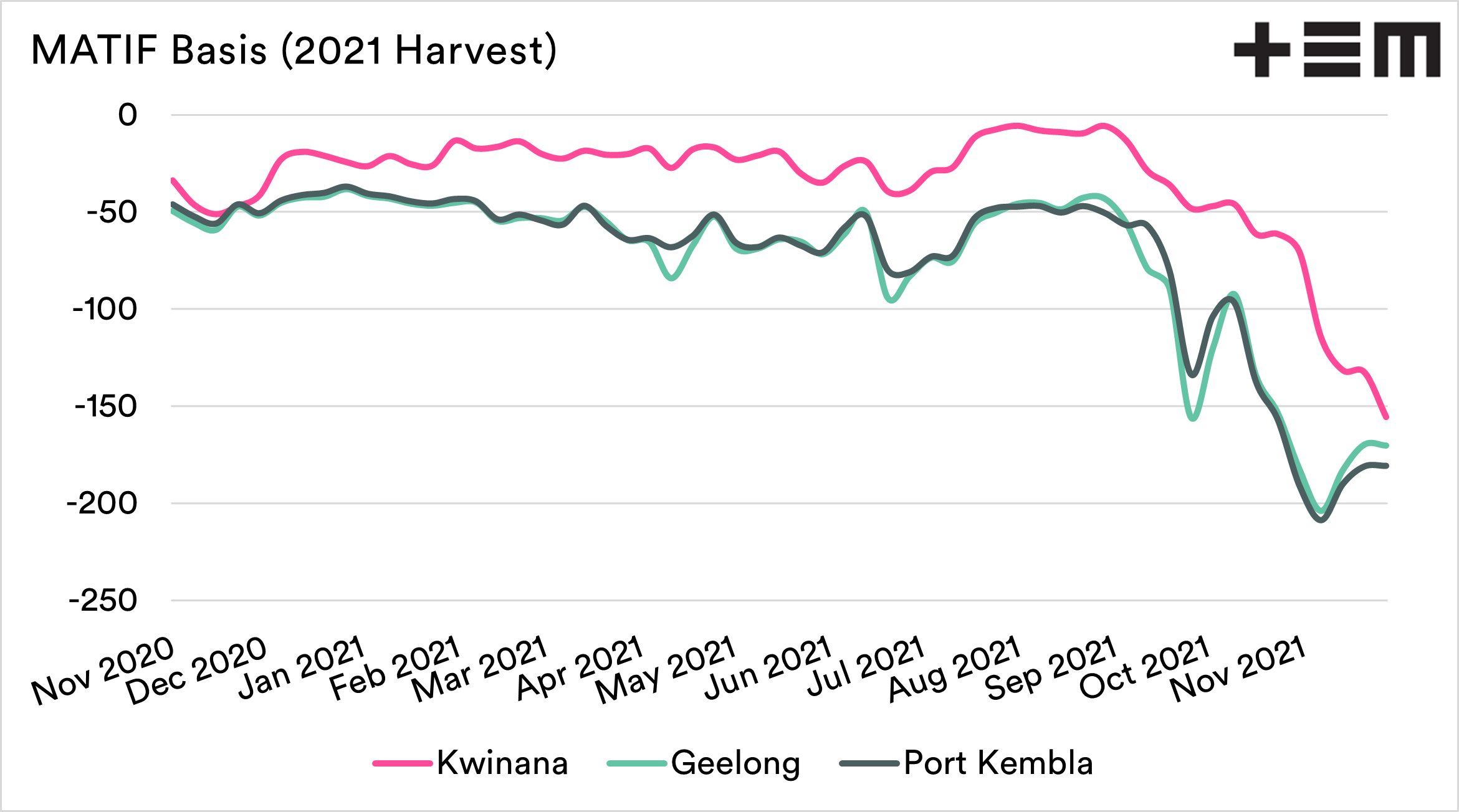

Basis

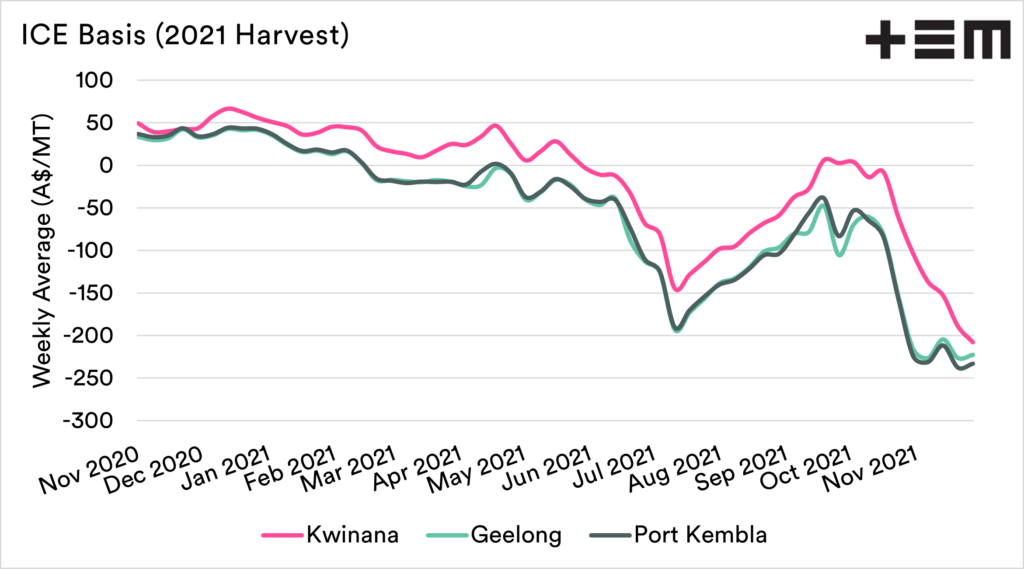

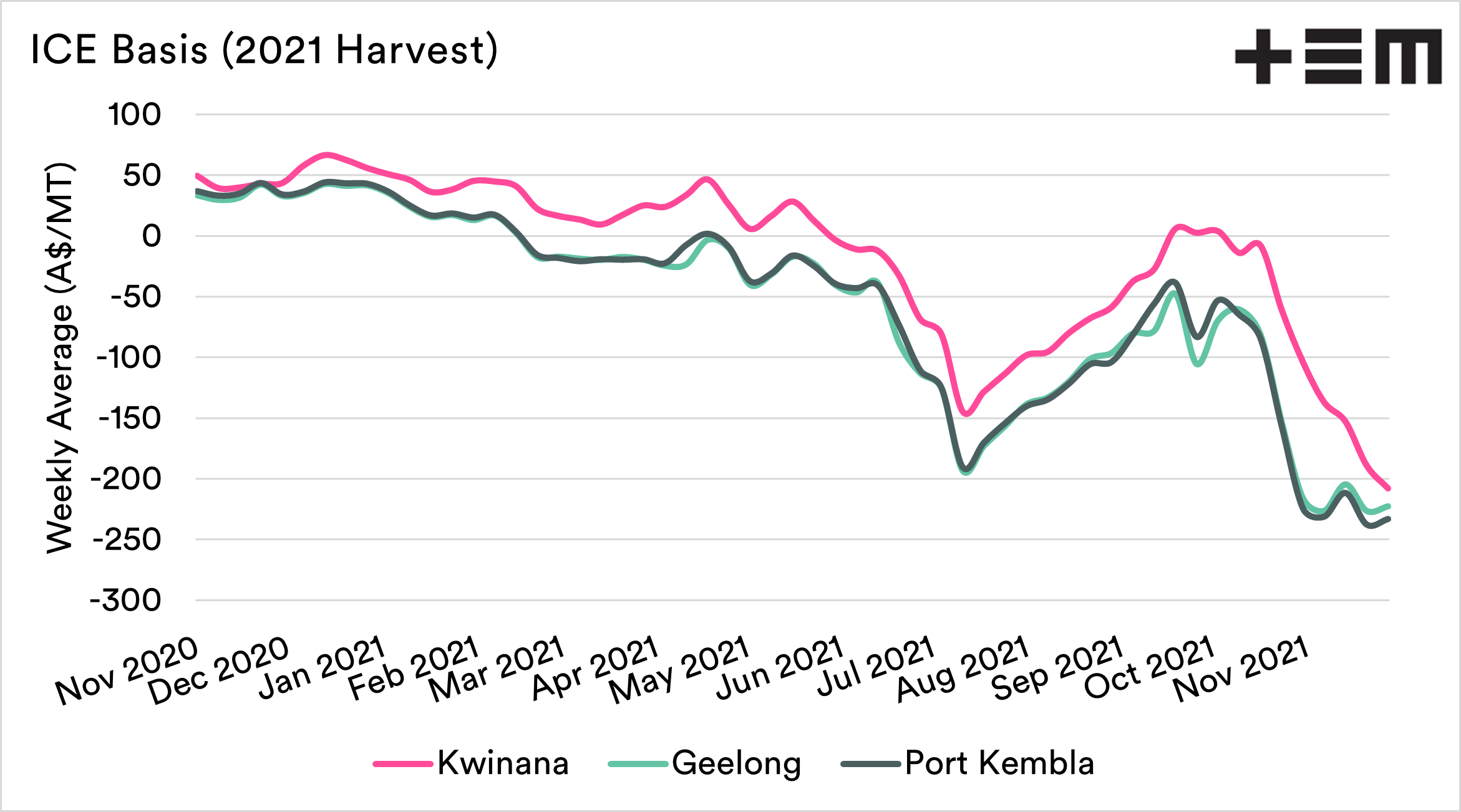

Basis is an important part of pricing, as it allows us (typically) to add the cream on top of our hedging. It is also an indicator of our relative value versus a benchmark price of futures.

If we lock in a futures level that is attractive, then the basis is all that is left to play with – and typically, that would be a premium over ICE futures (or Chicago for pricing wheat).

Typically our basis trades at a premium to ICE futures; this year it is at a massive discount. We do generally have a discount to MATIF, but that discount has also blown out to very large levels

Cost and Freight

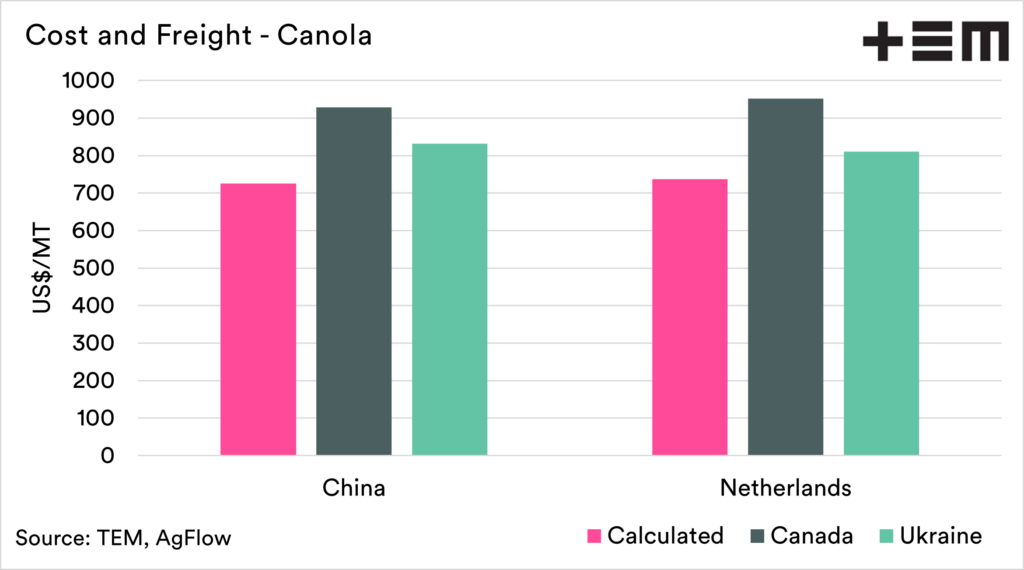

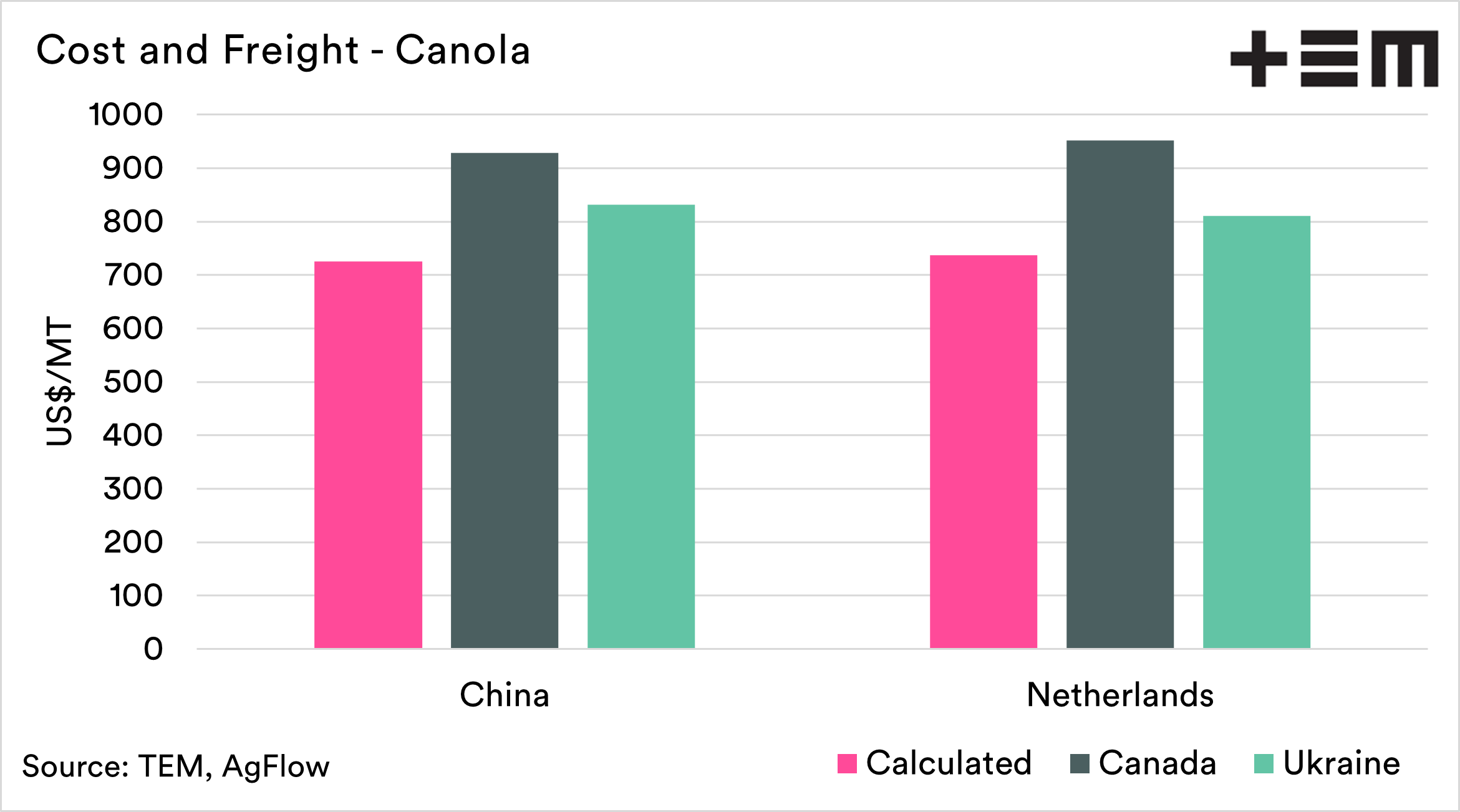

The best way of determining whether a price is reasonable relative to the rest of the world is how it compares to our customers. That is, what would our price look like with freight to the main customers around the world.

Through combining our data with that of our partners at AgFlow, we are able to provide a cost and freight matrix of Australian Canola pricing (at a grower level) to some of the main consumers of rapeseed.

We can see that our pricing is competitive into Europe and China. The question is whether we are too competitive?

Should it be so low?

The combination of a very low Canadian crop, with a very large Australian crop should logically result in a large discount for our canola. The question is whether it should be as large. At present, we are trading at huge discounts, but we are also the a huge source of canola to a world struggling with low supplies.

The good thing is that the flat price is still strong, albeit discounted, which will provide good returns to farmers.

If you liked reading this article and you haven’t already done so, make sure to sign up for the free Episode3 email update here. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.